Monte Carlo Excel Template

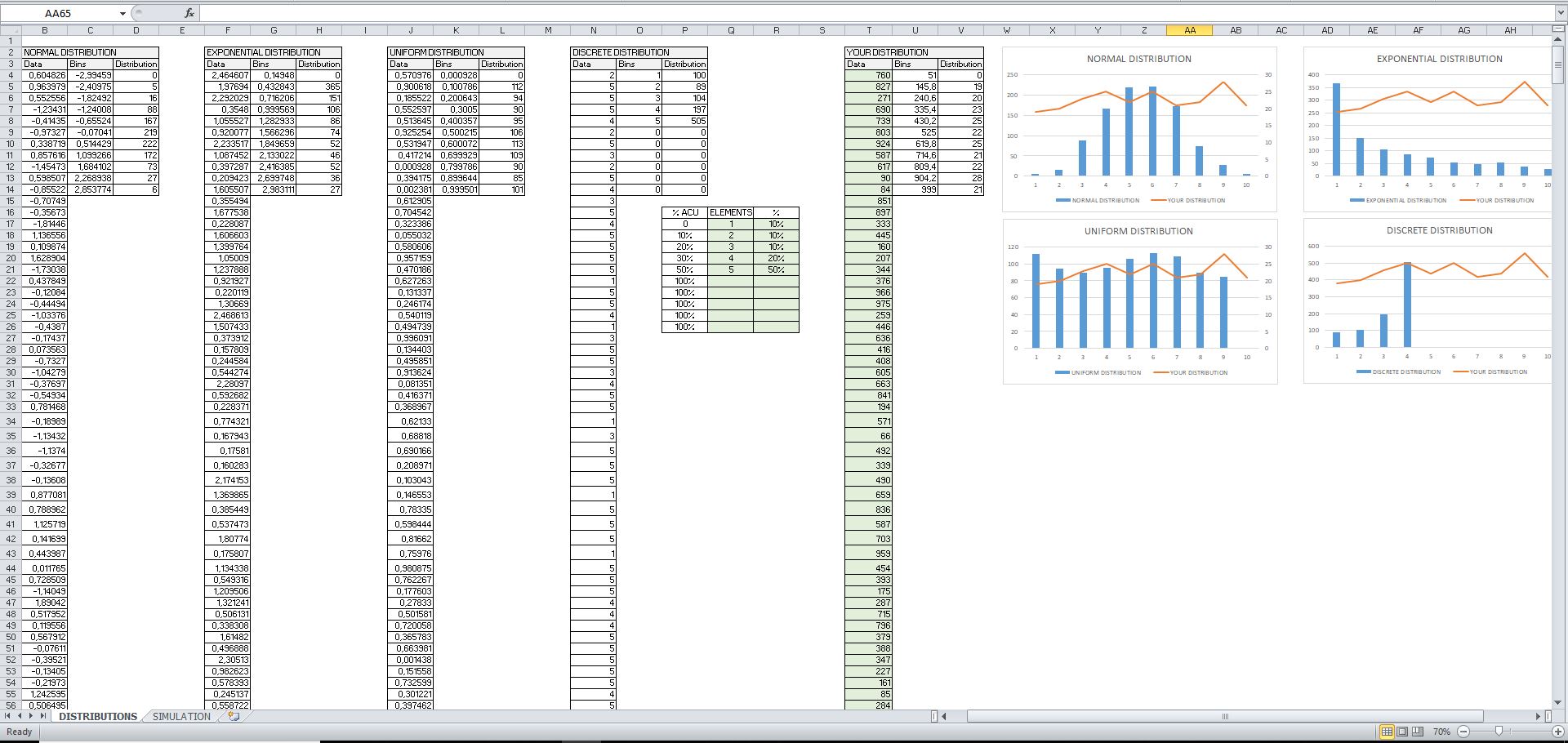

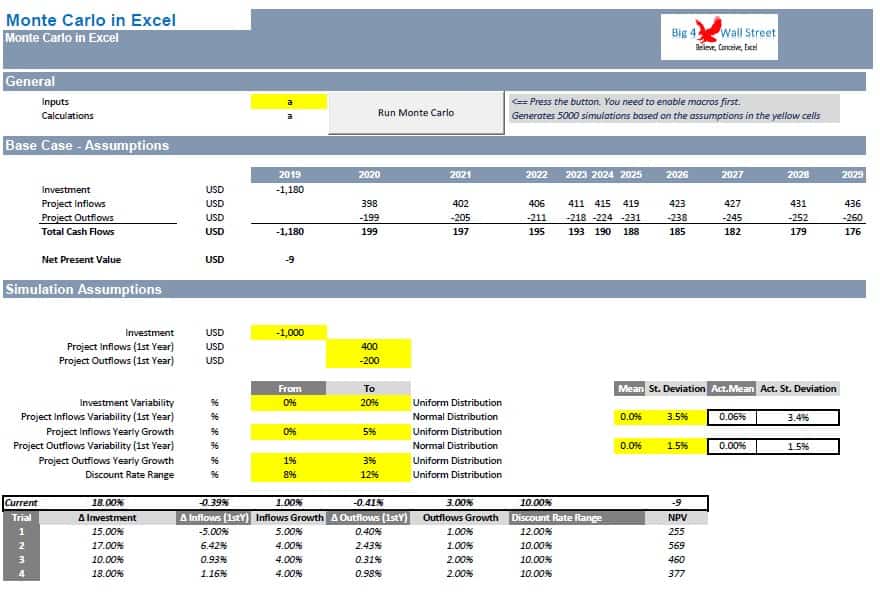

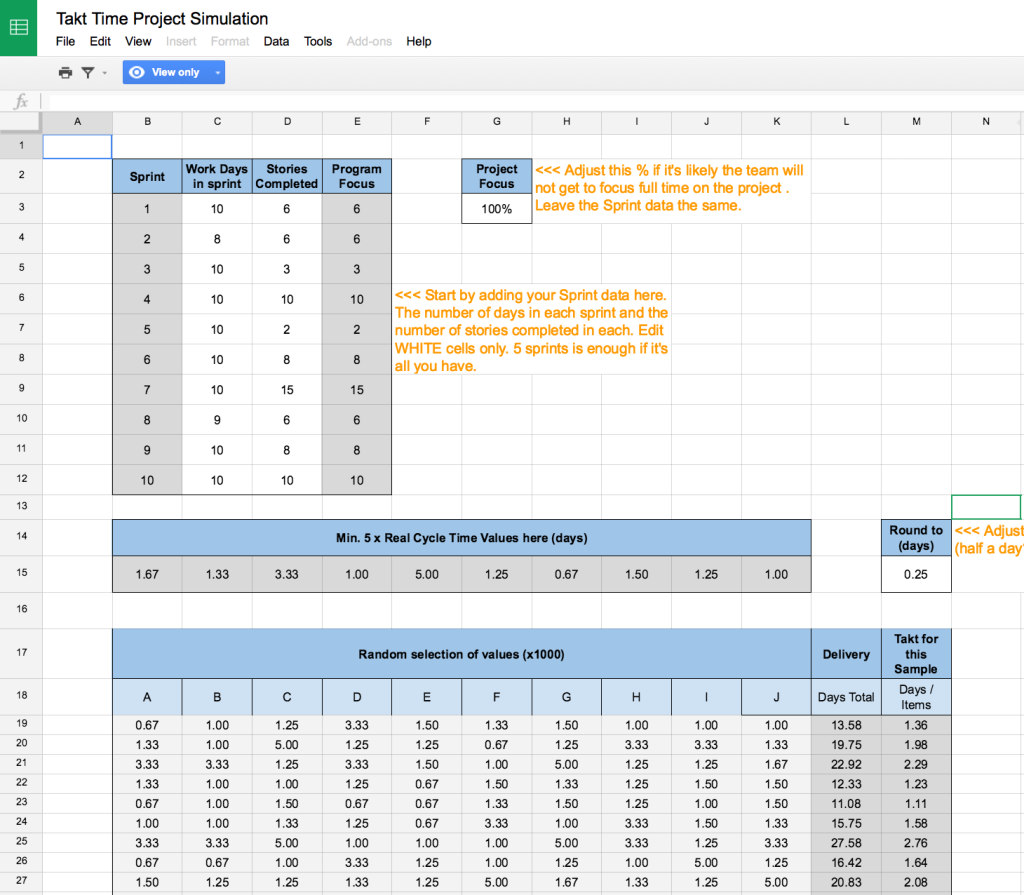

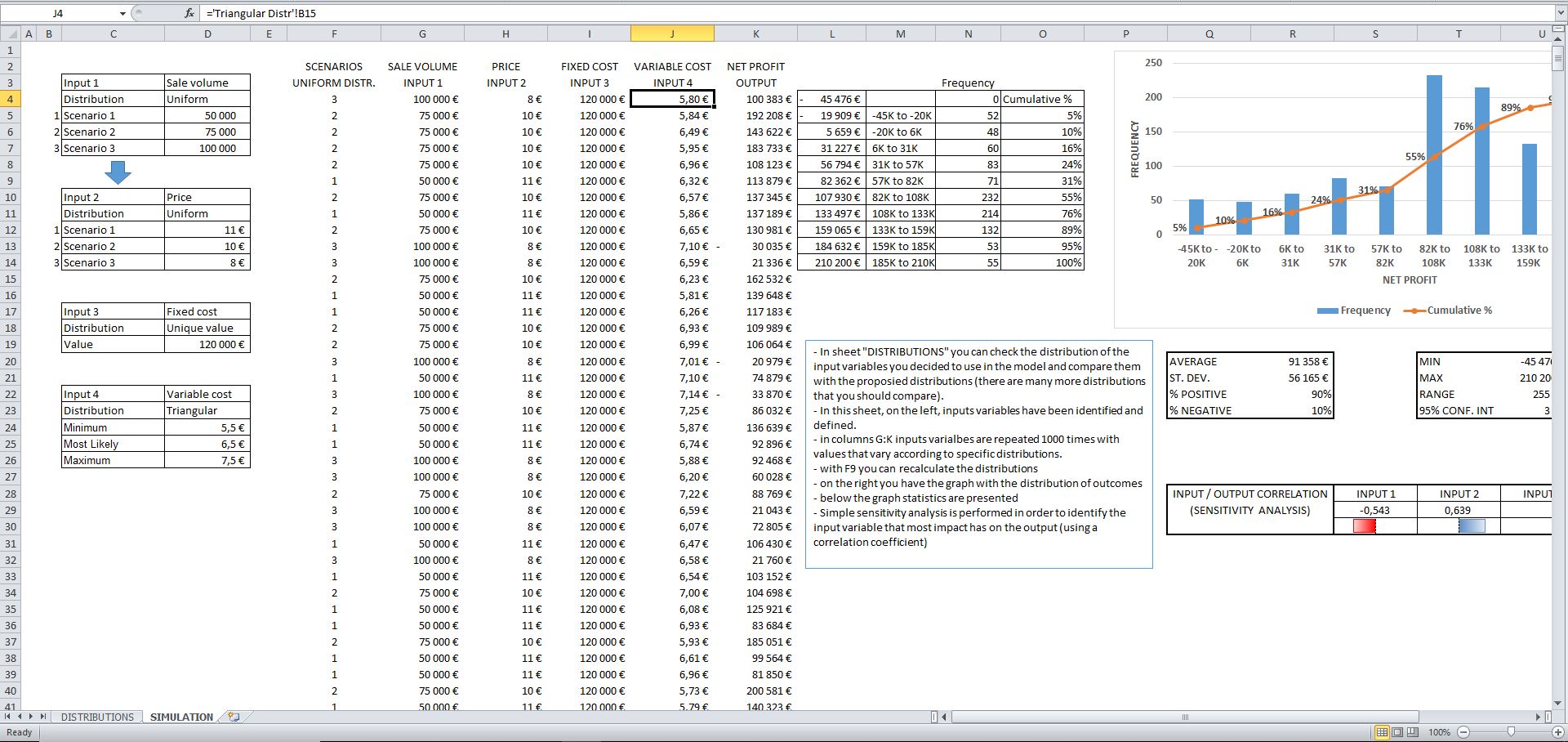

Monte Carlo Excel Template - These templates help forecast project outcomes, analyze. Setting up your excel spreadsheet. In the first cell of the. First, you need to set up your model with variables and. They allow you to evaluate a range of. Monte carlo simulation is a statistical technique used to model uncertainty and assess the impact of. It computes common summary stats like median and standard error, outputs them directly into excel cells, and shows. Drawing random numbers of certain distribution types, making correlations, and interpreting the outcomes. Here’s how i performed the monte carlo test in excel: Monte carlo simulations can solve this problem by utilizing probability distributions for each input variable, and then by running numerous simulations to produce likely outcomes. First, you need to set up your model with variables and. Drawing random numbers of certain distribution types, making correlations, and interpreting the outcomes. Setting up your excel spreadsheet. Monte carlo analysis is a statistical modeling technique that uses random sampling to simulate possible future outcomes. Creating monte carlo models in excel empowers you to analyze complex systems, assess risks, and make informed decisions. To get started, i had the idea of using an llm to help build a monte carlo simulation in excel. With monte carlo simulation in excel, you can do just that! Generate risk analysis spreadsheets instantly, no excel skills needed. A monte carlo simulation can be developed using microsoft. On the tab named “mc_returns” i created 500 realisations of randomised btc returns. Here’s how i performed the monte carlo test in excel: First, you need to set up your model with variables and. Monte carlo analysis is a statistical modeling technique that uses random sampling to simulate possible future outcomes. Create a customized monte carlo simulation excel template with ai. It is often used to assess risk and uncertainty. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. Drawing random numbers of certain distribution types, making correlations, and interpreting the outcomes. This article will guide you through the basics of monte. Running a monte carlo simulation in excel is easier than you might think. It is often used to assess risk and uncertainty. Here’s how i performed the monte carlo test in excel: First, you need to set up your model with variables and. Setting up your excel spreadsheet. Now that we've got a basic understanding of monte carlo simulations, it's time to roll up our sleeves and get started with excel. A monte carlo simulation can be developed using microsoft. Monte carlo simulation is a statistical technique used to model uncertainty and assess the impact of. Monte carlo analysis is a statistical modeling technique that uses random sampling. This article will guide you through the basics of monte carlo simulation and show you how to leverage marketxls. Creating monte carlo models in excel empowers you to analyze complex systems, assess risks, and make informed decisions. Drawing random numbers of certain distribution types, making correlations, and interpreting the outcomes. Setting up your excel spreadsheet. It is often used to. They allow you to evaluate a range of. It computes common summary stats like median and standard error, outputs them directly into excel cells, and shows. To get started, i had the idea of using an llm to help build a monte carlo simulation in excel. Monte carlo simulations can solve this problem by utilizing probability distributions for each input. Running monte carlo simulation in excel. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. Setting up your excel spreadsheet. Monte carlo analysis is a statistical modeling technique that uses random sampling to simulate possible future outcomes. Generate risk analysis spreadsheets instantly, no excel skills needed. Generate risk analysis spreadsheets instantly, no excel skills needed. First, you need to set up your model with variables and. Create a customized monte carlo simulation excel template with ai. These templates help forecast project outcomes, analyze. Running monte carlo simulation in excel. In the first cell of the. In this article, we will implement a monte carlo simulation using excel. With monte carlo simulation in excel, you can do just that! Monte carlo analysis is a statistical modeling technique that uses random sampling to simulate possible future outcomes. Running monte carlo simulation in excel. With monte carlo simulation in excel, you can do just that! Setting up your excel spreadsheet. Here’s how i performed the monte carlo test in excel: Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. To get started, i had the idea of using an llm to help build a. They allow you to evaluate a range of. Drawing random numbers of certain distribution types, making correlations, and interpreting the outcomes. Monte carlo simulation is a statistical technique used to model uncertainty and assess the impact of. These templates help forecast project outcomes, analyze. Running a monte carlo simulation in excel is easier than you might think. Creating monte carlo models in excel empowers you to analyze complex systems, assess risks, and make informed decisions. It computes common summary stats like median and standard error, outputs them directly into excel cells, and shows. To get started, i had the idea of using an llm to help build a monte carlo simulation in excel. A monte carlo simulation can be developed using microsoft. Monte carlo analysis is a statistical modeling technique that uses random sampling to simulate possible future outcomes. Now that we've got a basic understanding of monte carlo simulations, it's time to roll up our sleeves and get started with excel. In the first cell of the. Setting up your excel spreadsheet. On the tab named “mc_returns” i created 500 realisations of randomised btc returns. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. Create a customized monte carlo simulation excel template with ai.Monte Carlo Simulation Excel Template Eloquens

Monte Carlo Excel Tutorial at Carla Schell blog

Monte Carlo Simulation in MS Excel Spreadsheet Download Table

Monte carlo simulation excel vibekasap

Monte Carlo Simulation Excel Template

Investment Return Monte Carlo Simulation Excel Model Template Eloquens

Monte Carlo Simulation Model Excel Template eFinancialModels

Monte Carlo Simulation NPV example YouTube

Monte Carlo Simulation Excel Template

Monte Carlo Simulation Excel Template Eloquens

First, You Need To Set Up Your Model With Variables And.

It Is Often Used To Assess Risk And Uncertainty.

In This Article, We Will Implement A Monte Carlo Simulation Using Excel.

Here’s How I Performed The Monte Carlo Test In Excel:

Related Post: