Idependent Contractor List Template

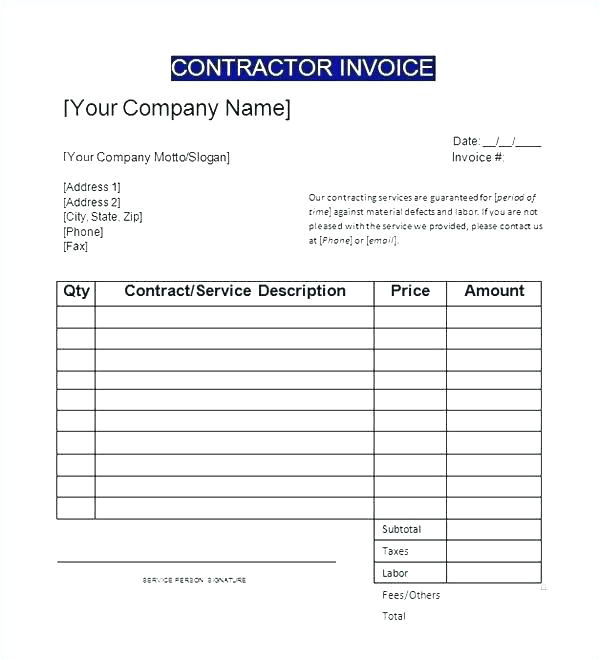

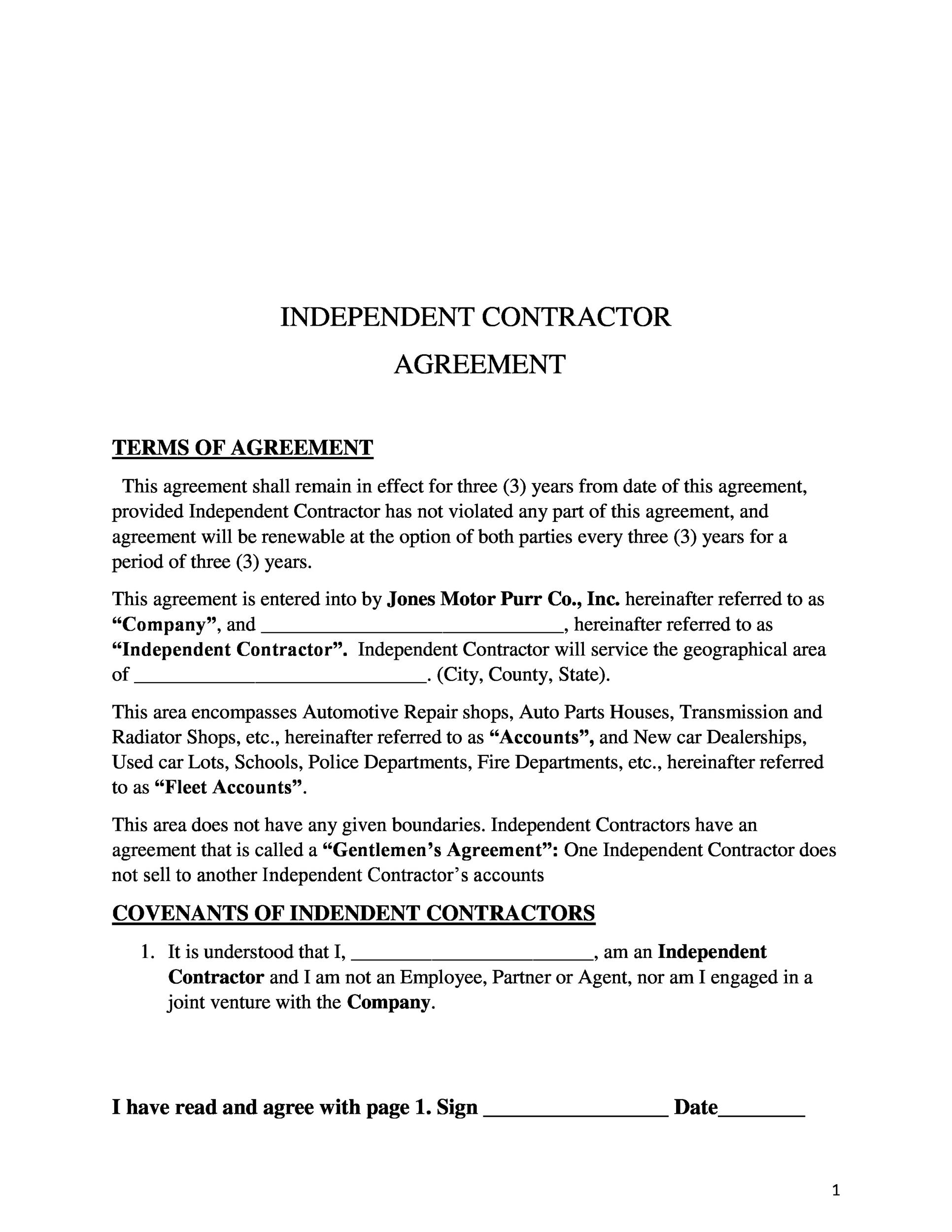

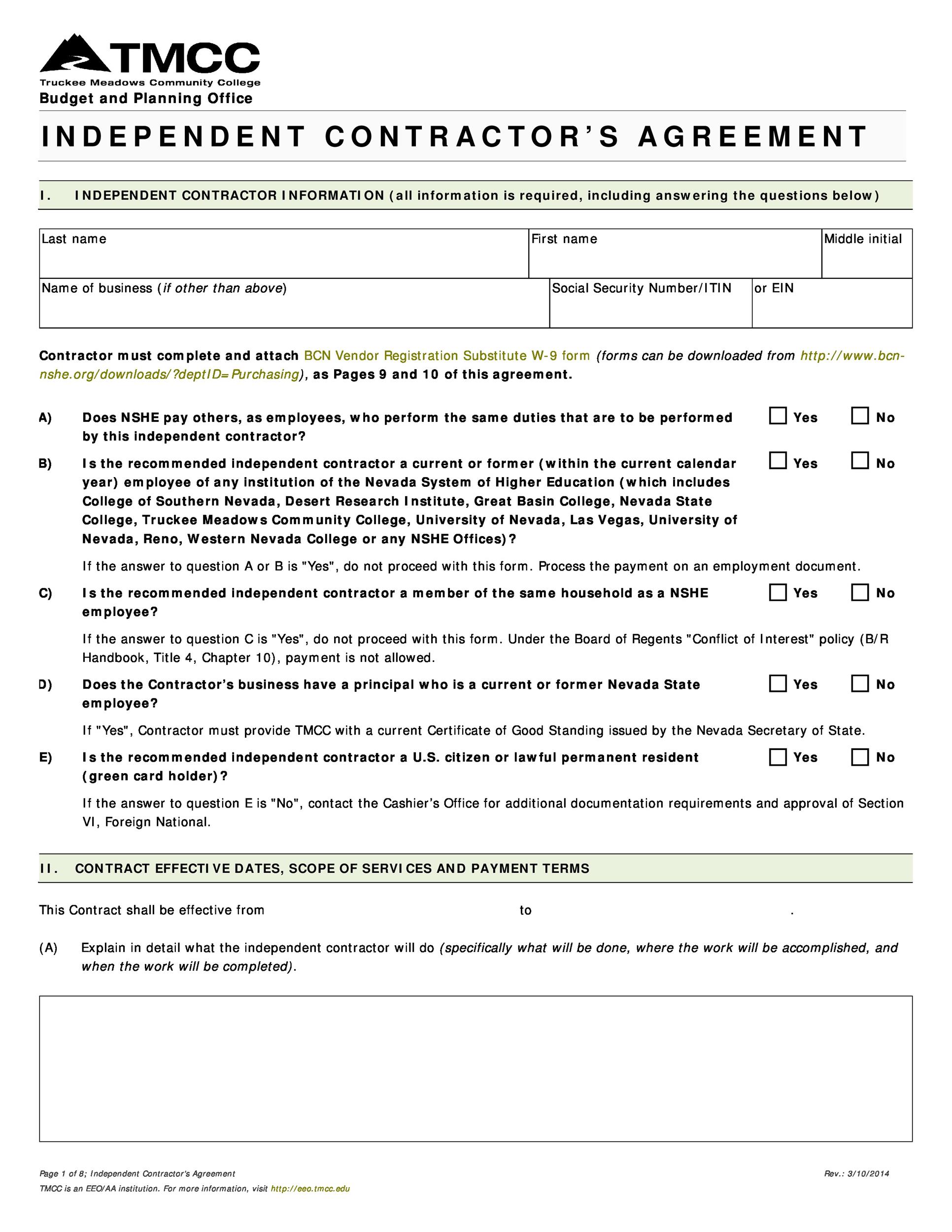

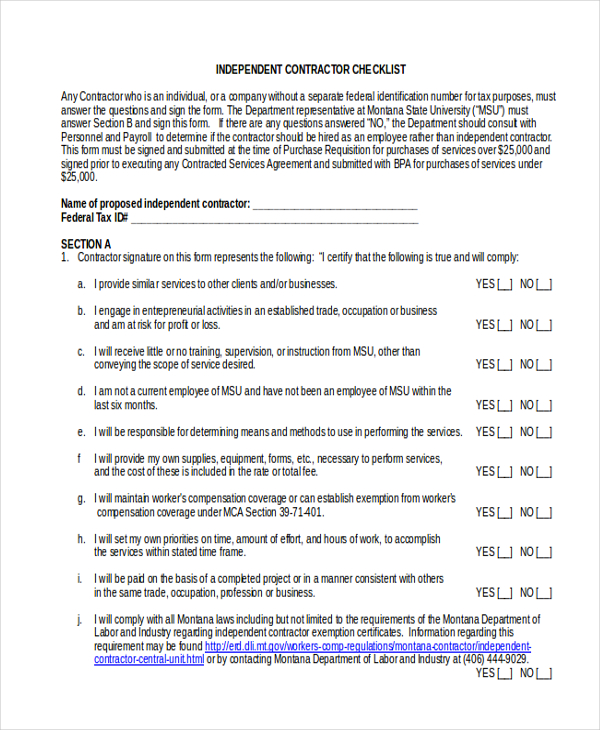

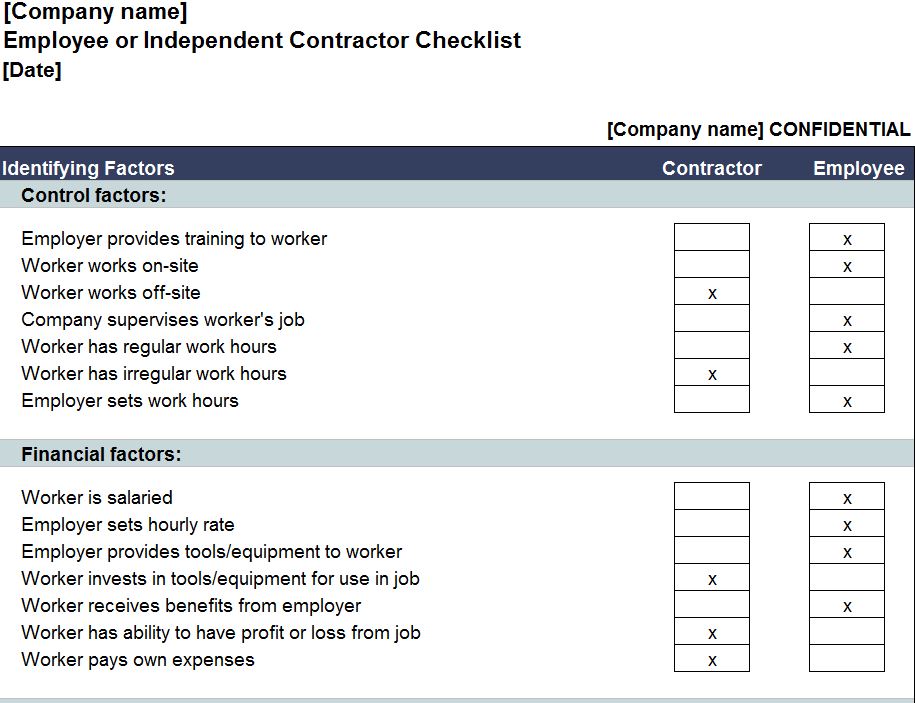

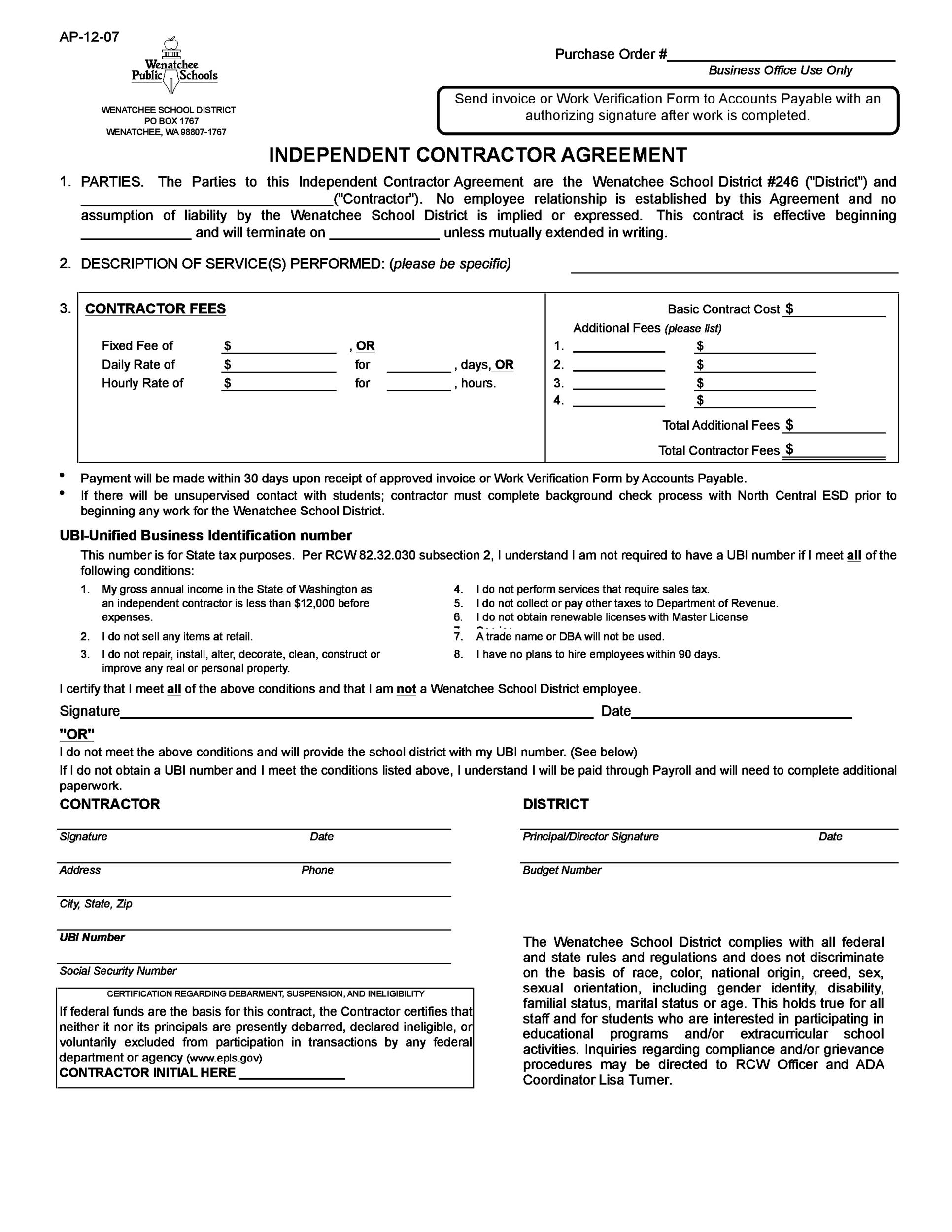

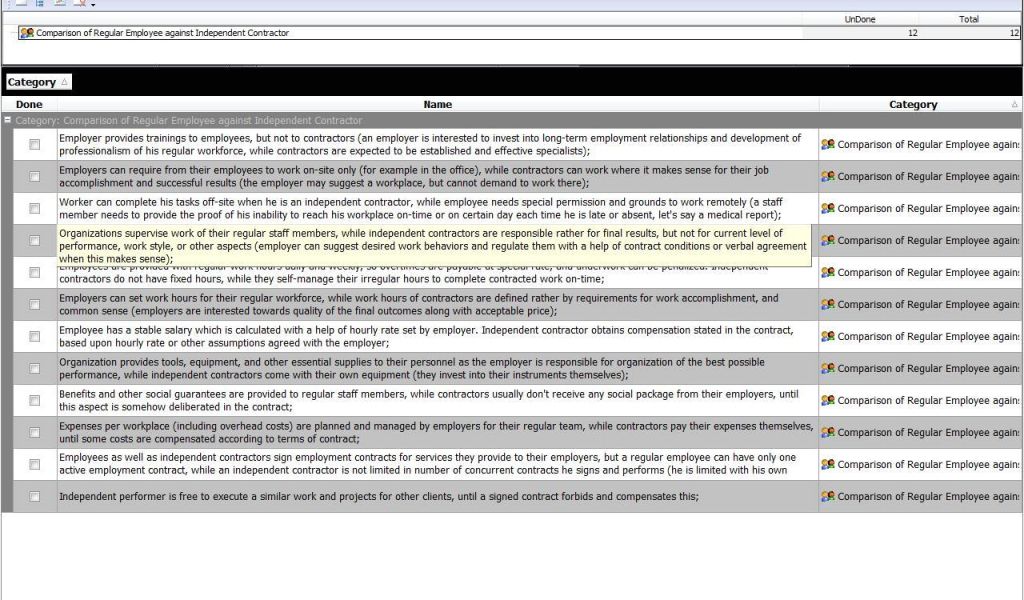

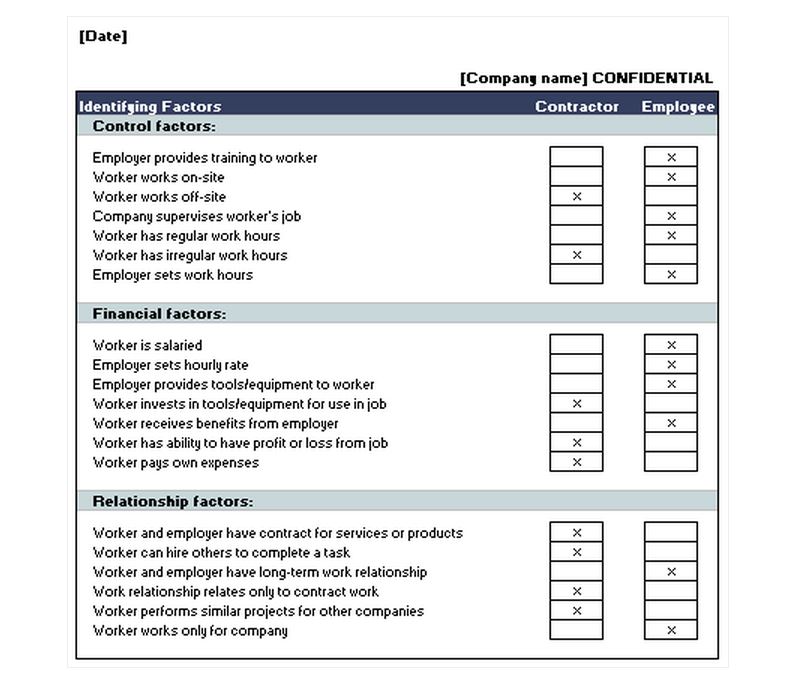

Idependent Contractor List Template - Save as a template for future determinations of classification. A great idea is to create a contractor invoice email template. Learn how to onboard seamlessly into your team with our handy independent contractor onboarding checklist, with consideration to processes & best practices This will save you from having to type the same message every time you send an invoice to a client. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. However, ensuring a smooth transition for these contractors is essential to. If you’re a contractor in the u.s., when you earn $600 or. Hiring an independent contractor for your business might be the right decision, but that doesn’t mean it’s easy. What is an independent contractor? There are many independent contractor expenses spreadsheet templates available on the internet. The client employs the contractor as an independent contractor, and the contractor. An independent contractor is classified by the irs as someone who conducts the. Hiring an independent contractor for your business might be the right decision, but that doesn’t mean it’s easy. If you’re a contractor in the u.s., when you earn $600 or. In this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. There are many independent contractor expenses spreadsheet templates available on the internet. Without the right tools, processes, and platforms (like worksuite),. There are 20 factors used by the irs to determine whether you have enough. We will also discuss its uses, benefits, and common tax. First, customize the free independent contractor checklist with the business’s name and information. Hiring an independent contractor for your business might be the right decision, but that doesn’t mean it’s easy. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. An independent contractor is classified by the irs as someone. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. First, customize the free independent contractor checklist with the business’s name and information. Independent contractors play a crucial role in many businesses today, offering specialized skills and flexibility. There are 20 factors used by the irs to determine whether you have enough. A. You may use this checklist to determine whether the worker described above is an employee or independent contractor under three irs categories. In this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. Pdf, ms word (.docx), opendocument. First, customize the free independent contractor checklist with the business’s name. Independent contractors play a crucial role in many businesses today, offering specialized skills and flexibility. Learn how to onboard seamlessly into your team with our handy independent contractor onboarding checklist, with consideration to processes & best practices A great idea is to create a contractor invoice email template. In this article, we’ll provide a free 1099 expenses template so you. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. What is an independent contractor? There are many independent contractor expenses spreadsheet templates available on the internet. An independent contractor is classified by the irs as someone who conducts the. Tax considerations for contractor invoices. You may use this checklist to determine whether the worker described above is an employee or independent contractor under three irs categories. We will also discuss its uses, benefits, and common tax. Independent contractors play a crucial role in many businesses today, offering specialized skills and flexibility. Hiring an independent contractor for your business might be the right decision, but. Tax considerations for contractor invoices. An independent contractor is classified by the irs as someone who conducts the. You may use this checklist to determine whether the worker described above is an employee or independent contractor under three irs categories. To determine the worker’s classification,. Without the right tools, processes, and platforms (like worksuite),. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. Hiring an independent contractor for your business might be the right decision, but that doesn’t mean it’s easy. Learn how to onboard seamlessly into your team with our handy independent contractor onboarding checklist, with consideration to processes & best practices But we have. There are many independent contractor expenses spreadsheet templates available on the internet. In this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. An independent contractor is classified by the irs as someone who. In this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. This will save you from having to type the same message every time you send an invoice to a client. We will also discuss its uses, benefits, and common tax. Save as a template for future determinations of. If you’re a contractor in the u.s., when you earn $600 or. In this article, we help you with an independent contractor onboarding checklist that can facilitate a seamless employee experience. Your invoices play a vital role in tax compliance and financial planning. To determine the worker’s classification,. There are 20 factors used by the irs to determine whether you have enough. Save as a template for future determinations of classification. An independent contractor is classified by the irs as someone who conducts the. This will save you from having to type the same message every time you send an invoice to a client. Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. Pdf, ms word (.docx), opendocument. Learn how to onboard seamlessly into your team with our handy independent contractor onboarding checklist, with consideration to processes & best practices Tax considerations for contractor invoices. Nothing in this agreement shall indicate the contractor is a partner, agent, or employee of the client. There are many independent contractor expenses spreadsheet templates available on the internet. Latest research finds that almost 15% of all workers in the. We will also discuss its uses, benefits, and common tax.Employee or Independent Contractor Checklist Template williamsonga.us

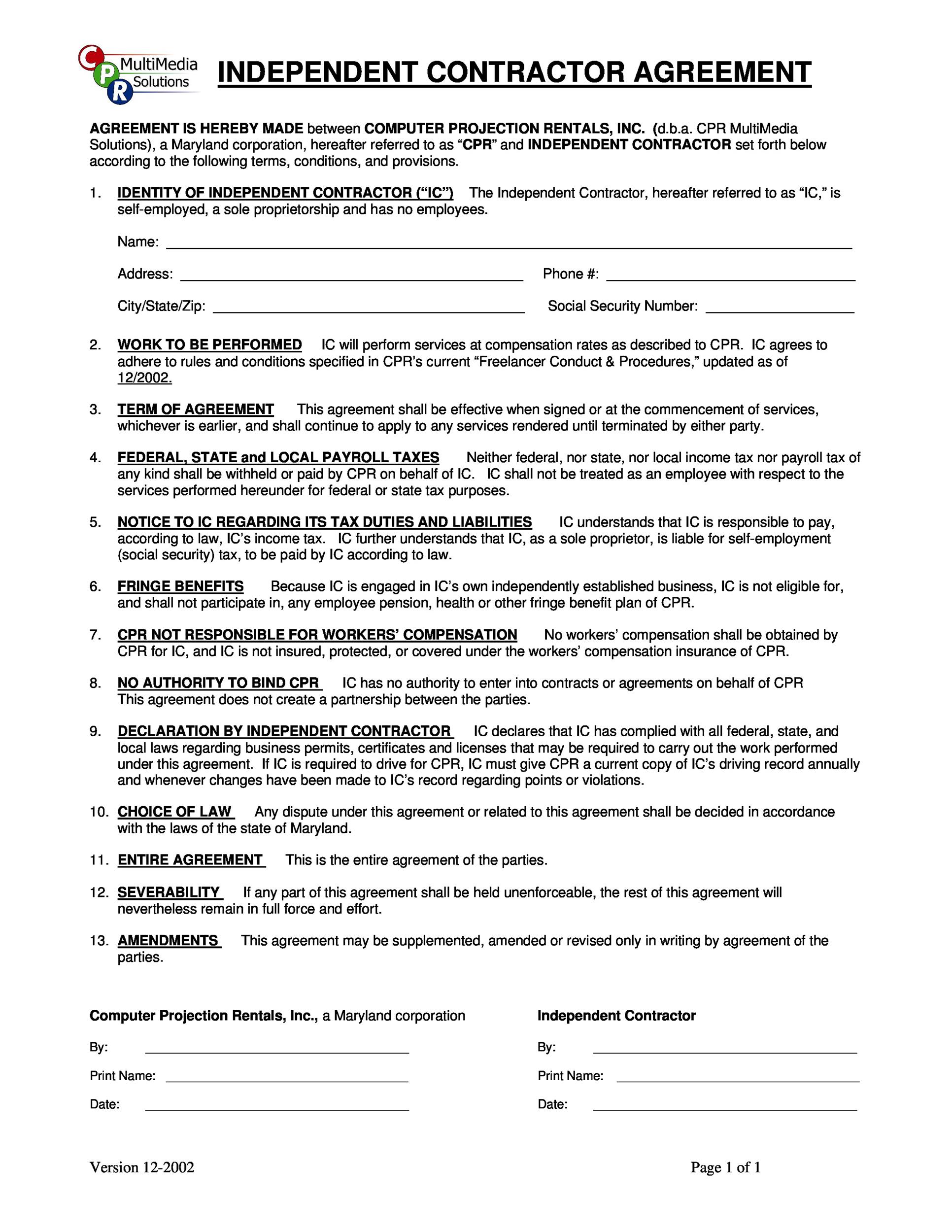

50+ FREE Independent Contractor Agreement Forms & Templates

Independent Contractor Agreement Template Free Agreement Templates

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Independent Contractor Checklist Independent Contractor Template

50+ FREE Independent Contractor Agreement Forms & Templates

Employee or Independent Contractor Checklist Template Employee Vs

Independent Contractor Checklist Independent Contractor List

50+ FREE Independent Contractor Agreement Forms & Templates

50+ Simple Independent Contractor Agreement Templates [FREE]

First, Customize The Free Independent Contractor Checklist With The Business’s Name And Information.

A Great Idea Is To Create A Contractor Invoice Email Template.

What Is An Independent Contractor?

But We Have Picked The Top Three Templates For You To Make Your Task.

Related Post:

![50+ Simple Independent Contractor Agreement Templates [FREE]](https://templatelab.com/wp-content/uploads/2017/01/independent-contractor-agreement-33-790x1022.jpg)