Irs Response Letter Template

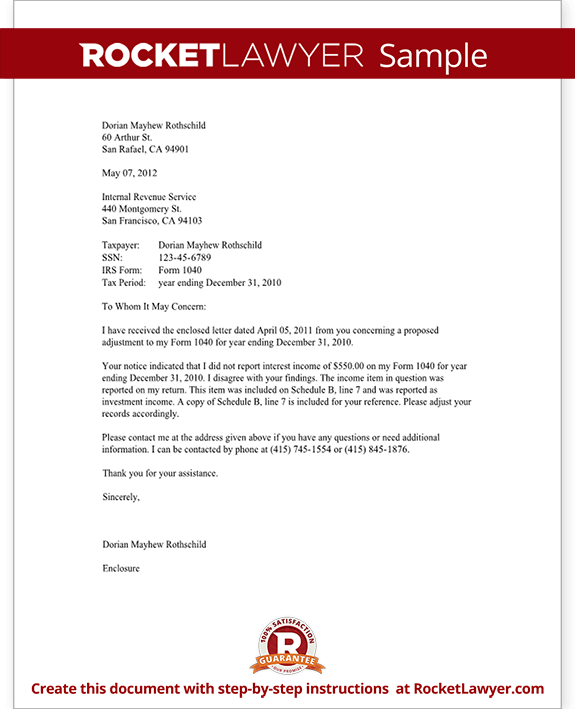

Irs Response Letter Template - If you made such a request, you have received letter 3173 from the Optima tax relief, llc is a tax resolution firm independent from the irs. The letter is a response to a notice cp2000 claiming tax. If you made such a request, you have received letter 3173 from the third. This article covers the basics of irs correspondence audits, appeals, and tax court procedures. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax issues. Penalties and interest will continue to accrue until your tax liability is paid in full to the irs. Download a basic template to request a reduction or cancellation of a tax penalty from the irs. This provides proof that the irs received your documents. It provides a standard, templated. Learn how to respond effectively to irs notices and avoid common pitfalls. If you made such a request, you have received letter 3173 from the When a taxpayer (an individual or a business) wishes to respond to an irs suggesting an adjustment to a tax return, particularly to add items of unreported or incorrectly. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax issues. Send your response via certified mail. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. However, responding effectively and promptly is essential to. If you made such a request, you have received letter 3173 from the third. Optima tax relief, llc is a tax resolution firm independent from the irs. If you feel you received a cp2000 notice in error and the irs got it wrong, you’ll need to prove it by finding the right forms and submitting a notice of your own: The letter is a response to a notice cp2000 claiming tax. This article covers the basics of irs correspondence audits, appeals, and tax court procedures. Write the full legal name of the person or business who is requesting that the irs review a penalty assessed. Always send your response using certified mail with a return receipt. If you made such. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return,. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. It provides a standard, templated. Protest the assessment of taxes. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. Penalties and interest will continue to accrue until your tax liability is paid in full to the irs. This article covers the basics of irs correspondence audits, appeals, and tax court procedures. This provides proof that the irs received your documents. It demonstrates how to reference. Send your response via certified mail. This article covers the basics of irs correspondence audits, appeals, and tax court procedures. Optima tax relief, llc is a tax resolution firm independent from the irs. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax issues. Write the full legal name. Learn how to fill out the letter, what information to include, and how to send it via. It provides a standard, templated. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax issues. When a taxpayer (an individual or a business) wishes to respond to an irs suggesting an. It provides a standard, templated. Learn how to respond effectively to irs notices and avoid common pitfalls. If you made such a request, you have received letter 3173 from the third. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a. Learn how to respond effectively to irs notices and avoid common pitfalls. It provides a standard, templated. Send your response via certified mail. Penalties and interest will continue to accrue until your tax liability is paid in full to the irs. Download a basic template to request a reduction or cancellation of a tax penalty from the irs. Always send your response using certified mail with a return receipt. Download a basic template to request a reduction or cancellation of a tax penalty from the irs. If you made such a request, you have received letter 3173 from the third. When a taxpayer (an individual or a business) wishes to respond to an irs suggesting an adjustment to. If you feel you received a cp2000 notice in error and the irs got it wrong, you’ll need to prove it by finding the right forms and submitting a notice of your own: It provides a standard, templated. Always send your response using certified mail with a return receipt. A response to irs notice letter is a document used by. This entity will be known as the requester going forward. It demonstrates how to reference the notice, explain the issue, provide. Penalties and interest will continue to accrue until your tax liability is paid in full to the irs. Download a basic template to request a reduction or cancellation of a tax penalty from the irs. Optima tax relief, llc. It demonstrates how to reference the notice, explain the issue, provide. Learn how to fill out the letter, what information to include, and how to send it via. This article covers the basics of irs correspondence audits, appeals, and tax court procedures. Write the full legal name of the person or business who is requesting that the irs review a penalty assessed. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax issues. If you made such a request, you have received letter 3173 from the This provides proof that the irs received your documents. Send your response via certified mail. If you made such a request, you have received letter 3173 from the third. Up to $50 cash back the irs response letter template is a document used by the internal revenue service (irs) to respond to taxpayer inquiries. Optima tax relief, llc is a tax resolution firm independent from the irs. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. Learn how to respond effectively to irs notices and avoid common pitfalls. The letter is a response to a notice cp2000 claiming tax. If you feel you received a cp2000 notice in error and the irs got it wrong, you’ll need to prove it by finding the right forms and submitting a notice of your own: Penalties and interest will continue to accrue until your tax liability is paid in full to the irs.Fantastic Irs Response Letter Template Letter templates, Formal

Response To Irs Notice Cp2000

IRS Response Letter Template Federal Government Of The United States

IRS Response Letter DocumentCloud

Letter to the IRS IRS Response Letter Form (with Sample)

Irs Response Letter Template in 2022 Letter templates, Business

Irs Response Letter Template Samples Letter Template Collection

Templates Sample Response Letter To Irs Cp Manswikstromse for Irs

Response To Irs Notice Cp2000

Response To Cp2000 Letter

Always Send Your Response Using Certified Mail With A Return Receipt.

This Sample Letter Guides Individuals In Responding To Irs Notice Cp2000 Regarding Income Discrepancies.

Download A Basic Template To Request A Reduction Or Cancellation Of A Tax Penalty From The Irs.

However, Responding Effectively And Promptly Is Essential To.

Related Post: