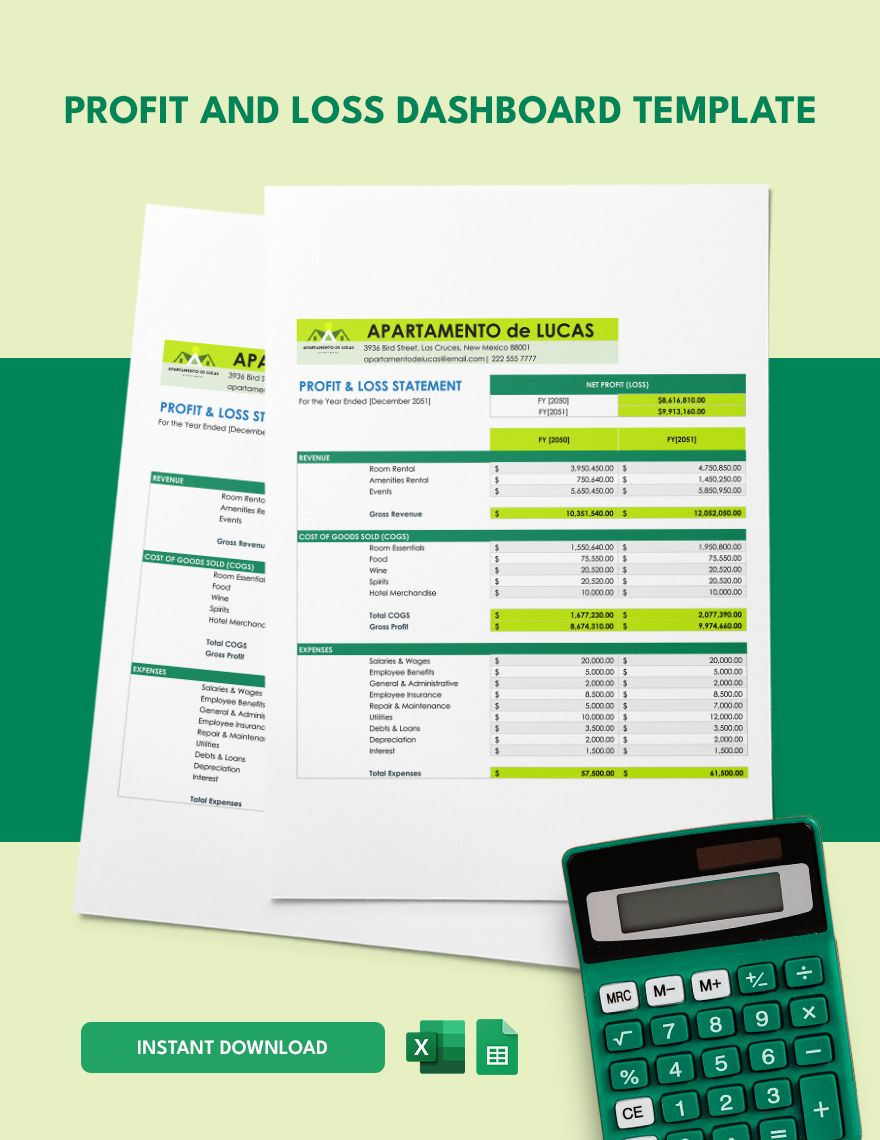

Rental Property Profit And Loss Template Excel

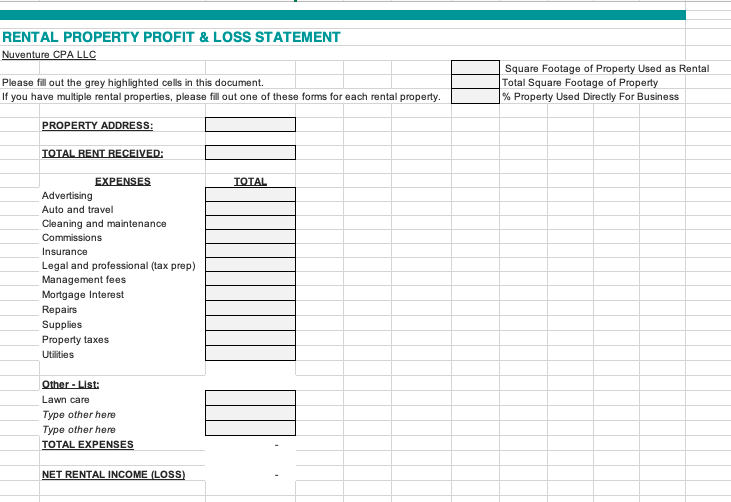

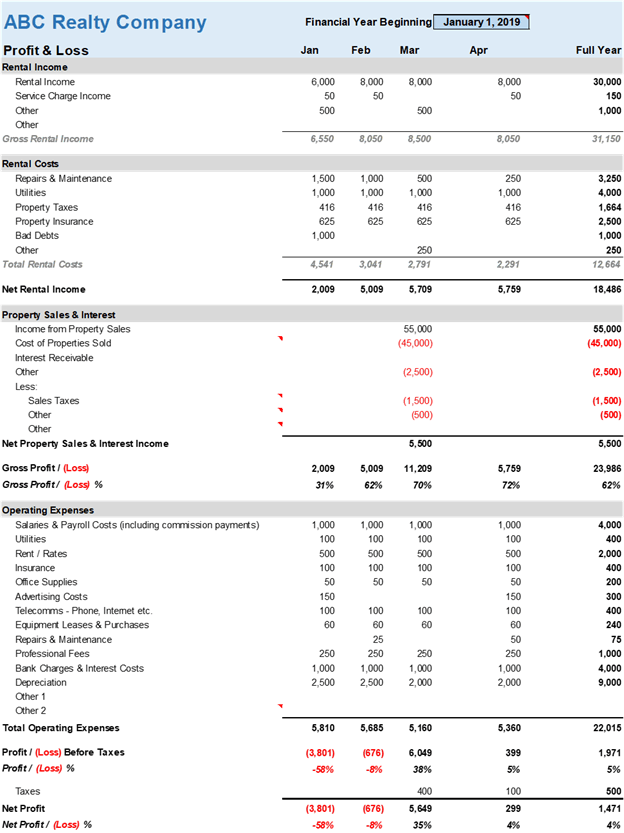

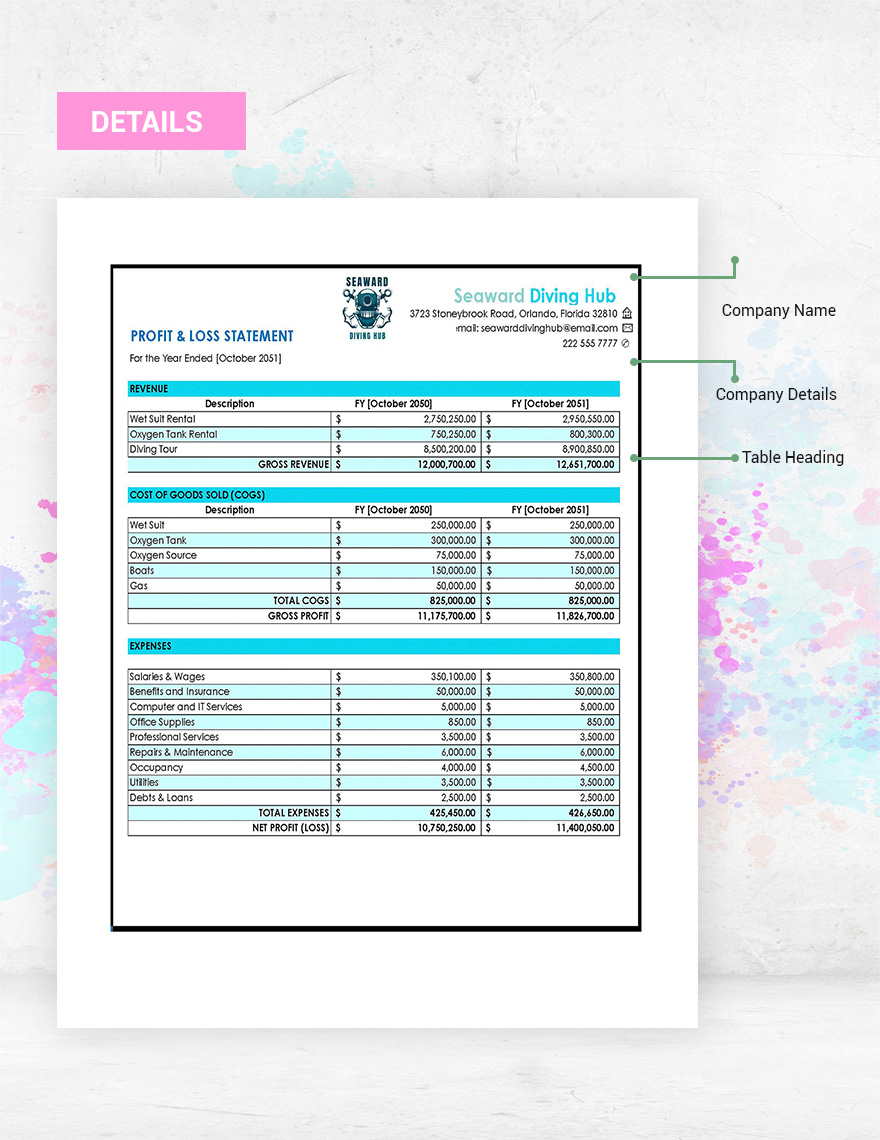

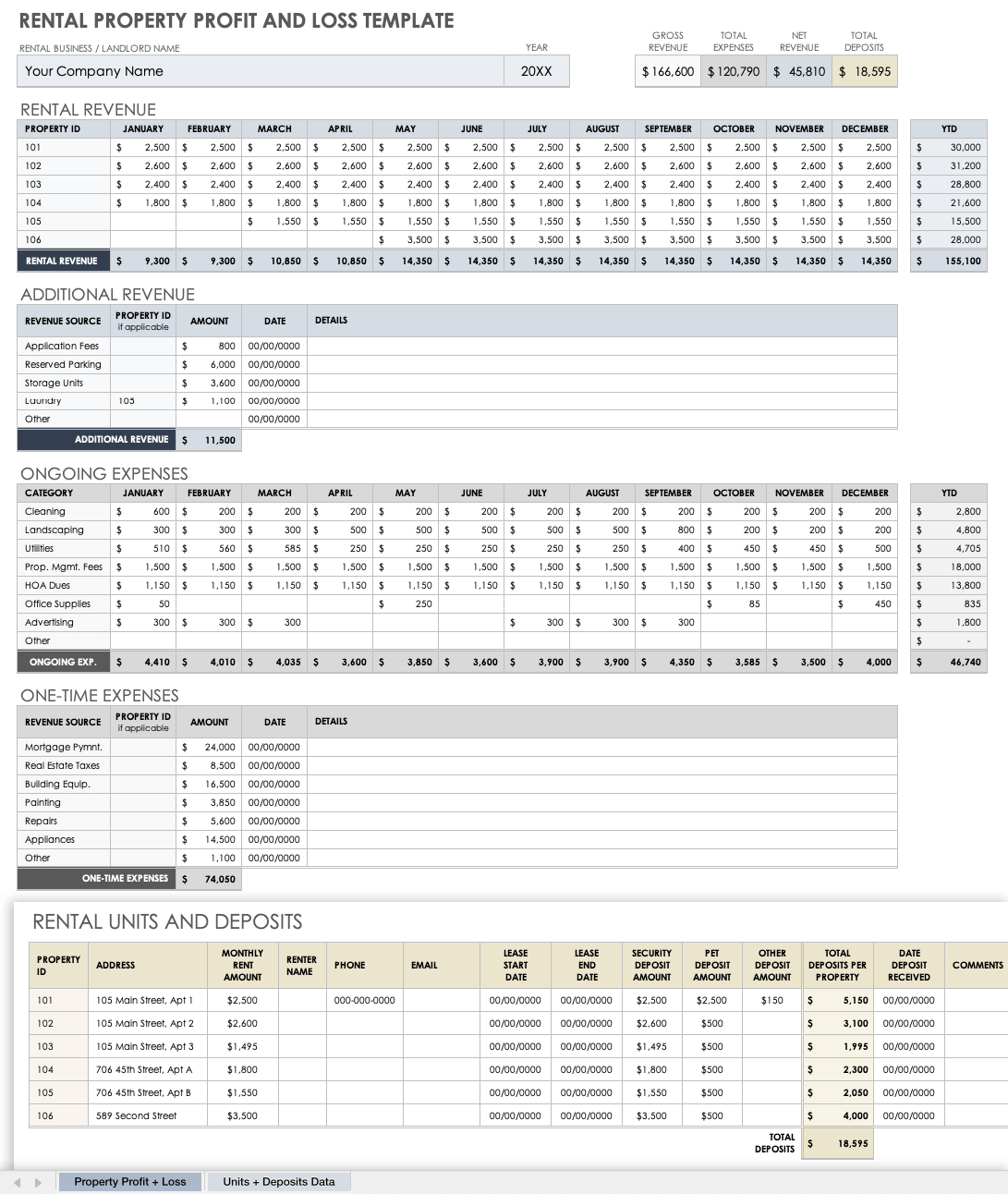

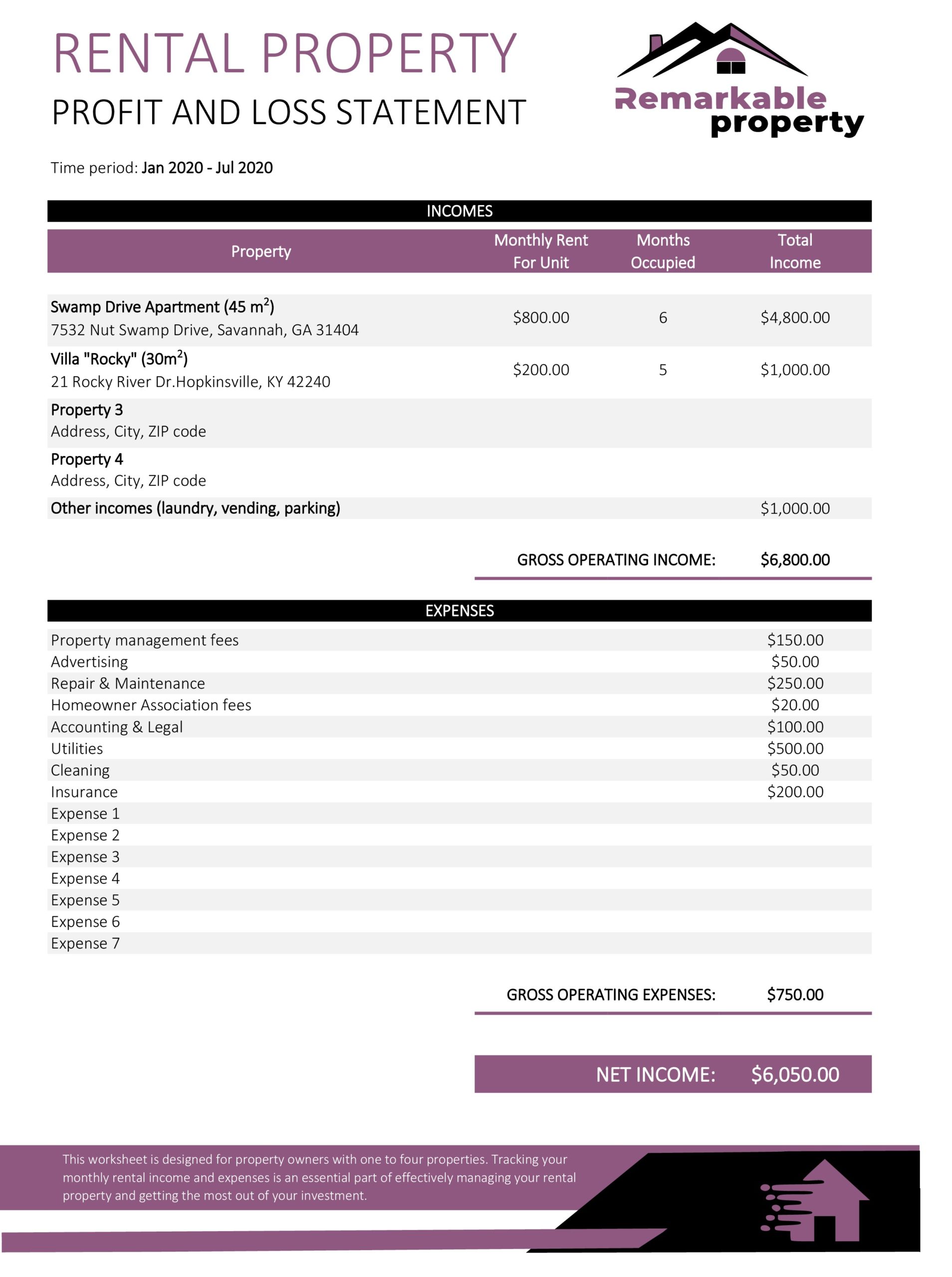

Rental Property Profit And Loss Template Excel - Before calculating net profit, it’s important to understand gross profit, which represents the revenue left after subtracting the cost of goods sold (cogs). Using excel rental property spreadsheets can save you a lot of time. A rent ledger and a lease tracker are both essential tools in property management, yet they serve distinct purposes. Why use a rental property depreciation spreadsheet? This includes the value of your rental property, cash and cash equivalents, accounts receivable, and other assets such as furniture and equipment. Go to file > new and search for “profit and loss.” choose a template that fits your needs and click create. A profit and loss (p&l) statement is a simple way to track your business’s income and expenses over time. If a tenant starts paying late, then enforce your late fee cost policy to maintain cash flow.; Monitor all income and expenses associated with your rental properties. A rent ledger focuses primarily on logging rent ledger transactions and maintaining accurate records of amounts paid, due dates, and outstanding balances for each tenant. Download this rental property profit and loss template design in excel, google sheets format. Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your cost basis, and ultimately stay irs compliant when depreciating your rental property. Up to 50% cash back with this rental property profit and loss statement template excel you can add up your bank income and expenses and calculate your operating profit for a given period. Our free rental property depreciation spreadsheet comes with a built in depreciation calculator. Using excel rental property spreadsheets can save you a lot of time. Designed for landlords and real estate investors, this intuitive template is your key to unlocking a clear financial overview of your rental properties. Costs for equipment or property upkeep; Loss statement includes company details, total income from sales and services, and a list of expenses. In this article, we will discuss the top 8 excel rental property templates to help you get the most out of your property investments. A profit and loss (p&l) statement is a simple way to track your business’s income and expenses over time. Up to 50% cash back with this rental property profit and loss statement template excel you can add up your bank income and expenses and calculate your operating profit for a given period. A profit and loss (p&l) statement is a simple way to track your business’s income and expenses over time. Items needed for daily operations; Gain financial clarity. Consider setting up separate sheets for different categories. If you want to use one that’s already built, you can access it directly from excel. Effortlessly analyze your property investments, track rental income, and manage expenses with precision. Profit loss template google sheets Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your cost. We have mentioned all the instructions for using them, so. If you want to attract investors, then ensure your rent roll reflects a consistent income stream. For instance, you might have one sheet for income, another for expenses, and one for. Maximize your rental and realtor profits with our customizable excel and google sheets templates. Loss statement includes company details,. Consider setting up separate sheets for different categories. Gain financial clarity and strategic insights tailored for rental property owners with our rental property profit & loss statement template. If you want to attract investors, then ensure your rent roll reflects a consistent income stream. For instance, you might have one sheet for income, another for expenses, and one for. These. These templates can be downloaded for free and also include a formula. Simplify financial management for landlords with our rental property profit and loss template. It’s format specifically for real estate businesses. Rental income statement spreadsheet, excel landlord template, rental profit and loss. Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your. A profit and loss (p&l) statement is a simple way to track your business’s income and expenses over time. Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. To create a rental property balance sheet excel template, you need to understand the key components that should be included. Effortlessly. Save your file with a name that's easy to remember like rental property management. set up sheets: Our free rental property depreciation spreadsheet comes with a built in depreciation calculator. Why use a rental property depreciation spreadsheet? Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your cost basis, and ultimately stay irs. Using excel rental property spreadsheets can save you a lot of time. If a tenant starts paying late, then enforce your late fee cost policy to maintain cash flow.; Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your cost basis, and ultimately stay irs compliant when depreciating your rental property. Maximize your. Quickly and easily calculate the annual depreciation rate for each property, track closing costs, work out your cost basis, and ultimately stay irs compliant when depreciating your rental property. Designed for landlords and real estate investors, this intuitive template is your key to unlocking a clear financial overview of your rental properties. Our free rental property depreciation spreadsheet comes with. For owners in the real estate business, our real estate profit and loss statement template is an excellent tool for remaining financially informed. Designed for landlords and real estate investors, this intuitive template is your key to unlocking a clear financial overview of your rental properties. Go to file > new and search for “profit and loss.” choose a template. A profit and loss (p&l) statement is a simple way to track your business’s income and expenses over time. Simplify financial management for landlords with our rental property profit and loss template. Real estate investors can gain better control over income and expenses with a good rental property accounting template. Loss statement includes company details, total income from sales and services, and a list of expenses. If you want to attract investors, then ensure your rent roll reflects a consistent income stream. Gain financial clarity and strategic insights tailored for rental property owners with our rental property profit & loss statement template. For owners in the real estate business, our real estate profit and loss statement template is an excellent tool for remaining financially informed. Using excel rental property spreadsheets can save you a lot of time. This includes the value of your rental property, cash and cash equivalents, accounts receivable, and other assets such as furniture and equipment. Save your file with a name that's easy to remember like rental property management. set up sheets: Download this free template to track and analyze your rental property income and expenses in excel. Great for airbnb and vrbo hosts. A rent ledger and a lease tracker are both essential tools in property management, yet they serve distinct purposes. Costs for equipment or property upkeep; Before calculating net profit, it’s important to understand gross profit, which represents the revenue left after subtracting the cost of goods sold (cogs). For instance, you might have one sheet for income, another for expenses, and one for.Rental Property Profit & Loss Statement for Clients — Nuventure CPA LLC

Real Estate Profit And Loss Statement excel template for free

Rental Property Profit And Loss Template Download in Excel, Google

Rental Property Profit And Loss Template Google Sheets, Excel

Rental Property Profit And Loss Template Download in Excel, Google

Rental Profit And Loss Template Google Sheets, Excel

Landlords Rental and Expenses Tracking Spreadsheet

Free Profit and Loss Templates Smartsheet

Rental Property Profit And Loss Template Download in Excel, Google

Free Rental Property Profit And Loss Statement Template

Why Use A Rental Property Depreciation Spreadsheet?

It’s Format Specifically For Real Estate Businesses.

Net Profit Or Loss Is The Remaining Income After Subtracting All Expenses (Cogs, Labor, And Operating Expenses) From Total Revenue.

Effortlessly Analyze Your Property Investments, Track Rental Income, And Manage Expenses With Precision.

Related Post: