Inquiry Removal Letter Template

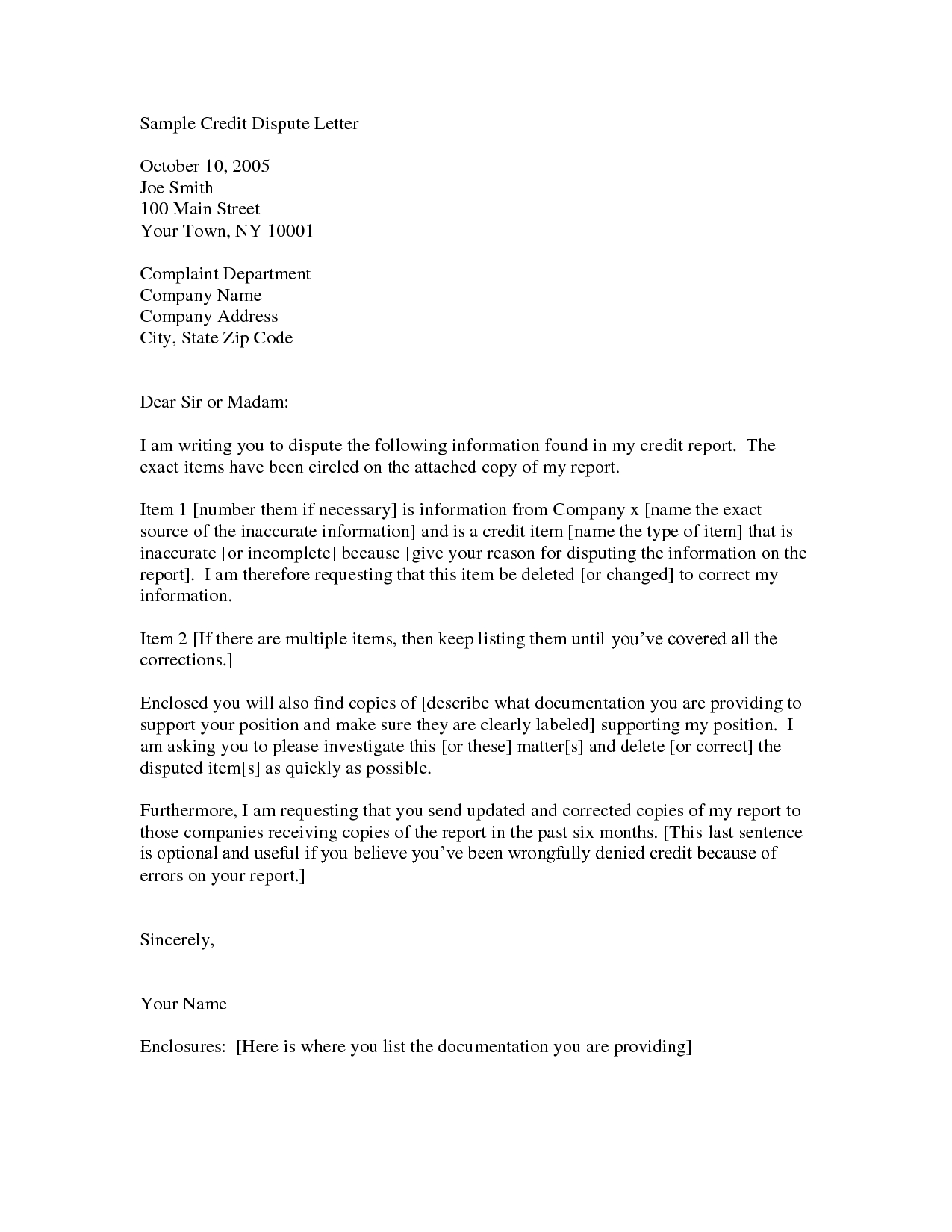

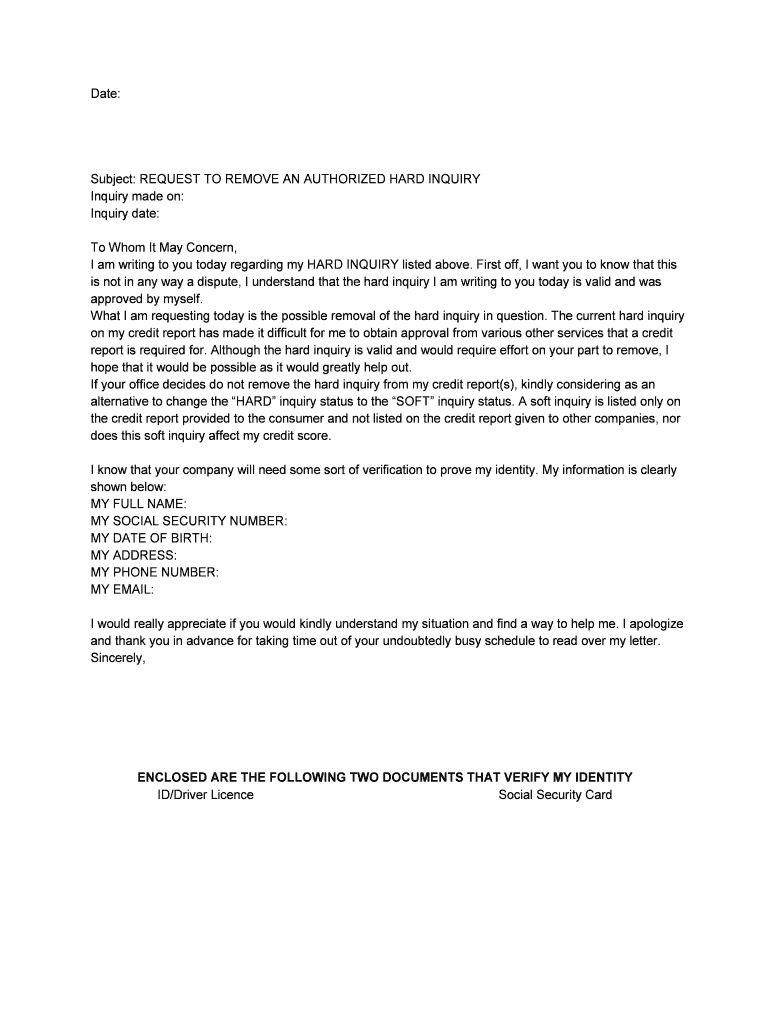

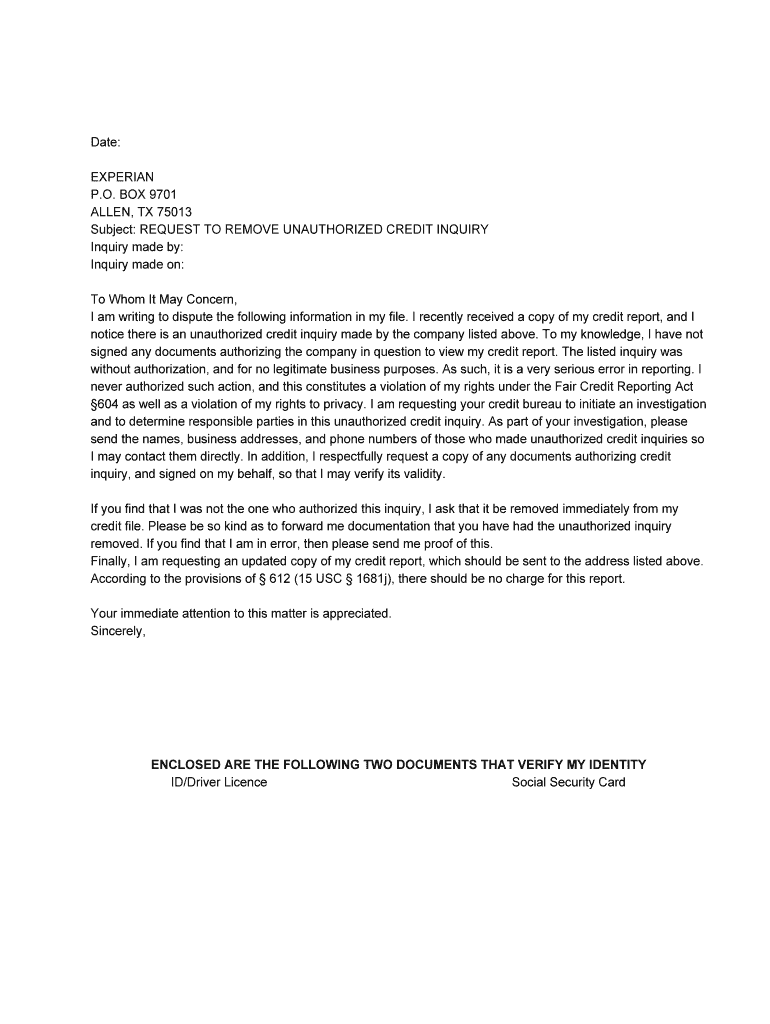

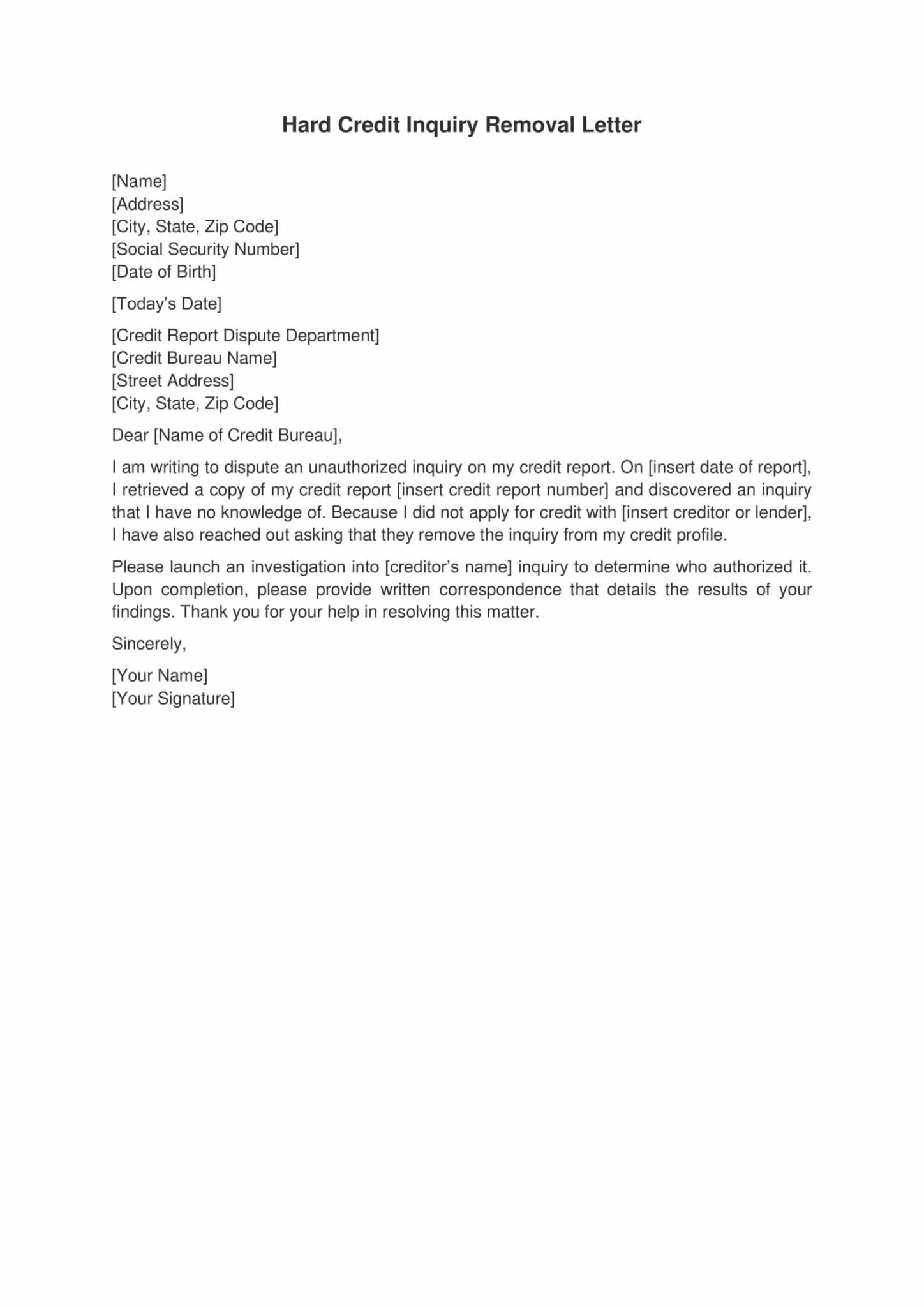

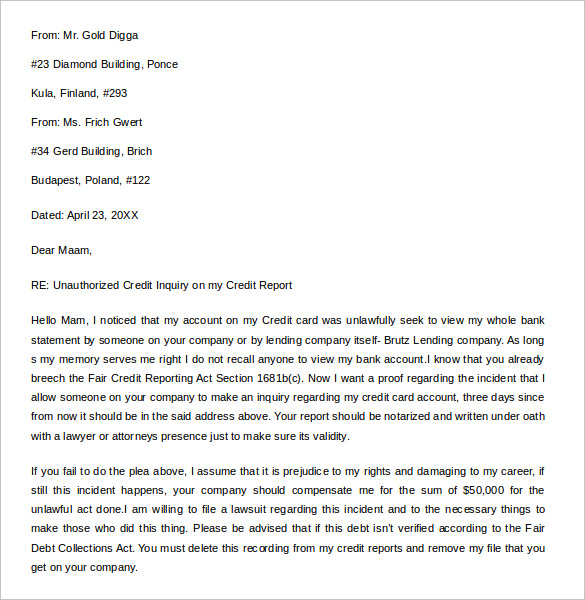

Inquiry Removal Letter Template - Why removing inquiries matters and how it can improve your credit score. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. What is a letter of interest? In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Make sure that you use fax or certified mail in order to ensure your. Submit a formal removal letter to the major credit bureaus. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. Accurately locate them in your credit report. Submit a formal removal letter to the major credit bureaus. A simple, yet effective letter to. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. Up to 40% cash back send 604 inquiry removal letter pdf via email, link, or fax. It notes three specific unauthorized inquiries and requests documentation showing authorization,. Procedures for disputing hard inquiries include contacting credit bureaus such as experian, equifax, or. A simple, yet effective letter to. Please ensure that this information is updated within the. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. This includes the date of the inquiry, the name of the creditor, and any supporting documents. Removing false inquiries from your report requires you to: It notes three specific unauthorized inquiries and requests documentation showing authorization,. Accurately locate them in. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Please ensure that this information is updated within the. Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i. Accurately locate them in your credit report. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. A simple, yet effective letter to. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit. The full text of the letter is below. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. Collect all relevant information about the credit inquiry you wish to remove. Timely removal of erroneous inquiries can help improve creditworthiness. Edit your hard inquiry removal letter pdf online. A simple, yet effective letter to. You can also download it, export it or print it out. Make sure that you use fax or certified mail in order to ensure your. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. You can send this sample. Upon receipt, it is the credit bureaus duty to investigate. This includes the date of the inquiry, the name of the creditor, and any supporting documents. Make sure that you use fax or certified mail in order to ensure your. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. You can also download it, export. Upon receipt, it is the credit bureaus duty to investigate. You can send this sample letter to a credit bureau requesting to remove inquiries from your credit report. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Collect all relevant. What is a letter of interest? Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i am writing. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter. Accurately locate them in your credit report. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Edit your hard inquiry removal letter pdf online. Upon receipt, it is the credit bureaus duty to investigate. A credit inquiry removal letter is. Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i am writing. A simple, yet effective letter to. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. Collect all. A simple, yet effective letter to. Why removing inquiries matters and how it can improve your credit score. Up to 40% cash back send 604 inquiry removal letter pdf via email, link, or fax. Submit a formal removal letter to the major credit bureaus. Upon receipt, it is the credit bureaus duty to investigate. Why removing inquiries matters and how it can improve your credit score. Accurately locate them in your credit report. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. A letter of interest (also called a “prospecting letter,” “letter of inquiry,” or “statement of inquiry”) shows your general interest in working at a. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. This letter requests the removal of unauthorized credit inquiries from the recipient's credit report. It notes three specific unauthorized inquiries and requests documentation showing authorization,. The full text of the letter is below. This includes the date of the inquiry, the name of the creditor, and any supporting documents. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i am writing.Credit Inquiry Removal Letter Template

Inquiry Removal Letter Template Printable Word Searches

Credit Inquiry Removal Letter Pdf Fill Online, Printable, Fillable

Inquiry Removal Letters Inquiry Removal Letter 1 PDF

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal DIY Credit Dispute Letter Template Effective

Hard Inquiry Removal Credit Dispute Letter Template DIY Credit Repair

Hard Credit Inquiry Removal Letter Draft Destiny

Credit Inquiry Removal Letter Template

Collect All Relevant Information About The Credit Inquiry You Wish To Remove.

You Can Also Download It, Export It Or Print It Out.

What Is A Letter Of Interest?

A Credit Inquiry Removal Letter Is Used To Alert The Credit Bureaus Of An Unauthorized Inquiry And Request That It Be Removed.

Related Post: