Hard Inquiry Removal Letter Template

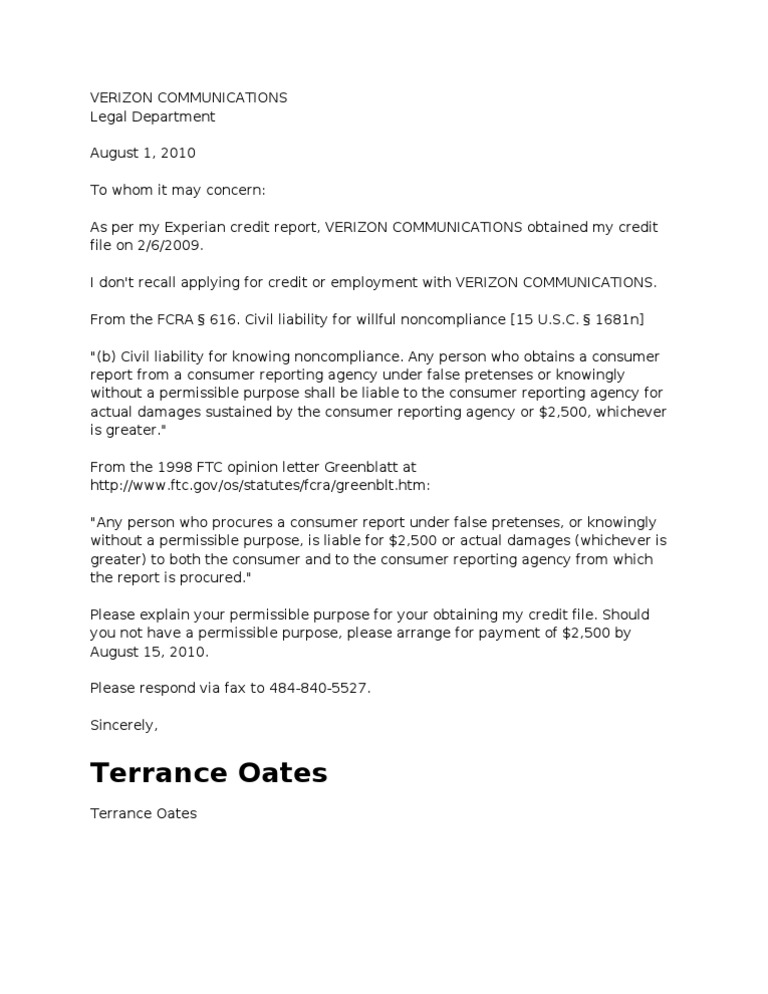

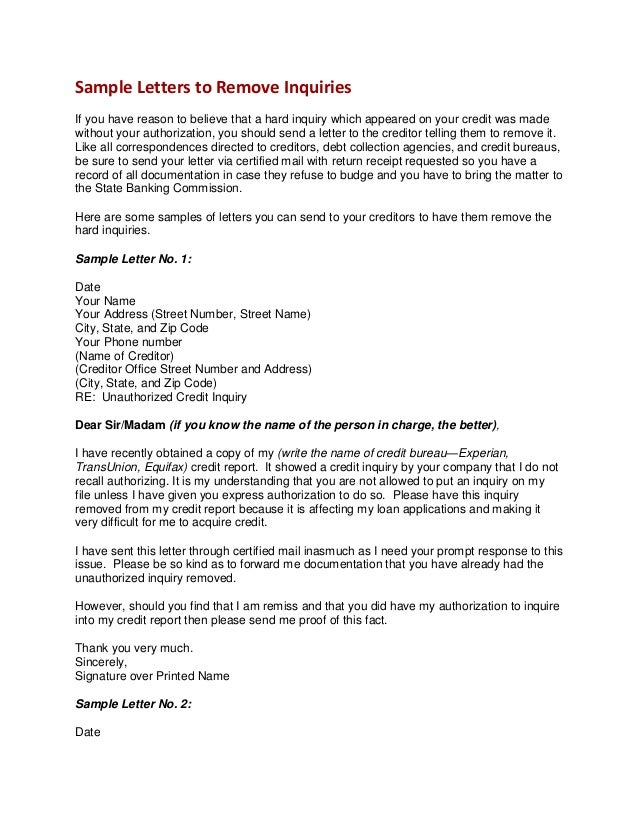

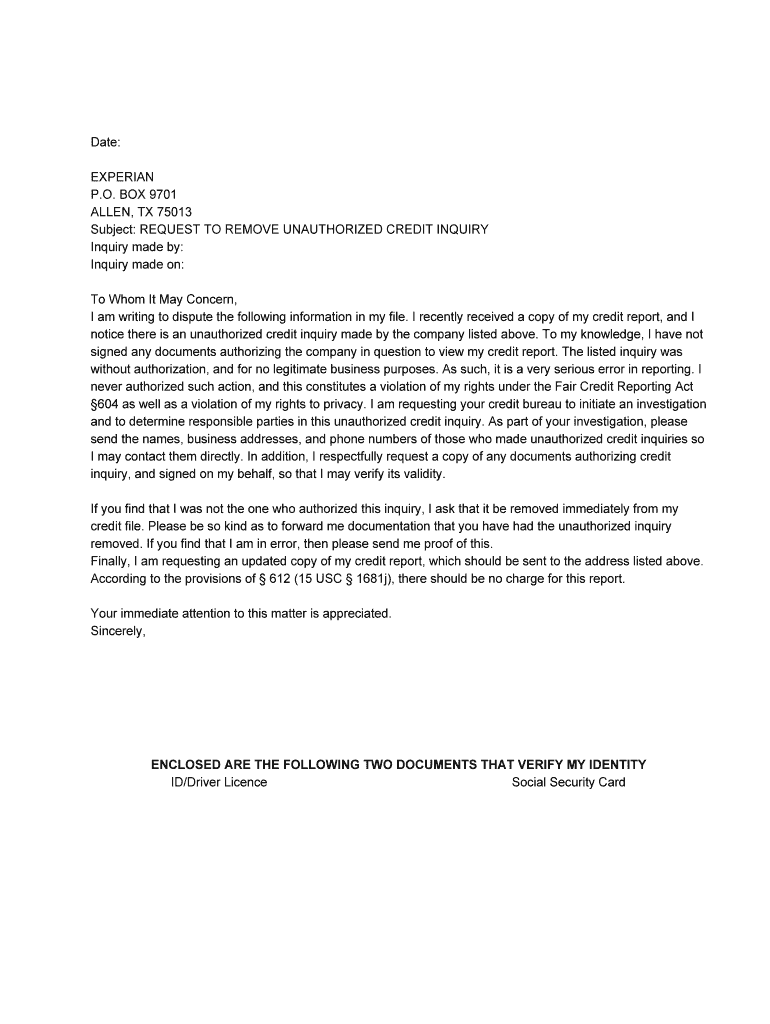

Hard Inquiry Removal Letter Template - Hello, my quesitons is about removing hard inqiry removal from august of 2020 for a car loan. (don't use an online template letter; The fcra never even uses the terms hard or soft inquiry, and only regulates,. They are required to provide a statement of their permissible purpose, which is one or more of the purposes listed under fcra 604. Verified hard inquiry removal sample letter hi and welcome to the forums! Hard inquiry removal questions when a party requests your credit report, they send the request to the cra for evaluation. Penfed investigated, mailed me a letter saying agreeing the inquiry needed to be removed and stating they had contacted eq to remove the inquiry. Now, in august, the situation repeated. The yall have the same date as well. Email this letter to each and every executive of that company. I had one more, the last one, hard inquiry, dated august 15, 2018, from verizon wireless, from getting an iphone there. Figure out their email addresses. They are required to provide a statement of their permissible purpose, which is one or more of the purposes listed under fcra 604. The fcra does not regulate credit scoring,and thus does not address the sticky issue of how inquiries must be coded so that fico can determine whether or not it. I notified penfed of this and provided them with an image showing the inquiry on my eq report along with a cover letter asking for removal. (don't use an online template letter; Hello, my quesitons is about removing hard inqiry removal from august of 2020 for a car loan. Hard inquiry removal questions when a party requests your credit report, they send the request to the cra for evaluation. Make it your own and make it clear, to the point. Verified hard inquiry removal sample letter hi and welcome to the forums! I had one more, the last one, hard inquiry, dated august 15, 2018, from verizon wireless, from getting an iphone there. (don't use an online template letter; I have successfully gotten many hard inquiries deleted with transunion and equifax but for some reason experian hasnt deleted not 1 inquiry and i started my credit repair journey back in march 2020.. Write a simple, polite and to the point goodwill letter explaining the situation and exactly what you would like from them. Hard inquiry removal questions @anonymous wrote: Verified hard inquiry removal sample letter hi and welcome to the forums! Be brief and explain why they should be removed immediately. I was approved for the car so am i able to. Write a simple, polite and to the point goodwill letter explaining the situation and exactly what you would like from them. The yall have the same date as well. On the report it showed the removal date of august 15, 2020. Verified hard inquiry removal sample letter hi and welcome to the forums! I have sent out many letters to. Hello, my quesitons is about removing hard inqiry removal from august of 2020 for a car loan. The yall have the same date as well. The fcra never even uses the terms hard or soft inquiry, and only regulates,. If the inquiry is inaccurate based on any aspect of fcra it has to be removed. I was once told that. I went to a local dealership and they ran my credit but they ran it with 5 differnet places so it gave me 5 hard inquiers. I was once told that they cannot remove them until the 2 year mark, but that is not true. I had an unauthorized inquiry from penfed on my eq report. Hello, my quesitons is. They are required to provide a statement of their permissible purpose, which is one or more of the purposes listed under fcra 604. (don't use an online template letter; Be brief and explain why they should be removed immediately. Now, in august, the situation repeated. The fcra does not regulate credit scoring,and thus does not address the sticky issue of. I had one more, the last one, hard inquiry, dated august 15, 2018, from verizon wireless, from getting an iphone there. Email this letter to each and every executive of that company. Hard inquiry removal questions when a party requests your credit report, they send the request to the cra for evaluation. The fcra does not regulate credit scoring,and thus. Under fcra 604(c) what can be provided to the credtor on the basis of the stated purpose of an inquiry. I was once told that they cannot remove them until the 2 year mark, but that is not true. Now, in august, the situation repeated. (don't use an online template letter; If the inquiry is inaccurate based on any aspect. Now, in august, the situation repeated. I was approved for the car so am i able to g. If the inquiry is inaccurate based on any aspect of fcra it has to be removed. Verified hard inquiry removal sample letter hi and welcome to the forums! Be brief and explain why they should be removed immediately. In all honesty, removing hard pulls that are valid just plain won't happen, many can't even remove nonvalid hard pulls myself included. Hello, my quesitons is about removing hard inqiry removal from august of 2020 for a car loan. They are required to provide a statement of their permissible purpose, which is one or more of the purposes listed under. Im wanting to send out letters to try and get some inquiries removed from my report to get in the best position possible to purchase a home in the next 6 to 12 months. Hard inquiry removal questions @anonymous wrote: Figure out their email addresses. Now, in august, the situation repeated. (don't use an online template letter; I notified penfed of this and provided them with an image showing the inquiry on my eq report along with a cover letter asking for removal. On the report it showed the removal date of august 15, 2020. Write a simple, polite and to the point goodwill letter explaining the situation and exactly what you would like from them. Make it your own and make it clear, to the point. Under fcra 604(c) what can be provided to the credtor on the basis of the stated purpose of an inquiry. I have sent out many letters to experian to request some get deleted and they ignore my hard inquiry request and only focus on other things im. I had an unauthorized inquiry from penfed on my eq report. Email this letter to each and every executive of that company. Hello, my quesitons is about removing hard inqiry removal from august of 2020 for a car loan. They are required to provide a statement of their permissible purpose, which is one or more of the purposes listed under fcra 604. The fcra does not regulate credit scoring,and thus does not address the sticky issue of how inquiries must be coded so that fico can determine whether or not it.Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Letter

Get Our Sample of Credit Inquiry Removal Letter Template for Free

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Dispute Letter Template Inquiries Credit Bureau

Hard Inquiry Removal DIY Credit Dispute Letter Template Effective

Credit Hard Inquiry Removal Letter Template

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Credit Dispute Letter Template DIY Credit Repair

Hard Credit Inquiry Removal Letter Draft Destiny

Penfed Investigated, Mailed Me A Letter Saying Agreeing The Inquiry Needed To Be Removed And Stating They Had Contacted Eq To Remove The Inquiry.

I Was Approved For The Car So Am I Able To G.

Hard Inquiry Removal Questions When A Party Requests Your Credit Report, They Send The Request To The Cra For Evaluation.

I Had One More, The Last One, Hard Inquiry, Dated August 15, 2018, From Verizon Wireless, From Getting An Iphone There.

Related Post: