Loan Amortization Schedule Excel Template

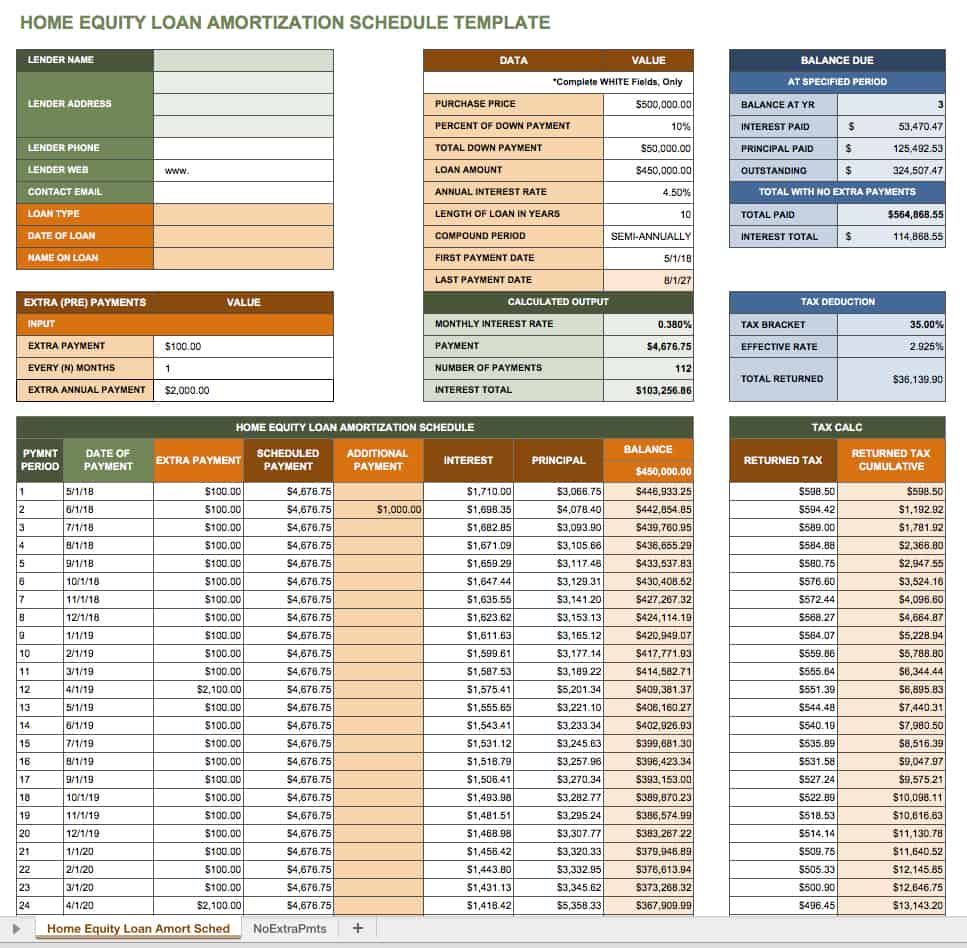

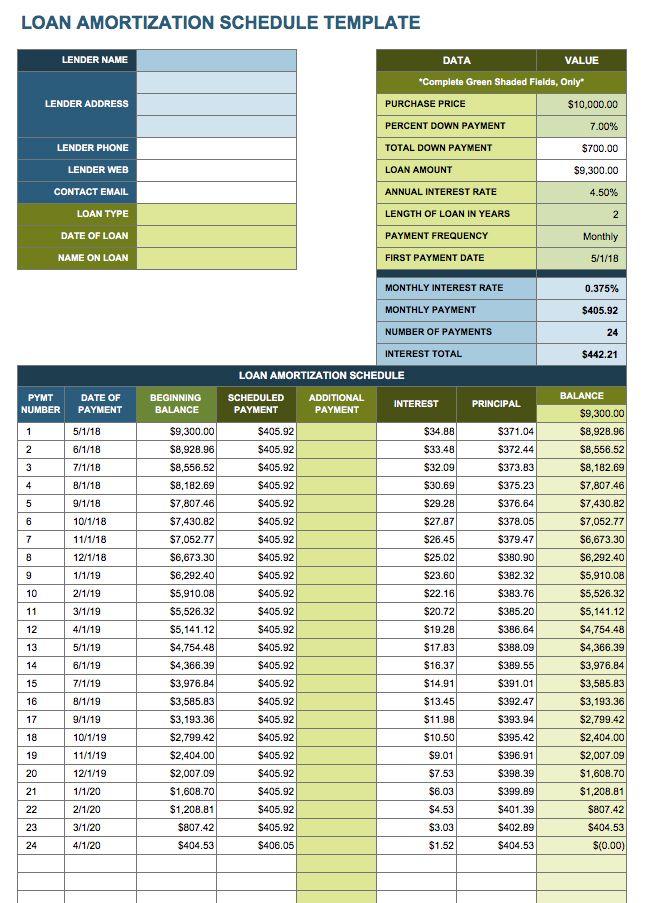

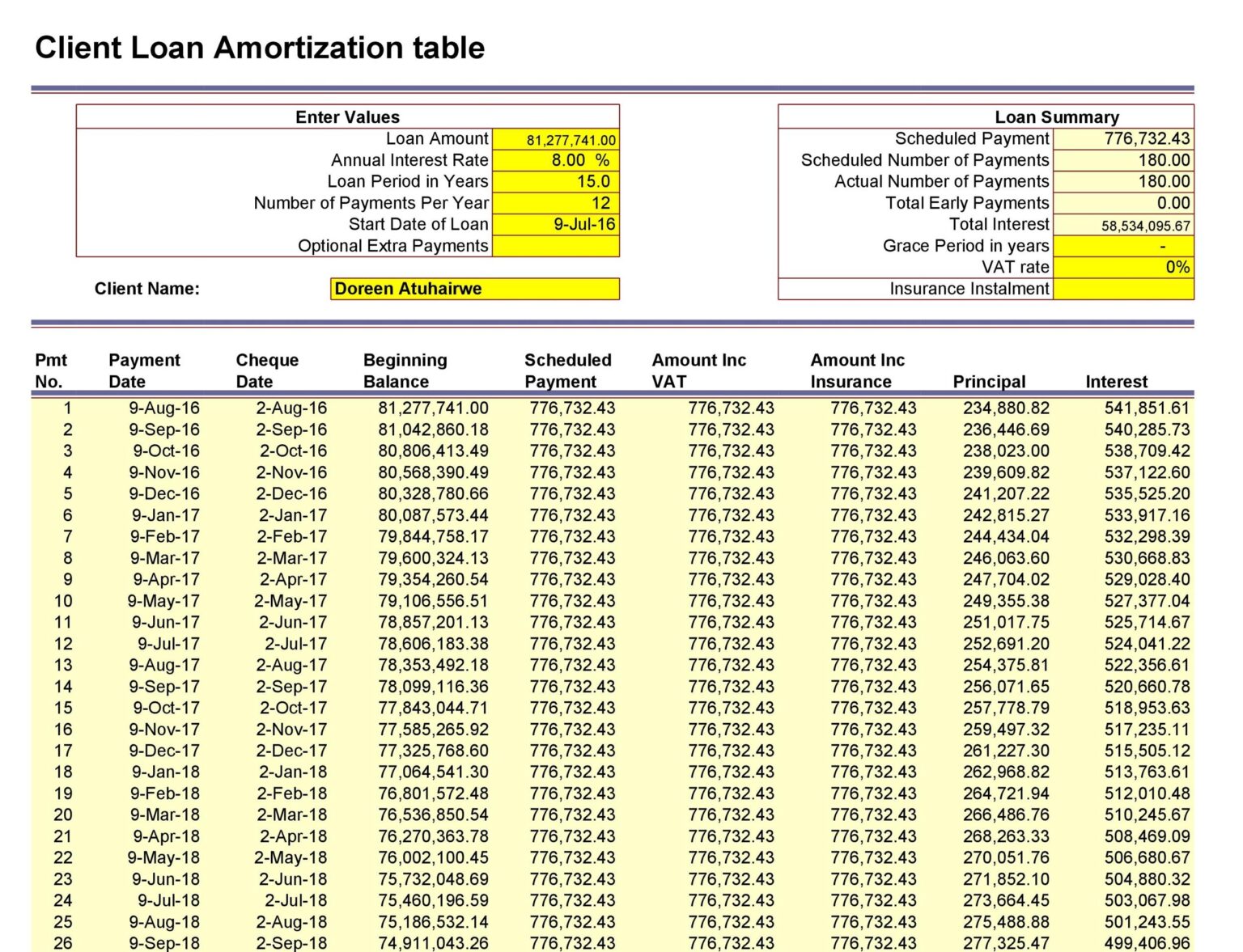

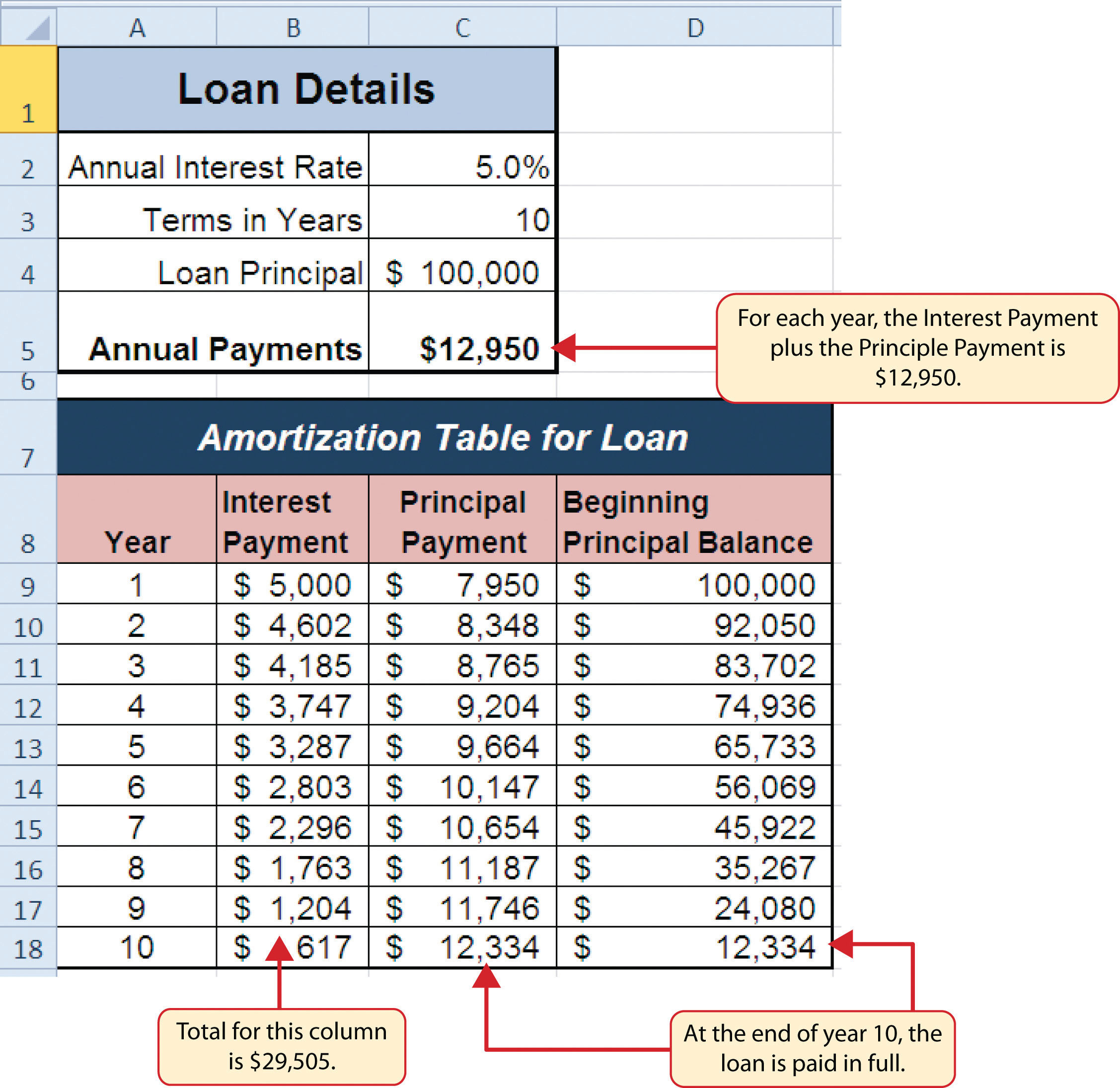

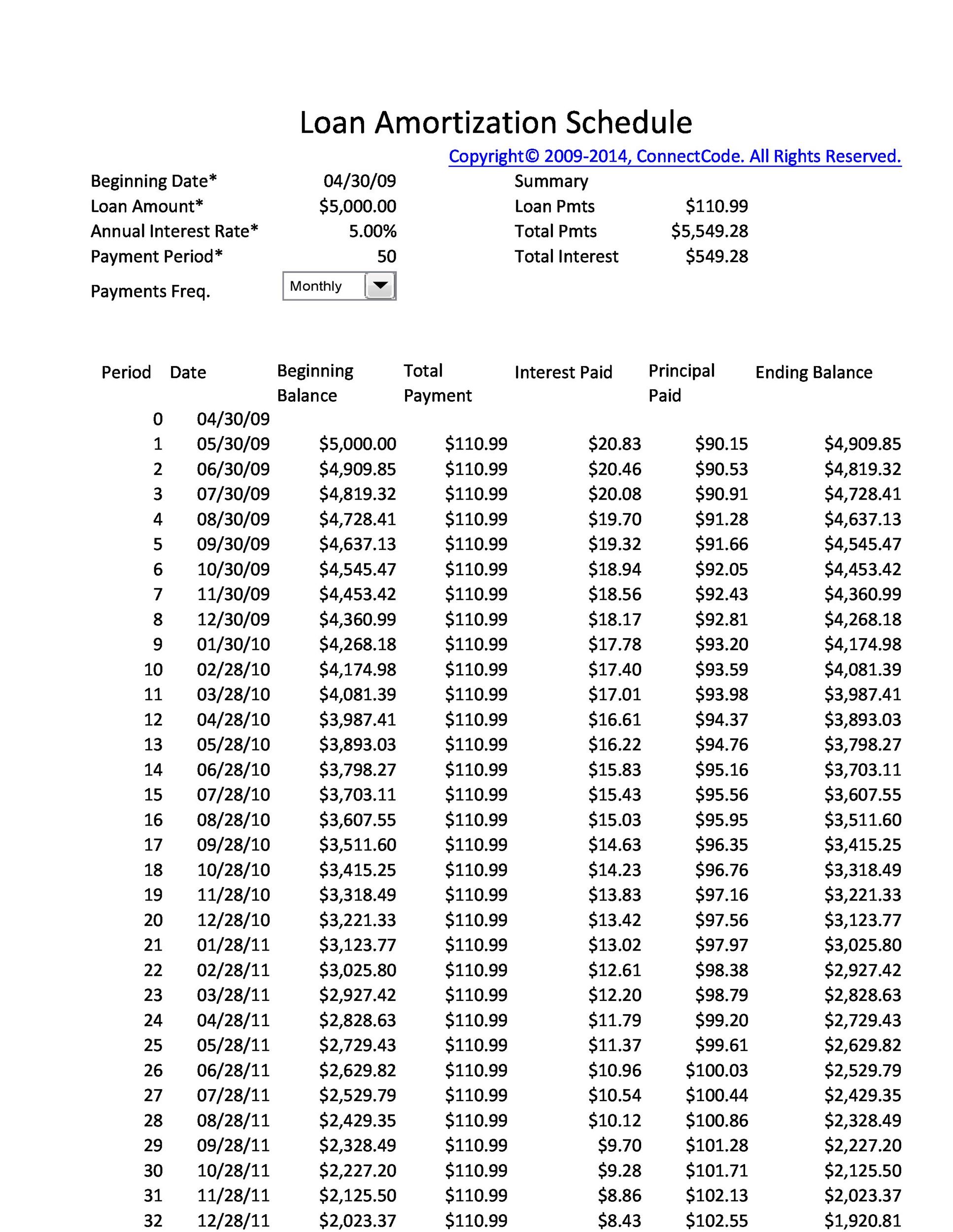

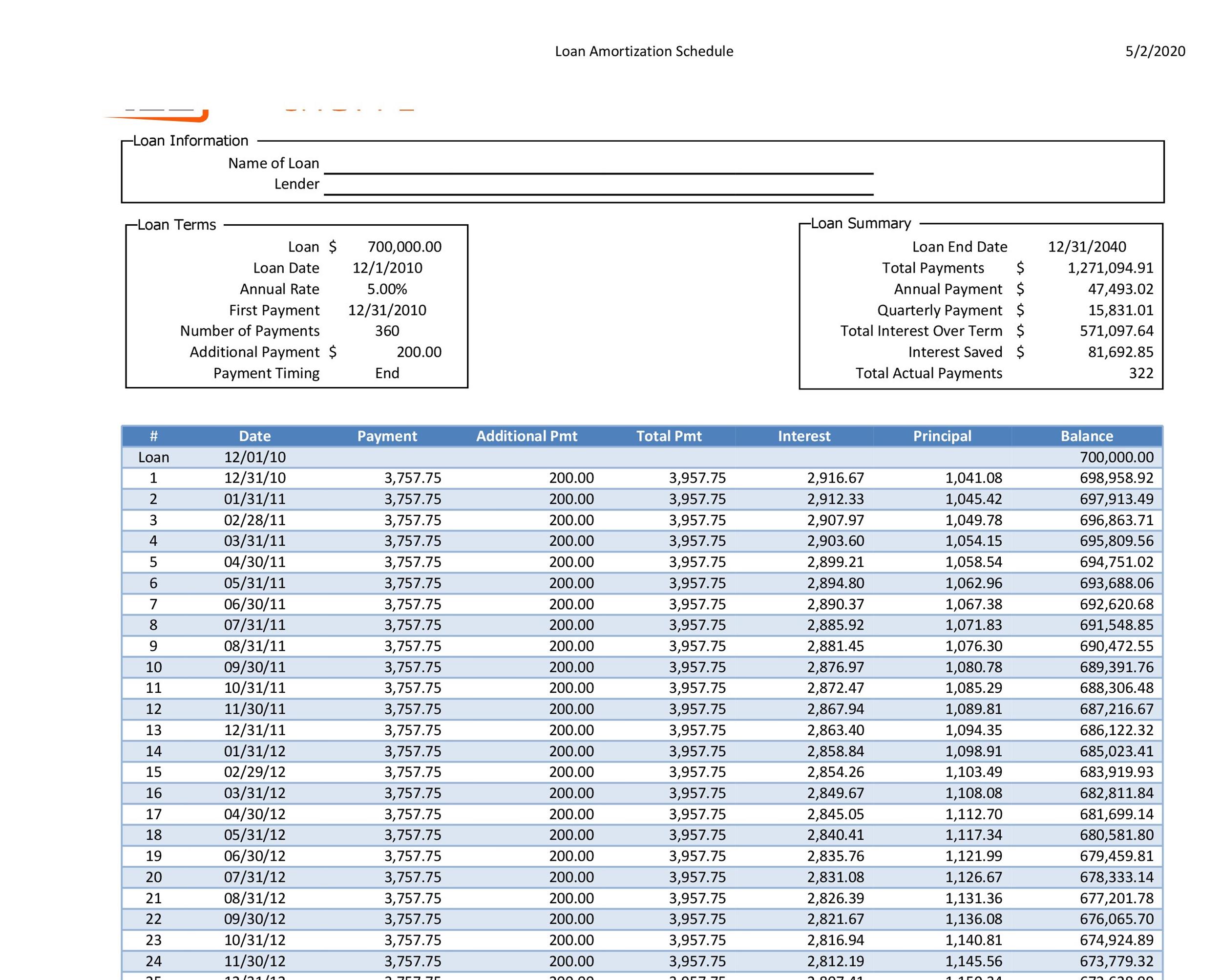

Loan Amortization Schedule Excel Template - Learn how to use an excel template to calculate and display the repayment schedule of a loan. Use this free loan amortization template to create a monthly loan amortization table for any loan period up to 30 years. Learn how to calculate loan amortization schedule in excel using pmt, ipmt, ppmt and sequence functions. To calculate the interest (which only happens at the beginning of the year for interest), our loan amortization schedule excel template sets the compounding period and frequency of payment. With an amortization schedule template for microsoft excel, you can enter the basic loan details and view the entire schedule in just minutes. The template requires inputting the loan amount, interest rate, start date, and optional. Download free excel templates for creating amortization tables or schedules for loans, mortgages, and other financial calculations. Learn how to use an amortization calculator to plan your. This essential financial tool calculates. Learn how to use the schedule, cust… The most straightforward approach to calculating payments for an amortized loan is utilizing a schedule template. Download a free template and customize it for your own. In this article, we’ll walk through the steps to create a loan amortization schedule using excel. Download free excel templates for creating amortization tables or schedules for loans, mortgages, and other financial calculations. Use this free loan amortization template to create a monthly loan amortization table for any loan period up to 30 years. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. Learn how to use the schedule, cust… Looking for a flexible free downloadable loan calculator built in excel? Some templates also allow you to include extra payments to. The template requires inputting the loan amount, interest rate, start date, and optional. We’ll cover everything from setting up your spreadsheet to understanding the. The charge paid for borrowing the principal. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. The length of time over. Learn how to calculate loan amortization schedule in excel using pmt, ipmt, ppmt and sequence functions. Download free excel templates for different types of loans, such as mortgages, auto loans, and home equity loans. Learn how to use an excel template to calculate and display the repayment schedule of a loan. Learn how to build an amortization schedule in excel to detail periodic payments on a loan or mortgage. To calculate the interest (which only happens. Download free excel templates for different types of loans, such as mortgages, auto loans, and home equity loans. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. Learn how to use an amortization calculator to plan your. It typically requires basic information such. Key concepts in amortization * principal: This essential financial tool calculates. The length of time over. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. Learn how to build an amortization schedule in excel to detail periodic payments on a loan or mortgage. Learn how to use an amortization calculator to plan your. With an amortization schedule template for microsoft excel, you can enter the basic loan details and view the entire schedule in just minutes. Limited user input with comprehensive automated calculations and can. It typically requires basic information such. Learn how to use an excel template to calculate and display the repayment schedule of a loan. Learn how to build an. Download a free template and customize it for your own. Learn how to use an amortization calculator to plan your. Some templates also allow you to include extra payments to. Limited user input with comprehensive automated calculations and can. The template requires inputting the loan amount, interest rate, start date, and optional. For most any type of loan, microsoft. It offers payment details and amortization tables with principal & interest. Learn how to use an excel template to calculate and display the repayment schedule of a loan. Learn how to use amortization formulas, extra payments, and. Download a free template and customize it for your own. Learn how to use amortization formulas, extra payments, and. Download free excel templates for different types of loans, such as mortgages, auto loans, and home equity loans. The length of time over. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. For most any type of loan, microsoft. Learn how to use an amortization calculator to plan your. Download and customize these templates to calculate your monthly payments, interest, principal, and loan term. The charge paid for borrowing the principal. Learn how to use an excel template to calculate and display the repayment schedule of a loan. Learn how to build an amortization schedule in excel to detail. Some templates also allow you to include extra payments to. To calculate the interest (which only happens at the beginning of the year for interest), our loan amortization schedule excel template sets the compounding period and frequency of payment. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. It. Learn how to calculate loan amortization schedule in excel using pmt, ipmt, ppmt and sequence functions. Key concepts in amortization * principal: Learn how to use the schedule, cust… For most any type of loan, microsoft. Use this free loan amortization template to create a monthly loan amortization table for any loan period up to 30 years. Some templates also allow you to include extra payments to. Download a free template and customize it for your own. Download free excel templates for different types of loans, such as mortgages, auto loans, and home equity loans. Learn how to use an amortization calculator to plan your. Learn how to build an amortization schedule in excel to detail periodic payments on a loan or mortgage. It typically requires basic information such. The length of time over. This essential financial tool calculates. The charge paid for borrowing the principal. It offers payment details and amortization tables with principal & interest. The template requires inputting the loan amount, interest rate, start date, and optional.amortization schedule formula by hand Ecosia Images

EXCEL of Useful Loan Amortization Schedule.xlsx WPS Free Templates

Free Excel Amortization Schedule Templates Smartsheet

Free Excel Amortization Schedule Templates Smartsheet

Sample Templates Unlock Hidden Savings Master Amortization Schedules

Free Excel Amortization Schedule Templates Smartsheet

Loan Amortization Schedule Spreadsheet —

Excel Loan Amortization Schedule Template For Your Needs

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

Excel Amortization Chart Loan amortization schedule excel template

To Calculate The Interest (Which Only Happens At The Beginning Of The Year For Interest), Our Loan Amortization Schedule Excel Template Sets The Compounding Period And Frequency Of Payment.

The Most Straightforward Approach To Calculating Payments For An Amortized Loan Is Utilizing A Schedule Template.

Looking For A Flexible Free Downloadable Loan Calculator Built In Excel?

We’ll Cover Everything From Setting Up Your Spreadsheet To Understanding The.

Related Post: