609 Credit Letter Template

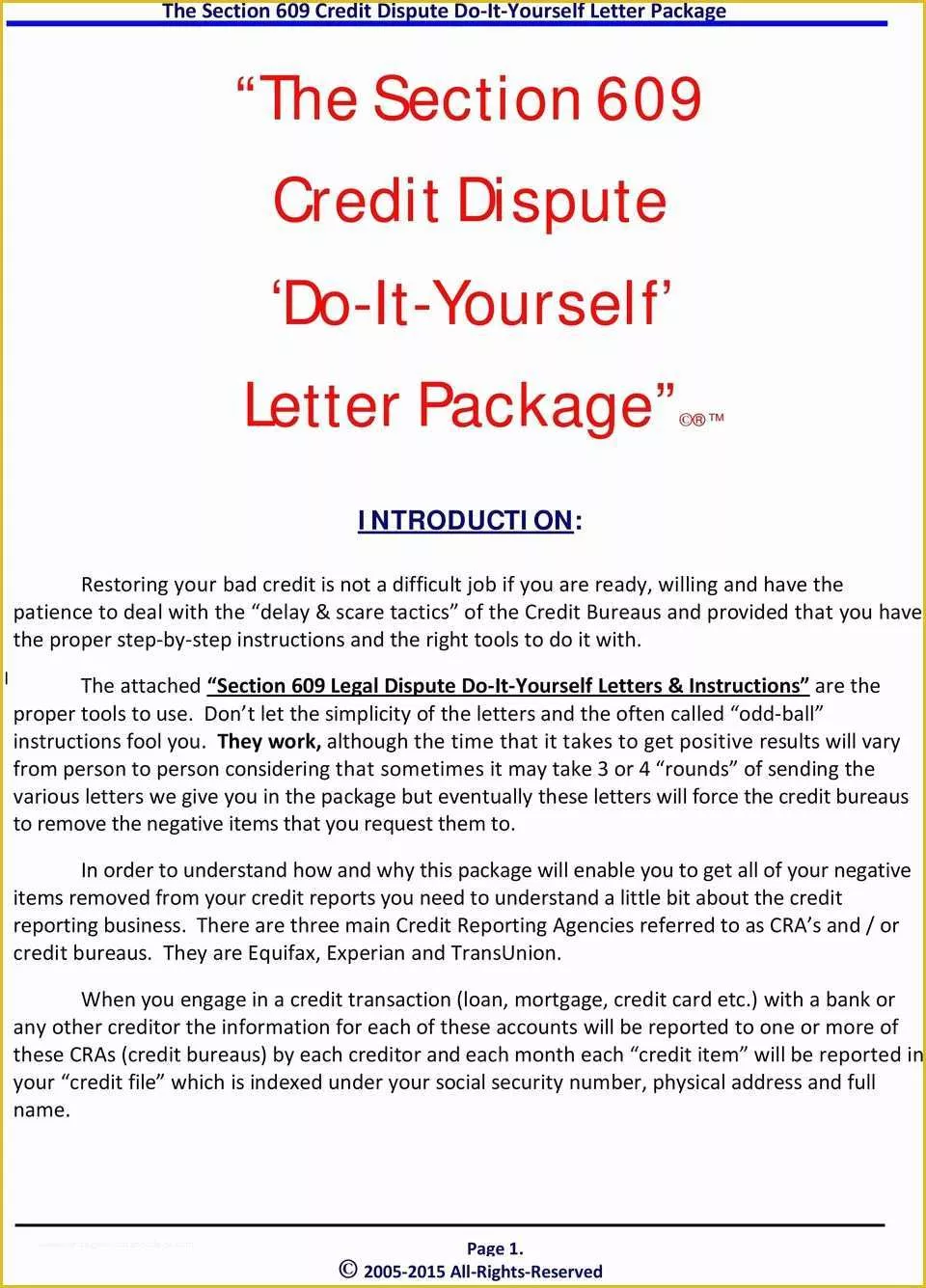

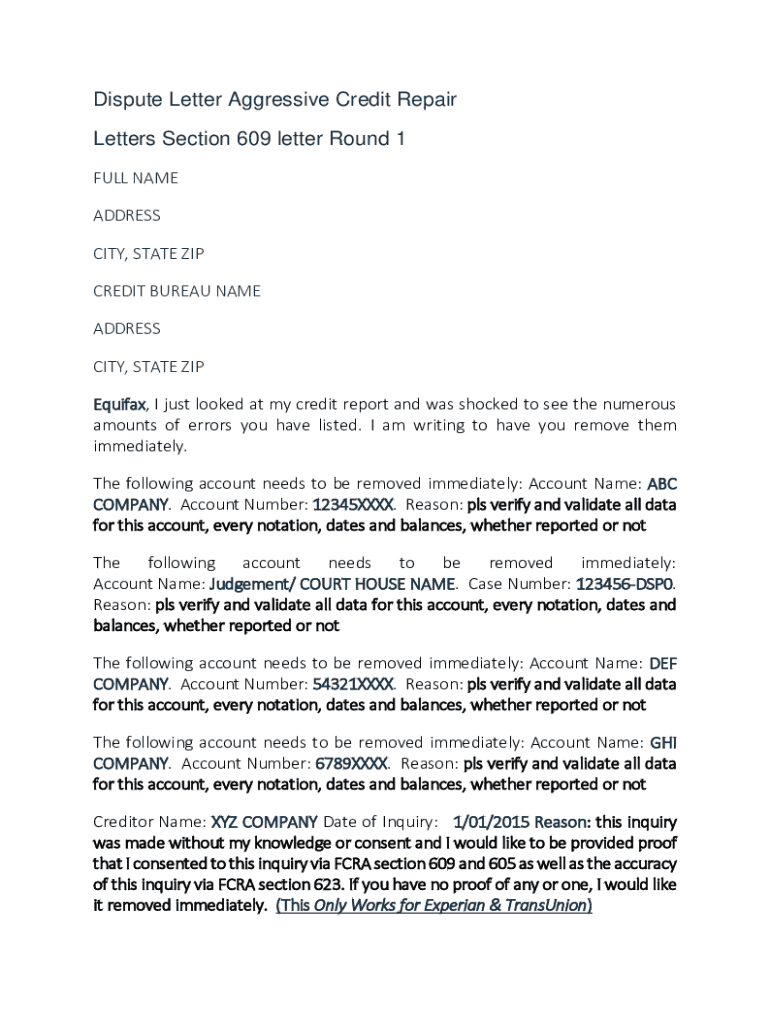

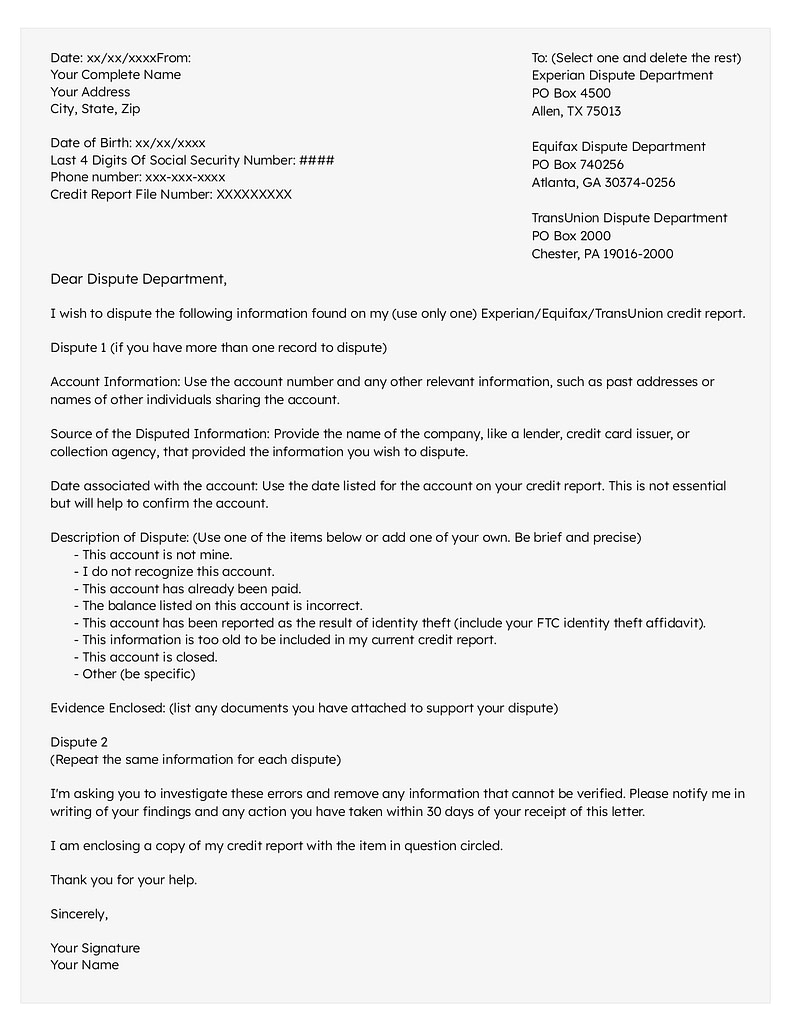

609 Credit Letter Template - As proof of my identity, i have included copies of my birth certificate, social security card, pas. Fair credit reporting act (fcra), specifically section 609. There are a few 609 letter templates you can follow to ensure you are including the correct information. Here is a free 609 credit repair letter sample: A “609 dispute letter” is often used to dispute inaccuracies on your credit report under the u.s. If the entries are negative, they are removed from the credit report, which increases. Below is a sample template for a. Dear (experian, transunion, or equifax), in accordance with rights guaranteed by the fair credit reporting act, section 609, i. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. Two sections of the fair credit reporting act build up the. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. Dear (experian, transunion, or equifax), in accordance with rights guaranteed by the fair credit reporting act, section 609, i. It allows consumers to obtain information about the sources of data on their. Below is a sample template for a. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. Use solosuit to respond to debt collectors fast. Fair credit reporting act (fcra), specifically section 609. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. Two sections of the fair credit reporting act build up the. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Here's how to prepare an effective 609 letter that really works. If the entries are negative, they are removed from the credit report, which increases. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. As proof of my identity, i have included copies of my birth certificate, social security card, pas. Dear (experian,. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. Below is a sample of a typical 609 letter, as well as a downloadable. I have also included a copy of. Section 609 of the fair credit reporting act. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. Here is a free 609 credit repair letter sample: Here's how to prepare an effective 609 letter that really works. As proof of my identity, i have included copies. Two sections of the fair credit reporting act build up the. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. There are a few 609 letter templates you can follow to ensure you are including the correct information. A 609 letter is a formal written request sent to credit bureaus, invoking rights under. Use solosuit to respond to debt collectors fast. Two sections of the fair credit reporting act build up the. Below is a sample template for a. I have also included a copy of. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. Dear (experian, transunion, or equifax), in accordance with rights guaranteed by the fair credit reporting act, section 609, i. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Below is a sample of a typical 609 letter, as well as a downloadable. I have also included a copy of.. Here is a free 609 credit repair letter sample: As proof of my identity, i have included copies of my birth certificate, social security card, pas. If the entries are negative, they are removed from the credit report, which increases. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit. Below is a sample of a typical 609 letter, as well as a downloadable. Use solosuit to respond to debt collectors fast. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. Section 609 outlines your right to. There are a few 609 letter templates you can follow to ensure you are. Here is a free 609 credit repair letter sample: If the entries are negative, they are removed from the credit report, which increases. Here's how to prepare an effective 609 letter that really works. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications. Use solosuit to respond to debt collectors fast. Section 609 outlines your right to. I have also included a copy of. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. A 609 letter is a formal written request sent to credit bureaus, invoking. I have also included a copy of. Below is a sample template for a. Use solosuit to respond to debt collectors fast. Section 609 outlines your right to. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. There are a few 609 letter templates you can follow to ensure you are including the correct information. Here is a free 609 credit repair letter sample: It allows consumers to obtain information about the sources of data on their. Two sections of the fair credit reporting act build up the. Here's how to prepare an effective 609 letter that really works. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. A “609 dispute letter” is often used to dispute inaccuracies on your credit report under the u.s. If the entries are negative, they are removed from the credit report, which increases. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. As proof of my identity, i have included copies of my birth certificate, social security card, pas. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk.Generic 609 Credit Dispute Letter PDF Credit History Credit Score

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

609 Letter Template & How to File a Credit Dispute

Free Section 609 Credit Dispute Letter Template Of the Section 609

Free 609 Credit Dispute Letter Templates Pdf Printable Templates

609 Letter Template Free Of Free Section 609 Credit Dispute Letter

Pdf Printable Free 609 Credit Dispute Letter Templates

609 Letter Template How To File A Credit Dispute Fillable Form 2023

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Learn How To Structure Your Arguments, Include Supporting Evidence, And Craft A Compelling Request For Correction.

Fair Credit Reporting Act (Fcra), Specifically Section 609.

Dear (Experian, Transunion, Or Equifax), In Accordance With Rights Guaranteed By The Fair Credit Reporting Act, Section 609, I.

Below Is A Sample Of A Typical 609 Letter, As Well As A Downloadable.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02-790x1022.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/dispute-credit-report-letter.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/609-credit-dispute-letter.jpg)