941 Reconciliation Template Excel

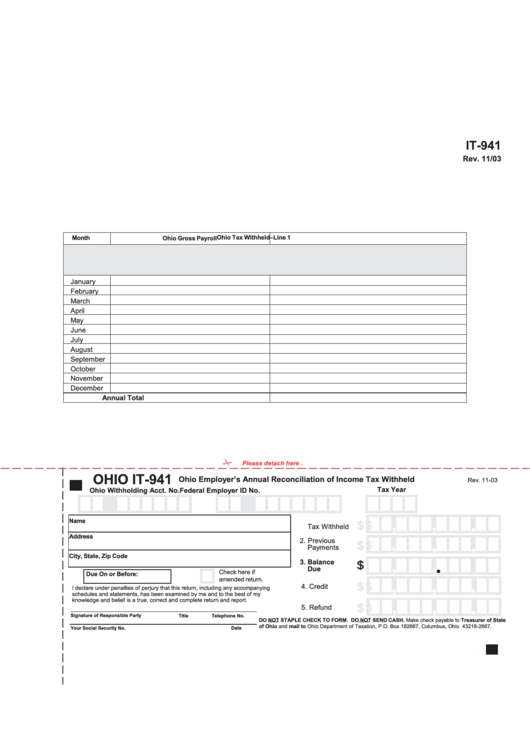

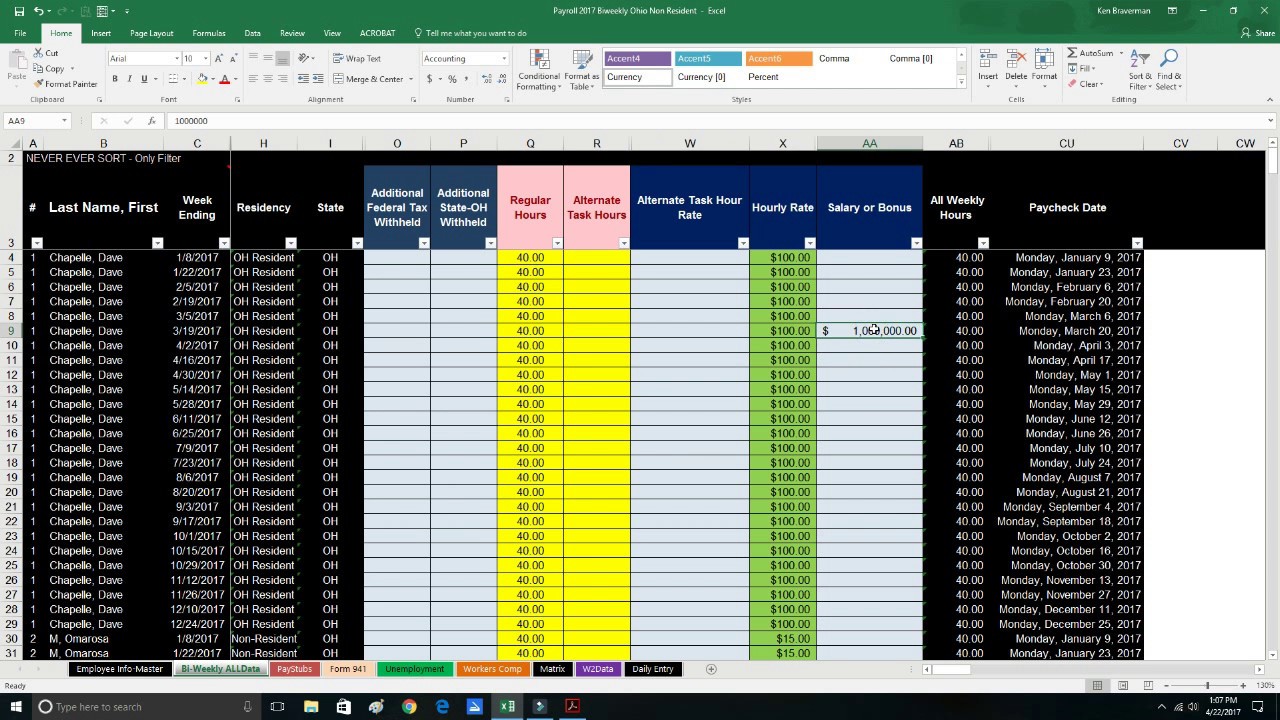

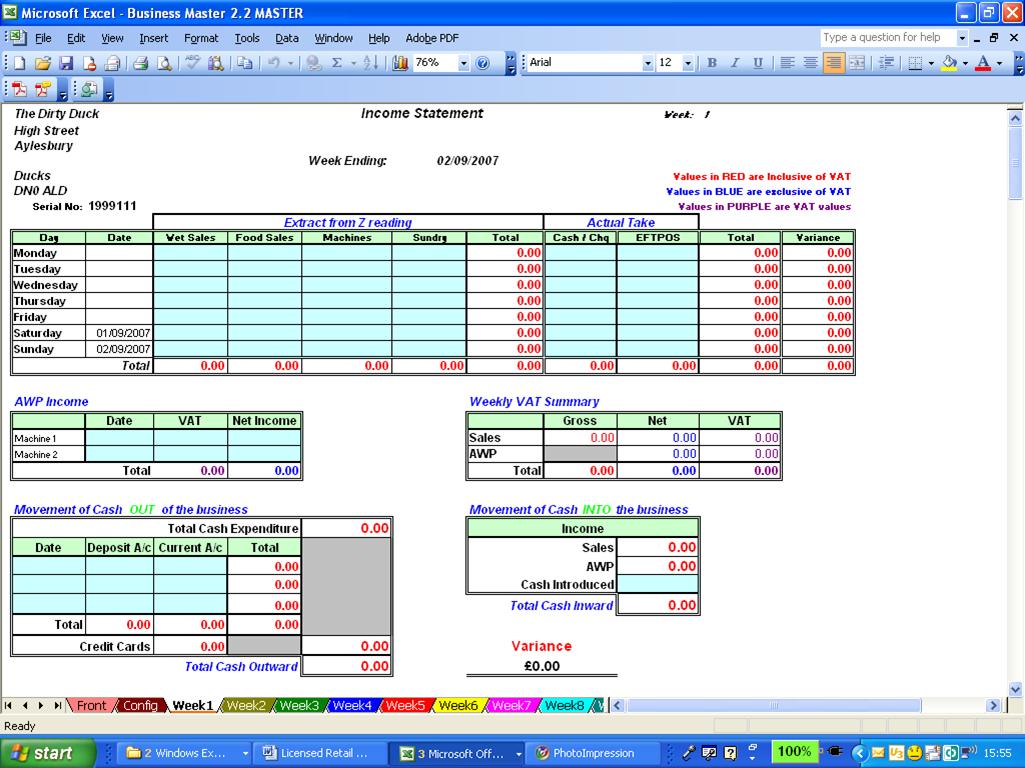

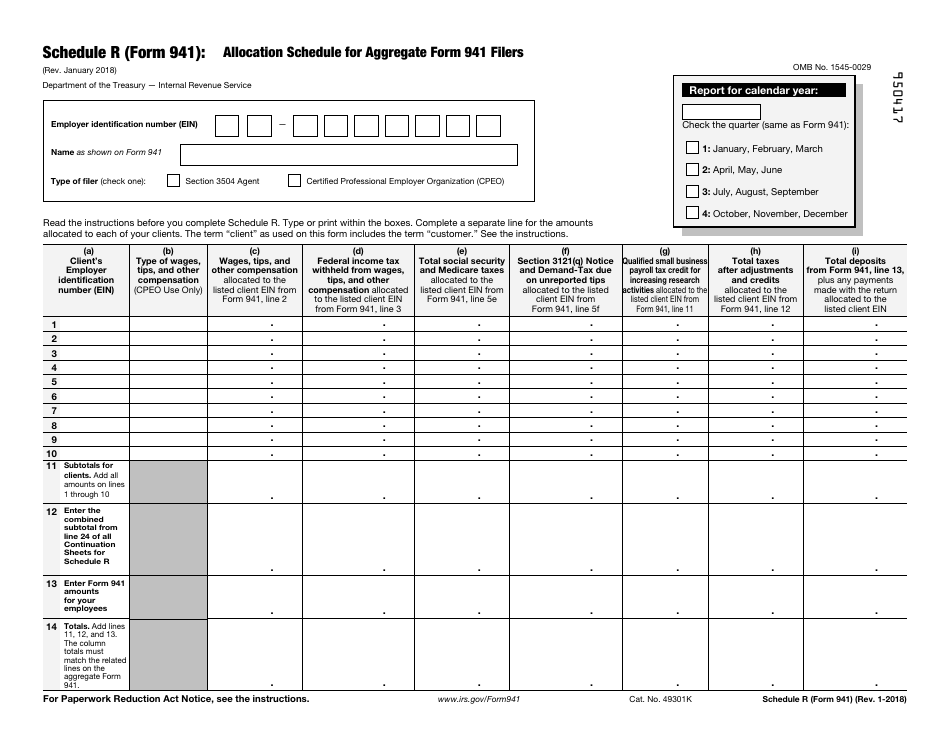

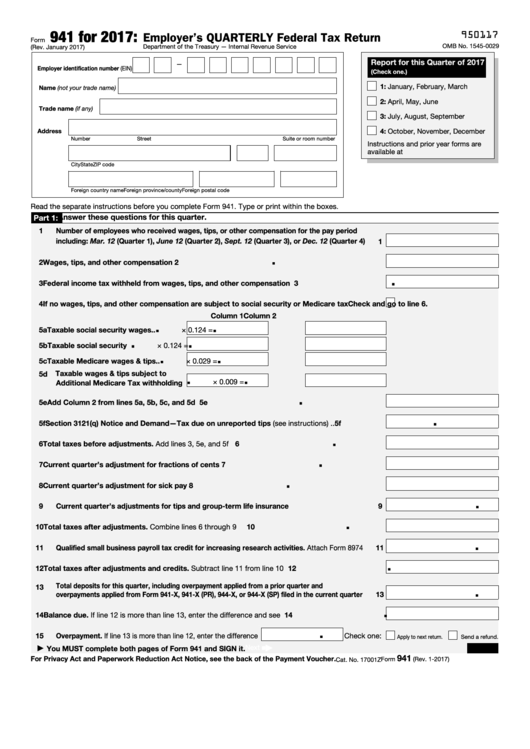

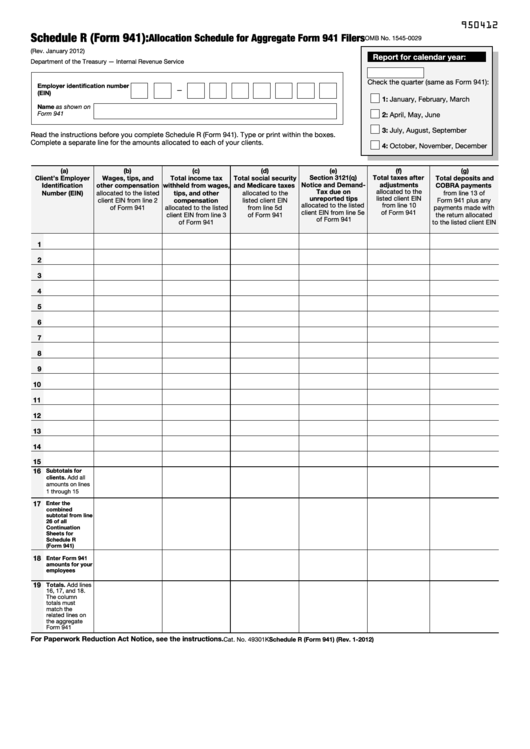

941 Reconciliation Template Excel - The template systematically compares payroll. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Compare those figures with the totals reported on all four 941s for the year. It includes detailed instructions to ensure payroll records match federal reporting. To the total dollars reported in the general ledger labor accounts. This may seem like a. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Reconciliation of the total labor dollars reported on the 941s. Find out how to use spreadsheets, softwar… You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. Multiply column 1 by 0.124 (or. Run a report that shows annual payroll amounts. A 941 reconciliation excel template streamlines quarterly federal tax return preparation by automating calculations and reducing errors. Reconciliation of the total labor dollars reported on the 941s. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: What are the changes in form 941 for 2023? Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax form 941 with their payroll records. Compare those figures with the totals reported on all four 941s for the year. Learn how to reconcile form 941, employer’s quarterly federal tax return, and why it is important for your small business. This may seem like a. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? Run a report that shows annual payroll amounts. This may seem like a. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Download our 941 form excel template to. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? Below are instructions and worksheets to. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. Reconciliation of the total labor dollars reported on the 941s. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel. Learn how to reconcile form 941, employer’s quarterly federal tax return, and why it is important for your small business. Multiply column 1 by 0.124 (or. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax. What are the changes in form 941 for 2023? Streamline your financial reconciliation process with our reconciliation excel template generator. Compare those figures with the totals reported on all four 941s for the year. Most employers must report employees' wages paid and taxes withheld plus their. Up to $50 cash back the 941 reconciliation template in excel is a tool. Using the 941 forms, transfer totals for each category listed by. Download our 941 form excel template to import multiple 941. Ofm strongly suggests that you reconcile at the end of each. Use on any account, petty cash, ledger, or other purposes. Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Ofm strongly suggests that you reconcile at the end of each. This may seem like a. After you print the reports (as part of the year end checklist),. Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Multiply column 1 by 0.124 (or. For the fiscal year ending: Streamline your financial reconciliation process with our reconciliation excel template generator. You can use this worksheet to reconcile quarterly reports, annual 941 report, employee tax summary, and payroll history. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Make reconciliation documents with template.net's free reconciliation templates excel. Make reconciliation documents with template.net's free reconciliation templates excel. Ofm strongly suggests that you reconcile at the end of each. Reconciliation of the total labor dollars reported on the 941s. Multiply column 1 by 0.124 (or. Using the 941 forms, transfer totals for each category listed by. Make reconciliation documents with template.net's free reconciliation templates excel. Use on any account, petty cash, ledger, or other purposes. A 941 reconciliation excel template streamlines quarterly federal tax return preparation by automating calculations and reducing errors. Most employers must report employees' wages paid and taxes withheld plus their. Learn how to reconcile form 941, employer’s quarterly federal tax return, and. W2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Reconciliation of the total labor dollars reported on the 941s. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? Streamline your financial reconciliation process with our reconciliation excel template generator. Using the 941 forms, transfer totals for each category listed by. This may seem like a. It includes detailed instructions to ensure payroll records match federal reporting. Up to $50 cash back the 941 reconciliation template in excel is a tool that helps businesses reconcile their quarterly payroll tax form 941 with their payroll records. Find out how to use spreadsheets, softwar… Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Most employers must report employees' wages paid and taxes withheld plus their. In column 1, enter employees’ total wages, sick pay, and taxable fringe benefits subject to social security taxes from the quarter. After you print the reports (as part of the year end checklist),. Compare those figures with the totals reported on all four 941s for the year. Learn how to reconcile form 941, employer’s quarterly federal tax return, and why it is important for your small business. For example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs.941 Reconciliation Template Excel prntbl.concejomunicipaldechinu.gov.co

941 X Worksheet 2 Excel

941 Reconciliation To General Ledger Template prntbl

941 Reconciliation Template Excel prntbl.concejomunicipaldechinu.gov.co

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

Make Reconciliation Documents With Template.net's Free Reconciliation Templates Excel.

You Can Use This Worksheet To Reconcile Quarterly Reports, Annual 941 Report, Employee Tax Summary, And Payroll History.

Multiply Column 1 By 0.124 (Or.

The Template Systematically Compares Payroll.

Related Post: