Monte Carlo Simulation Excel Template

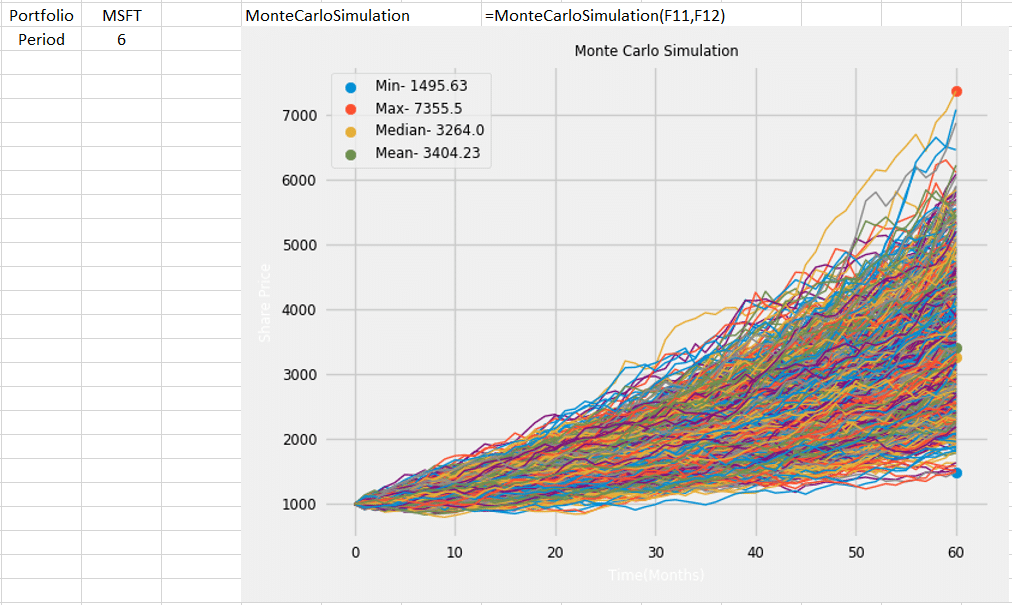

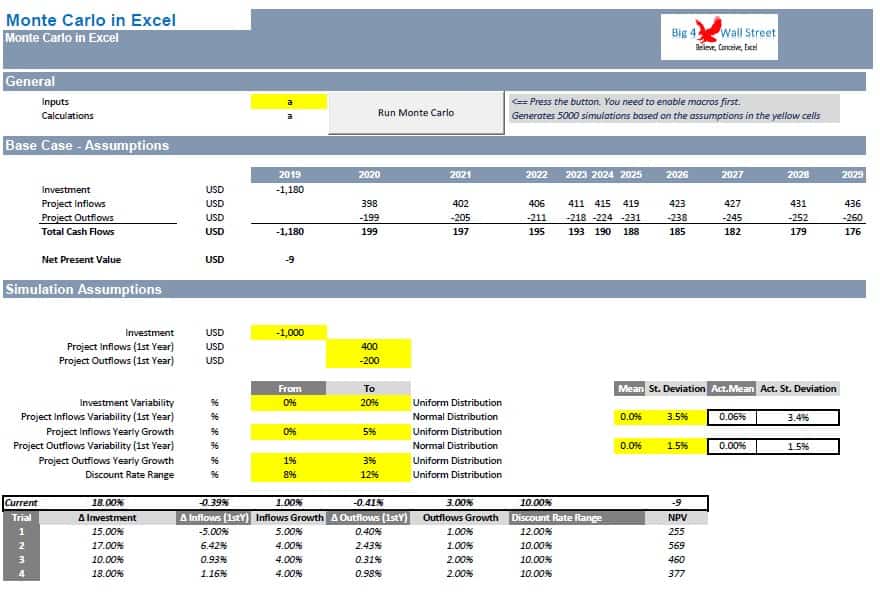

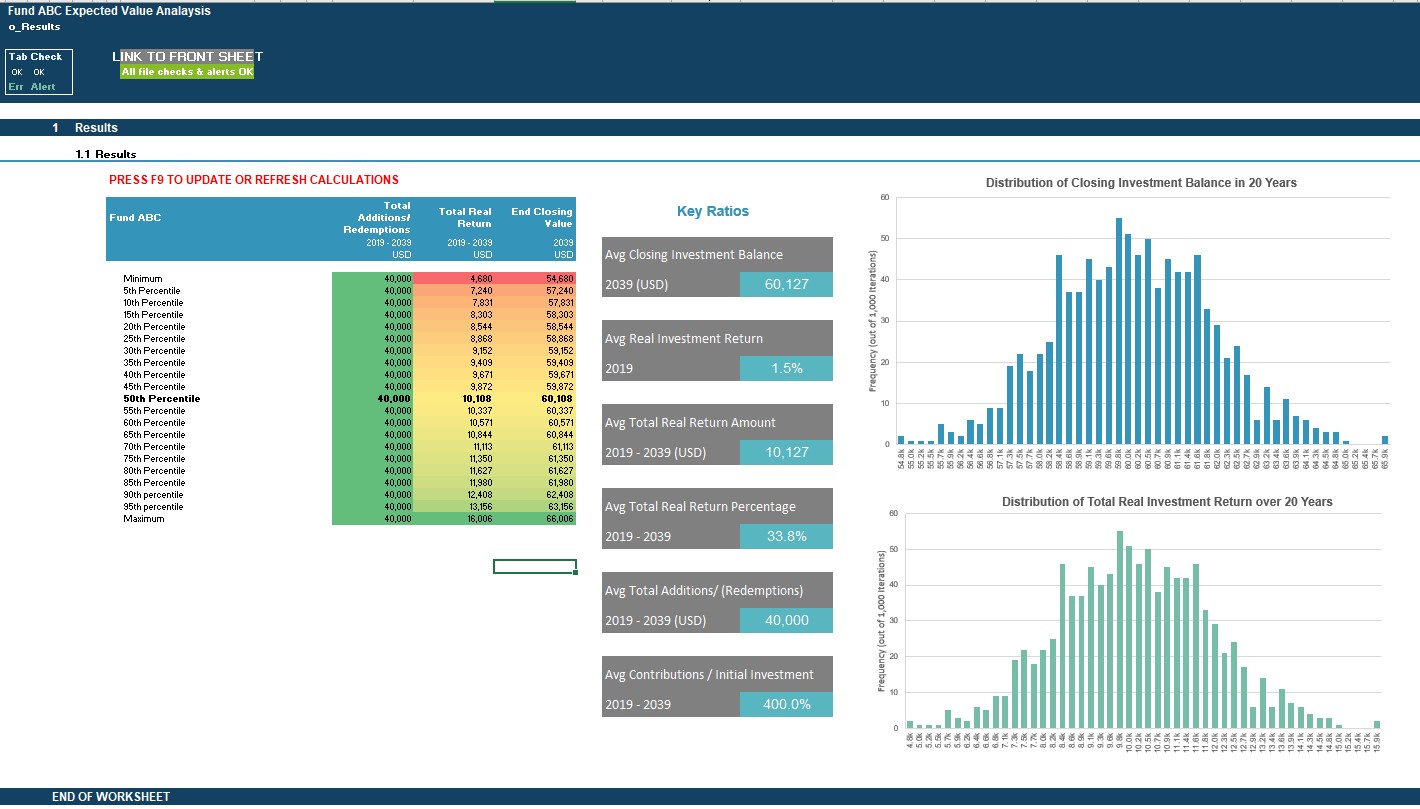

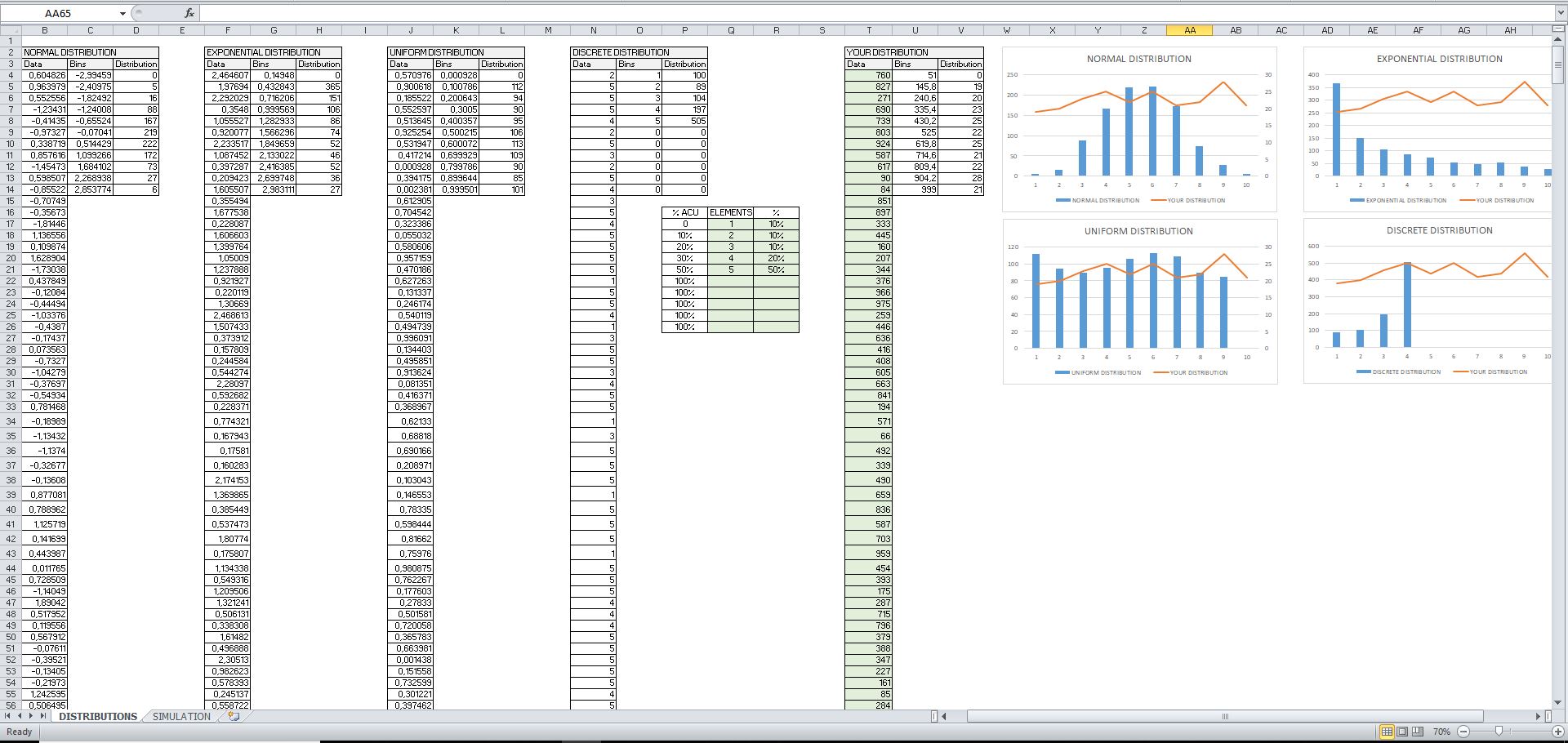

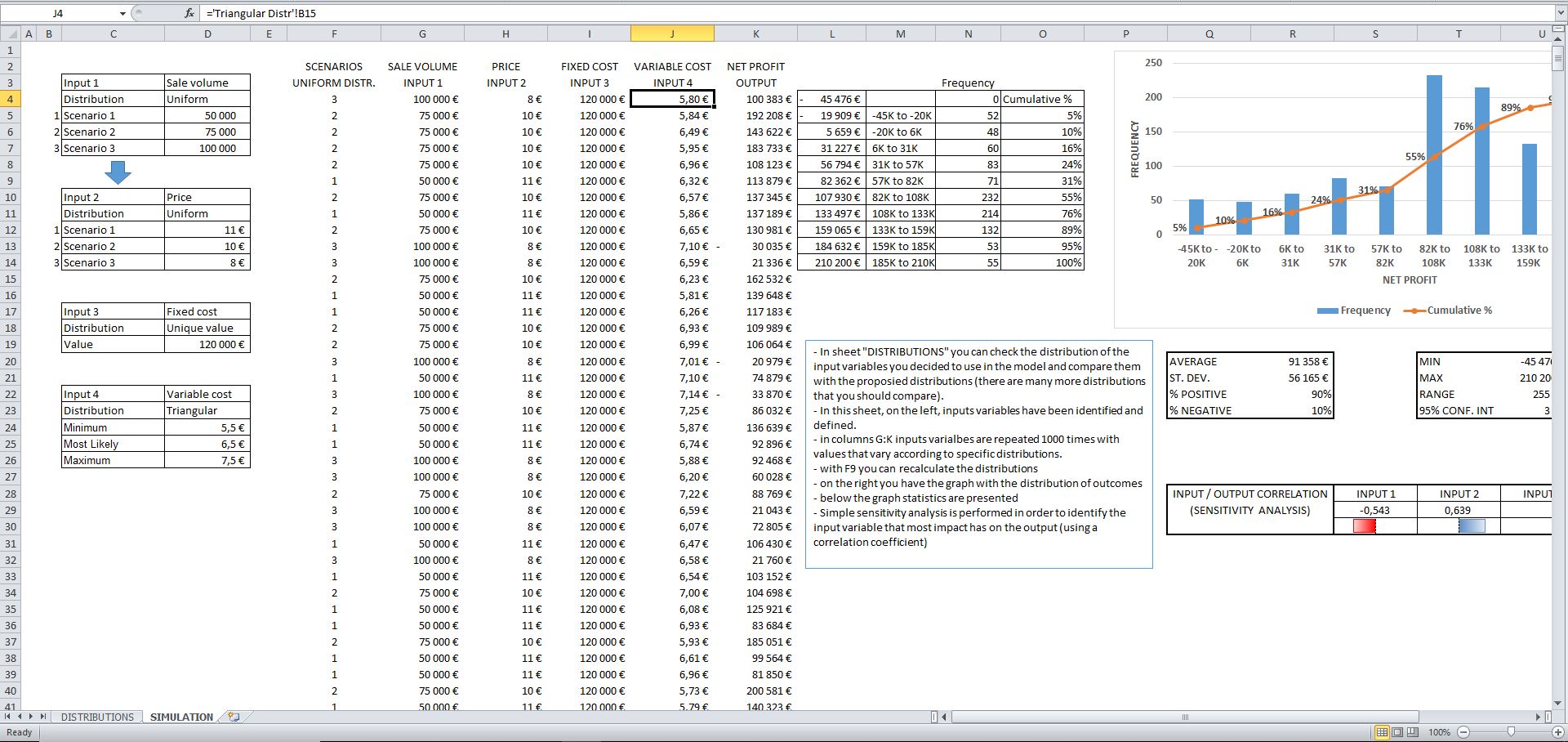

Monte Carlo Simulation Excel Template - Create a customized monte carlo simulation excel template with ai. Up to 10% cash back monte carlo simulation excel is an excellent tool for investors when assessing the potential risks associated with the portfolio and asset allocation. Monte carlo simulations can solve this problem by utilizing probability distributions for each input variable, and then by running numerous simulations to produce likely outcomes. In this article, we will implement a monte carlo simulation using excel. One simple example of a monte carlo simulation is to. Here are a few examples of how they're. Monte carlo simulation tutorial using microsoft excel. Generate risk analysis spreadsheets instantly, no excel skills needed. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. Up to 10% cash back monte carlo simulation is a quantitative technique used to understand the impact of risk and uncertainty in financial models, including those for the stock. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. Up to 10% cash back monte carlo simulation excel is an excellent tool for investors when assessing the potential risks associated with the portfolio and asset allocation. Monte carlo simulation tutorial using microsoft excel. Understand where the actual effect sits within the context of what could happen by chance using simulation: Here are a few examples of how they're. Monte carlo simulations are used in a wide range of industries and applications. They allow you to evaluate a range of. What is a monte carlo simulation? When a monte carlo simulation is complete, it yields a range of possible outcomes with the probability of each result occurring. Create a customized monte carlo simulation excel template with ai. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. Monte carlo simulation tutorial using microsoft excel. A monte carlo simulation is a. Sales forecasting example to demonstrate monte carlo simulation using excel. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. These templates help forecast project outcomes, analyze. Monte carlo simulations are a powerful tool for understanding uncertainty and variability in financial modeling, risk analysis, and forecasting. One simple example of a monte carlo simulation is to. A monte carlo simulation can be developed using microsoft. Monte carlo simulations are used in a wide range of industries and applications. Monte carlo simulations can solve this problem by utilizing probability distributions for each input variable, and then by running numerous simulations to produce likely outcomes. Up to 10% cash back monte carlo simulation excel is an excellent tool for investors when assessing the potential risks associated with the portfolio and asset allocation. Generate risk analysis spreadsheets instantly, no excel skills. They allow you to evaluate a range of. Up to 10% cash back monte carlo simulation is a quantitative technique used to understand the impact of risk and uncertainty in financial models, including those for the stock. Here are a few examples of how they're. When a monte carlo simulation is complete, it yields a range of possible outcomes with. Monte carlo simulation tutorial using microsoft excel. Here are a few examples of how they're. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. Monte carlo simulations can solve this problem by utilizing probability distributions for each input variable, and then by running numerous simulations to produce likely outcomes. Monte carlo. Monte carlo simulation tutorial using microsoft excel. Below, i’ll guide you through the process of creating a macro for a monte carlo simulation in excel. A monte carlo simulation is a. Monte carlo simulations are used in a wide range of industries and applications. Up to 10% cash back monte carlo simulation is a quantitative technique used to understand the. In this article, we will implement a monte carlo simulation using excel. They allow you to evaluate a range of. Monte carlo simulation is a statistical technique used to model uncertainty and assess the impact of. A monte carlo simulation is a. Up to 10% cash back monte carlo simulation excel is an excellent tool for investors when assessing the. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. Monte carlo simulations are used in a wide range of industries and applications. Below, i’ll guide you through the process of creating a macro for a monte carlo simulation in excel. Generate risk analysis spreadsheets instantly, no excel skills needed. They allow. Create a customized monte carlo simulation excel template with ai. When a monte carlo simulation is complete, it yields a range of possible outcomes with the probability of each result occurring. Here are a few examples of how they're. Sales forecasting example to demonstrate monte carlo simulation using excel. Up to 10% cash back monte carlo simulation is a quantitative. These templates help forecast project outcomes, analyze. Understand where the actual effect sits within the context of what could happen by chance using simulation: Below, i’ll guide you through the process of creating a macro for a monte carlo simulation in excel. When a monte carlo simulation is complete, it yields a range of possible outcomes with the probability of. Monte carlo simulations can solve this problem by utilizing probability distributions for each input variable, and then by running numerous simulations to produce likely outcomes. In this article, we will implement a monte carlo simulation using excel. Below, i’ll guide you through the process of creating a macro for a monte carlo simulation in excel. These templates help forecast project outcomes, analyze. Monte carlo simulation tutorial using microsoft excel. Sales forecasting example to demonstrate monte carlo simulation using excel. Generate risk analysis spreadsheets instantly, no excel skills needed. Monte carlo simulations are used in a wide range of industries and applications. A monte carlo simulation is a. Up to 10% cash back monte carlo simulation excel is an excellent tool for investors when assessing the potential risks associated with the portfolio and asset allocation. What is a monte carlo simulation? Here are a few examples of how they're. When a monte carlo simulation is complete, it yields a range of possible outcomes with the probability of each result occurring. The monte carlo method seeks to improve the analysis of data using random data sets and probability calculations. One simple example of a monte carlo simulation is to. Monte carlo simulation is a statistical technique used to model uncertainty and assess the impact of.FormulaMonteCarloSimulation.png

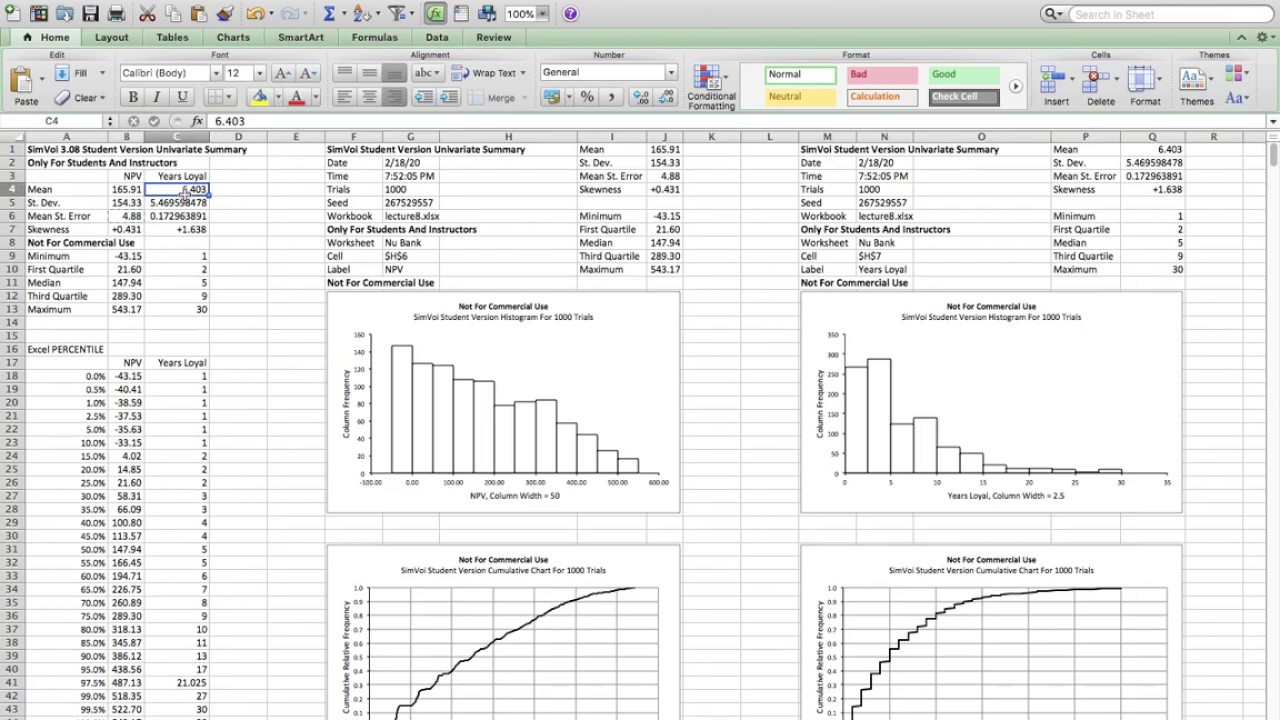

Monte Carlo Simulations Using Excel Spreadsheet Vertical Flight

Monte Carlo Simulation Excel Template • 365 Financial Analyst

Monte Carlo Simulation Model Excel Template eFinancialModels

Monte Carlo Excel Template This Has Been A Simple Example Of Monte

Monte Carlo Simulation Excel Template

Monte Carlo Simulation Excel Template Eloquens

Monte Carlo Simulation in Excel LongTerm Value of a Customer YouTube

Monte Carlo Simulation Excel Template Eloquens

Monte Carlo Simulation Excel Template

Understand Where The Actual Effect Sits Within The Context Of What Could Happen By Chance Using Simulation:

Create A Customized Monte Carlo Simulation Excel Template With Ai.

They Allow You To Evaluate A Range Of.

Up To 10% Cash Back Monte Carlo Simulation Is A Quantitative Technique Used To Understand The Impact Of Risk And Uncertainty In Financial Models, Including Those For The Stock.

Related Post: