Home Loan Letter Of Explanation Template

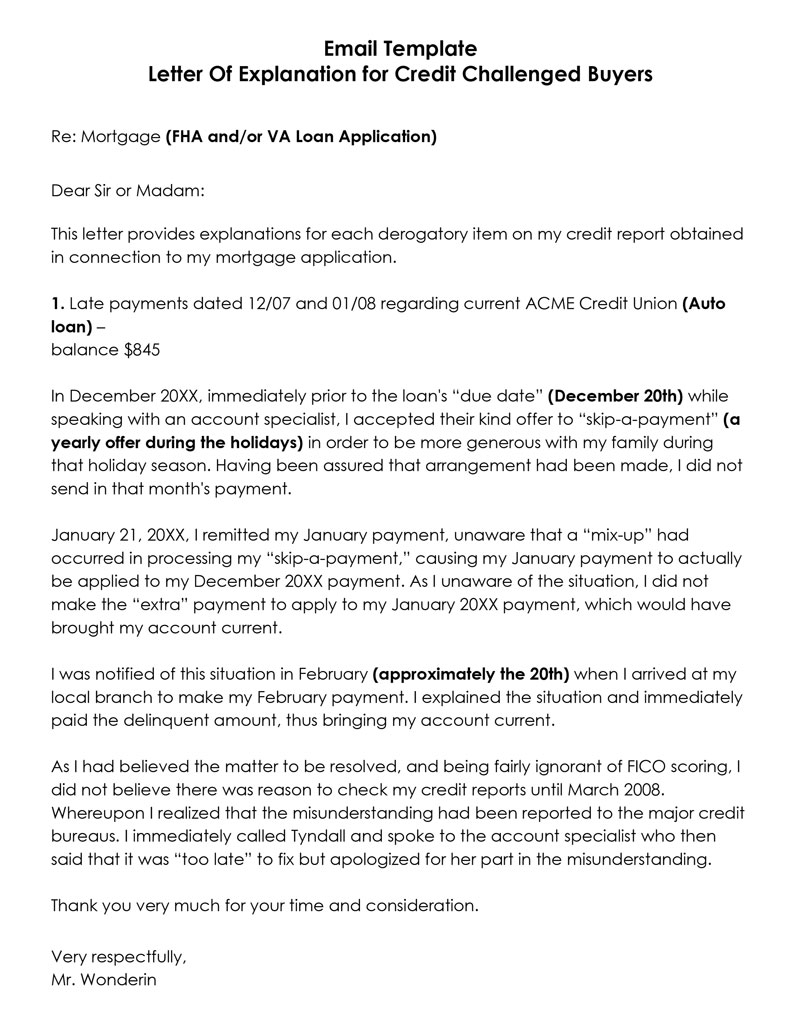

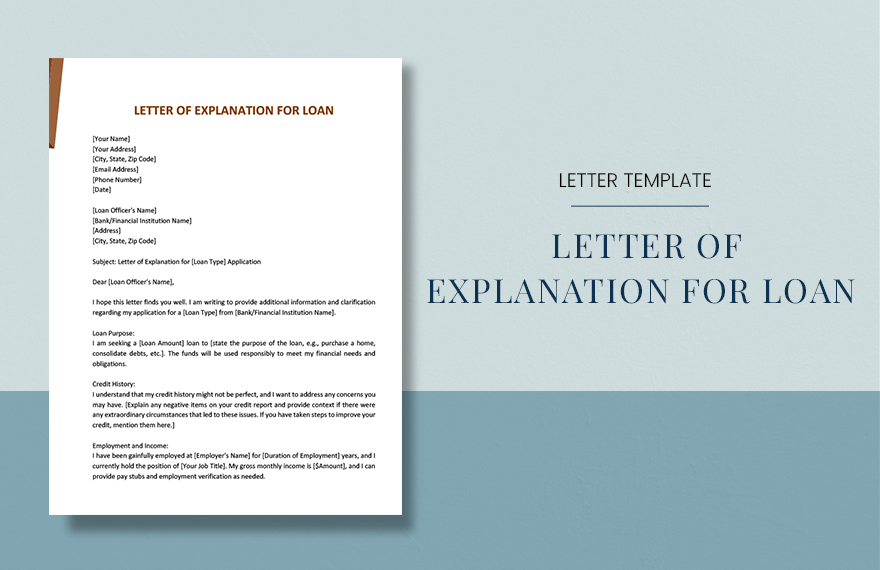

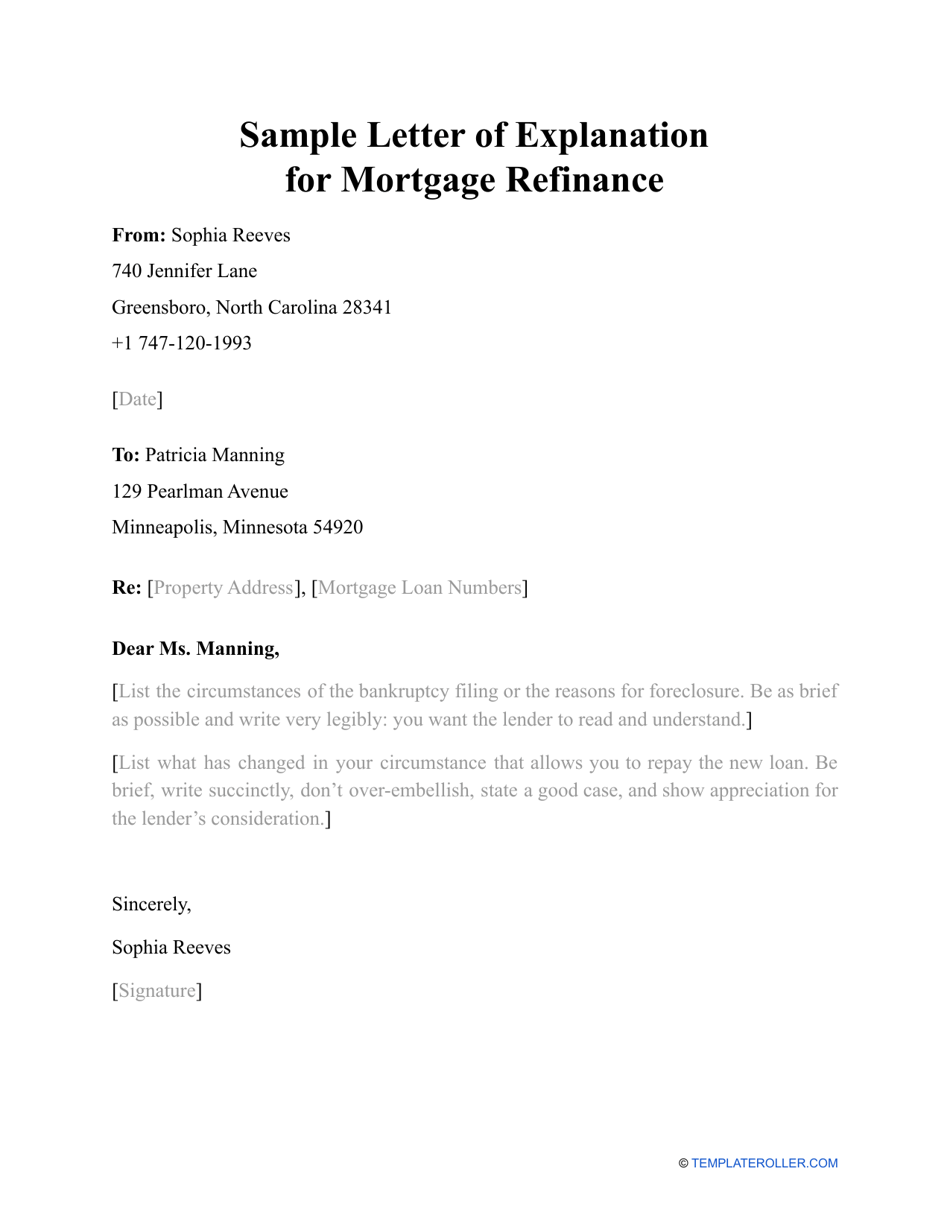

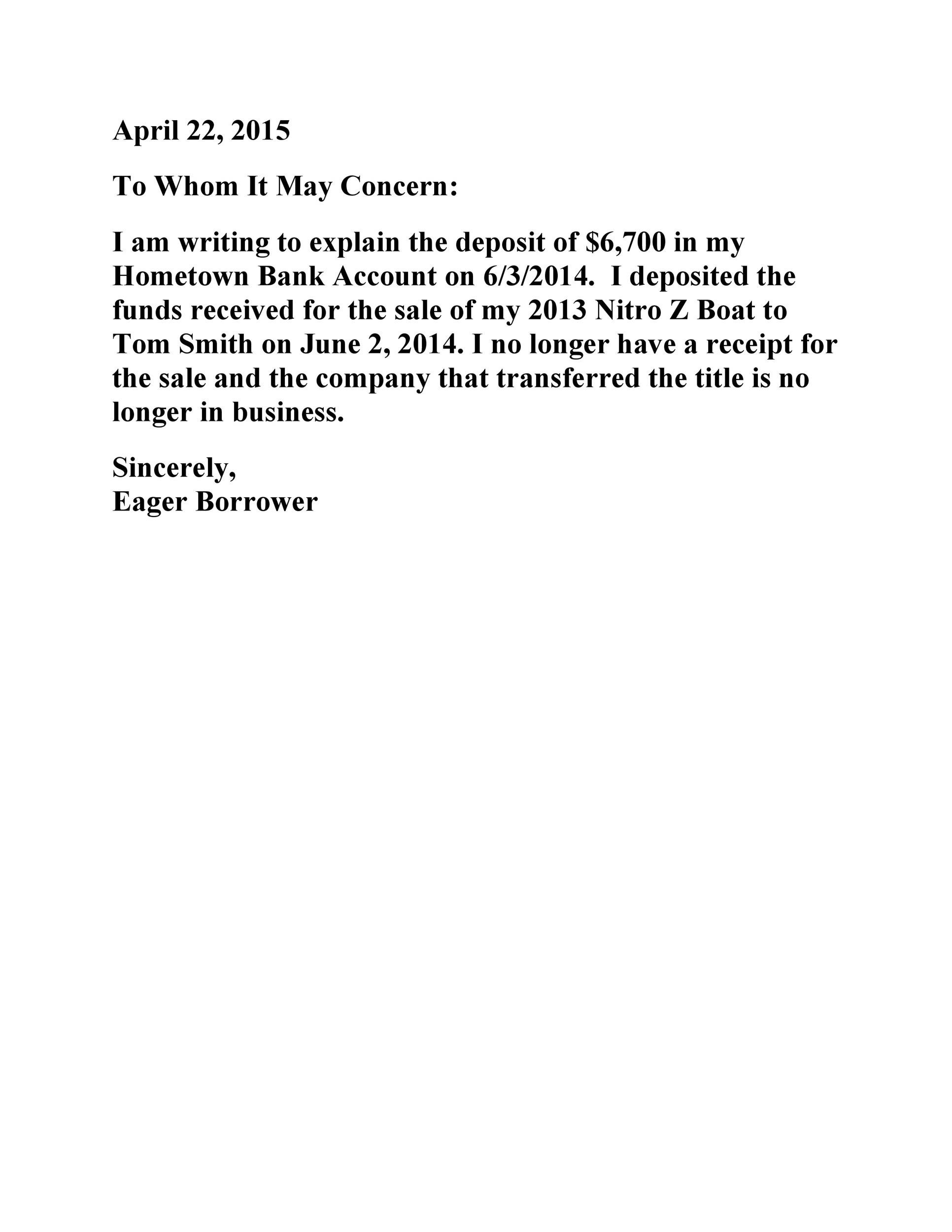

Home Loan Letter Of Explanation Template - It is of utmost importance not to take it personally and to stay as truthful as. A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. For instance, a lender may ask for a letter of explanation for derogatory credit before. The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. Follow these steps to create a letter of explanation for mortgage: So, grab a cup of coffee, and let's. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. Greet the recipient (preferably, by name) and write down your own name. A letter of explanation might be requested. And this guide will tell. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: A letter of explanation is a short document you would send to a recipient such as a lender. Mortgage loan number (or property address) to whom it may concern,. Follow these steps to create a letter of explanation for mortgage: To write a letter of explanation for mortgage you will need to see from the lender’s notice what the subject is. If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your. Quickly download a free sample letter of explanation for mortgage in pdf or word format. The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. So, grab a cup of coffee, and let's. If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your. Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. The exact content will vary based on your situation, but here’s a general. Quickly download a free sample letter of explanation for mortgage in pdf or word format. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. Mortgage loan number (or property address) to whom it may concern,. A letter of explanation can allow you to clarify any complications, including glitches in your credit. In this comprehensive guide, we will cover when and why these. Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender. Mortgage loan number (or property address) to whom it may concern,. Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as. Greet the recipient (preferably, by name) and write down your own name. A letter of explanation can be a key to qualifying for home loan funding. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. A letter of explanation might be requested. So, grab a cup of coffee, and let's. Mortgage loan number (or property address) to whom it may concern,. A letter of explanation can be a key to qualifying for home loan funding. It is of utmost importance not to take it personally and to stay as truthful as. Follow these steps to create a letter of explanation for mortgage: The exact content will vary based on your. Our 'free letter of explanation for loan' template is here to assist you. Why do mortgage lenders ask for letters of explanation, and do you have a sample template we can use to get started?” the letter of explanation (or loe for short) is a common part of the. It is of utmost importance not to take it personally and. The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. It is of utmost importance not to take it personally and to stay as truthful as. Mortgage loan number (or property address) to whom it may concern,. And this guide will tell. A letter of explanation is a short. Knowing how to write a letter of explanation is important if you hope to acquire a loan for a house, as the document provides clarification about your credit report or bank. This article will explain what a mortgage letter of explanation is, why you need one, how it will help you if you have any discrepancies on your application, what. For instance, a lender may ask for a letter of explanation for derogatory credit before. A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. So, grab a cup of coffee, and let's. A letter of explanation can be a key to qualifying. For instance, a lender may ask for a letter of explanation for derogatory credit before. A letter of explanation is a short document you would send to a recipient such as a lender. The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. In this comprehensive guide, we will. A letter of explanation can be a key to qualifying for home loan funding. A letter of explanation is a short document you would send to a recipient such as a lender. Learning how to craft an effective home loan letter of explanation can help boost your chances of approval. And this guide will tell. Our 'free letter of explanation for loan' template is here to assist you. If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your. (click the image to open a pdf version.) remember to include your mailing address, phone. In this comprehensive guide, we will cover when and why these. Why do mortgage lenders ask for letters of explanation, and do you have a sample template we can use to get started?” the letter of explanation (or loe for short) is a common part of the. Mortgage loan number (or property address) to whom it may concern,. Greet the recipient (preferably, by name) and write down your own name. To write a letter of explanation for mortgage you will need to see from the lender’s notice what the subject is. Sample mortgage letter of explanation [your name] [current address] [city, state, zip] [date] re: The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. Mortgage lenders request a document named a letter of explanation when they want more details regarding your financial situation. A letter of explanation might be requested.Free Printable Letter Of Explanation Templates [PDF, Word] Mortgage

Letter Of Explanation Template Letter Explanation Mortgage S

Mortgage Letter of Explanation (How to Write + sample).

Letter of Explanation For Loan in Word, PDF, Google Docs, Pages

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

Sample Letter of Explanation for Mortgage Refinance Download Printable

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

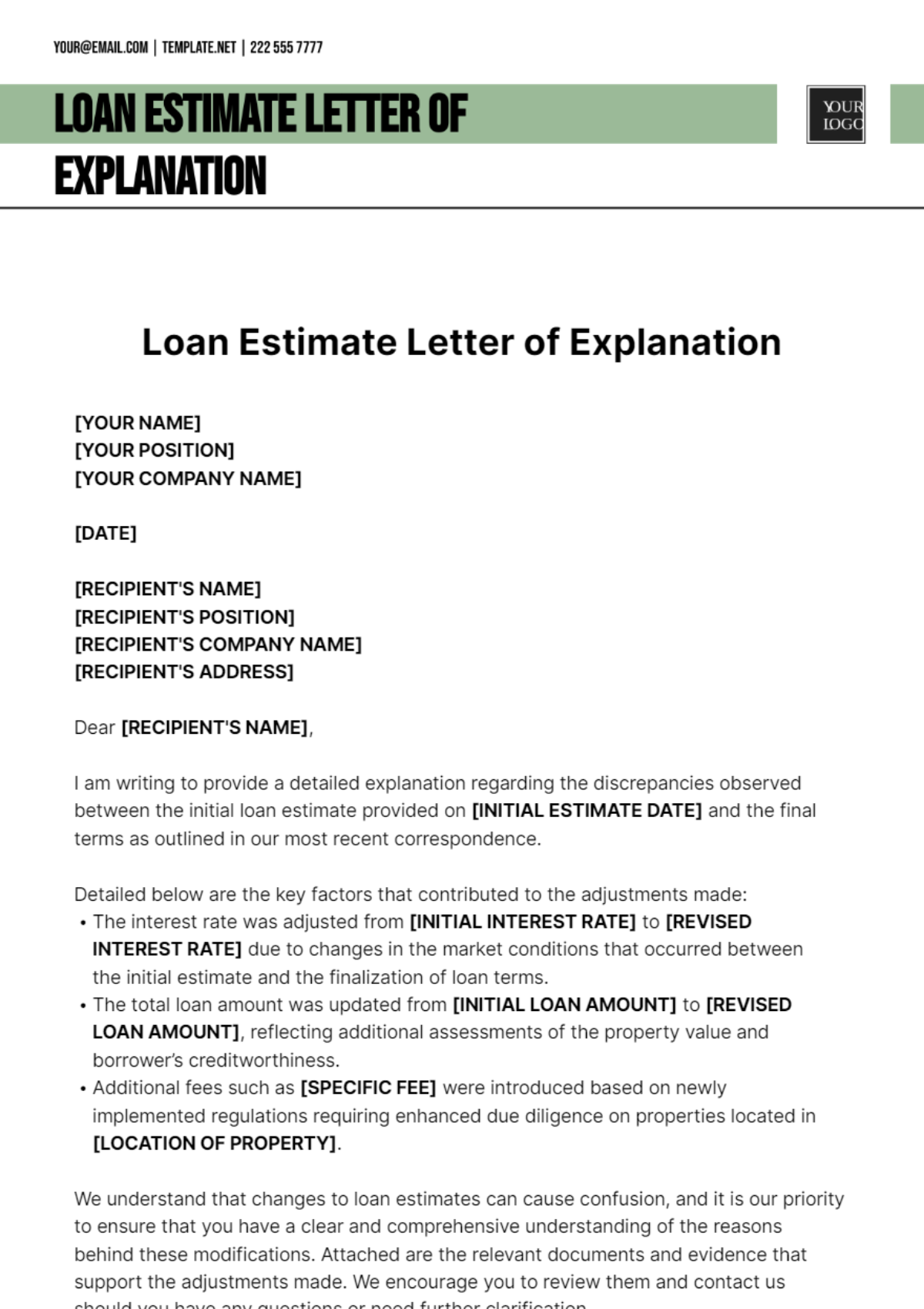

Free Loan Estimate Letter Of Explanation Template Edit Online

48 Letters Of Explanation Templates (Mortgage, Derogatory Credit...)

This Article Will Explain What A Mortgage Letter Of Explanation Is, Why You Need One, How It Will Help You If You Have Any Discrepancies On Your Application, What Information Your Lender Needs To.

A Letter Of Explanation Can Allow You To Clarify Any Complications, Including Glitches In Your Credit History Or Employment, To Help You Qualify For A Home Loan.

It Is Of Utmost Importance Not To Take It Personally And To Stay As Truthful As.

So, Grab A Cup Of Coffee, And Let's.

Related Post:

![Free Printable Letter Of Explanation Templates [PDF, Word] Mortgage](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-of-explanation-mortgage.jpg)