Merger And Acquisition Agreement Template

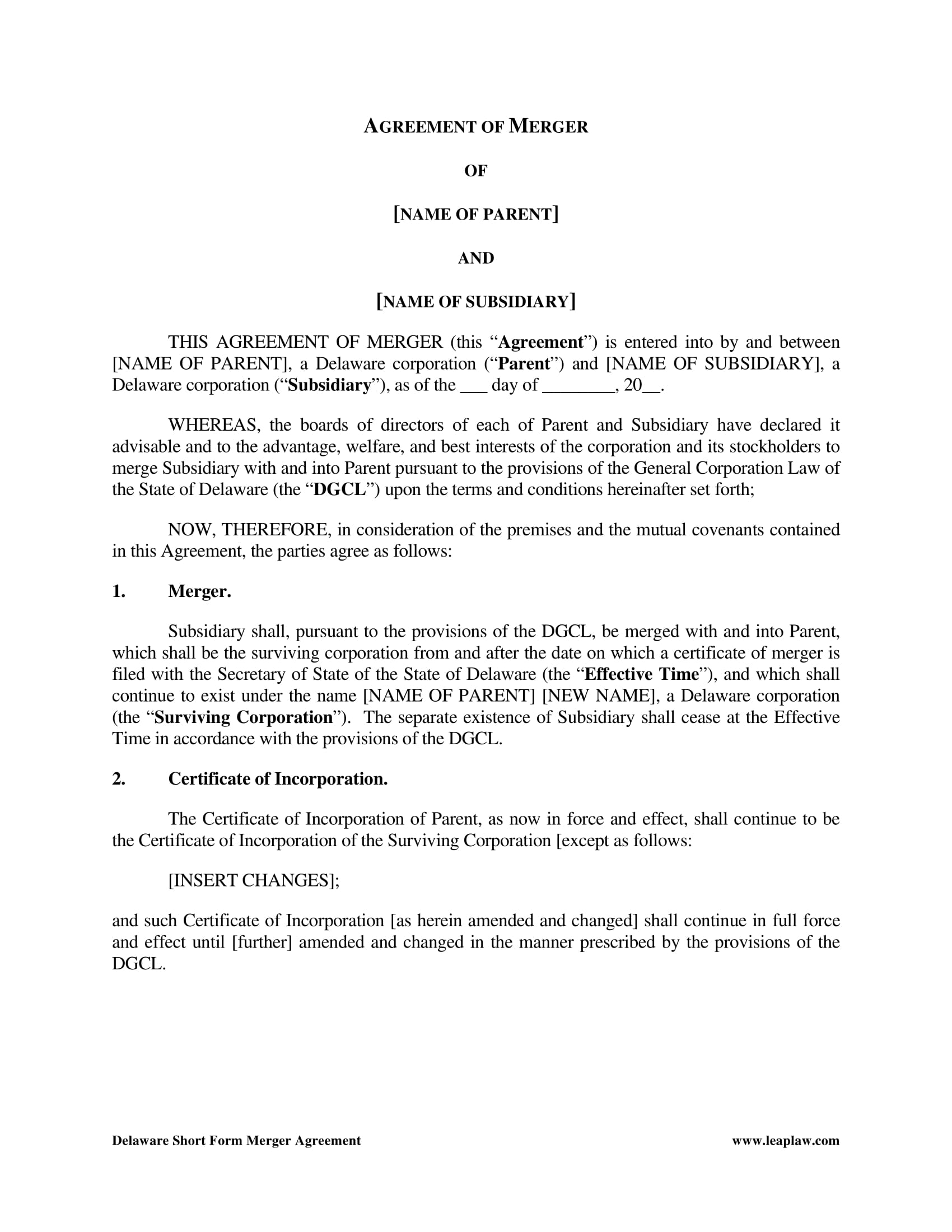

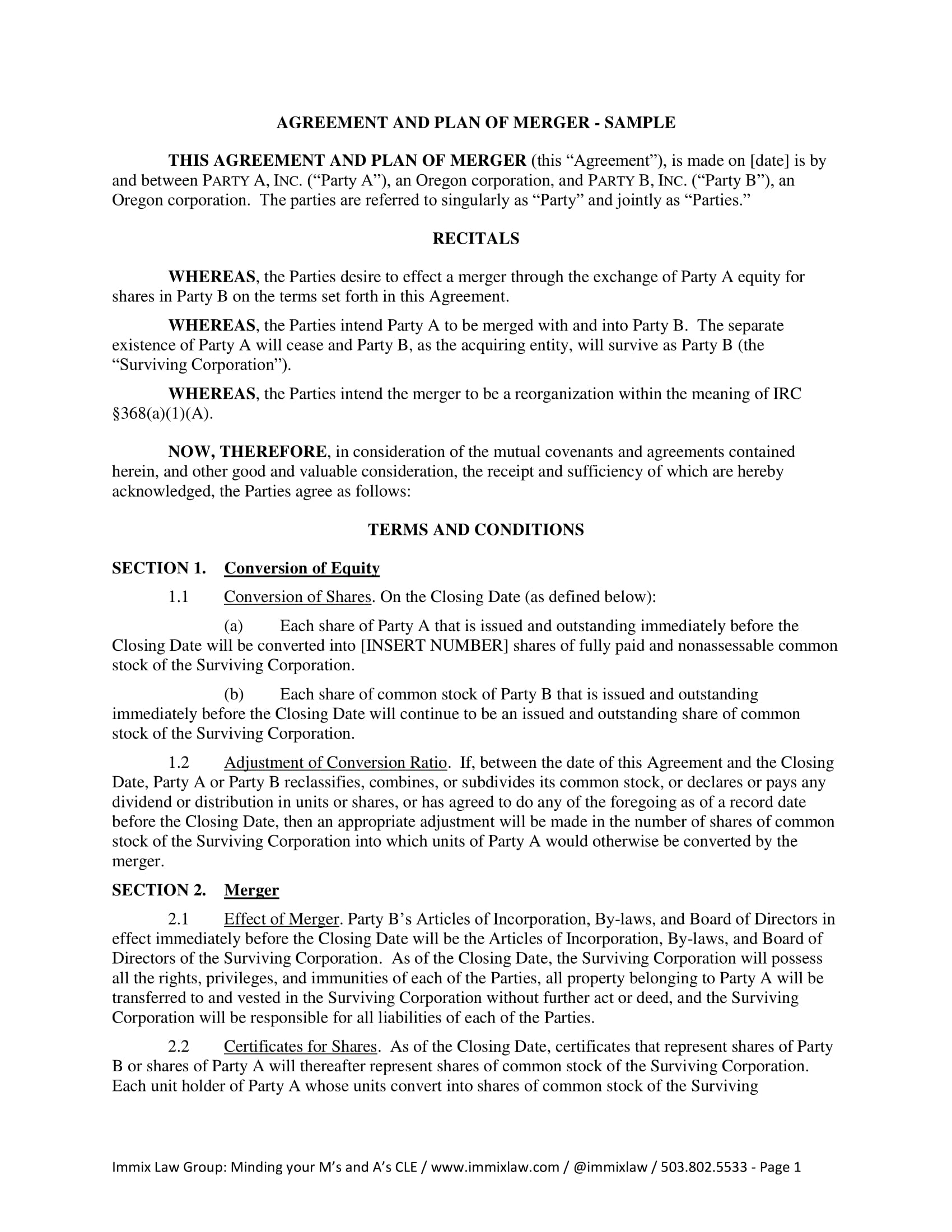

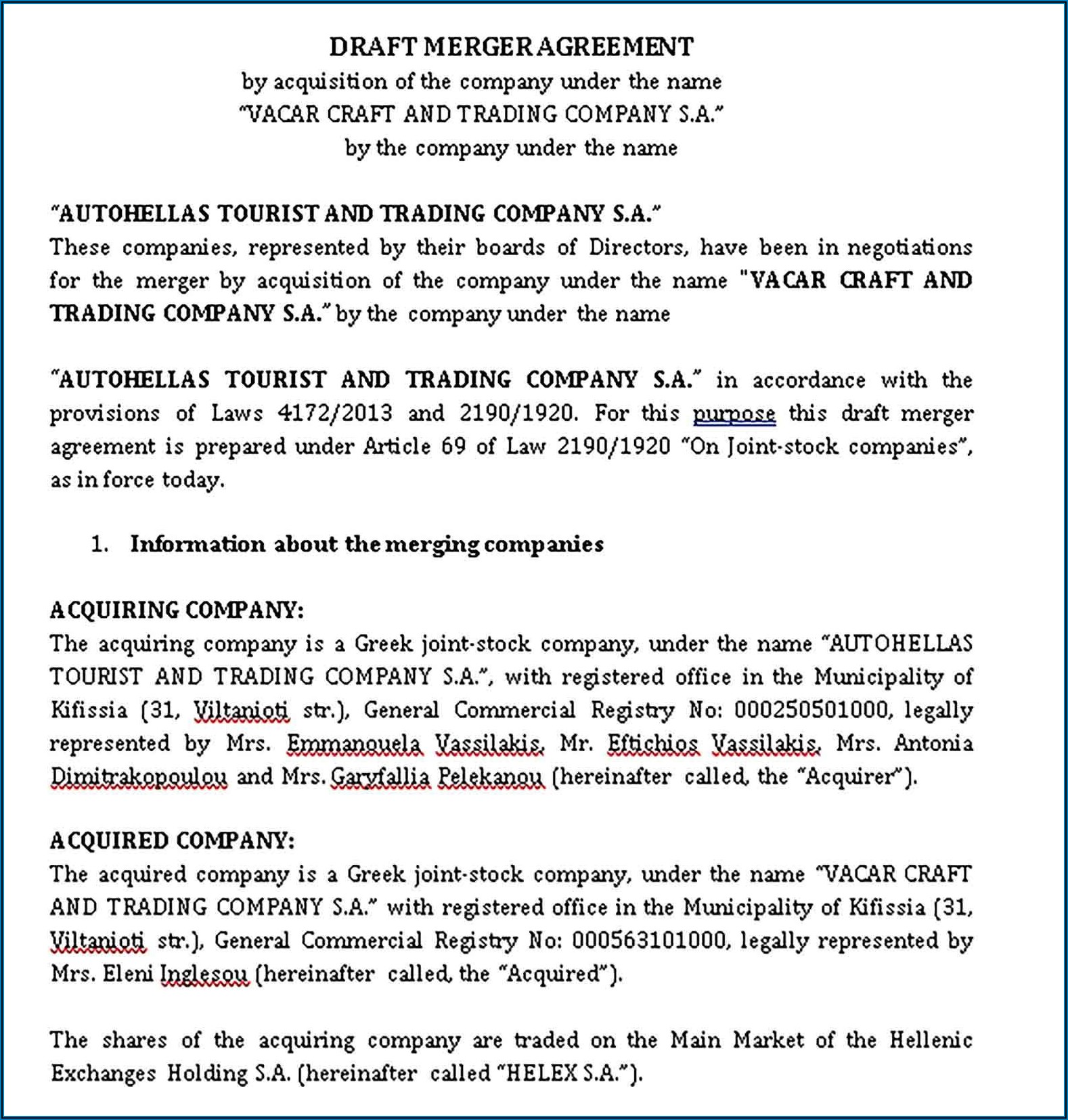

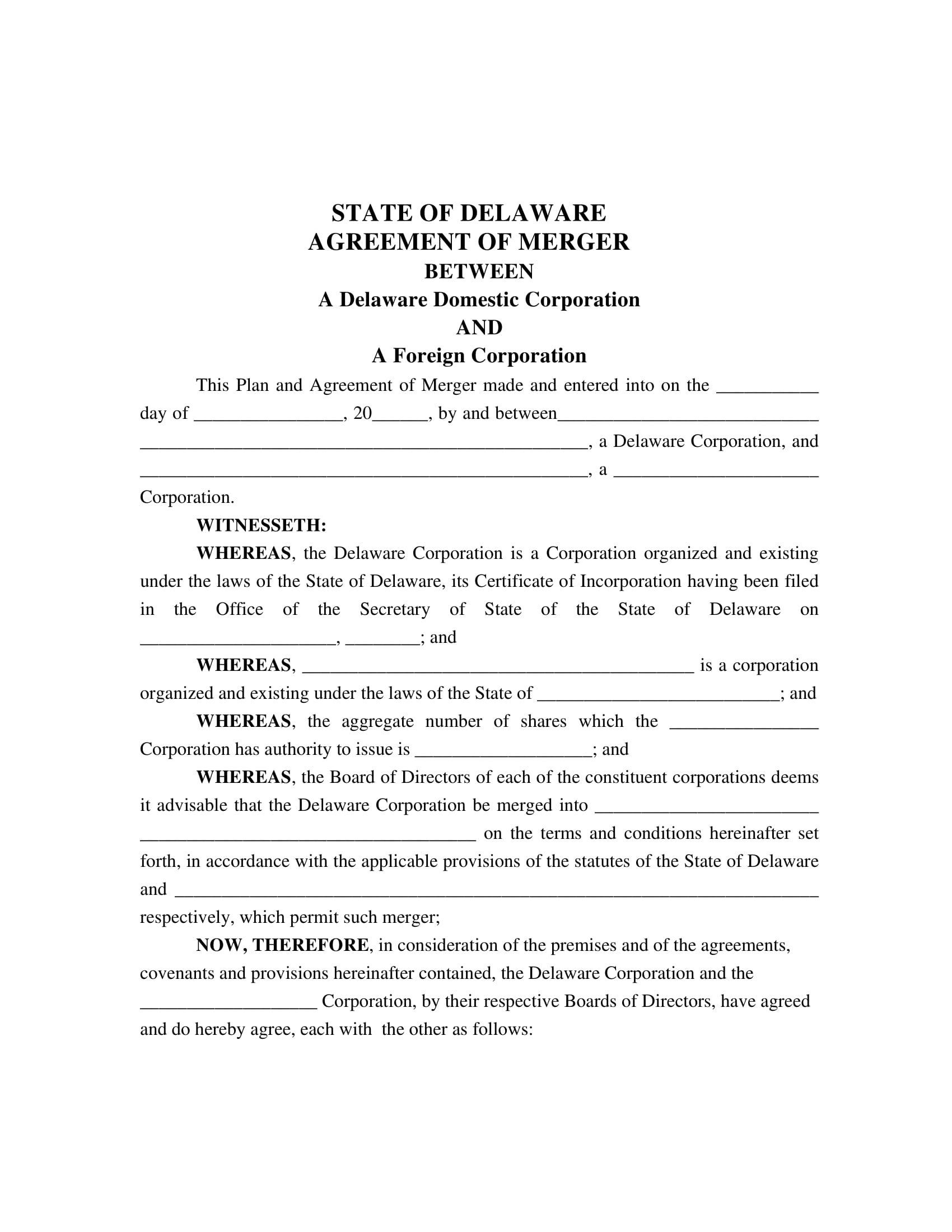

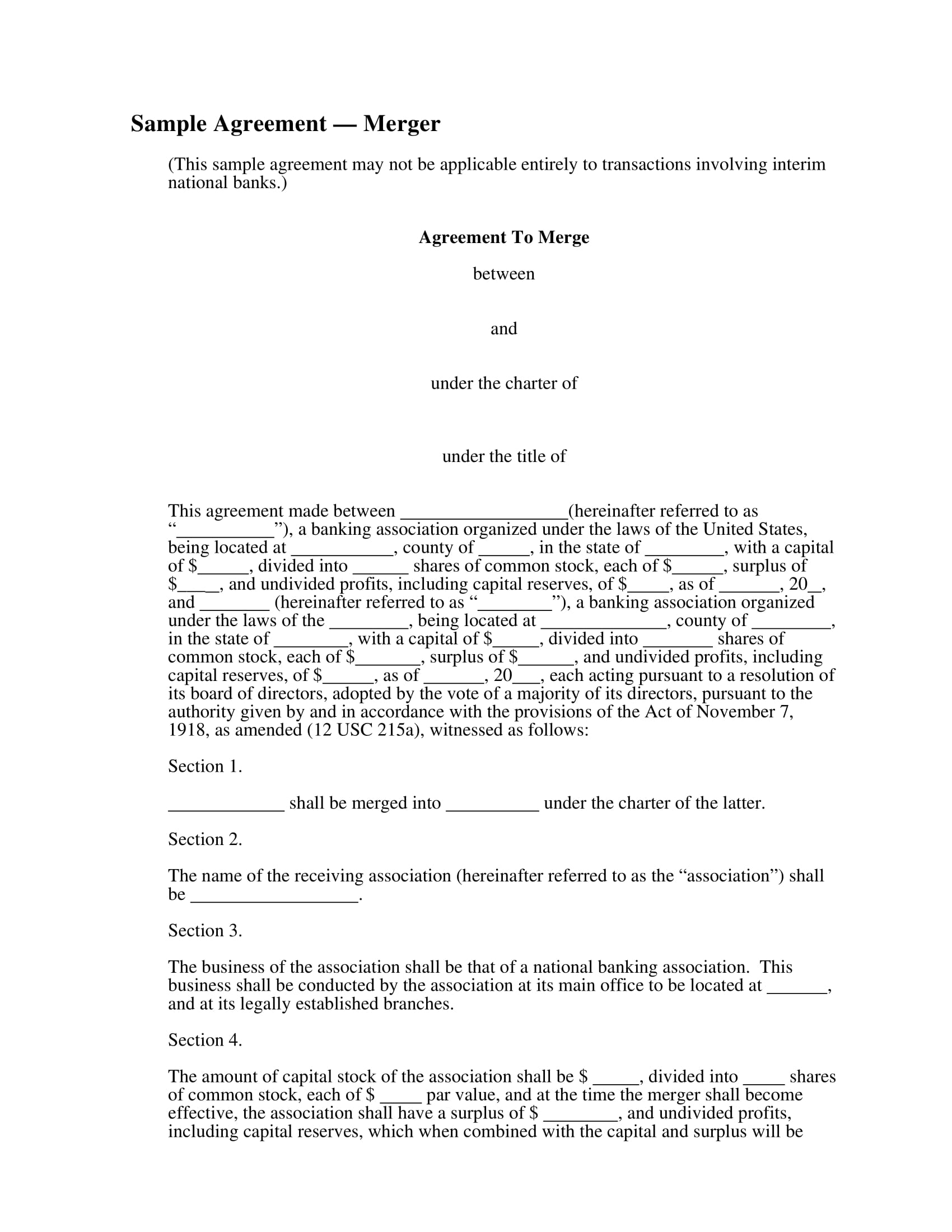

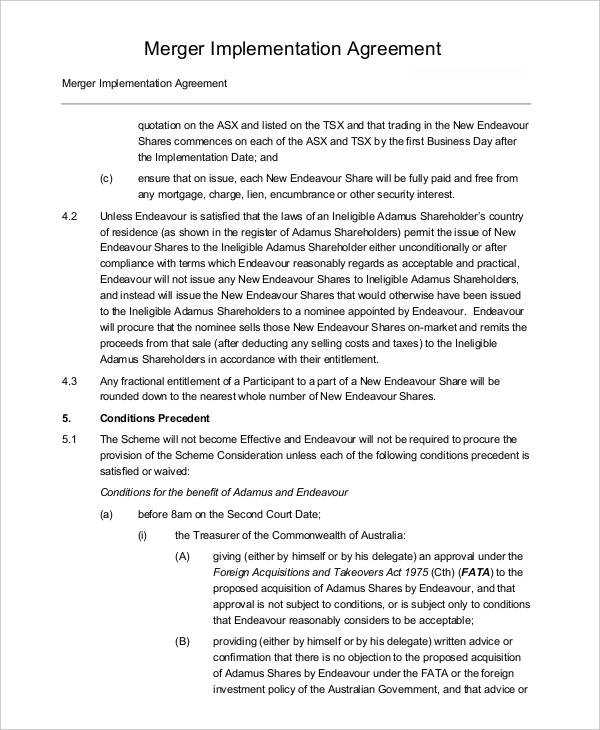

Merger And Acquisition Agreement Template - This agreement will detail the financial terms of the merger, and how the. It specifies the terms of the merger,. A rare exception was capital one’s $35 billion pending acquisition of discover in february 2024, which was one of the largest announced m&a transactions globally across all. This agreement and plan of merger (“agreement”) is made and entered into as of _______ __, 20___, by and among: No software required — easily edit to suit your specific transaction needs. Research from hbr indicates that a substantial 60% of significant mergers destroy. One of the most critical aspects of successful mergers and acquisitions (m&a) is blending organizational cultures. These agreements play a critical role in shaping the. [acquiror], inc., a delaware corporation (“parent”);. Mergers & acquisitions documents are legally binding documents used to facilitate the sale of a business, including a letter of intent, due diligence report, purchase agreement, closing. Download a free, customizable acquisition agreement template for your business. Research from hbr indicates that a substantial 60% of significant mergers destroy. Mergers and acquisitions (m&a) are deals in which two or more companies integrate in some way. It specifies the terms of the merger,. Download m&a press release sample template here. Check out the following 10 free merger agreement templates in word and pdf formats for less difficulty in preparing for a business merger agreement. Despite the fact that mergers and. Entrepreneurs would do almost anything just to survive the very competitive world of business. [acquiror], inc., a delaware corporation (“parent”);. A rare exception was capital one’s $35 billion pending acquisition of discover in february 2024, which was one of the largest announced m&a transactions globally across all. No software required — easily edit to suit your specific transaction needs. Research from hbr indicates that a substantial 60% of significant mergers destroy. On or prior to the initial closing date, the company shall execute and deliver to the placement agent an agreement with the placement agent regarding mergers and acquisitions, in the form. Companies that decide to combine. Our mergers and acquisitions (m&a) lifecycle series has looked at the key stages of an m&a transaction, from the inception of the deal and term sheets, to the process of due. This agreement will detail the financial terms of the merger, and how the. When two companies come together, their shared. Mergers and acquisitions (m&a) are among the most strategic. Merger and acquisition agreement • august 12th, 2011 • global pharm holdings group, inc. When two companies come together, their shared. These agreements play a critical role in shaping the. If you want to ensure that your merger turns out well, you need a merger agreement to clarify all your activity’s terms. It specifies the terms of the merger,. Our mergers and acquisitions (m&a) lifecycle series has looked at the key stages of an m&a transaction, from the inception of the deal and term sheets, to the process of due. One of the most critical aspects of successful mergers and acquisitions (m&a) is blending organizational cultures. On or prior to the initial closing date, the company shall execute and. Mergers & acquisitions documents are legally binding documents used to facilitate the sale of a business, including a letter of intent, due diligence report, purchase agreement, closing. Our mergers and acquisitions (m&a) lifecycle series has looked at the key stages of an m&a transaction, from the inception of the deal and term sheets, to the process of due. Research from. These agreements play a critical role in shaping the. A rare exception was capital one’s $35 billion pending acquisition of discover in february 2024, which was one of the largest announced m&a transactions globally across all. This study empirically examines the determinants of merger and acquisition (m&a) activities in vietnam from 2005 to 2020, which has not been examined before,. A merger and acquisition agreement also called an m&a or merger, is a type of legal contract that outlines how two businesses will handle the consolidation of companies through financial. It specifies the terms of the merger,. [acquiror], inc., a delaware corporation (“parent”);. This agreement will detail the financial terms of the merger, and how the. Companies that decide to. This agreement will detail the financial terms of the merger, and how the. These agreements play a critical role in shaping the. Companies that decide to combine their businesses may enter into a merger agreement. This agreement and plan of merger (including all exhibits, hereinafter referred to as this agreement ) is made and entered into as of november 28,. A merger and acquisition agreement also called an m&a or merger, is a type of legal contract that outlines how two businesses will handle the consolidation of companies through financial. Check out the following 10 free merger agreement templates in word and pdf formats for less difficulty in preparing for a business merger agreement. No software required — easily edit. It’s essential to confront the challenging reality of mergers and acquisitions (m&a). Companies that decide to combine their businesses may enter into a merger agreement. When two companies come together, their shared. This agreement and plan of merger (including all exhibits, hereinafter referred to as this agreement ) is made and entered into as of november 28, 2011 by and.. Despite the fact that mergers and. It’s essential to confront the challenging reality of mergers and acquisitions (m&a). Mergers & acquisitions documents are legally binding documents used to facilitate the sale of a business, including a letter of intent, due diligence report, purchase agreement, closing. This agreement and plan of merger (“agreement”) is made and entered into as of _______ __, 20___, by and among: This agreement will detail the financial terms of the merger, and how the. One of the most critical aspects of successful mergers and acquisitions (m&a) is blending organizational cultures. No software required — easily edit to suit your specific transaction needs. Need to announce a merger or acquisition to the press? Our mergers and acquisitions (m&a) lifecycle series has looked at the key stages of an m&a transaction, from the inception of the deal and term sheets, to the process of due. Download a free, customizable acquisition agreement template for your business. A rare exception was capital one’s $35 billion pending acquisition of discover in february 2024, which was one of the largest announced m&a transactions globally across all. Our clean team nda template can be used in conjunction with our (or any. Companies that decide to combine their businesses may enter into a merger agreement. This helps all parties involved understand their roles and the underlying. Entrepreneurs would do almost anything just to survive the very competitive world of business. These agreements play a critical role in shaping the.FREE 5+ Merger Agreement Contract Forms in PDF MS Word

FREE 5+ Merger Agreement Contract Forms in PDF MS Word

Merger And Acquisition Agreement Template Template 2 Resume

FREE 5+ Merger Agreement Contract Forms in PDF MS Word

FREE 5+ Merger Agreement Contract Forms in PDF MS Word

Free Merger Agreement Template Darrin Kenney's Templates

Merger And Acquisition Agreement Template PDF Template

merger agreement sample Doc Template pdfFiller

Merger Agreement Templates 10 Free Word, PDF Format Download

Merger Agreement Templates 10 Free Word, PDF Format Download

Merger And Acquisition Agreement • August 12Th, 2011 • Global Pharm Holdings Group, Inc.

This Study Empirically Examines The Determinants Of Merger And Acquisition (M&A) Activities In Vietnam From 2005 To 2020, Which Has Not Been Examined Before, Using A Fixed.

This Agreement And Plan Of Merger (Including All Exhibits, Hereinafter Referred To As This Agreement ) Is Made And Entered Into As Of November 28, 2011 By And.

Acquisition Agreements Serve As Foundational Documents That Outline The Terms And Conditions Under Which One Entity Acquires Another.

Related Post: