Discounted Cash Flow Model Template

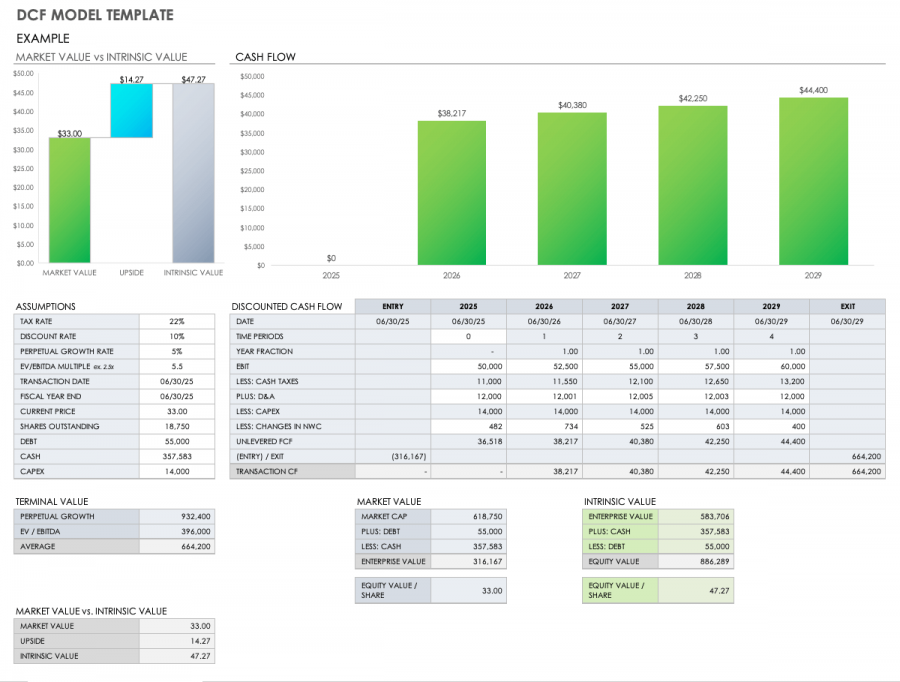

Discounted Cash Flow Model Template - This template allows you to build your own discounted cash flow model with different assumptions. Understand discounted cash flow principles and perform accurate valuations in excel. This discounted free cash flow financial model template allows you to estimate return potential by discounting future cash flow projections to a present value. This file allows you to calculate discounted cash flow in excel. Designed with both novice investors and seasoned financial analysts in mind, this. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. The template includes a dcf formula that allows users to input. Elevate your investment analysis with our free dcf model template. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Understand discounted cash flow principles and perform accurate valuations in excel. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. The template includes a dcf formula that allows users to input. What is a dcf model google sheets template? To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Designed with both novice investors and seasoned financial analysts in mind, this. Elevate your investment analysis with our free dcf model template. Download wso's free discounted cash flow (dcf) model template below! This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the. This file allows you to calculate discounted cash flow in excel. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see more Designed with both novice investors and seasoned financial analysts in mind, this. This discounted free cash flow financial model template allows you to estimate return potential by. This discounted free cash flow financial model template allows you to estimate return potential by discounting future cash flow projections to a present value. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. To help revive your analysis, here is an easy. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Designed with both novice investors and seasoned financial analysts in mind, this. This discounted free cash flow financial model template allows you to estimate return potential by discounting future cash flow projections to a present. Download wso's free discounted cash flow (dcf) model template below! This file allows you to calculate discounted cash flow in excel. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Understand discounted cash flow principles and perform accurate valuations in excel. This discounted free. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Elevate your investment analysis with our free dcf model template. This file allows you to calculate discounted cash flow in excel. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see. The template includes a dcf formula that allows users to input. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see more What is a dcf model google sheets template? This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own. Elevate your investment analysis with our free dcf model template. Understand discounted cash flow principles and perform accurate valuations in excel. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see more Download wso's free discounted cash flow (dcf) model template below! This discounted free cash flow financial model. This template allows you to build your own discounted cash flow model with different assumptions. Understand discounted cash flow principles and perform accurate valuations in excel. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the. It looks at the. This template allows you to build your own discounted cash flow model with different assumptions. Designed with both novice investors and seasoned financial analysts in mind, this. What is a dcf model google sheets template? This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see more To help revive. What is a dcf model google sheets template? This template allows you to build your own discounted cash flow model with different assumptions. Elevate your investment analysis with our free dcf model template. This file allows you to calculate discounted cash flow in excel. It looks at the present value of annual cash flows, allowing you to adjust the template. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions see more Elevate your investment analysis with our free dcf model template. What is a dcf model google sheets template? Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. This discounted free cash flow financial model template allows you to estimate return potential by discounting future cash flow projections to a present value. Download wso's free discounted cash flow (dcf) model template below! This file allows you to calculate discounted cash flow in excel. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the. The template includes a dcf formula that allows users to input. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. This template allows you to build your own discounted cash flow model with different assumptions.Discounted Cash Flow Template Free Excel Download

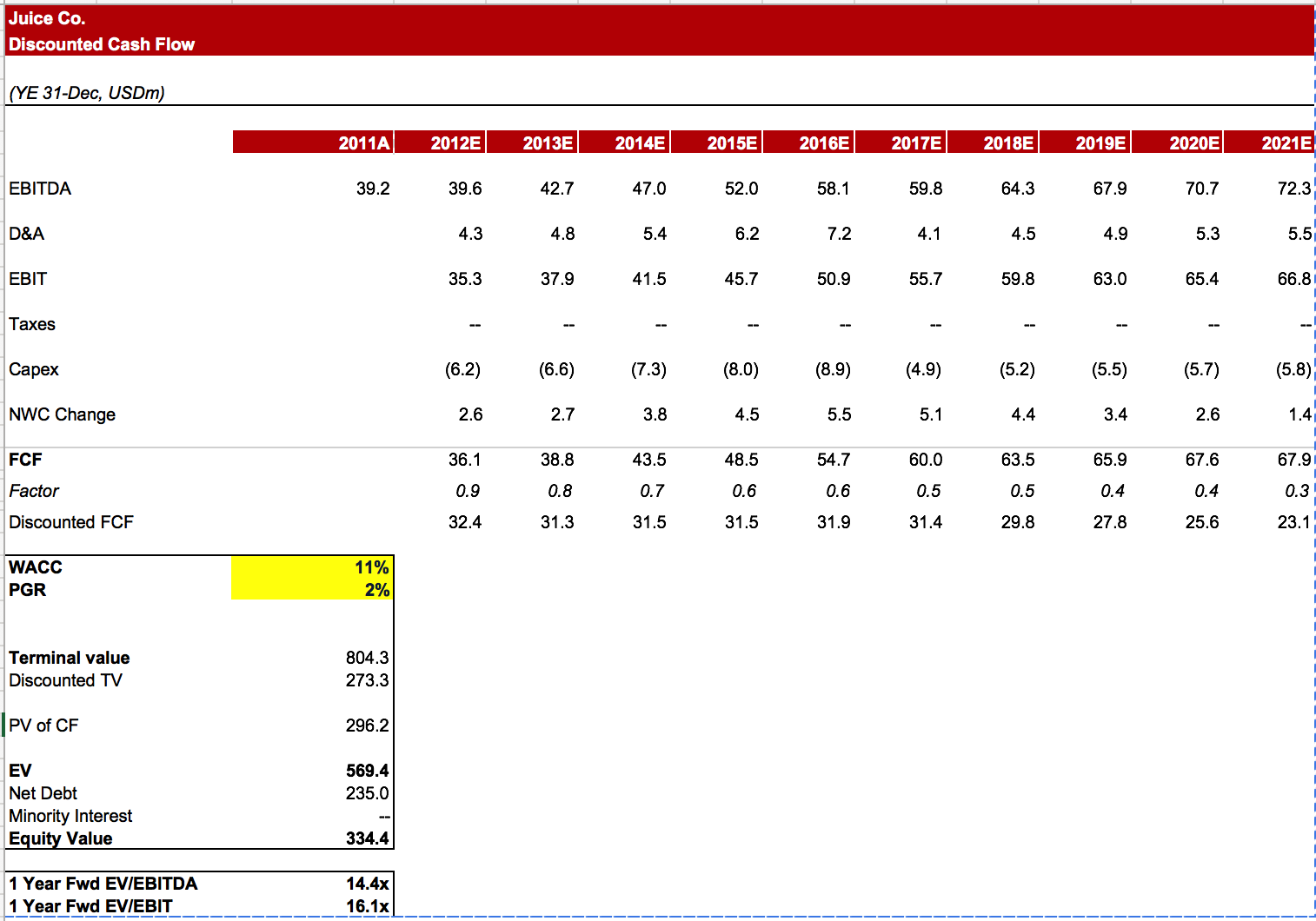

Free Discounted Cash Flow Templates Smartsheet

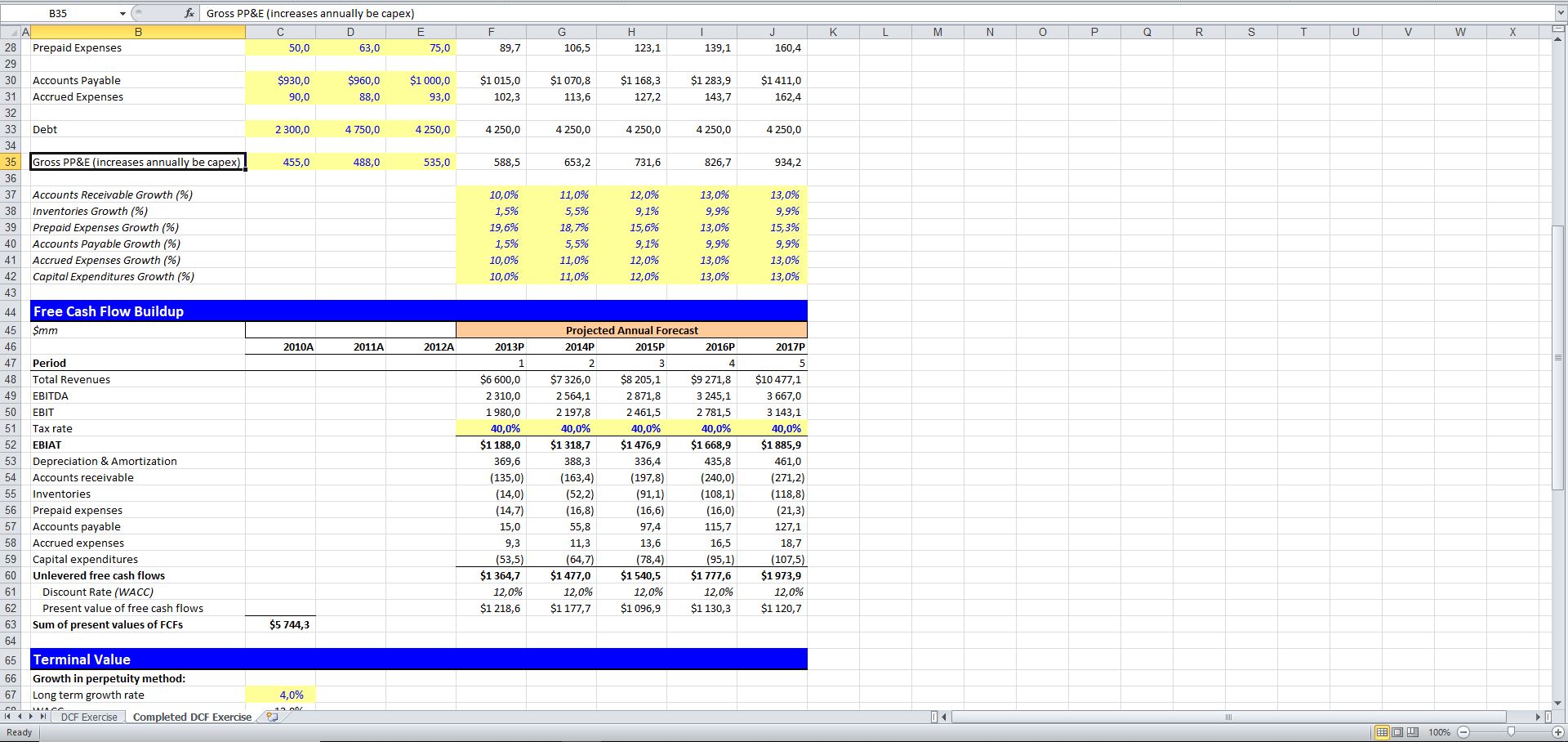

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Model Template, Below is a preview of the dcf

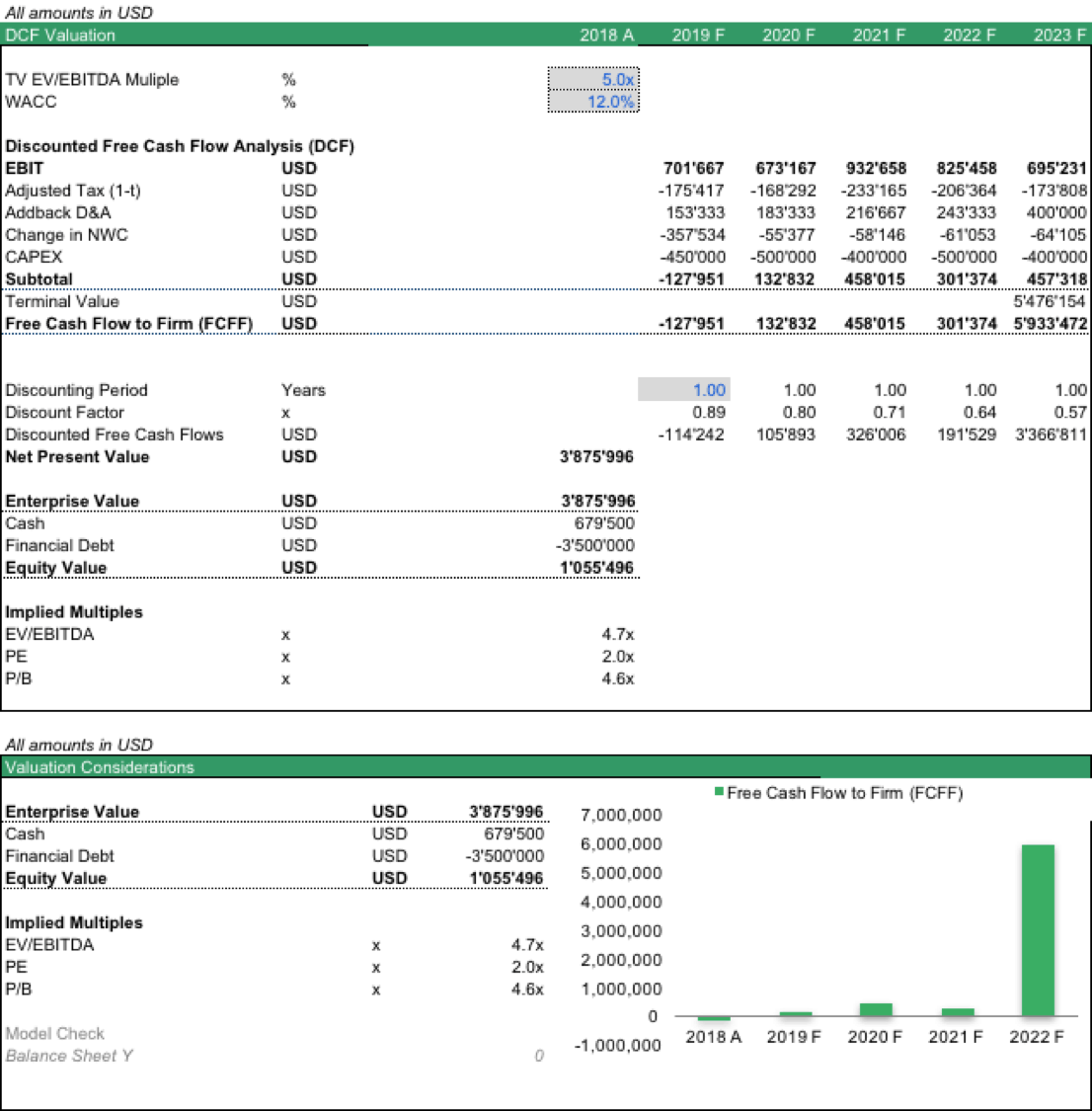

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow Model Template, Below is a preview of the dcf

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Dcf Model Excel Template, Web sample discounted cash flow excel template.

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Designed With Both Novice Investors And Seasoned Financial Analysts In Mind, This.

It Looks At The Present Value Of Annual Cash Flows, Allowing You To Adjust The Template For The Discount Rate.

Understand Discounted Cash Flow Principles And Perform Accurate Valuations In Excel.

This Free Excel Spreadsheet Contains A Discounted Cash Flow (Dcf) Model Template That Allows You To Build Your Own Discounted Cash Flow Model For Your Company With.

Related Post: