Non Profit Receipt Template

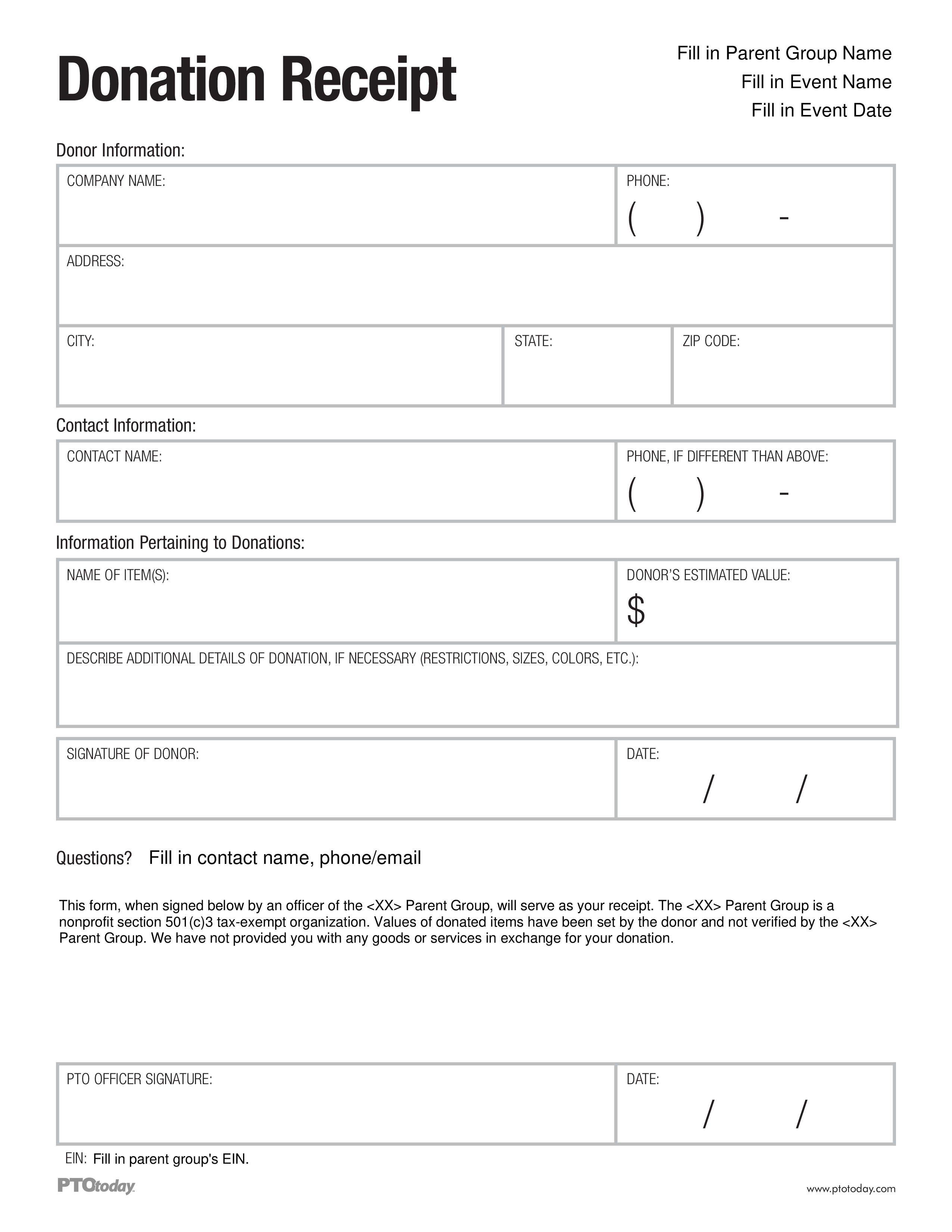

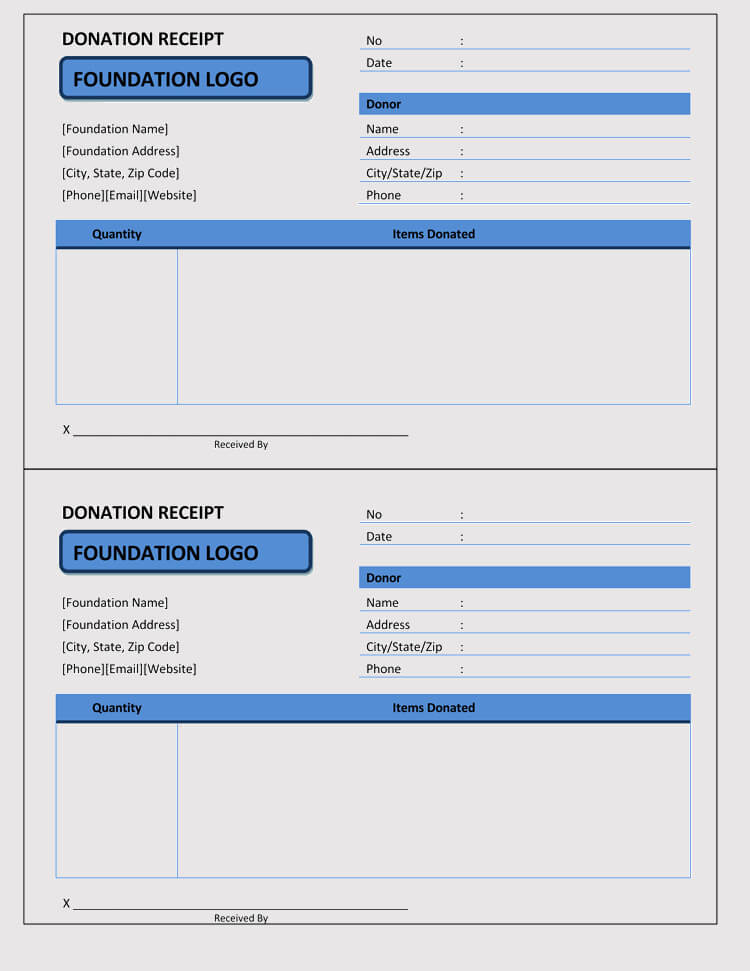

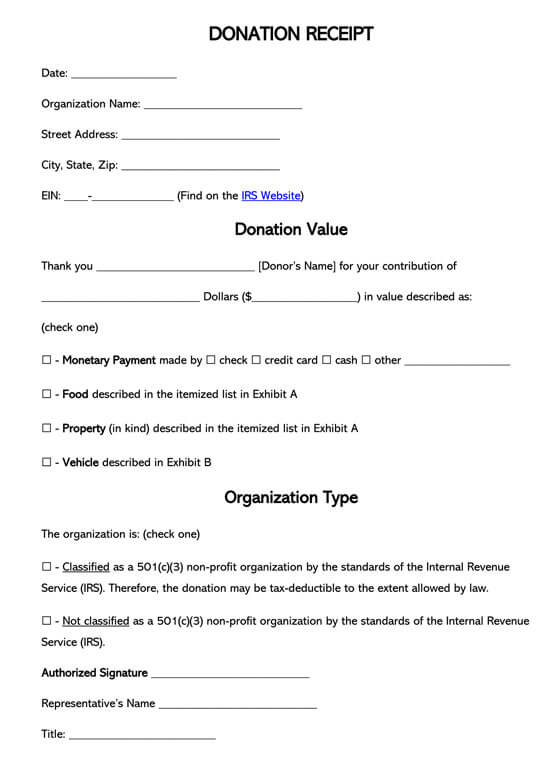

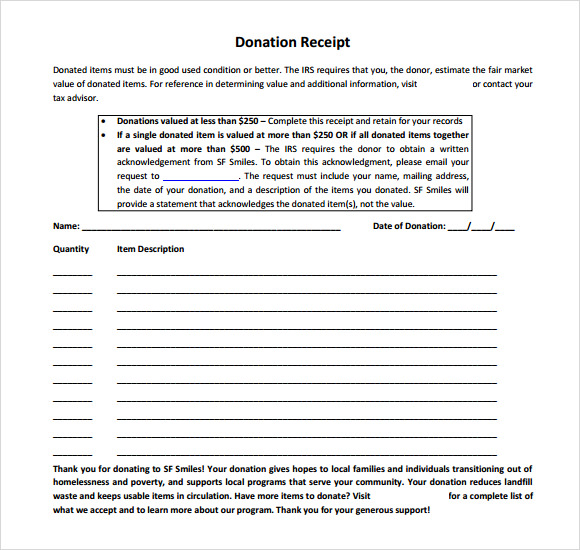

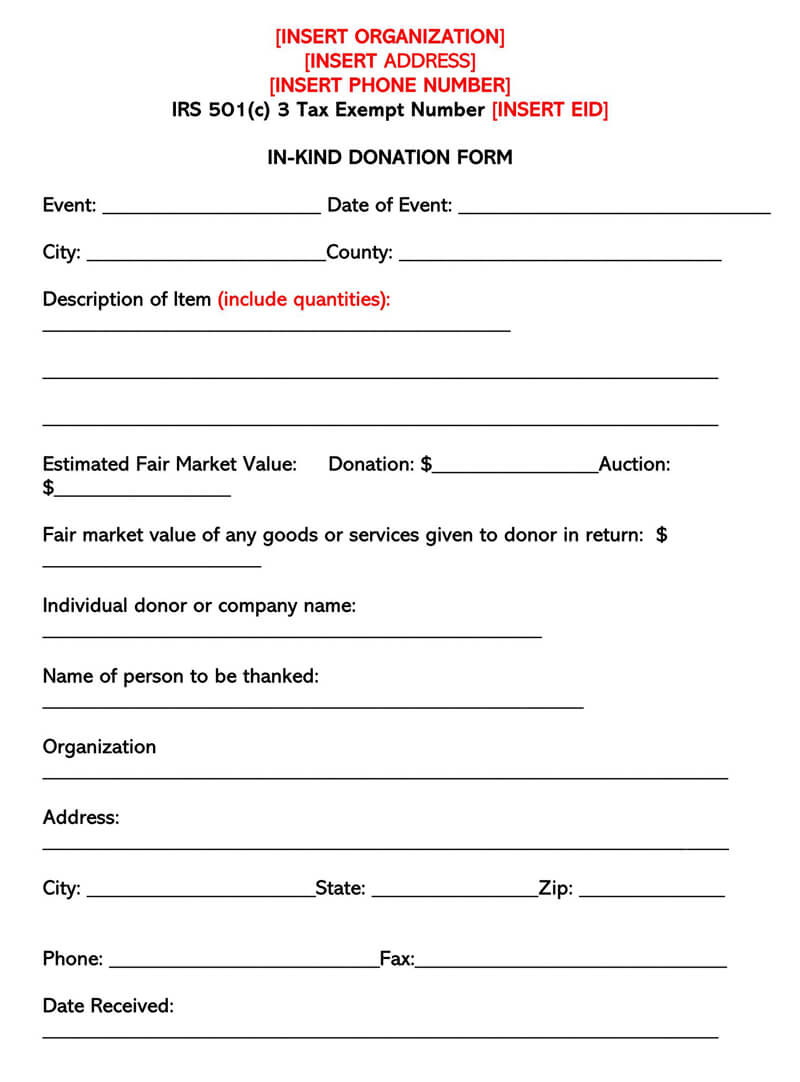

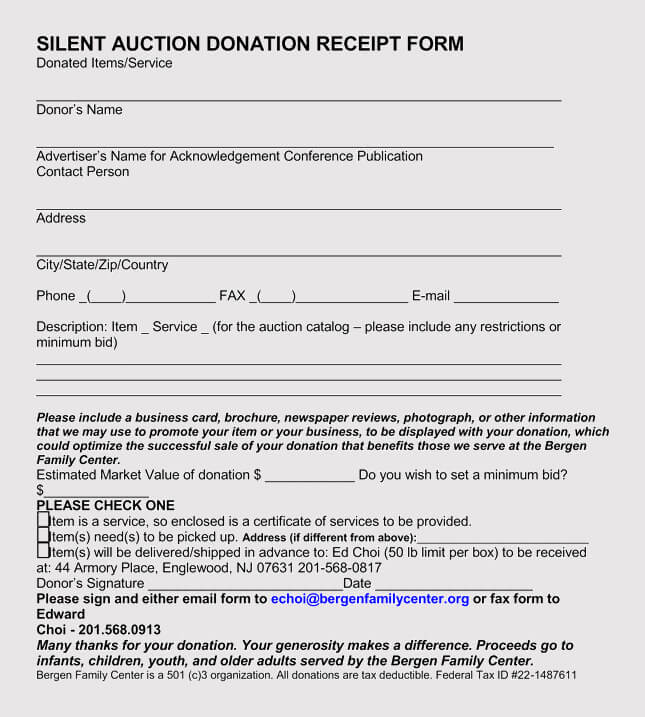

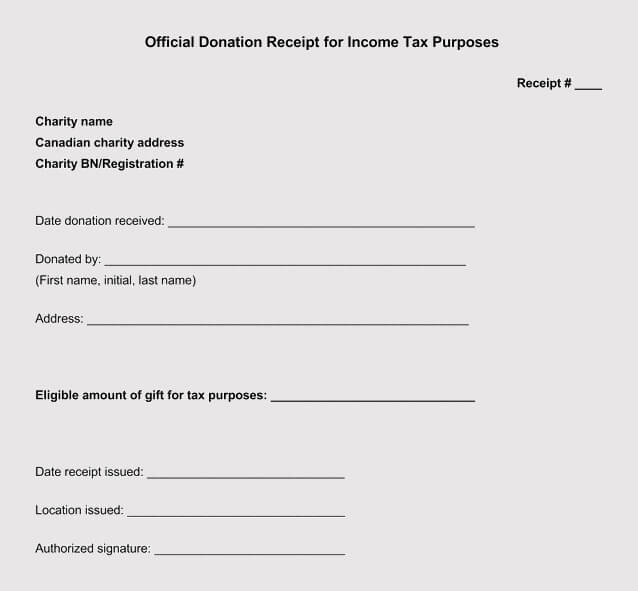

Non Profit Receipt Template - Financial statements help in making informed. Get simple, free templates that can be used for any donation or gift here. We’ll share our top 5. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. Therefore, it is imperative to record how many. Below are the examples for the different types of receipts for you to choose from. Donation receipt templates are a necessity when it comes to charitable donations. Below we have listed some of the best nonprofit donation receipt templates we could find. These will make your work easy and will also create a good impression. Made to meet us & canada requirements. These will make your work easy and will also create a good impression. It allows you to create and customize the draft of your receipt contents. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Therefore, it is imperative to record how many. Financial statements help in making informed. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Donation receipt templates are essential tools for any organization involved in charitable activities. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. It allows you to create and customize the draft of your receipt contents. Made to meet us & canada requirements. Financial statements help in making informed. Donation receipt templates are a necessity when it comes to charitable donations. Get simple, free templates that can be used for any donation or gift here. A donation receipt is an official. Therefore, it is imperative to record how many. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. It allows you to create and customize the draft of your receipt contents. To create a donation receipt that complies with tax regulations, you’ll want. Financial statements help in making informed. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. Made to meet us & canada requirements. A donation receipt is an official. Below are the examples for the. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. Donation. We’ll share our top 5. Below we have listed some of the best nonprofit donation receipt templates we could find. It allows you to create and customize the draft of your receipt contents. A donation receipt is an official. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Made to meet us & canada requirements. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. A donation receipt is an official. To create a donation receipt. Financial statements help in making informed. We’ll share our top 5. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Donation receipt templates are a necessity when. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Below are the examples for the different types of receipts for you to choose from. Financial statements help in making informed. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are a necessity when it comes to charitable donations. Therefore, it is imperative to record how many. Donation receipt templates are a necessity when it comes to charitable donations. These will make your work easy and will also create a good impression. A donation receipt is an official. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. Donation receipt templates are essential tools for any organization involved in charitable activities. Nonprofit financial statements provide crucial visibility into an organization’s financial health and performance. We’ll share our top 5. Get simple, free templates that can be used for any donation or gift here. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Made to meet us & canada requirements. Depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their return at the end. Therefore, it is imperative to record how many. Below we have listed some of the best nonprofit donation receipt templates we could find. To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template. These will make your work easy and will also create a good impression. Donation receipt templates are a necessity when it comes to charitable donations. Below are the examples for the different types of receipts for you to choose from. Financial statements help in making informed.46 Free Donation Receipt Templates (501c3, NonProfit)

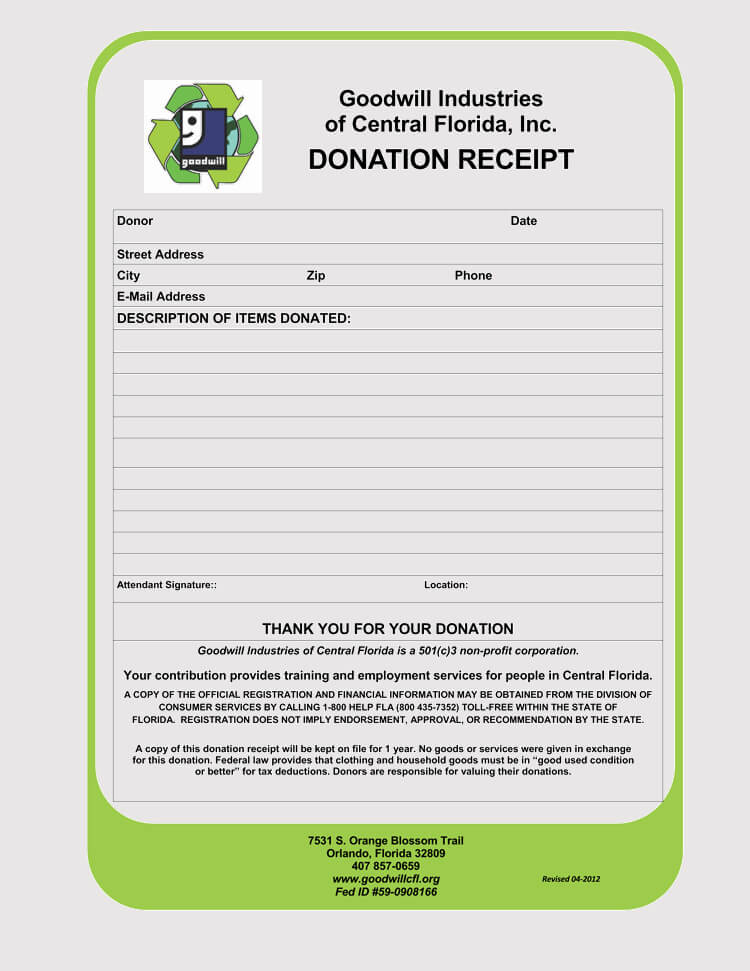

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Non Profit Donation Receipt Templates at

46 Free Donation Receipt Templates (501c3, NonProfit)

Free 501(c)(3) Donation Receipt Templates Word PDF

10 Donation Receipt Templates Free Samples, Examples & Format

Free Nonprofit (Donation) Receipt Templates (Forms)

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Donation Receipt Templates

A Nonprofit Receipt Template Is A Helpful Document Used To Create A Form Of Receipt States That A Benefactor Has Been Donated A Certain Value To A Beneficiary.

It Allows You To Create And Customize The Draft Of Your Receipt Contents.

A Donation Receipt Is An Official.

Get A Free Nonprofit Donation Receipt Template For Every Giving Scenario.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)