B Notice Template

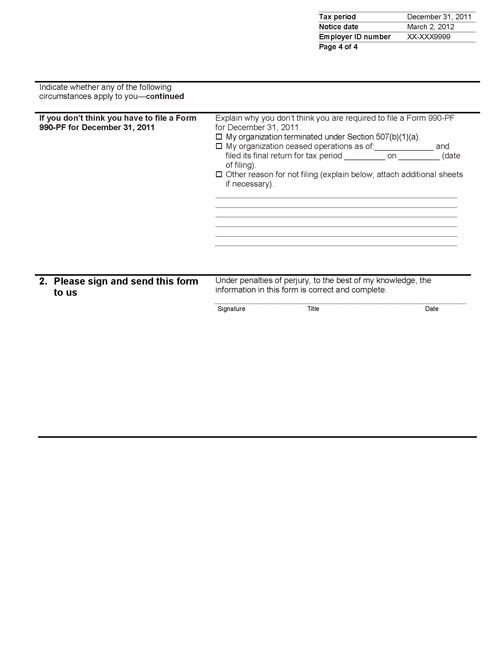

B Notice Template - You must have the irs or ssa validate your taxpayer. No need to install software, just go to dochub, and sign up instantly and for free. Then start using irs tin matching to verify tins before. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive a cp2100 or cp2100a notice from the irs. Before you go, you should call ssa so that they can explain what. You can also download it, export it or print it out. Up to 40% cash back edit, sign, and share b notice form pdf online. The irs has created publication 1288, which includes templates for the two b notices to send to your vendors. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. Up to 40% cash back edit, sign, and share b notice form pdf online. No need to install software, just go to dochub, and sign up instantly and for free. Why your tin may be considered as incorrect. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Cancel anytime100% money back guaranteepaperless solutions Edit your irs b notice template online. Edit your first b notice form template word online. Find out what to do if your payees have. Why your tin may be considered as incorrect?. Irs publication 1281, backup withholding for missing and incorrect names/tin(s), contains detailed information with respect to backup withholding and the “b”. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive a cp2100 or cp2100a notice from the irs. No need to install software, just go to dochub, and sign up instantly and for free. Up to 40% cash back edit, sign, and share b notice form pdf online. Up to 40% cash. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive a cp2100 or cp2100a notice from the irs. Up to 40% cash back send b notice template via email, link, or fax. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and. Up to 40% cash back edit, sign, and share b notice form pdf online. Find out what to do if your payees have. You can also download it, export it or print it out. Why your tin may be considered as incorrect?. Learn how to send a 1099 irs b notice to your payees within 15 days if you receive. You can also download it, export it or print it out. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. You can also download it, export it or print it out. Before you go, you should call ssa so that they can explain what. Up to 40% cash back send irs first. Why your tin may be considered as incorrect. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service. You can also download it, export it or print it out. Find out what to do if your payees have. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account. The irs has created publication 1288, which includes templates for the two b notices to send to your vendors. This notice contains a list of 1099 forms that. Cancel anytime100% money back guaranteepaperless solutions Before you go, you should call ssa so that they can explain what. This notice tells you how to help us make your account records accurate. Edit your irs b notice template online. You can also download it, export it or print it out. Up to 40% cash back edit, sign, and share b notice form pdf online. Report the withholding by january 31 on irs form 945. Before you go, you should call ssa so that they can explain what. You can also download it, export it or print it out. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Edit your first b notice form template word online. This notice contains a list of 1099 forms that. Up to 40% cash back send irs first b. Before you go, you should call ssa so that they can explain what. Find out the differences between cp2100, cp2100a and 972cg notices, and the steps to. Report the withholding by january 31 on irs form 945. Why your tin may be considered as incorrect?. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Irs publication 1281, backup withholding for missing and incorrect names/tin(s), contains detailed information with respect to backup withholding and the “b”. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. You can also download it, export it or print it out. Cancel anytime100% money back guaranteepaperless solutions The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or. If you receive a third 2100 notice, you can ignore it if you. Learn what an irs b notice is, why you may receive one, and how to respond to it. Then start using irs tin matching to verify tins before. We have received notice from the internal revenue service (irs) twice within 3 years stating that the combination of the name and taxpayer identification number (name/tin combination) on. Up to 40% cash back send b notice template via email, link, or fax. Edit your first b notice form template word online.B Notice Letter Fill Online, Printable, Fillable, Blank pdfFiller

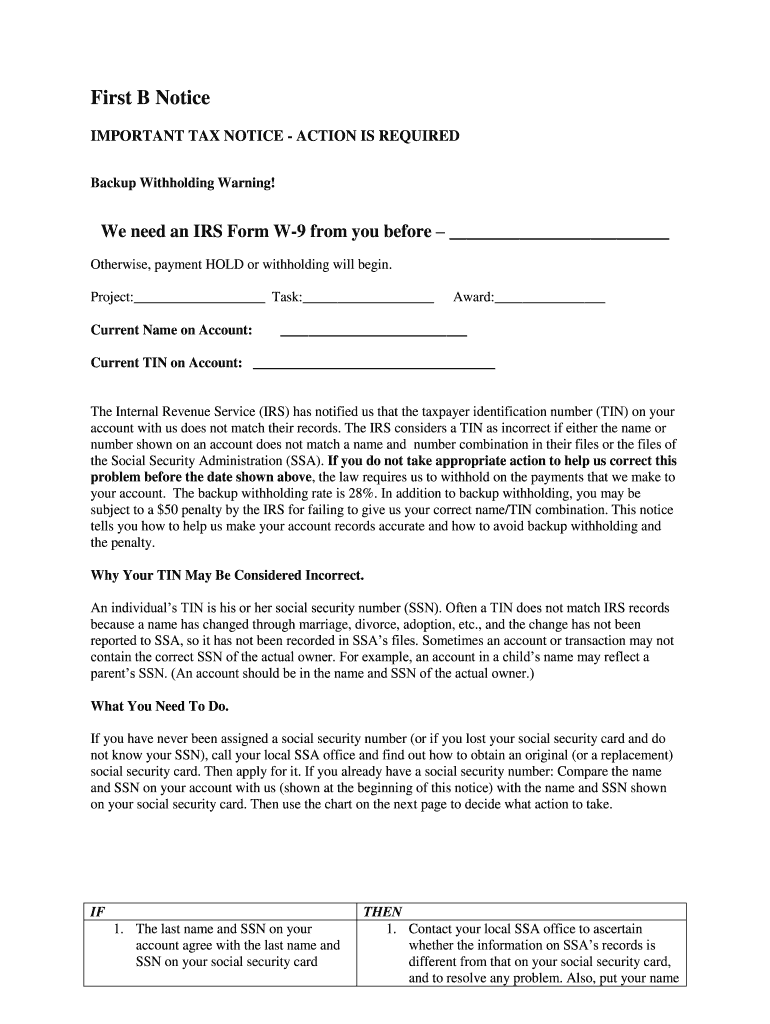

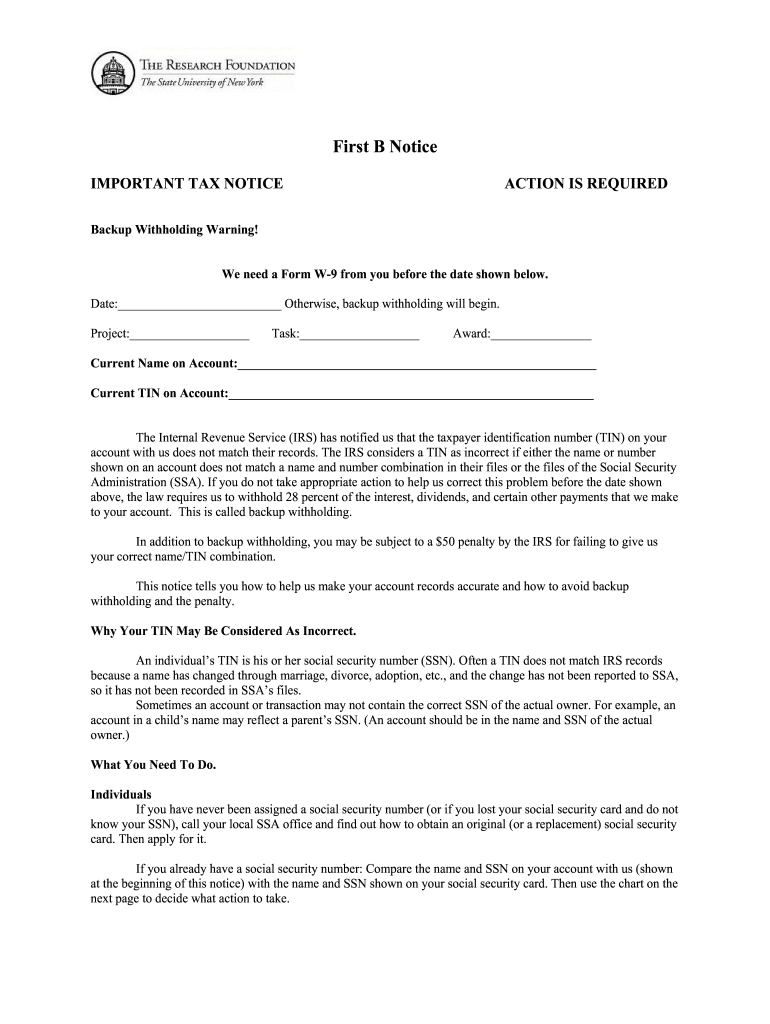

First B Notice Template

TIN Verification, BNotices, and Backup Withholding Best Practices to

1099 B Notice Template

Professional First B Notice Template Word PDF Sample Tacitproject

Irs B Notice Template

First B Notice Template

B Notice Form Complete with ease airSlate SignNow

B Notice Template

B Notice Template

Up To 40% Cash Back Edit, Sign, And Share B Notice Form Pdf Online.

Find Out What To Do If Your Payees Have.

You Can Also Download It, Export It Or Print It Out.

Why Your Tin May Be Considered As Incorrect.

Related Post: