Excel Template For Compound Interest Calculation

Excel Template For Compound Interest Calculation - In excel, enter the general compound interest formula. The tutorial explains how to use the compound interest formula in excel and gives examples of how to calculate the future. Moneygeek’s compound interest calculator calculates compound interest using the above formulas. The platform creates templates tailored to specific investment scenarios. The example is based on investing $100 quarterly for 18 years,. =b1* (1+b2/b4)^ (b4*b3) you will get the future. Open excel and click on file > new. in the search bar, type loan amortization or loan calculator. browse through the available templates and. Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. Create projection of your savings with fixed or variable interest rates and additional contributions to see how much you. Here are a few tips to help you avoid them: Moneygeek’s compound interest calculator calculates compound interest using the above formulas. Download a free savings interest calculator for microsoft® excel®. F= future accumulated value 2. Download this free compound interest calculator for excel to do all of your compound interest calculations. This article explains how to build a model in excel to show how money grows with compound interest and regular investing. Here are a few tips to help you avoid them: The document contains information about compound interest calculators that can calculate future values based on principal amounts, interest rates, compound frequencies, years of growth,. The formula for compound interest is: Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. P= principal (starting) amount 3. Create projection of your savings with fixed or variable interest rates and additional contributions to see how much you. In this tutorial, we’ll explain how to calculate simple compound interest, reverse compound interest, and continuous compound interest with examples in excel. Open excel and click on file > new. in the search bar, type loan amortization or loan calculator. browse. F= future accumulated value 2. The formula for compound interest is: The basic compound interest formula for calculating a future value is f = p*(1+rate)^nperwhere 1. Download a free savings interest calculator for microsoft® excel®. =b1* (1+b2/b4)^ (b4*b3) you will get the future. The platform creates templates tailored to specific investment scenarios. The document contains information about compound interest calculators that can calculate future values based on principal amounts, interest rates, compound frequencies, years of growth,. In this tutorial, we’ll explain how to calculate simple compound interest, reverse compound interest, and continuous compound interest with examples in excel. You’ll be impressed by how. The formula for compound interest is: Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. The platform creates templates tailored to specific investment scenarios. P= principal (starting) amount 3. Understanding and calculating compound interest isn't just an academic exercise; Click on the below link to download the practice file. These templates can include dynamic features like automated. Create projection of your savings with fixed or variable interest rates and additional contributions to see how much you. As with any tool, there are common mistakes people make when calculating compound interest in excel. In excel, enter the general compound interest. This article explains how to build a model in excel to show how money grows with compound interest and regular investing. Understanding and calculating compound interest isn't just an academic exercise; The example is based on investing $100 quarterly for 18 years,. Open excel and click on file > new. in the search bar, type loan amortization or loan calculator.. Open excel and click on file > new. in the search bar, type loan amortization or loan calculator. browse through the available templates and. The tutorial explains how to use the compound interest formula in excel and gives examples of how to calculate the future. Download a free savings interest calculator for microsoft® excel®. Download this free compound interest calculator. This professional compound interest calculator. The example is based on investing $100 quarterly for 18 years,. In this tutorial, we’ll explain how to calculate simple compound interest, reverse compound interest, and continuous compound interest with examples in excel. The document contains information about compound interest calculators that can calculate future values based on principal amounts, interest rates, compound frequencies, years. All we have to do is to select the correct cell references. Create projection of your savings with fixed or variable interest rates and additional contributions to see how much you. Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. These templates can include dynamic features like automated. Moneygeek’s compound. The example is based on investing $100 quarterly for 18 years,. Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. The formula for compound interest is: These templates can include dynamic features like automated. The platform creates templates tailored to specific investment scenarios. Download a free savings interest calculator for microsoft® excel®. =b1* (1+b2/b4)^ (b4*b3) you will get the future. In excel, compounding is typically used to calculate compound interest—a concept many of us might remember from school. The formula for compound interest is: This professional compound interest calculator. Download this free compound interest calculator for excel to do all of your compound interest calculations. These templates can include dynamic features like automated. The document contains information about compound interest calculators that can calculate future values based on principal amounts, interest rates, compound frequencies, years of growth,. As with any tool, there are common mistakes people make when calculating compound interest in excel. Interest = $1,000 x 0.05 x 3 = $150 compound interest. In excel, enter the general compound interest formula. Moneygeek’s compound interest calculator calculates compound interest using the above formulas. Compound interest, on the other hand, adds the interest to the principal at each interval, meaning you're earning interest. F= future accumulated value 2. All we have to do is to select the correct cell references. You’ll be impressed by how easy it is to perform complex compound interest.Examples of Compound Interest Excel Template and Compound Interest

Excel Template For Compound Interest Calculation

How to Calculate Monthly Compound Interest in Excel

How to Use Compound Interest Formula in Excel Sheetaki

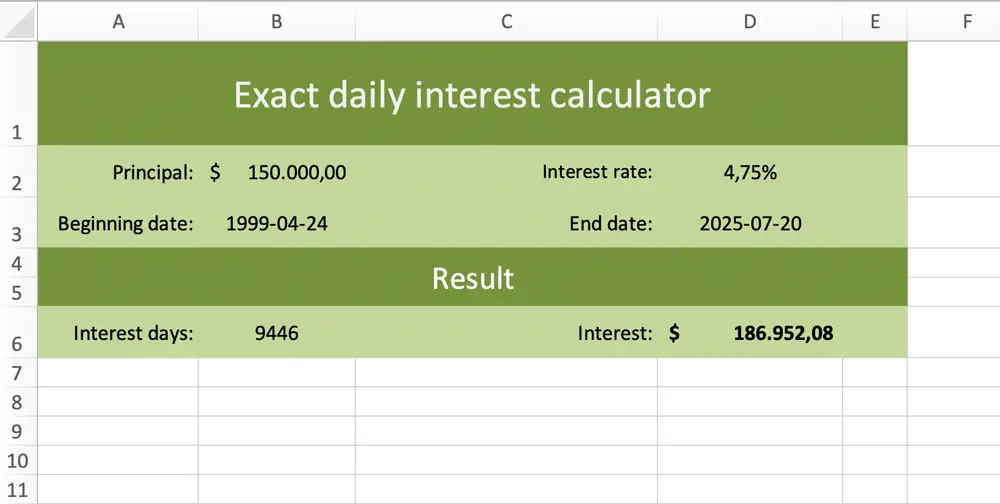

Daily Compound Interest Calculator Excel Template

Calculate compound interest Excel formula Exceljet

Compound Interest Calculator for Excel

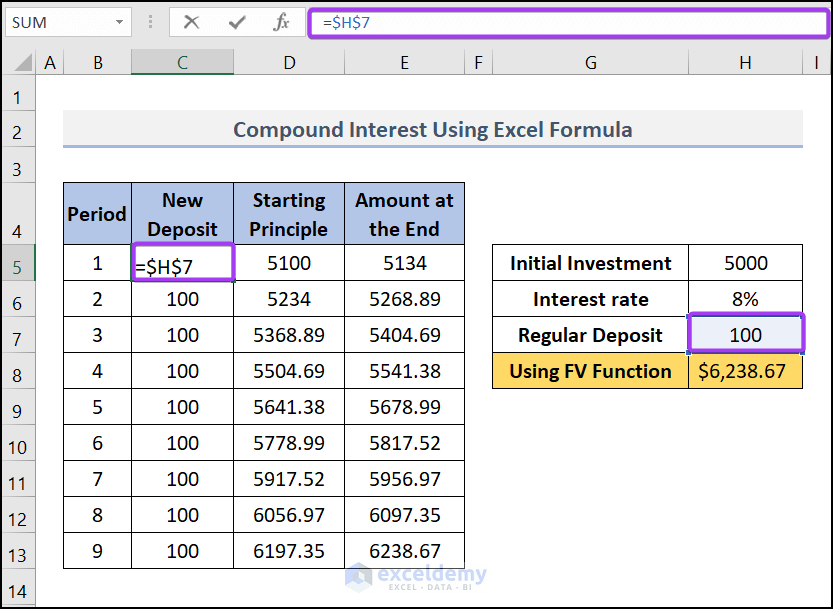

Excel Formula to Calculate Compound Interest with Regular Deposits

How to Use Compound Interest Formula in Excel Sheetaki

Compound Interest Calculator Excel Template

The Example Is Based On Investing $100 Quarterly For 18 Years,.

Create Projection Of Your Savings With Fixed Or Variable Interest Rates And Additional Contributions To See How Much You.

In This Tutorial, We’ll Explain How To Calculate Simple Compound Interest, Reverse Compound Interest, And Continuous Compound Interest With Examples In Excel.

Understanding And Calculating Compound Interest Isn't Just An Academic Exercise;

Related Post: