Donation Slip Template

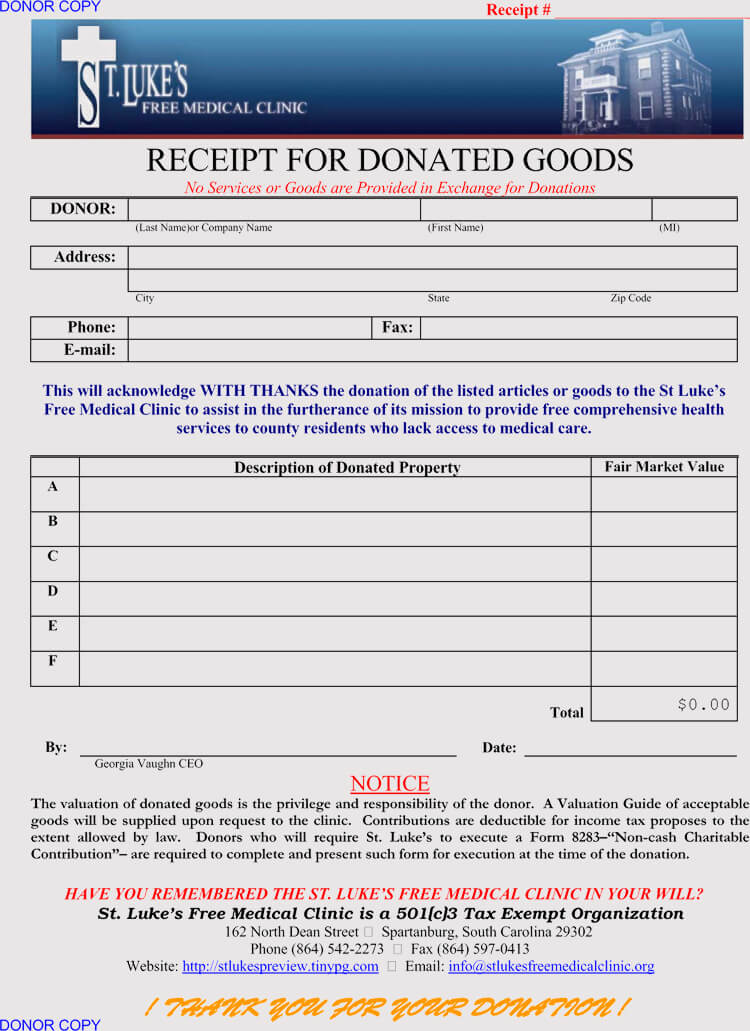

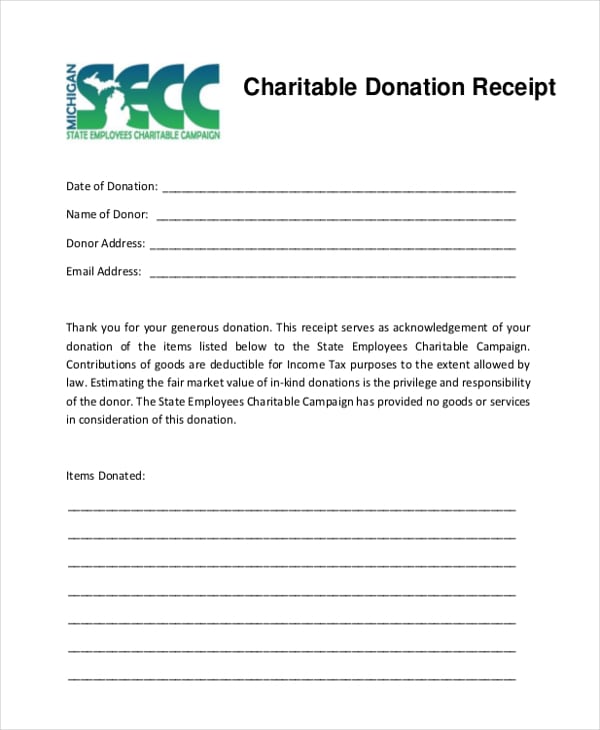

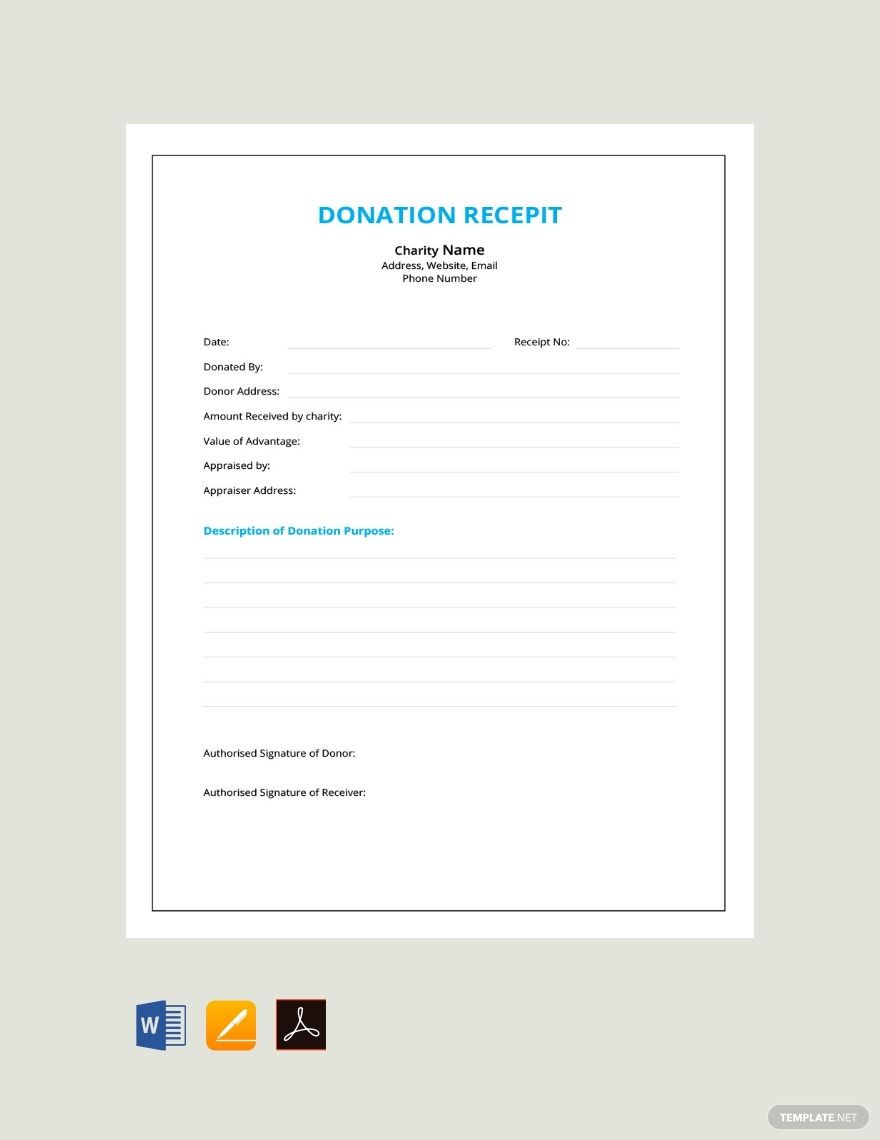

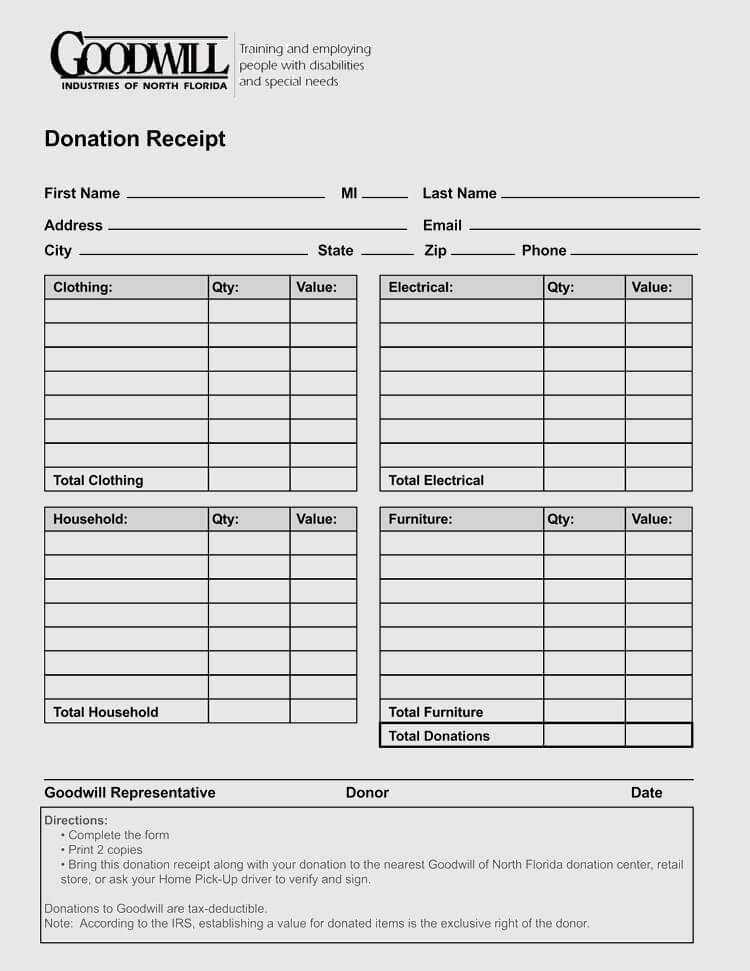

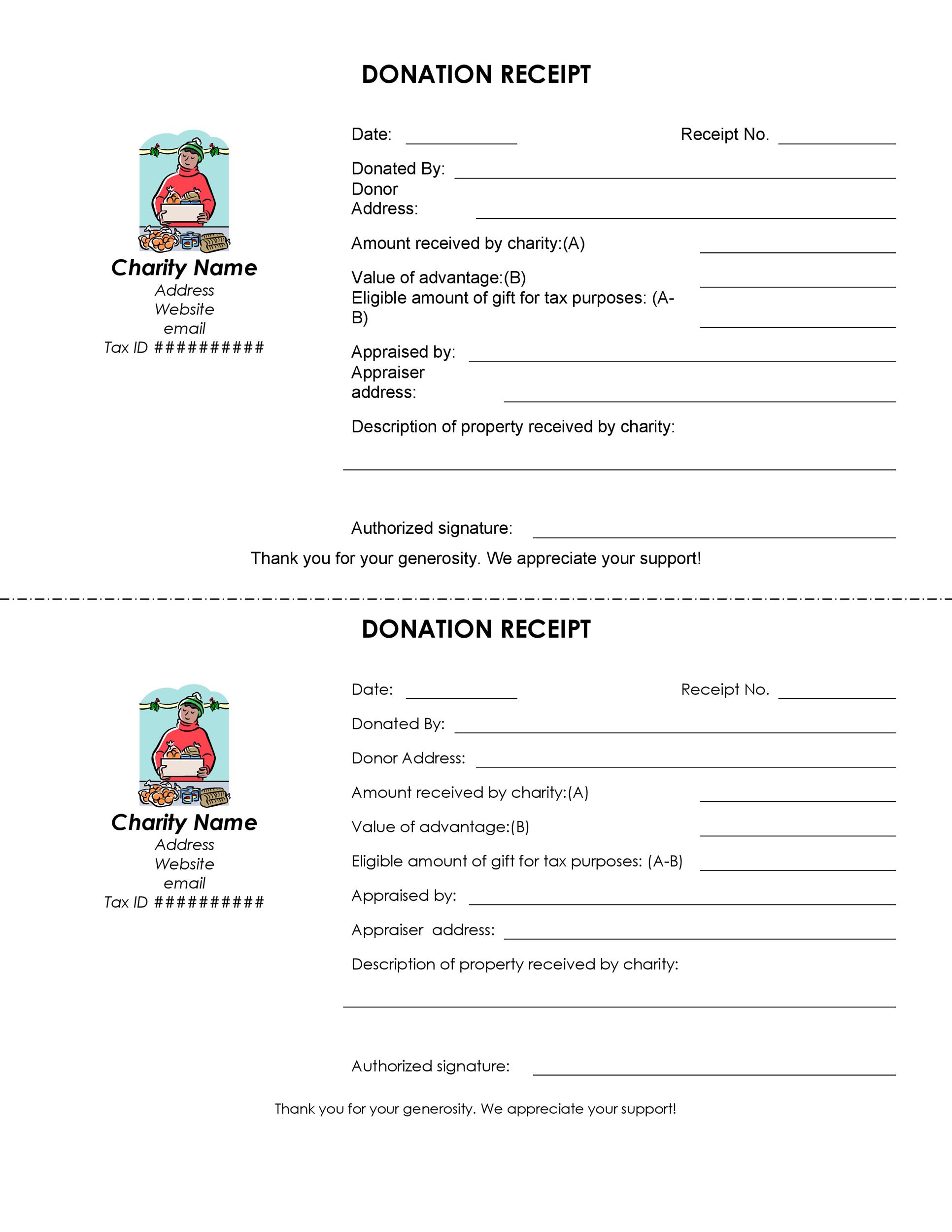

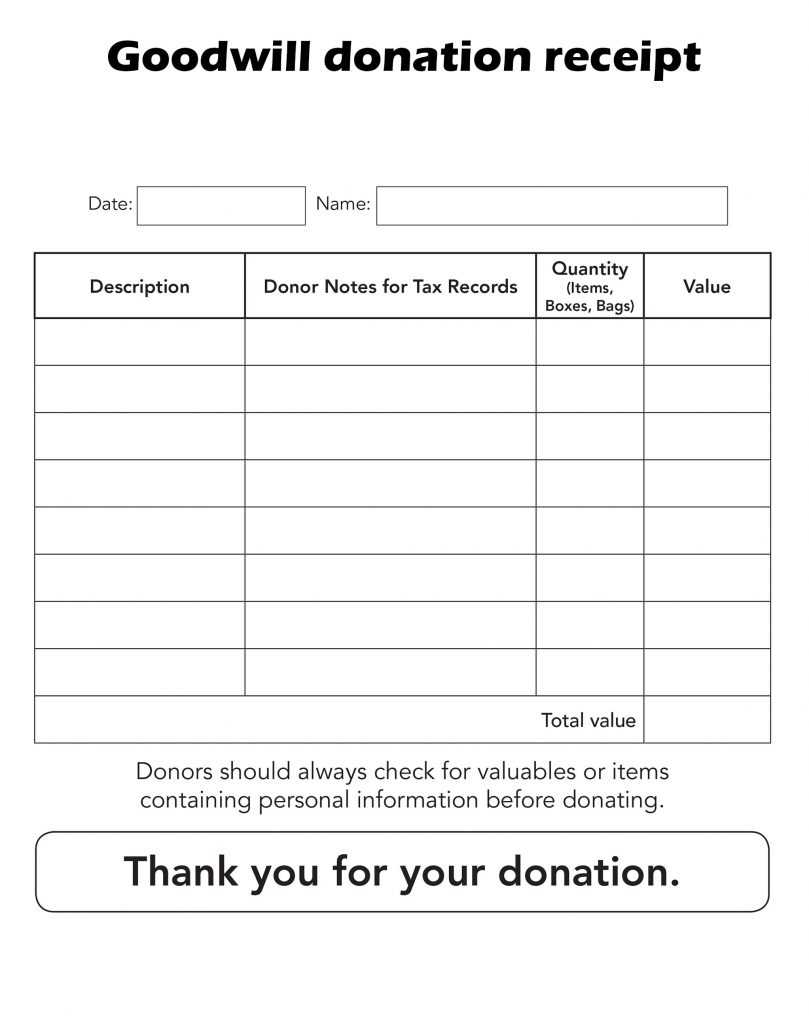

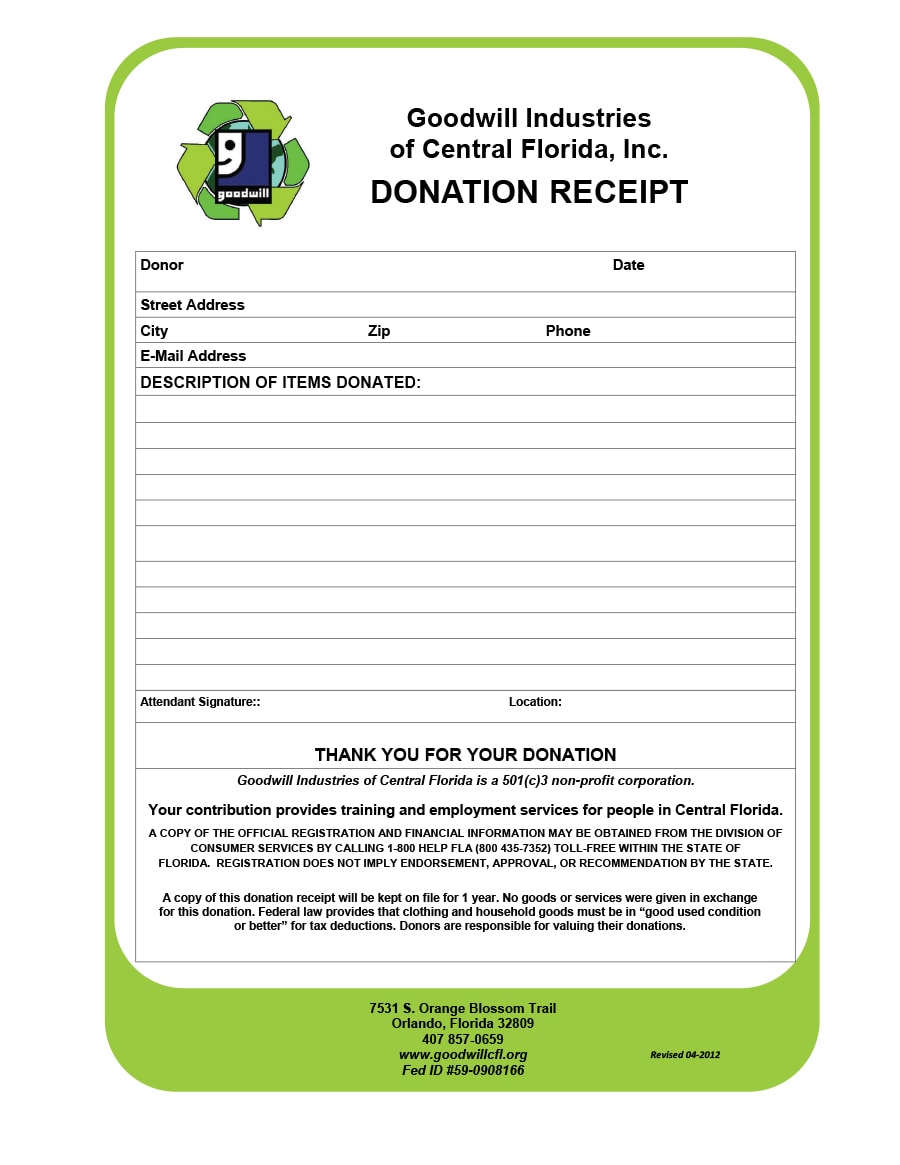

Donation Slip Template - Templates offer a structured way to. In the realm of fundraising and charity endeavors, the significance of donation slip templates is paramount. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations may apply). For more templates, refer to our main receipt templates page here. It is typically provided by. A donation receipt form should. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. For every online donation submission, this free template instantly generates a pdf receipt that can be downloaded, printed for your records, or automatically emailed to donors for their tax. A donation receipt can be prepared from a template. These simple yet pivotal documents smooth the flawless recording. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. Donation receipt template 39 types of receipts simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations may apply). You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Donation receipt templates are a necessity when it comes to charitable donations. Here’s our collection of donation receipt templates. A donation receipt form should. A donation receipt can be prepared from a template. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. These simple yet pivotal documents smooth the flawless recording. Our readers can download donation receipt templates from our site at no charge. Here’s our collection of donation receipt templates. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Get simple, free templates that can be used for any donation or gift. For more templates, refer to our main receipt templates page here. It is typically provided by. Here’s our collection of donation receipt templates. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of. In the realm of fundraising and charity endeavors, the significance of donation slip templates is paramount. Feel free to download, modify and use any you like. The templates are professionally designed to ease. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections. Get a free nonprofit donation receipt template for every giving scenario. Feel free to download, modify and use any you like. A donation receipt form should. It is typically provided by. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. They bridge the gap between donors and organizations and ensure compliance with tax regulations. Donation receipt templates are a necessity when it comes to charitable donations. A donation receipt form should. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Our readers can download donation receipt templates from our site at. Made to meet us & canada requirements. Here’s our collection of donation receipt templates. Get a free nonprofit donation receipt template for every giving scenario. Feel free to download, modify and use any you like. Templates offer a structured way to. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. In the realm of fundraising and charity endeavors, the significance of donation slip templates is paramount. Given below are donation receipt templates: A donation receipt form should. Donation receipt templates are. It is typically provided by. Donation receipt templates are indispensable. Donation receipt templates are a necessity when it comes to charitable donations. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. A nonprofit receipt template is a helpful document used. For more templates, refer to our main receipt templates page here. Get simple, free templates that can be used for any donation or gift here. Here’s our collection of donation receipt templates. For every online donation submission, this free template instantly generates a pdf receipt that can be downloaded, printed for your records, or automatically emailed to donors for their. Donation receipt templates are indispensable. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Made to meet us & canada requirements. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations may apply). For more templates, refer to our main receipt templates page here. These simple yet pivotal documents smooth the flawless recording. Our readers can download donation receipt templates from our site at no charge. Here’s our collection of donation receipt templates. Get a free nonprofit donation receipt template for every giving scenario. Get simple, free templates that can be used for any donation or gift here. It is typically provided by. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. In the realm of fundraising and charity endeavors, the significance of donation slip templates is paramount. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary.5 Charitable Donation Receipt Templates Free Sample Templates

Donation Receipt Template in Excel, Word, PDF, Pages Download

FREE 9+ Donation Receipt Templates in Google Docs Google Sheets

46 Free Donation Receipt Templates (501c3, NonProfit)

FREE 5+ Donation Receipt Forms in PDF MS Word

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Free Sample Printable Donation Receipt Template Form

Donation Receipt Template Excel Templates

Free Printable Donation Receipt Templates [PDF, Word, Excel]

46 Free Donation Receipt Templates (501c3, NonProfit)

For Every Online Donation Submission, This Free Template Instantly Generates A Pdf Receipt That Can Be Downloaded, Printed For Your Records, Or Automatically Emailed To Donors For Their Tax.

Given Below Are Donation Receipt Templates:

Donation Receipt Template 39 Types Of Receipts Simplify Your Process And Ensure Transparency And Gratitude Towards Your Generous Donors With Our Professionally Designed Templates.

Depending On Current Legislation, There May Be Ways To Deduct More The Limited Amount, For Example, In 2017 There Was.

Related Post:

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/Fillable-Donation-Receipt.jpg?gid=710)