1099Nec Word Template Free

1099Nec Word Template Free - It’s also used for reporting payments made for work performed outside of. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. And discover wise as a smarter way to make international payments. If your organization paid over $600 for services this year or withheld. Fill in, efile, print, or download forms in pdf format. Save time and hassle during filing! Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Download completed copies of form 1099 series information returns. It helps businesses accurately disclose payments made to freelancers or. Get the latest printable irs form templates for word. Get the latest printable irs form templates for word. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Make small adjustments if needed. It helps businesses accurately disclose payments made to freelancers or. Download this 2024 excel template. Download completed copies of form 1099 series information returns. Enter information into the portal or upload a file with a downloadable template in iris. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. It’s also used for reporting payments made for work performed outside of. Fill in, efile, print, or download forms in pdf format. Get the latest printable irs form templates for word. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. Fill in, efile, print, or download forms in pdf format. It helps businesses accurately disclose payments made to freelancers or. It’s also used for reporting payments made for work performed outside of. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. Save time and hassle during filing! If your organization paid over $600 for services this year or withheld. Enter information into the portal or upload a file with a downloadable template in iris. Download this 2024 excel template. It’s also used for reporting payments made for work performed outside of. Download completed copies of form 1099 series information returns. If your organization paid over $600 for services this year or withheld. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Make small adjustments if needed. It’s also used for reporting payments made for work performed outside of. Save time and hassle during filing! And discover wise as a smarter way to make international payments. If your organization paid over $600 for services this year or withheld. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. It’s also used for reporting payments made for work performed outside of. Download completed copies of form 1099 series information returns. Get the latest printable irs form templates for word. Fill in, efile, print, or download forms in pdf format. Save time and hassle during filing! Print to your paper 1099 or 1096 forms and. It helps businesses accurately disclose payments made to freelancers or. Get the latest printable irs form templates for word. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. Fill in, efile, print, or download forms in pdf format. Enter information into the portal or upload a file with a downloadable template in iris. Save time and hassle during filing! Download this 2024 excel template. Download completed copies of form 1099 series information returns. If your organization paid over $600 for services this year or withheld. It helps businesses accurately disclose payments made to freelancers or. Download this 2024 excel template. If your organization paid over $600 for services this year or withheld. Download completed copies of form 1099 series information returns. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Download this 2024 excel template. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Make small adjustments if needed. Print to your paper 1099 or 1096 forms and. And discover wise as a smarter way to make international payments. Download this 2024 excel template. Download completed copies of form 1099 series information returns. If your organization paid over $600 for services this year or withheld. It’s also used for reporting payments made for work performed outside of. Fill in, efile, print, or download forms in pdf format. Get the latest printable irs form templates for word. Download completed copies of form 1099 series information returns. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. It’s also used for reporting payments made for work performed outside of. Fill in, efile, print, or download forms in pdf format. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099. Enter information into the portal or upload a file with a downloadable template in iris. And discover wise as a smarter way to make international payments. Download this 2024 excel template. It helps businesses accurately disclose payments made to freelancers or. Save time and hassle during filing!1099Nec Template Free

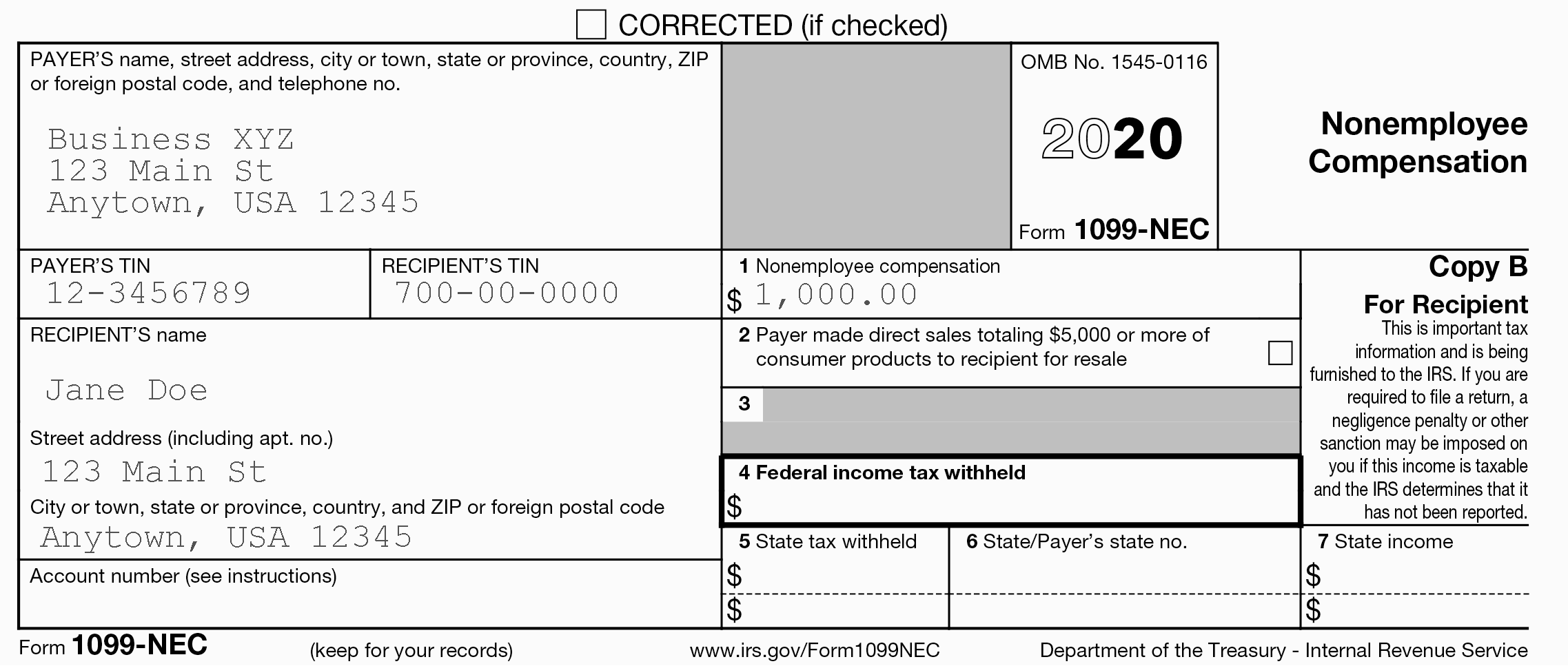

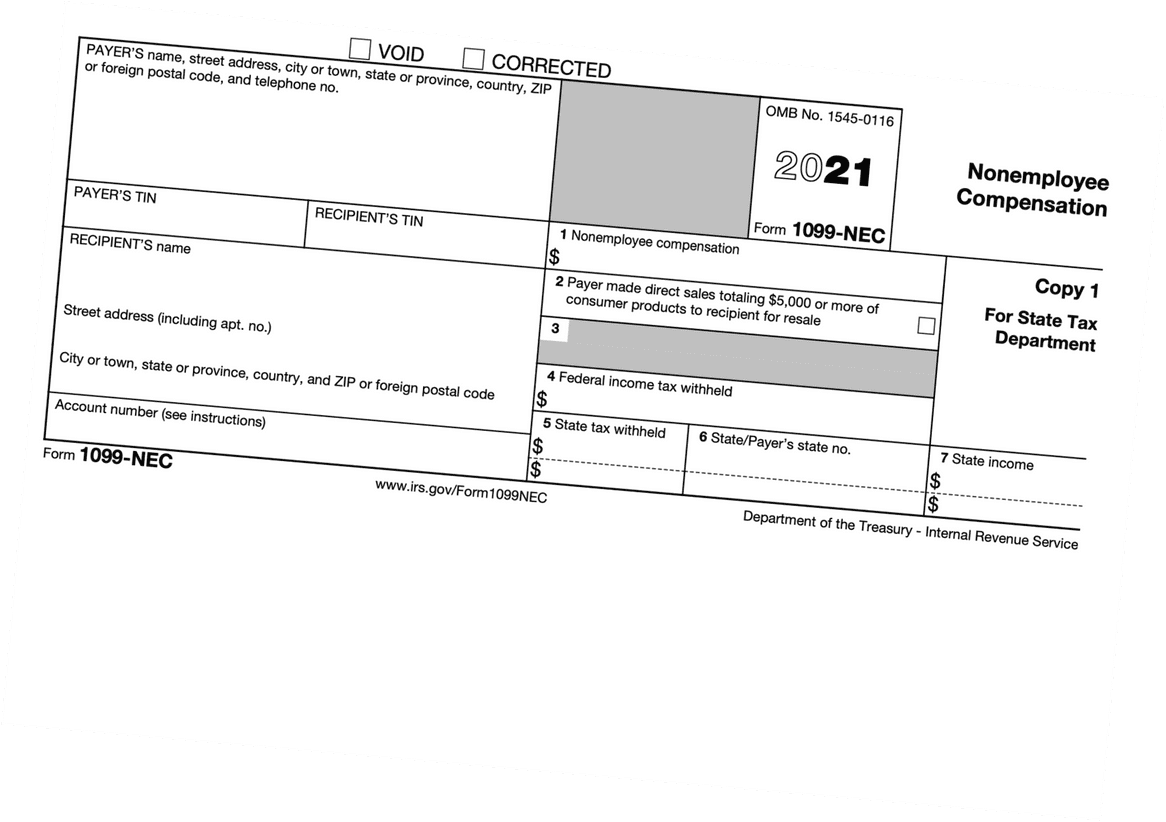

1099NEC Form Print Template for Word or PDF, 2021 Tax Year 1096

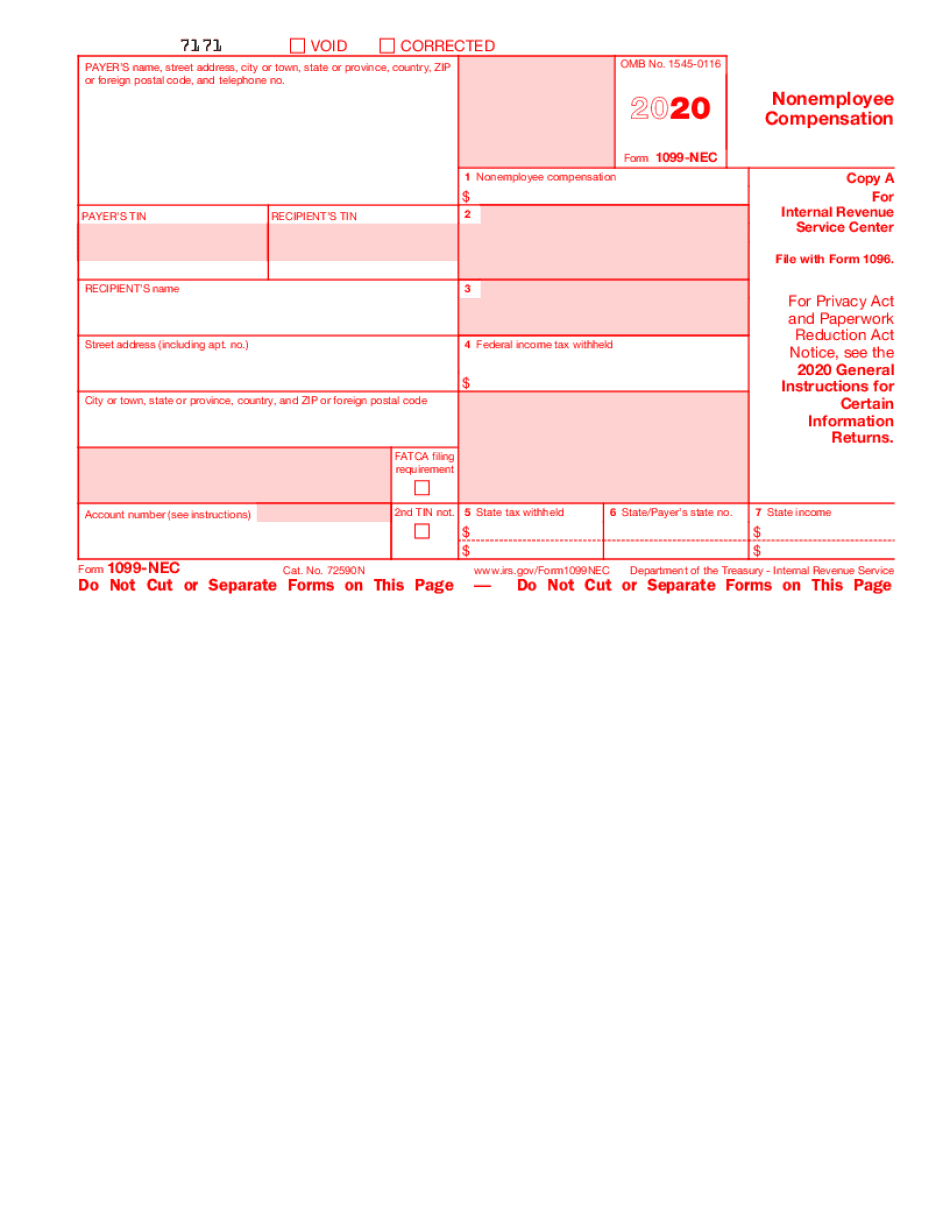

Printable Fillable 1099 Nec

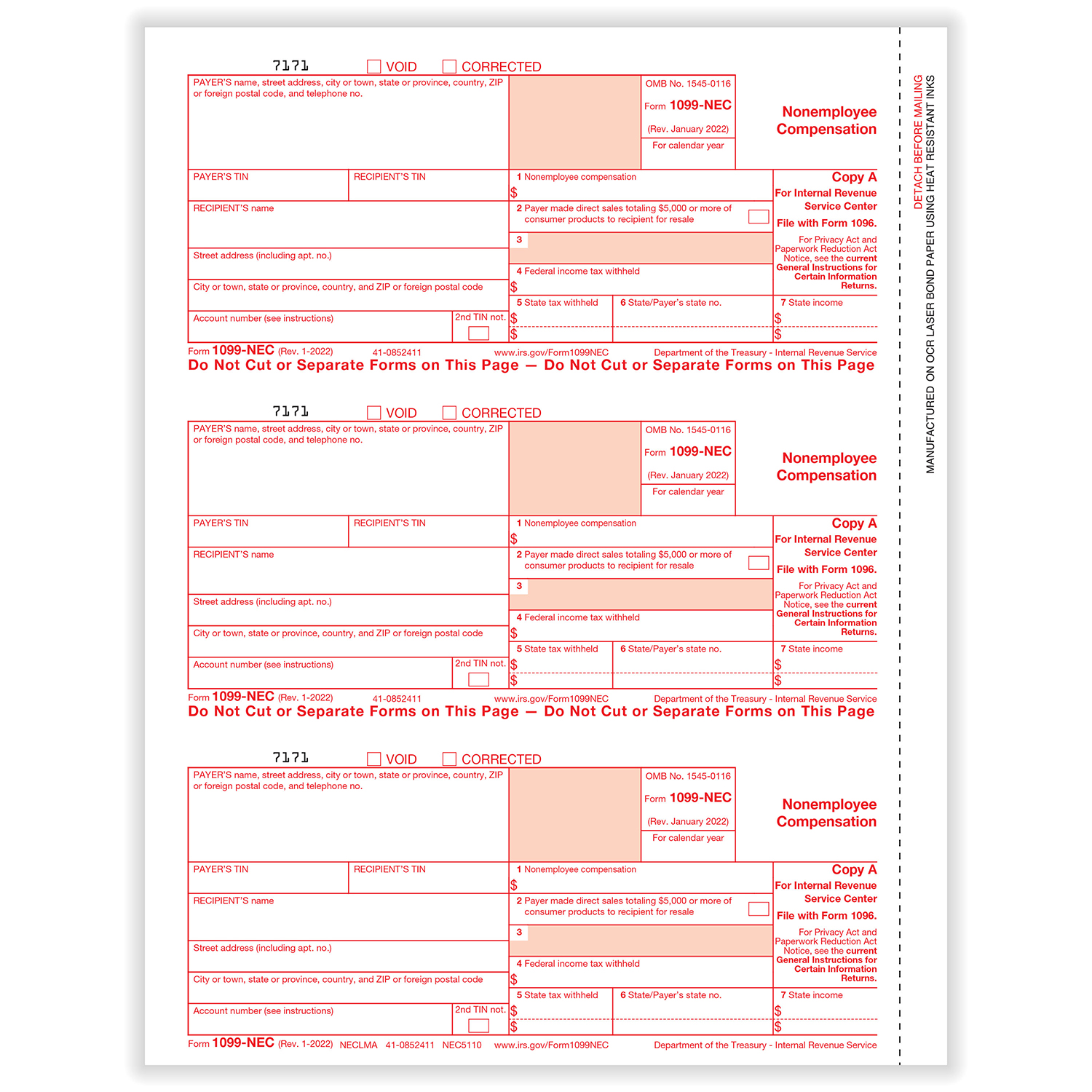

1099NEC 3Up Individual Fed Copy A Formstax

Form 1099 Nec Printable Blank PDF Online

Printable Form 1099 Nec

1099Nec Word Template Free See Your Tax Return Instructions For Where

2020 1099NEC Form Print Template for Word or PDF 1096 Transmittal

1099 Nec Printable Template

Free Printable 1099NEC File Online 1099FormTemplate

If Your Organization Paid Over $600 For Services This Year Or Withheld.

Print To Your Paper 1099 Or 1096 Forms And.

Make Small Adjustments If Needed.

Related Post: