Black Scholes Model Excel Template

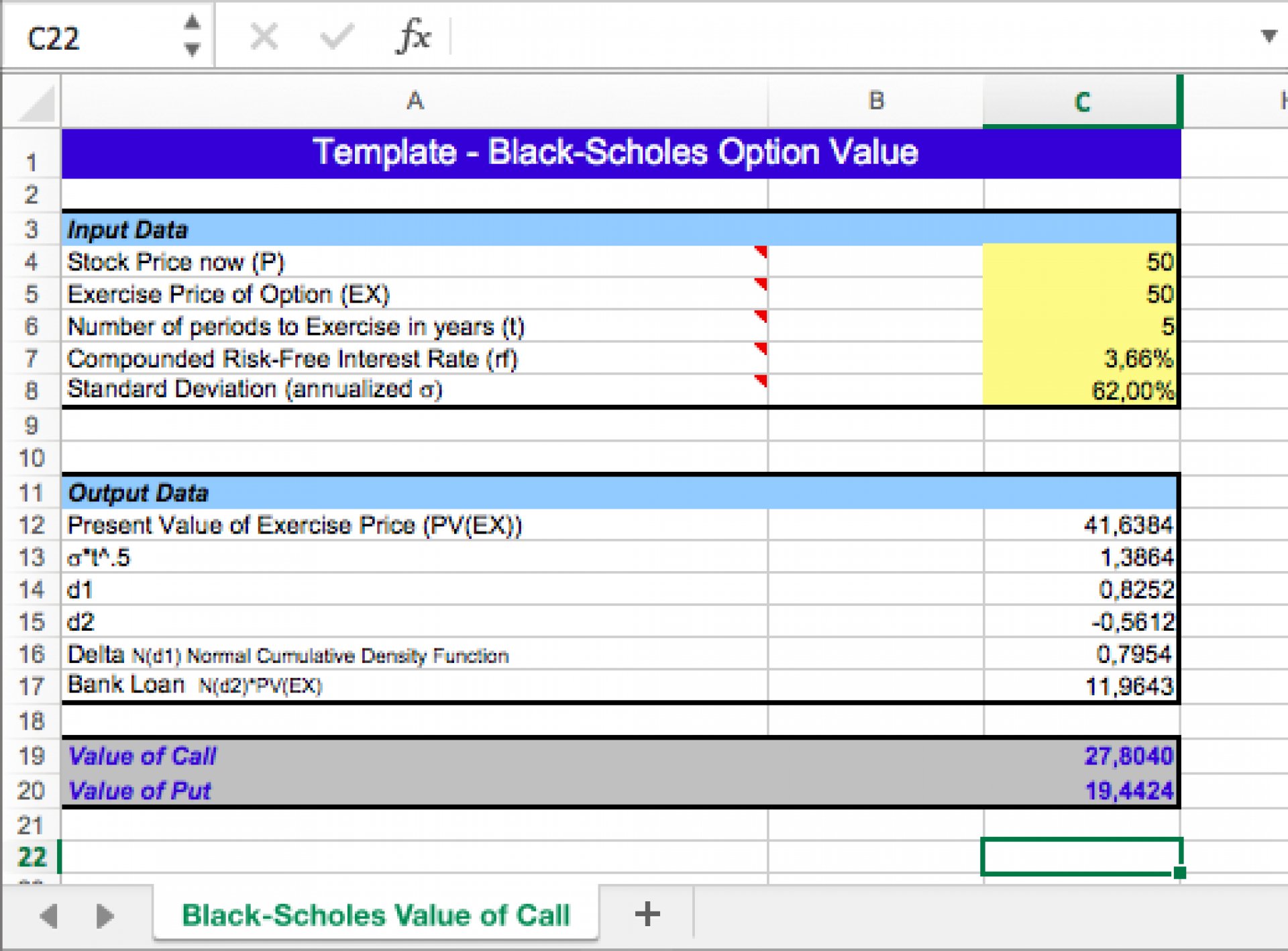

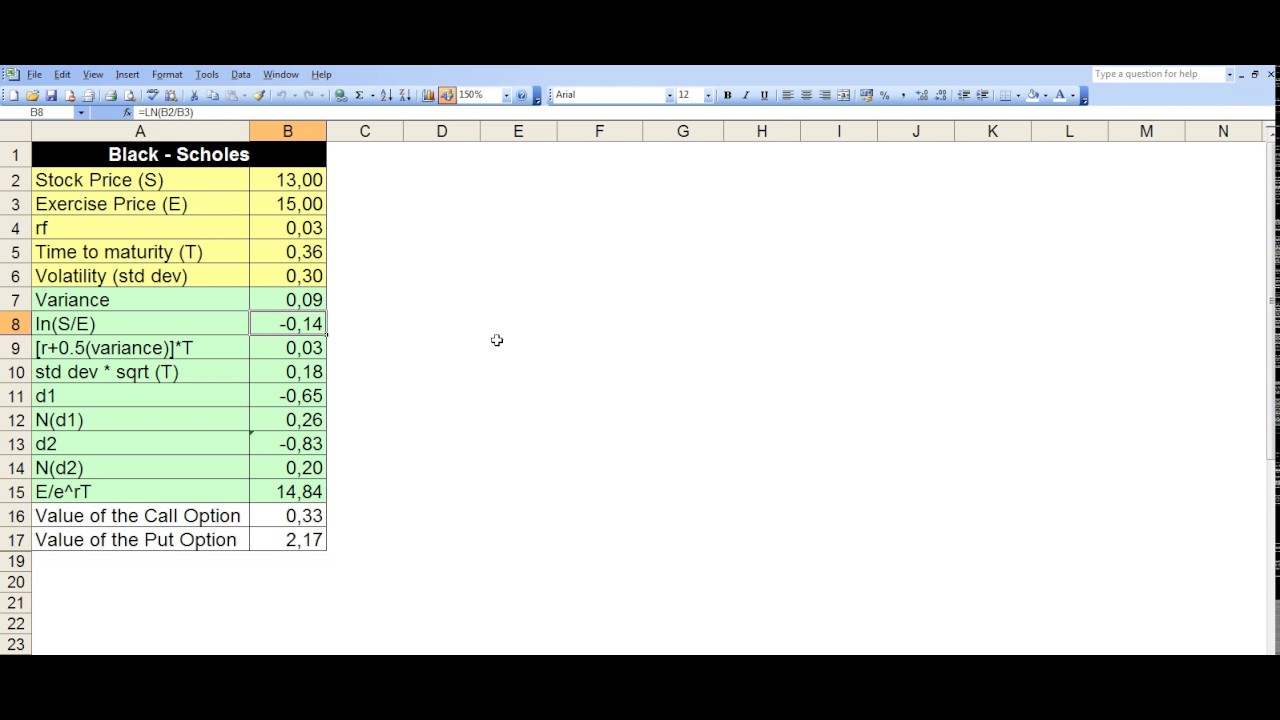

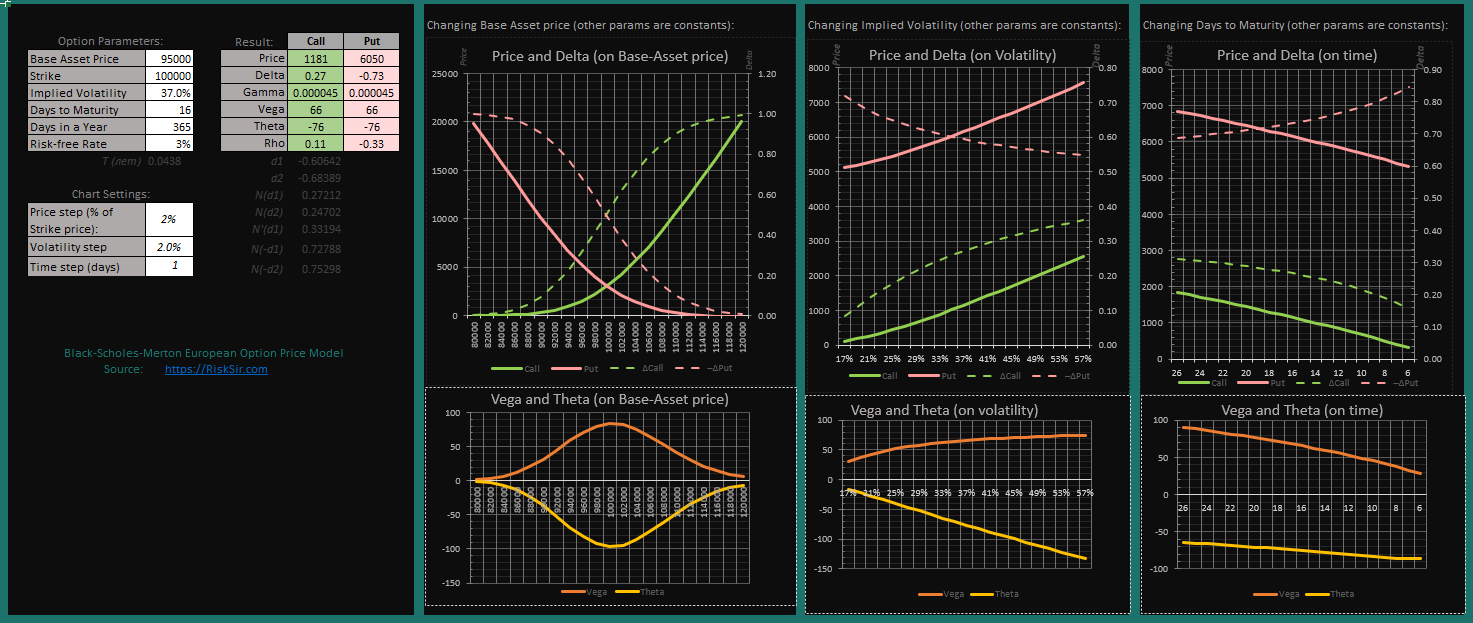

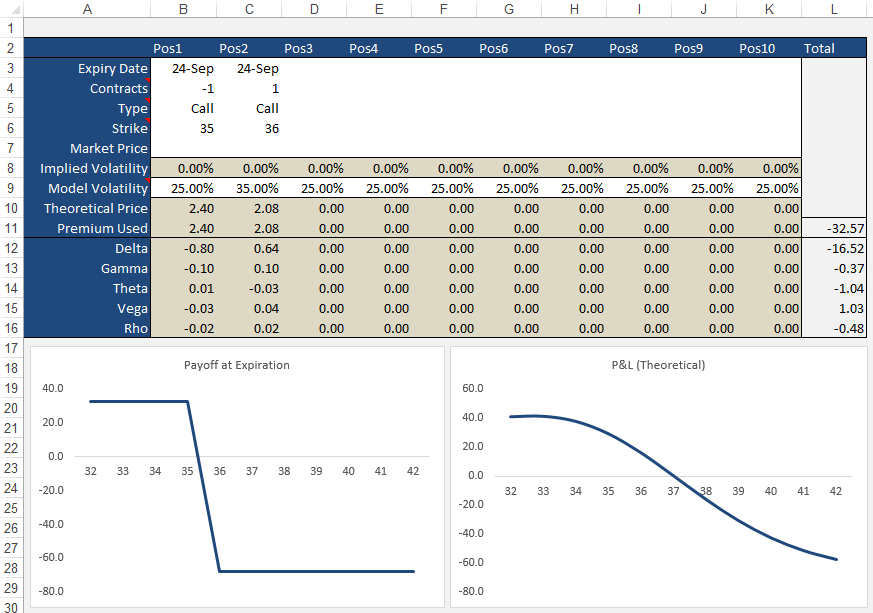

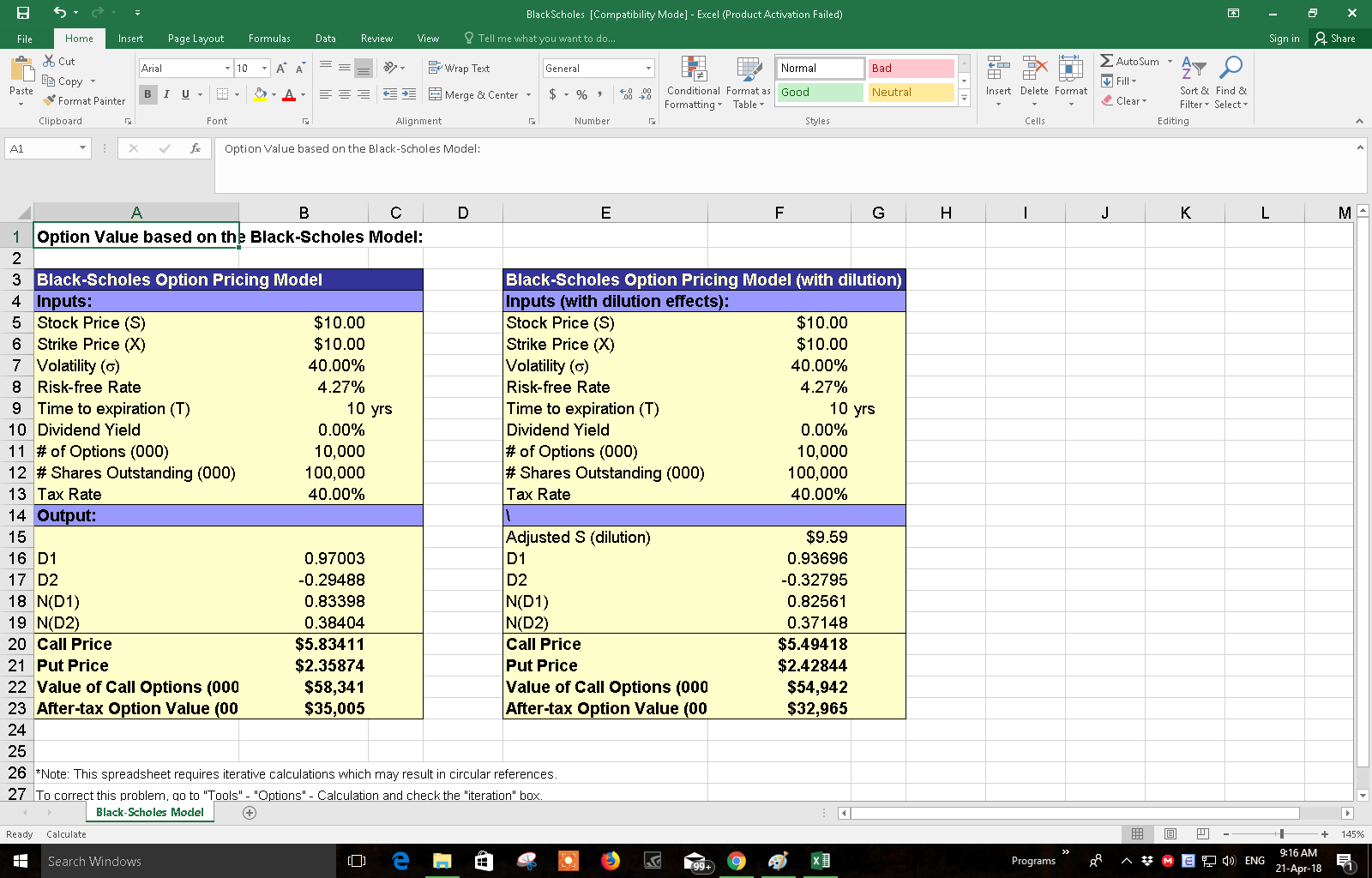

Black Scholes Model Excel Template - My option pricing spreadsheet will allow you to price european call and. Built by finance professors and financial modelers. Developed by fischer black, myron scholes, and robert merton in. Excel based black and scholes calculator for european stock/index options and american options using dividend yields. They’re versatile, powerful, and can be your best friend when it comes to crunching numbers and making. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. Calculate fair values across transaction prices with real examples, plus downloadable. Use marketxls with all options data in excel. “get your hands on our free downloadable excel file, ‘black scholes option pricing model excel workbook’, a comprehensive tool developed to enhance your understanding of. Developed by fischer black, myron scholes, and robert merton in. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike. Built by finance professors and financial modelers. Use marketxls with all options data in excel. “get your hands on our free downloadable excel file, ‘black scholes option pricing model excel workbook’, a comprehensive tool developed to enhance your understanding of. Calculate fair values across transaction prices with real examples, plus downloadable. Excel based black and scholes calculator for european stock/index options and american options using dividend yields. Excel models are like the swiss army knife of the business world. They’re versatile, powerful, and can be your best friend when it comes to crunching numbers and making. Excel based black and scholes calculator for european stock/index options and american options using dividend yields. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike. Built by finance professors and financial modelers. My option pricing spreadsheet will allow. Developed by fischer black, myron scholes, and robert merton in. Use marketxls with all options data in excel. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. Excel models are like the swiss army knife of the business world. They’re versatile, powerful, and can be your best. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. Excel based black and scholes calculator for european stock/index options and american options using dividend yields. They’re versatile, powerful, and can be your best friend when it comes to crunching numbers and making. “get your hands on our. Built by finance professors and financial modelers. Developed by fischer black, myron scholes, and robert merton in. Excel models are like the swiss army knife of the business world. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike.. My option pricing spreadsheet will allow you to price european call and. “get your hands on our free downloadable excel file, ‘black scholes option pricing model excel workbook’, a comprehensive tool developed to enhance your understanding of. Calculate fair values across transaction prices with real examples, plus downloadable. Built by finance professors and financial modelers. Developed by fischer black, myron. Excel based black and scholes calculator for european stock/index options and american options using dividend yields. They’re versatile, powerful, and can be your best friend when it comes to crunching numbers and making. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. Use marketxls with all options. Use marketxls with all options data in excel. Developed by fischer black, myron scholes, and robert merton in. Excel models are like the swiss army knife of the business world. Calculate fair values across transaction prices with real examples, plus downloadable. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike. Built by finance professors and financial modelers. Calculate fair values across transaction prices with real examples, plus downloadable. They’re versatile, powerful, and can be your best friend when it. Calculate fair values across transaction prices with real examples, plus downloadable. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. “get your hands on our free downloadable excel file, ‘black scholes option pricing model excel workbook’, a comprehensive tool developed to enhance your understanding of. Developed by. “get your hands on our free downloadable excel file, ‘black scholes option pricing model excel workbook’, a comprehensive tool developed to enhance your understanding of. Use marketxls with all options data in excel. Calculate fair values across transaction prices with real examples, plus downloadable. Built by finance professors and financial modelers. Up to 10% cash back black scholes excel model. Up to 10% cash back black scholes excel model is the best framework to calculate the underlying value of an option contract. Use marketxls with all options data in excel. My option pricing spreadsheet will allow you to price european call and. Excel models are like the swiss army knife of the business world. Developed by fischer black, myron scholes, and robert merton in. They’re versatile, powerful, and can be your best friend when it comes to crunching numbers and making. A black scholes model excel template is a spreadsheet tool used for calculating theoretical option prices and evaluating fair values for puts and calls using key variables like stock price, strike. Built by finance professors and financial modelers.Option Value Excel Model with BlackScholes formula Eloquens

BlackScholes Model on Excel for Option Pricing YouTube

10 Black Scholes Excel Template Excel Templates

10 Black Scholes Excel Template Excel Templates

Excel BlackScholesMerton Option Price and Greeks Financial Risk

Black Scholes Option Calculator

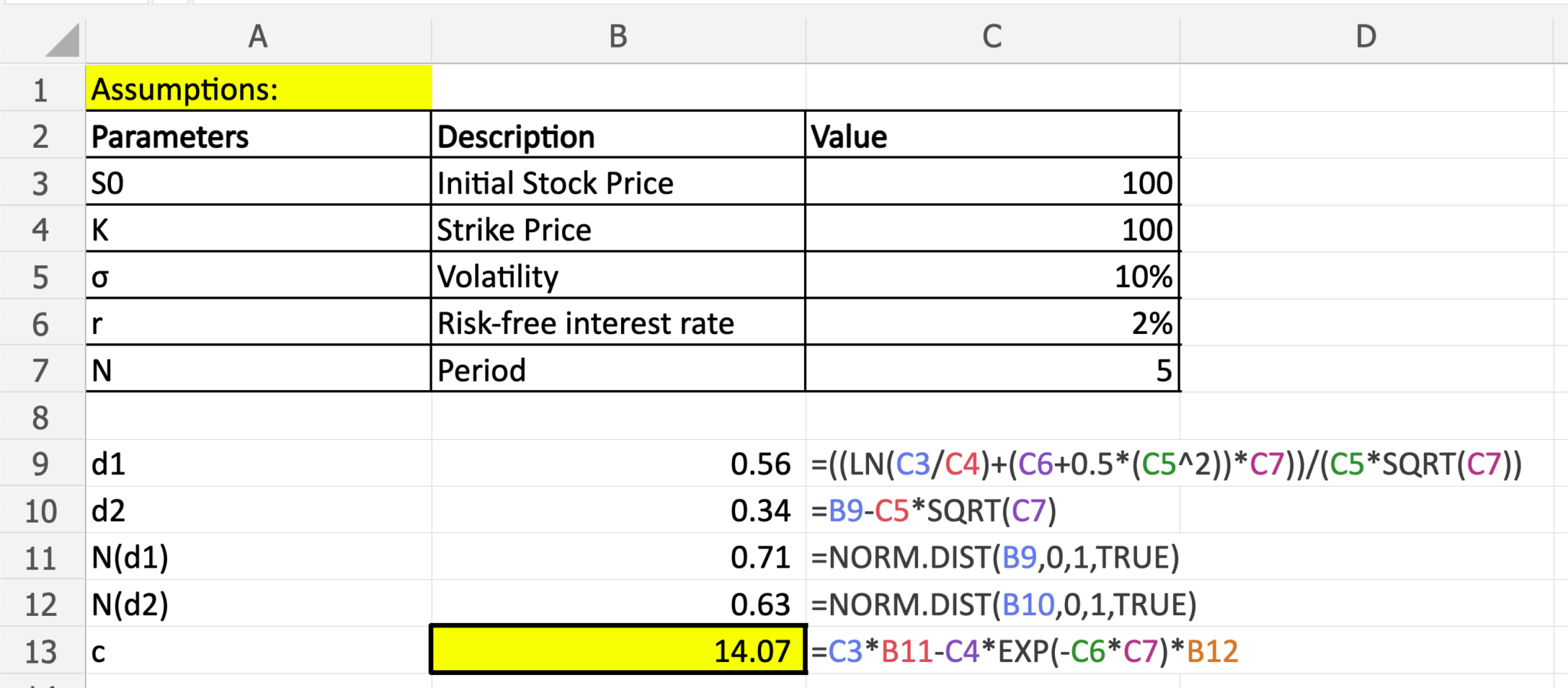

BlackScholes Option Pricing (Excel formula) Dollar Excel

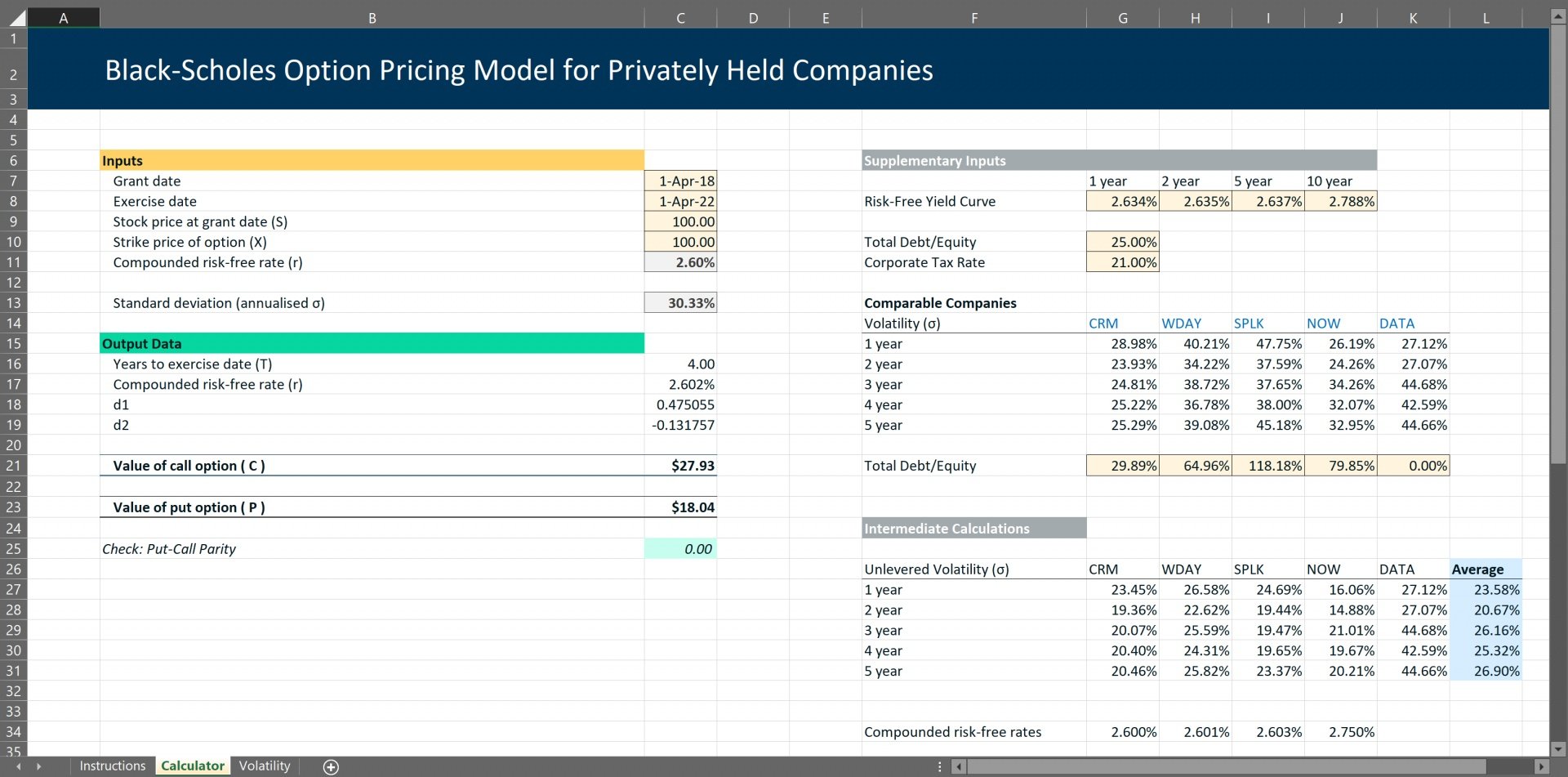

BlackScholes Option Pricing Excel Model (with addon for Privately

Pricing Model Template Excel

BlackScholes Option Pricing Model Spreadsheet YouTube

Calculate Fair Values Across Transaction Prices With Real Examples, Plus Downloadable.

“Get Your Hands On Our Free Downloadable Excel File, ‘Black Scholes Option Pricing Model Excel Workbook’, A Comprehensive Tool Developed To Enhance Your Understanding Of.

Excel Based Black And Scholes Calculator For European Stock/Index Options And American Options Using Dividend Yields.

Related Post: