Free Donation Receipt Template

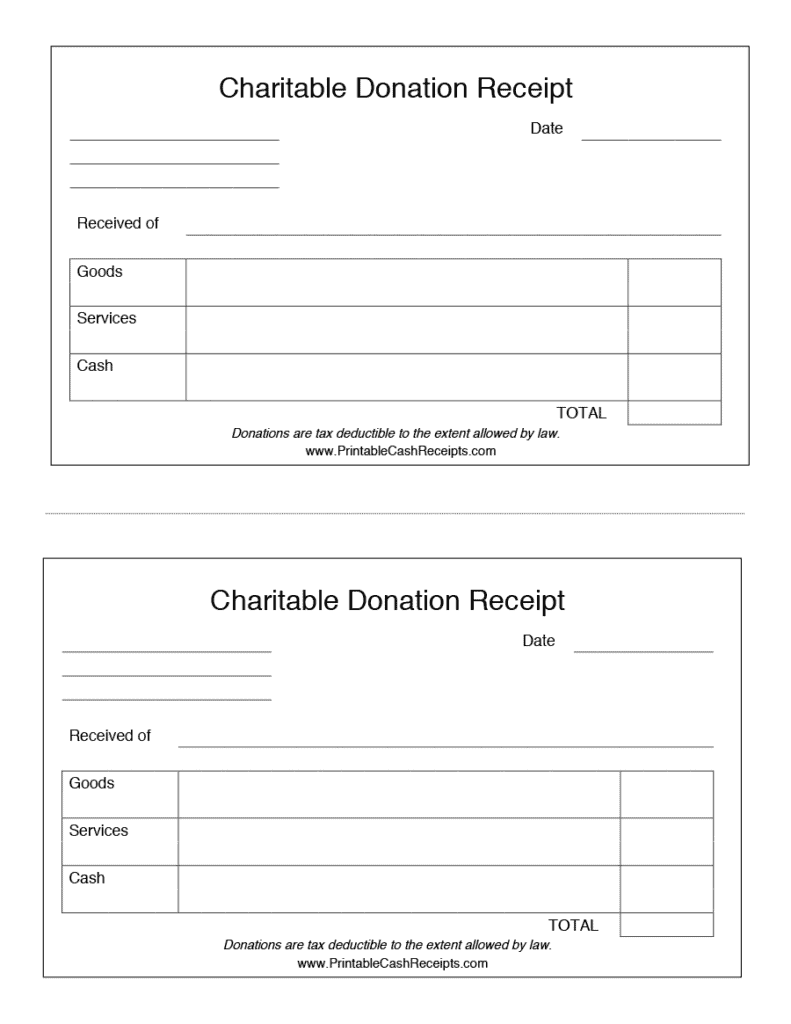

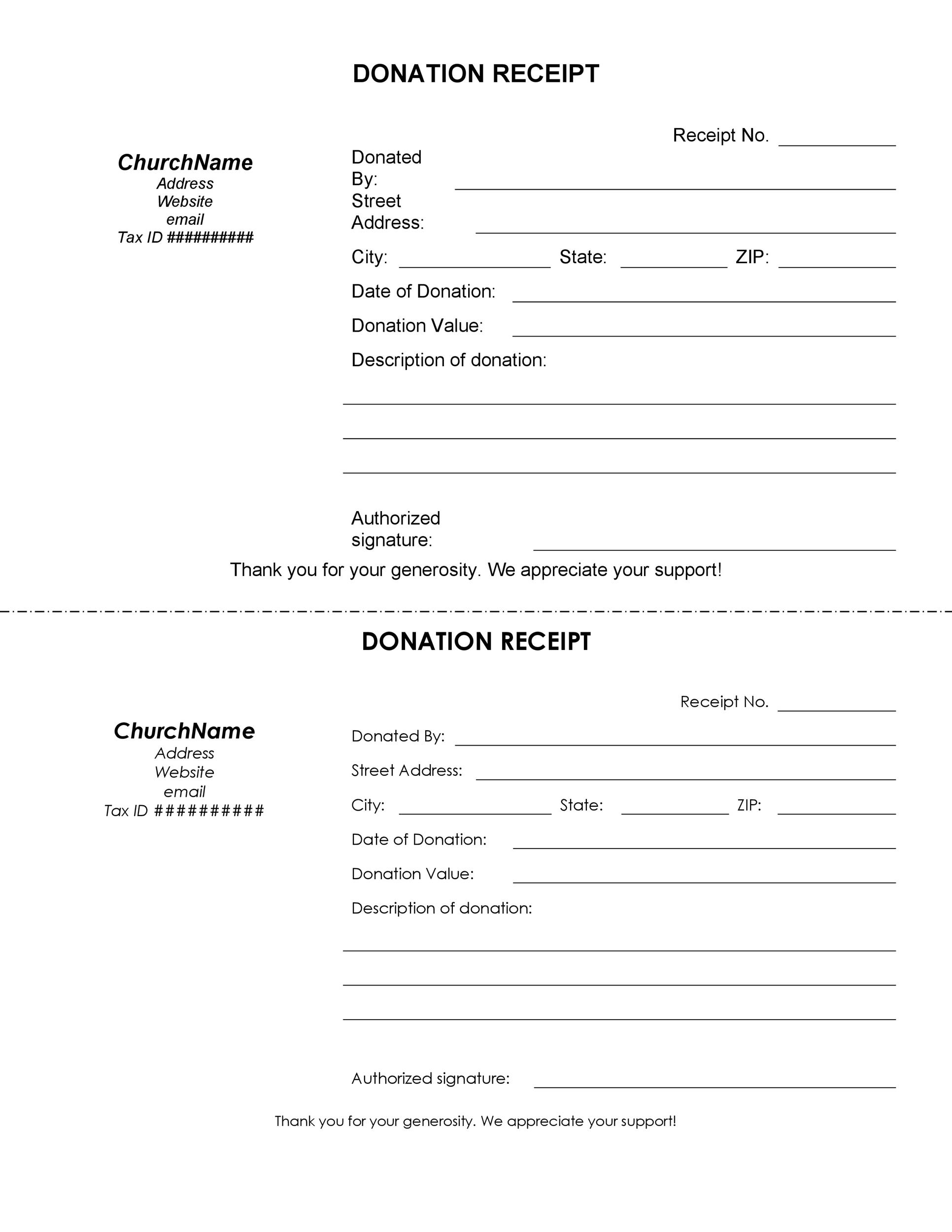

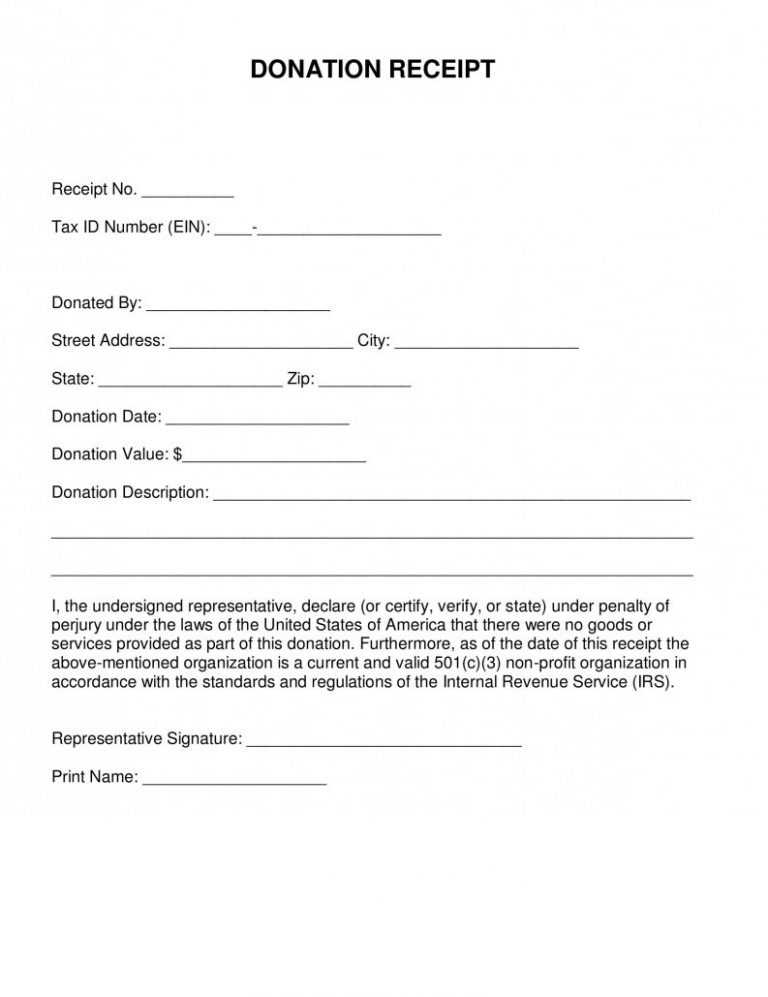

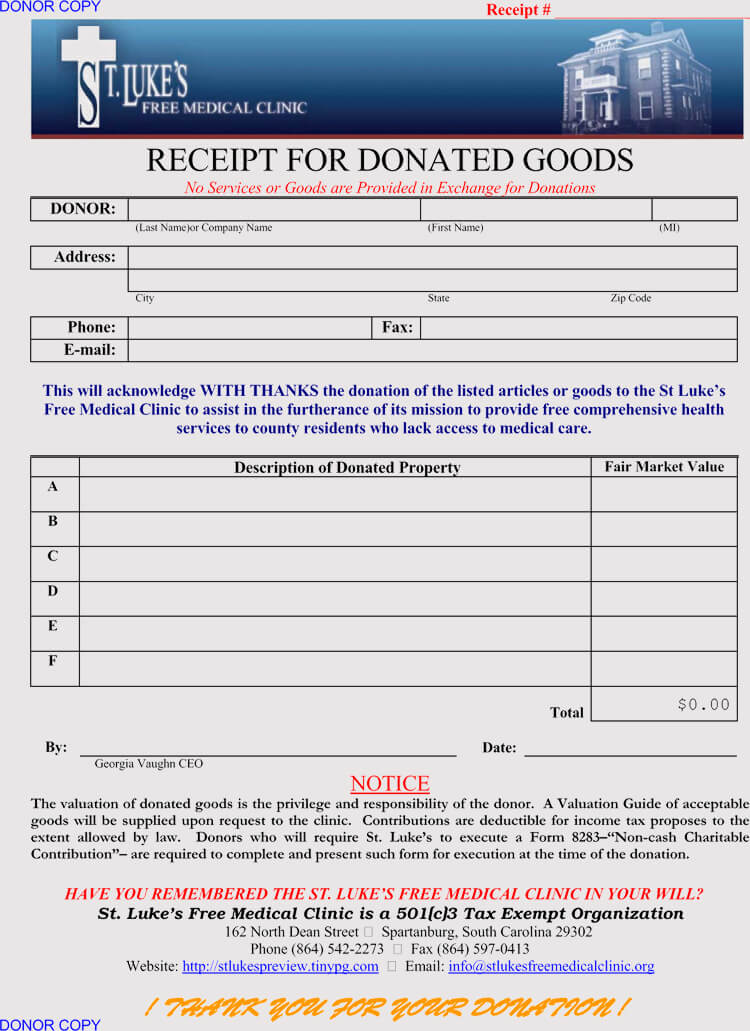

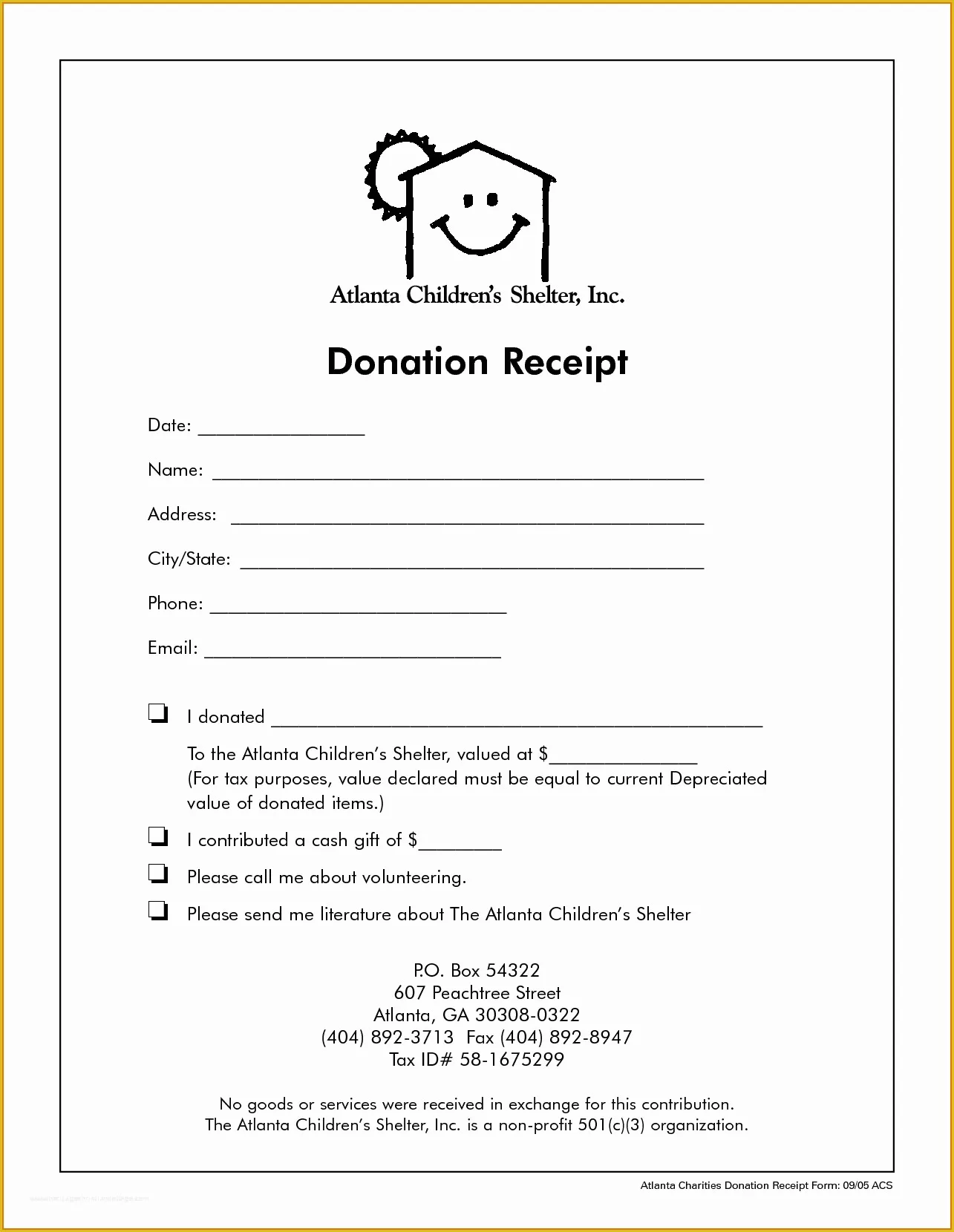

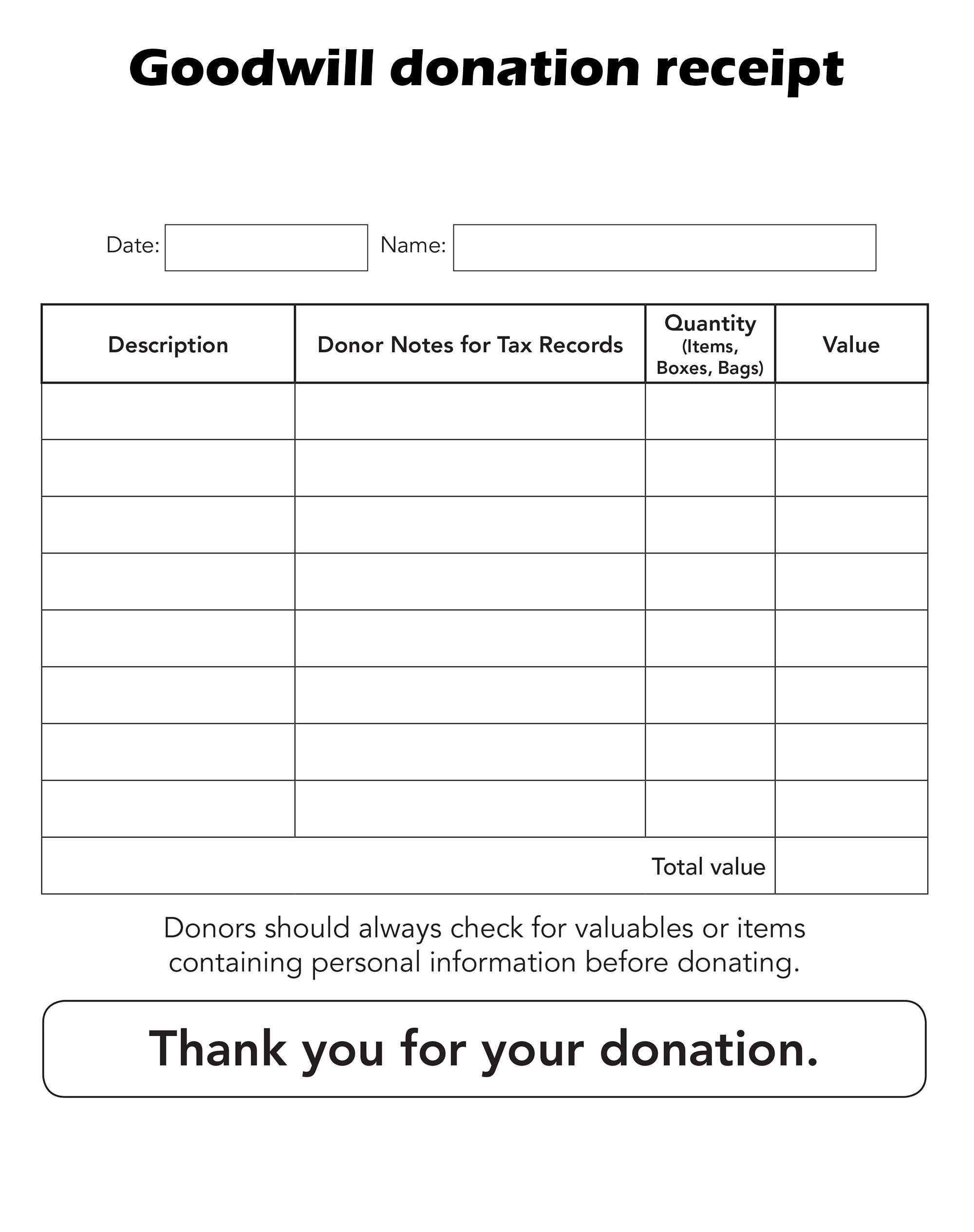

Free Donation Receipt Template - The charity organization should provide a receipt and fill in their details and a. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. Get simple, free templates that can be used for any donation or gift here. At wordlayouts, you’ll find a comprehensive collection of professionally designed donation receipt templates which have been carefully developed to meet all necessary documentation. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. When you make a charitable. A donation receipt form should. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. When you make a charitable. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations may apply). At wordlayouts, you’ll find a comprehensive collection of professionally designed donation receipt templates which have been carefully developed to meet all necessary documentation. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. Nonprofits and charitable organizations use these to acknowledge and record. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are a necessity when it comes to charitable donations. Get simple, free templates that can be used for any donation or gift here. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. When you make a charitable. A donation receipt form should. The charity organization should provide a receipt and fill in their details and. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation was given (other limitations may apply). The charity organization should provide a receipt and fill in their details and a. Donation receipt templates are a necessity when it comes to charitable donations. Depending. Donation receipt templates are a necessity when it comes to charitable donations. Nonprofits and charitable organizations use these to acknowledge and record. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Even though the irs does not have a form for charitable contributions less than $500,. Donation receipt templates are essential tools for any organization involved in charitable activities. Get simple, free templates that can be used for any donation or gift here. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Depending on current legislation, there may be ways to deduct more the limited. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Nonprofits and charitable organizations use these to acknowledge and record. Get simple, free templates that can be used for any donation or gift here. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of. When you make a charitable. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. The charity organization should provide a receipt and fill in their details and a. Nonprofit receipts are given to the donor when he donates to a. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. When you make a charitable. A donation receipt form should. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Donation receipt templates are essential tools for. Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was. Donation receipt templates are essential tools for any organization involved in charitable activities. In accordance with irs publication 526, an individual may deduct a maximum of up to 50% of their adjusted gross income (agi)for the tax year the donation. Donation receipt templates are a necessity when it comes to charitable donations. The charity organization should provide a receipt and fill in their details and a. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. You can download one of. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. The charity organization should provide a receipt and fill in their details and a. Donation receipt templates are a necessity when it comes to charitable donations. Donation receipt templates are essential tools for any organization involved in charitable activities. Nonprofits and charitable organizations use these to acknowledge and record. When you make a charitable. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Get simple, free templates that can be used for any donation or gift here. A donation receipt form should. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document.46 Free Donation Receipt Templates (501c3, NonProfit)

Free Printable Donation Receipt Templates [PDF, Word, Excel]

Non Profit Donation Receipt Letter

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Free Non Profit Donation Receipt Template Of 10 Donation Receipt

Charitable Donation List Template

Free Printable Donation Receipt Templates [PDF, Word, Excel]

6+ Free Donation Receipt Templates

Free Printable Donation Receipt Template Printable Templates Your Go

Free Sample Printable Donation Receipt Template Form

Depending On Current Legislation, There May Be Ways To Deduct More The Limited Amount, For Example, In 2017 There Was.

At Wordlayouts, You’ll Find A Comprehensive Collection Of Professionally Designed Donation Receipt Templates Which Have Been Carefully Developed To Meet All Necessary Documentation.

Nonprofit Receipts Are Given To The Donor When He Donates To A Nonprofit Organization.

In Accordance With Irs Publication 526, An Individual May Deduct A Maximum Of Up To 50% Of Their Adjusted Gross Income (Agi)For The Tax Year The Donation Was Given (Other Limitations May Apply).

Related Post:

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/PDF-Printable-Donation-Receipt.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-10.jpg)

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/Download-Free-Donation-Receipt.jpg?gid=710)