Non Profit Organization Receipt Template

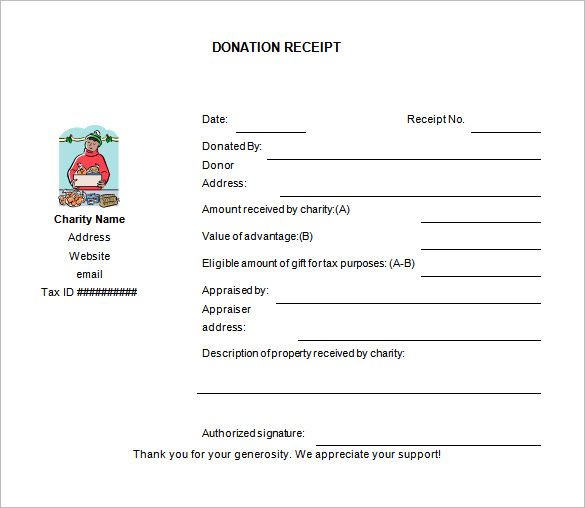

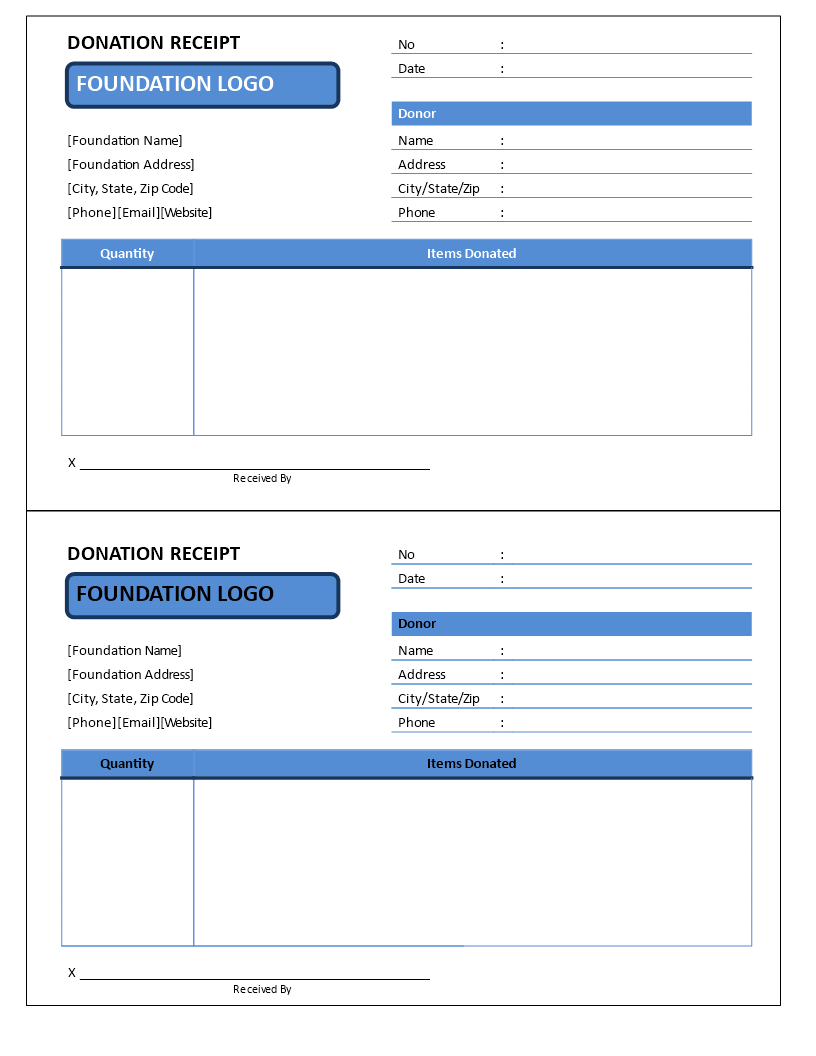

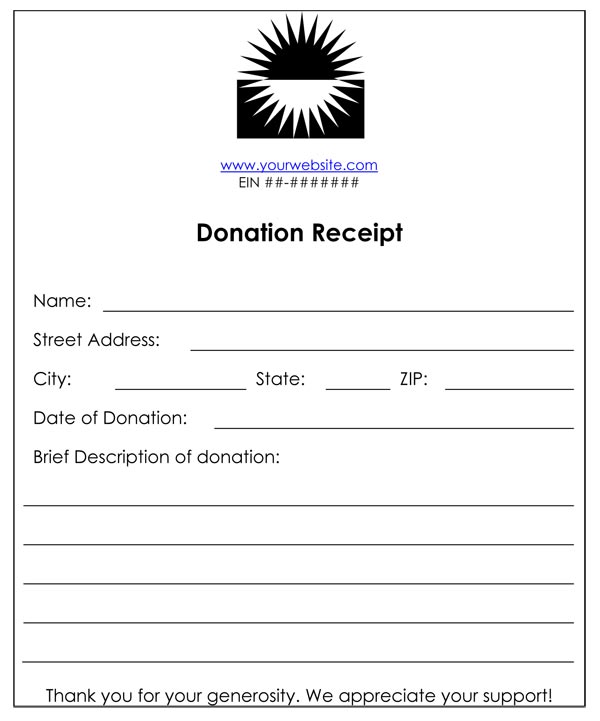

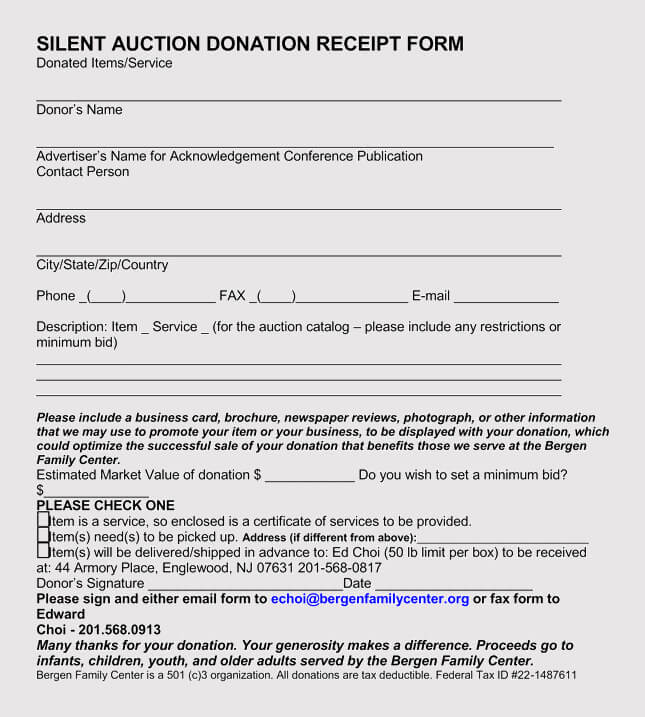

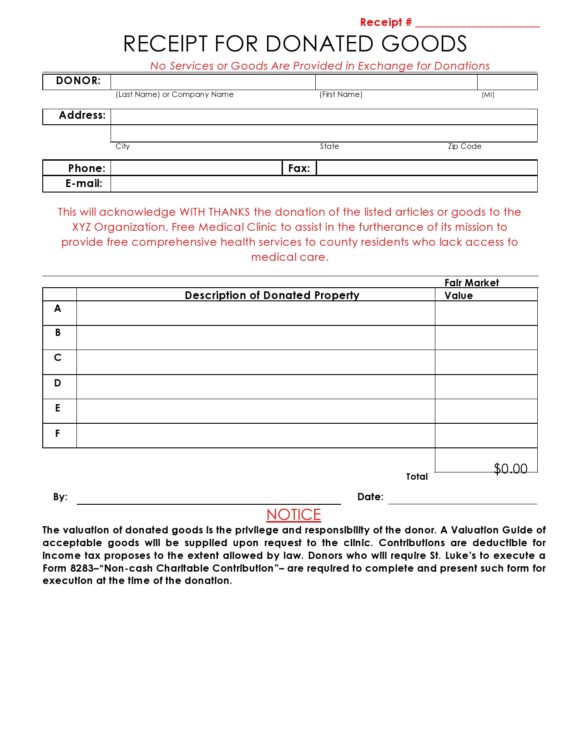

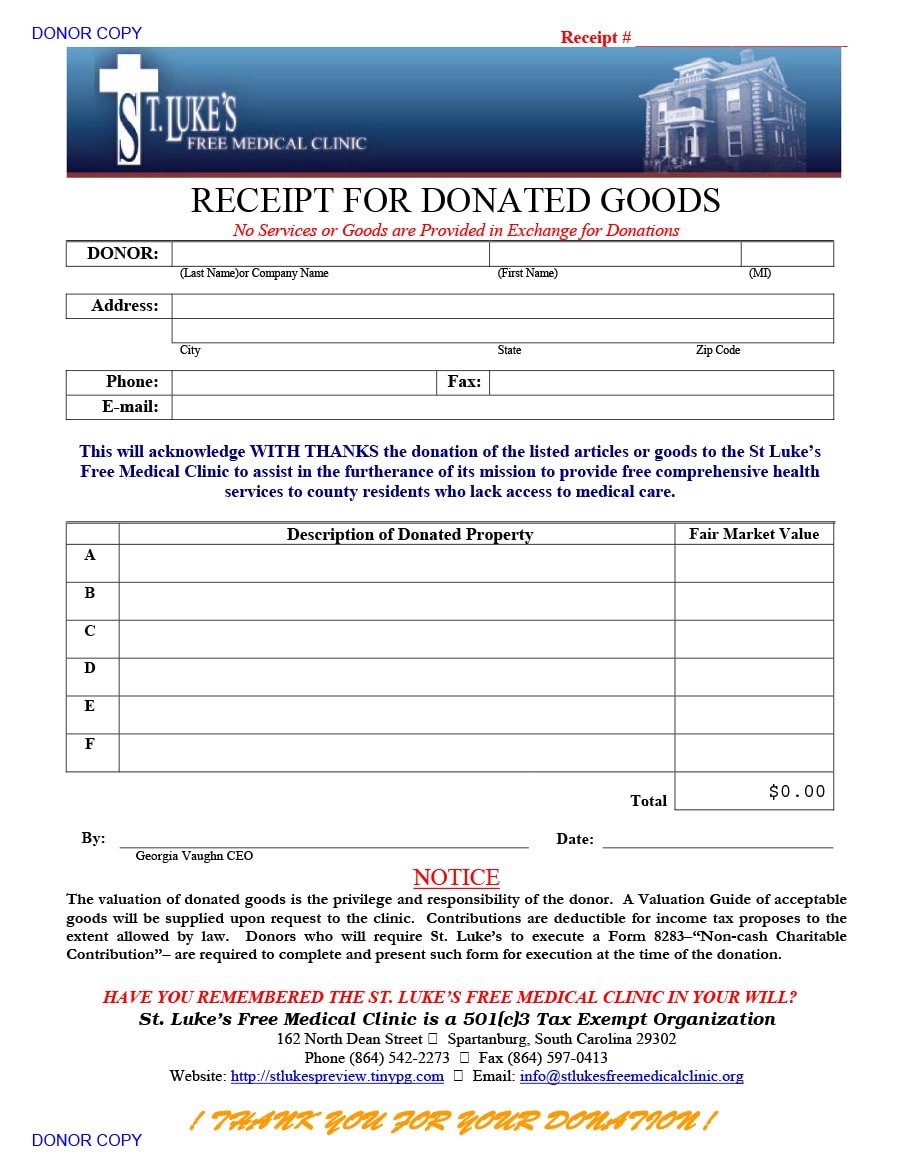

Non Profit Organization Receipt Template - All 501(c)(3) organizations must be approved by. A pledge or promise to pay does not count. Financial statements help in making informed. Both parties are required to use donation receipts to prove. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. This nonprofit organization donor receipt template is a tool designed to assist nonprofit organizations in acknowledging and documenting charitable contributions. Corporate grant proposal template [your organization’s name] corporate grant proposal to [company name] [date] i. A donation receipt is an official. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. We share the top free donation receipt templates for your nonprofit organization! A pledge or promise to pay does not count. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Both parties are required to use donation receipts to prove. This nonprofit organization donor receipt template is a tool designed to assist nonprofit organizations in acknowledging and documenting charitable contributions. A donation receipt is an official. Corporate grant proposal template [your organization’s name] corporate grant proposal to [company name] [date] i. We share the top free donation receipt templates for your nonprofit organization! If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. This nonprofit organization donor receipt template is a tool designed to assist nonprofit organizations in acknowledging and documenting charitable contributions. A pledge or promise to pay does not count. All 501(c)(3) organizations must be approved by. Financial statements help in making informed. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Financial statements help in making informed. We share the top free donation receipt templates for your nonprofit organization! Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. This. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A pledge or promise to pay does not count. We share the top free donation receipt templates for your nonprofit organization! A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. A donation receipt. Both parties are required to use donation receipts to prove. All 501(c)(3) organizations must be approved by. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. A pledge or promise to pay does not count. Corporate grant proposal template [your. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Financial statements help in making informed. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. A pledge or promise to pay does not count. All 501(c)(3) organizations must be approved by. A nonprofit receipt template is a helpful document used to create a form. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. A pledge or promise to pay does not count. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Corporate grant proposal template [your organization’s name]. Donation receipt templates are essential tools for any organization involved in charitable activities. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Address to the corporate giving. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Both parties are required to use donation receipts to prove. This nonprofit organization donor receipt template. This nonprofit organization donor receipt template is a tool designed to assist nonprofit organizations in acknowledging and documenting charitable contributions. Corporate grant proposal template [your organization’s name] corporate grant proposal to [company name] [date] i. We share the top free donation receipt templates for your nonprofit organization! If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. All 501(c)(3) organizations must be approved by. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A donation receipt is an official. Address to the corporate giving or csr. A pledge or promise to pay does not count. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Both parties are required to use donation receipts to prove.Donation Receipt Template Fill Out, Sign Online and Download PDF

Non Profit Donation Receipt Templates at

Nonprofit Receipt 6+ Examples, Format, Pdf

In a nonprofit organization, the use of a nonprofit donation receipt

Non profit donation receipt template Templates at

Non Profit Receipt Template printable receipt template

46 Free Donation Receipt Templates (501c3, NonProfit)

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

Printable Goodwill Donation Receipt Printable Templates

46 Free Donation Receipt Templates (501c3, NonProfit)

A Nonprofit Receipt Template Is A Helpful Document Used To Create A Form Of Receipt States That A Benefactor Has Been Donated A Certain Value To A Beneficiary.

Donation Receipt Templates Are Essential Tools For Any Organization Involved In Charitable Activities.

Financial Statements Help In Making Informed.

Related Post: