Charitable Donation Receipt Template

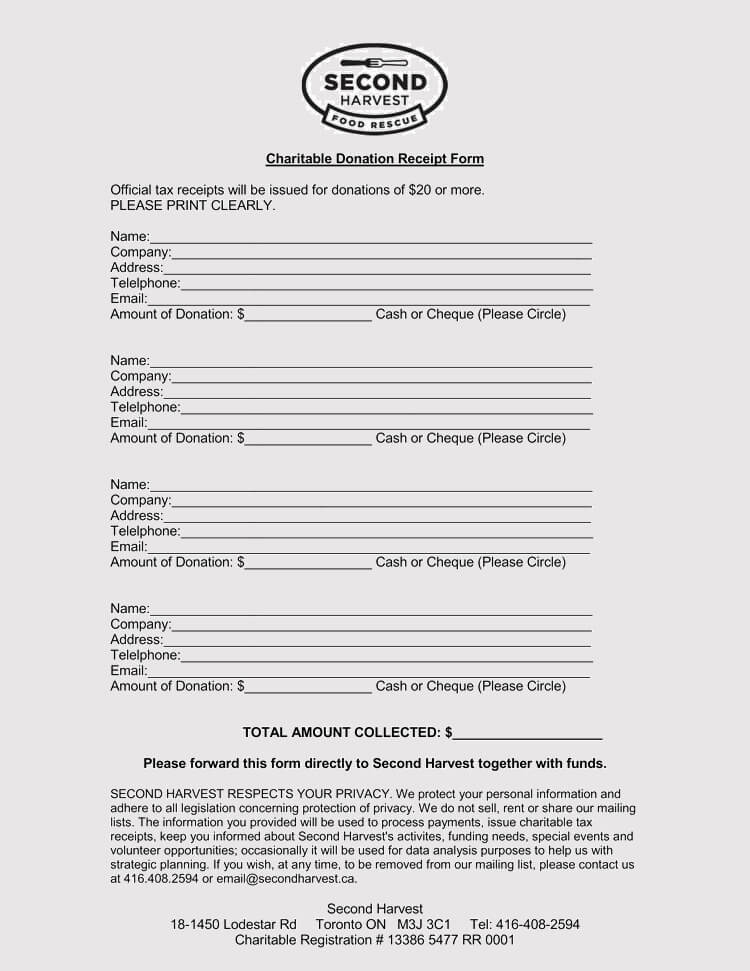

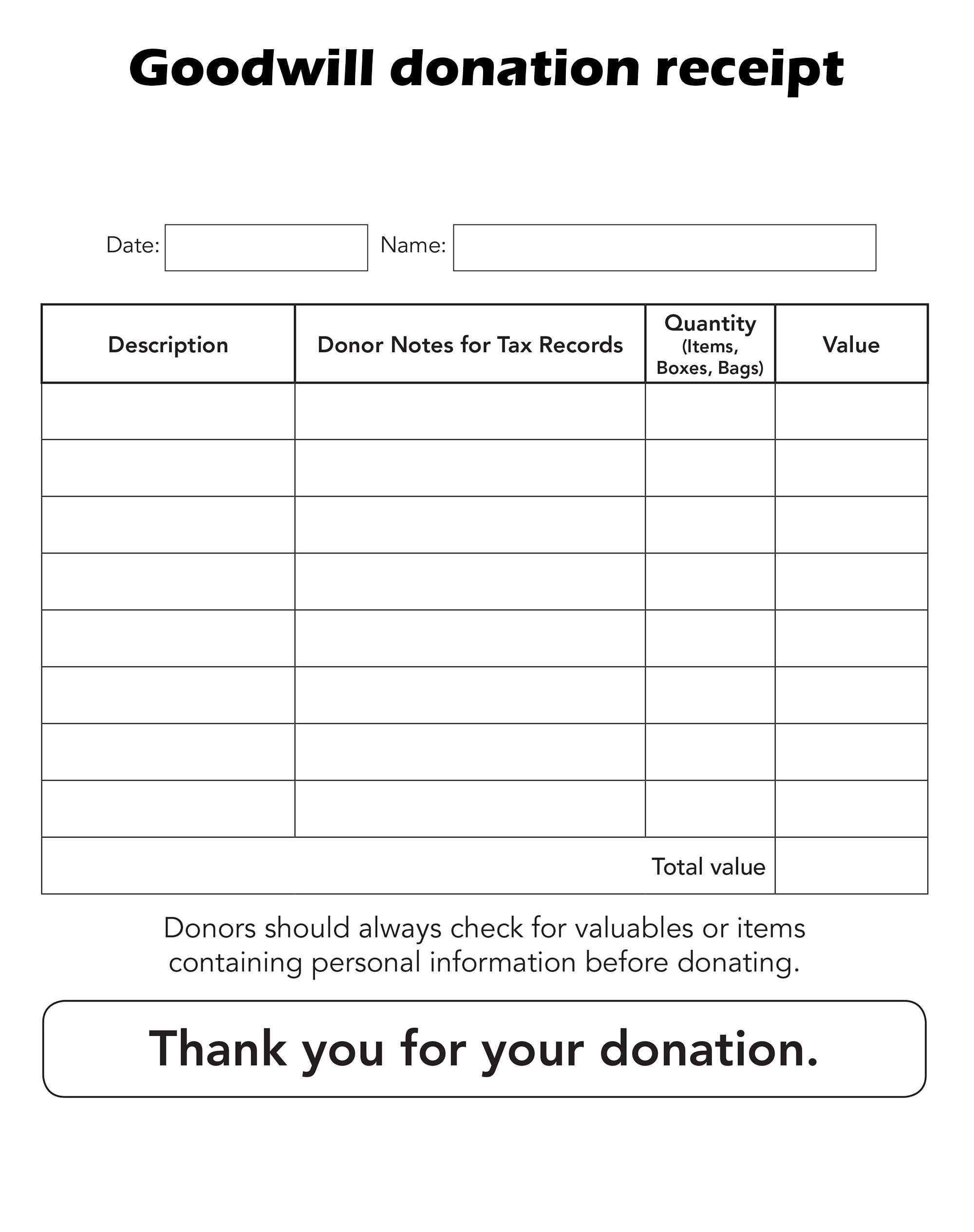

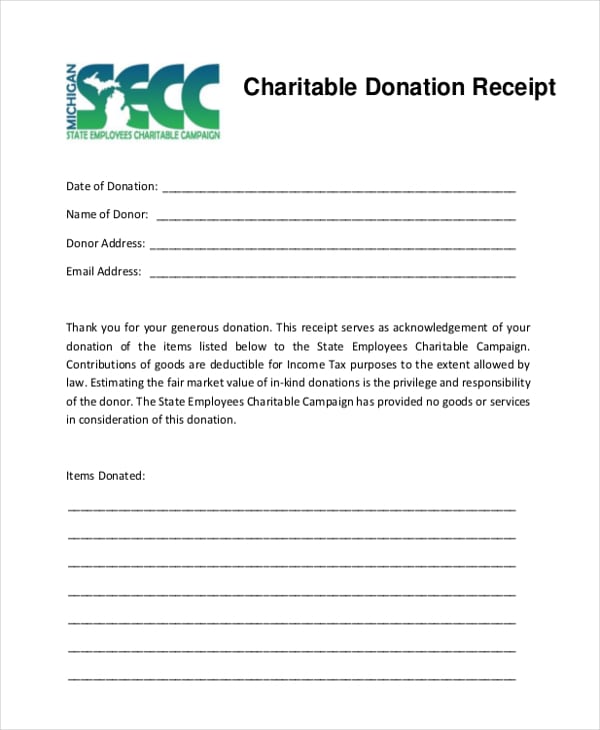

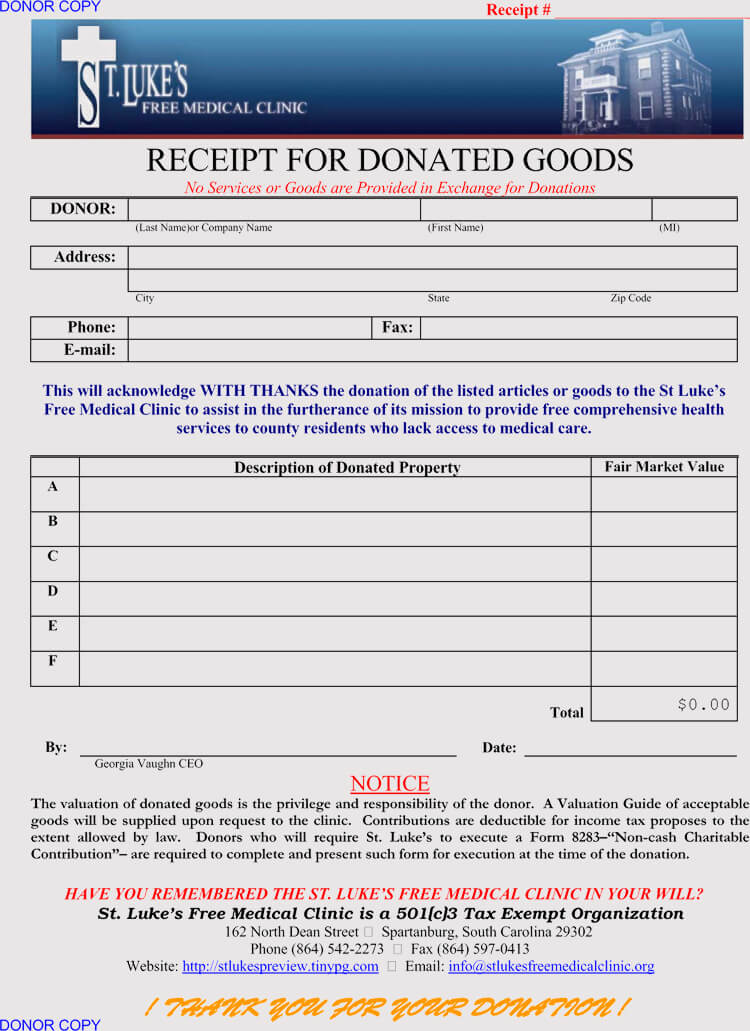

Charitable Donation Receipt Template - A church donation receipt is a record of a charitable donation made to a church. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. The american heart association is a 501(c)(3) charity, which means that all donations are tax deductible as the association is federally tax exempt. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is used to claim a tax deduction for clothing and. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. A church donation receipt is a record of a charitable donation made to a church. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. An american heart association donation receipt is a document used to. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. Since donated clothing is often secondhand, it is up to the donor to estimate. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A donor is responsible for valuing the donated items, and it's important not to. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. The receipt proves the transaction's authenticity to. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A church donation receipt is a record of a charitable donation made to a church. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that. The receipt proves the transaction's authenticity to the government should the donor wish to deduct the contribution from their total income. A church donation receipt is a record of a charitable donation made to a church. An american heart association donation receipt is a document used to show proof of a contribution when disclosing donations in order to receive a tax deduction. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's value. A donor is responsible for valuing the donated items, and it's important not to abuse or overvalue such items in the event of a tax audit. Donors seeking to deduct the value of a donated vehicle from their income tax will need the donation receipt to prove the validity of the donation. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim a tax deduction. The american heart association is a 501(c)(3) charity, which means that all donations are tax deductible as the association is federally tax exempt.Charitable Donation List Template

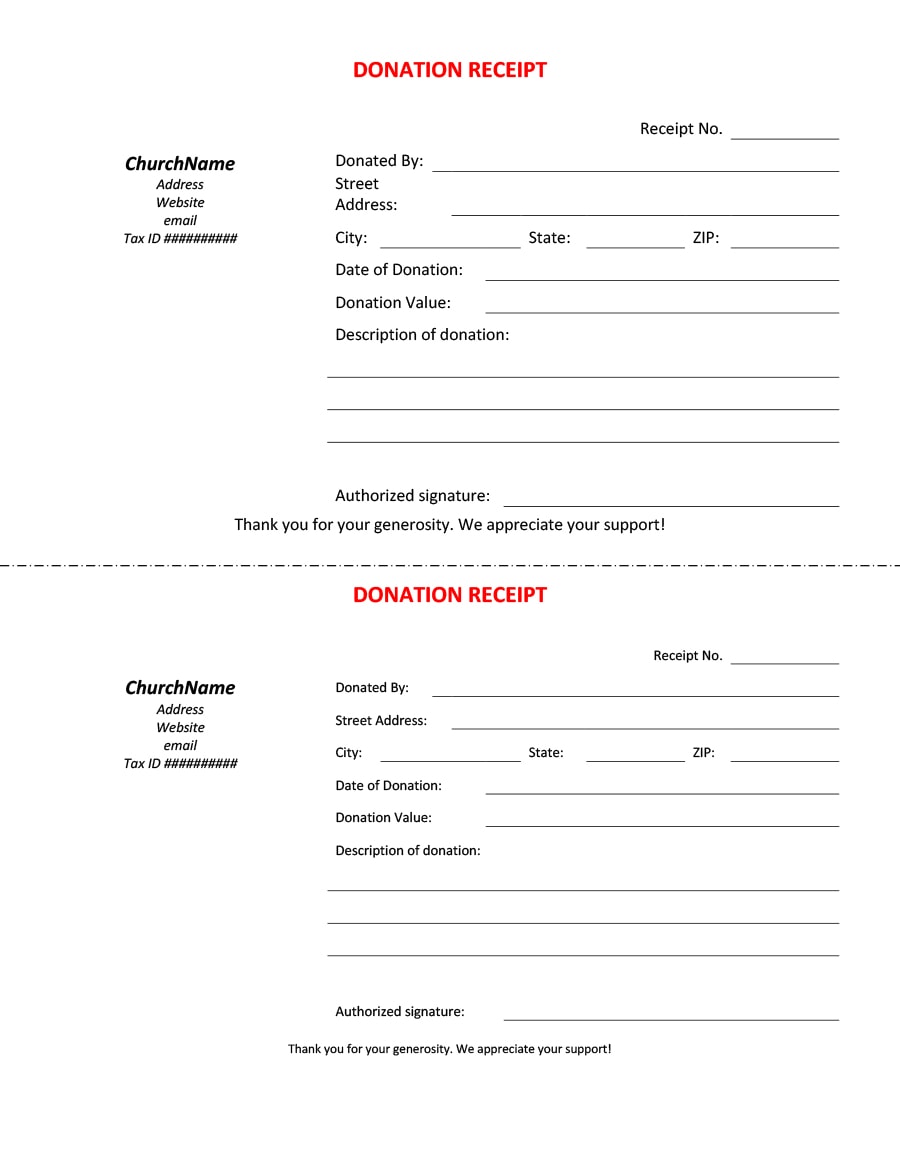

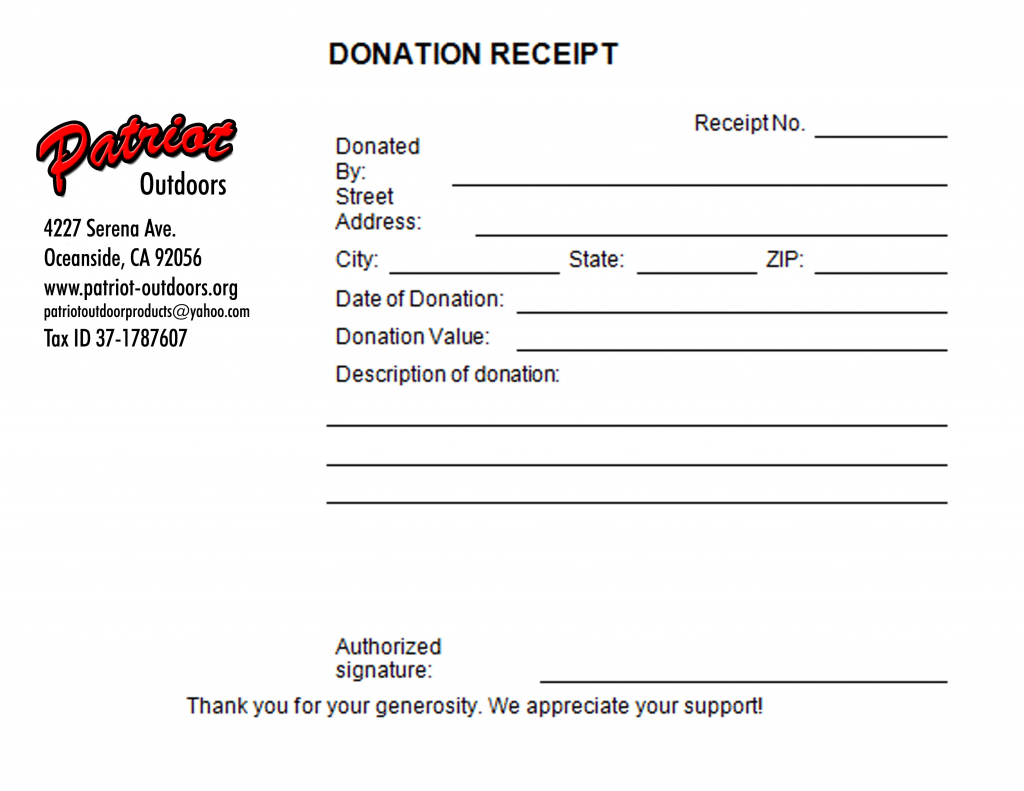

5 Charitable Donation Receipt Templates Free Sample Templates

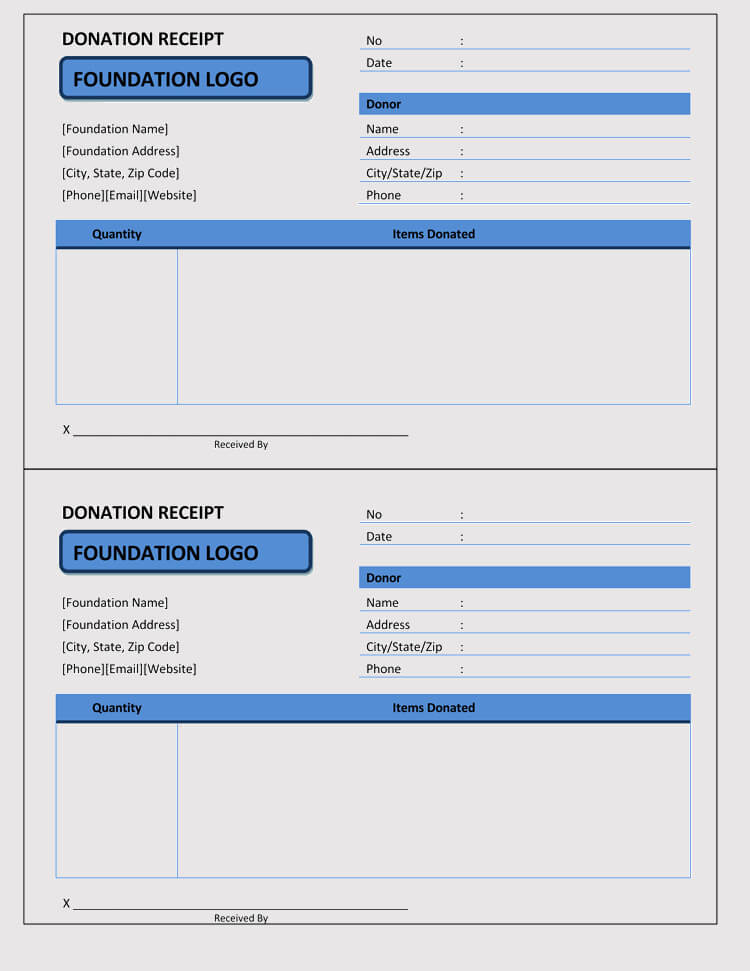

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Printable Donation Receipt Template Printable Templates Your Go

Printable Donation Receipt Template

5 Charitable Donation Receipt Templates formats, Examples in Word Excel

Printable Donation Receipt Template

46 Free Donation Receipt Templates (501c3, NonProfit)

501c3 Donation Receipt Template Printable [Pdf & Word]

46 Free Donation Receipt Templates (501c3, NonProfit)

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual's Taxes.

A Vehicle Donation Receipt, Also Known As A Vehicle Donation Bill Of Sale, Is A Formal Record That Documents The Charitable Gift Of An Automobile.

Primarily, The Receipt Is Used By Organizations For Filing Purposes And Individual Taxpayers To Provide A Deduction On Their State And Federal (Irs) Income Tax.

Related Post:

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)