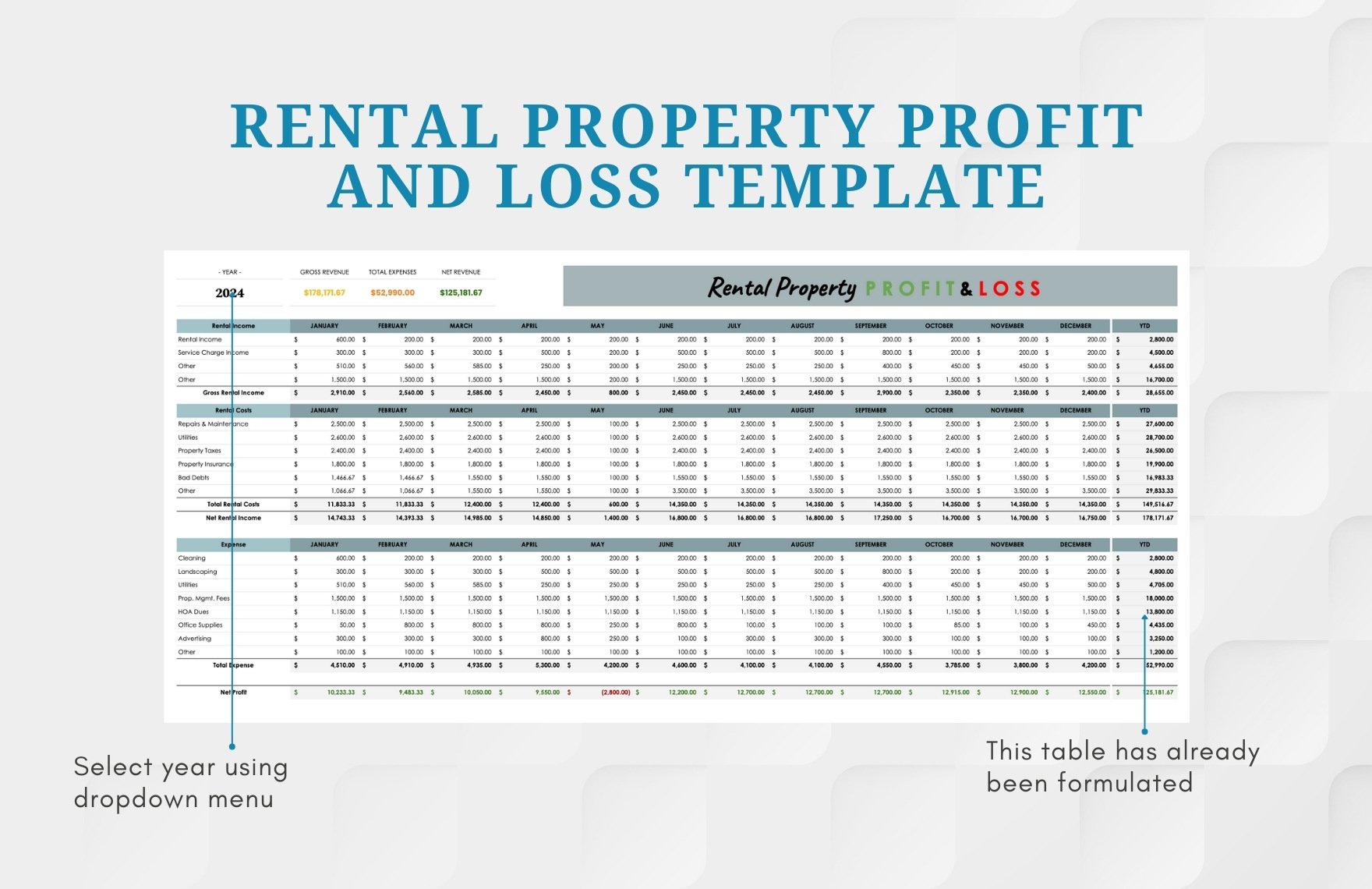

Rental Property Profit And Loss Template

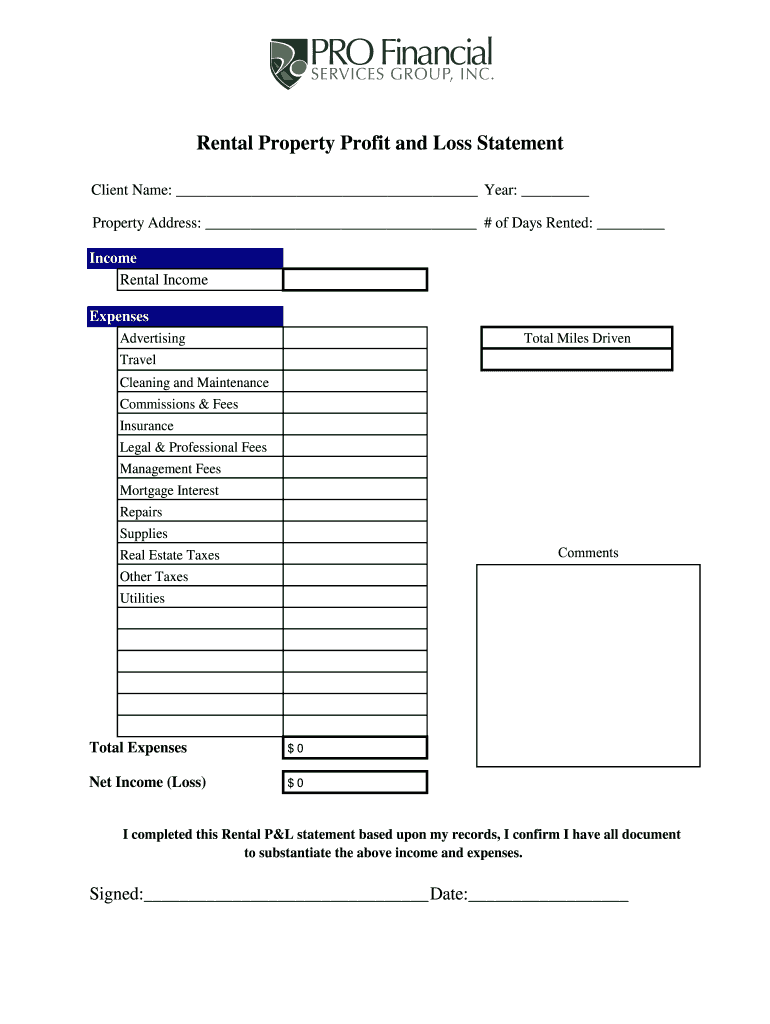

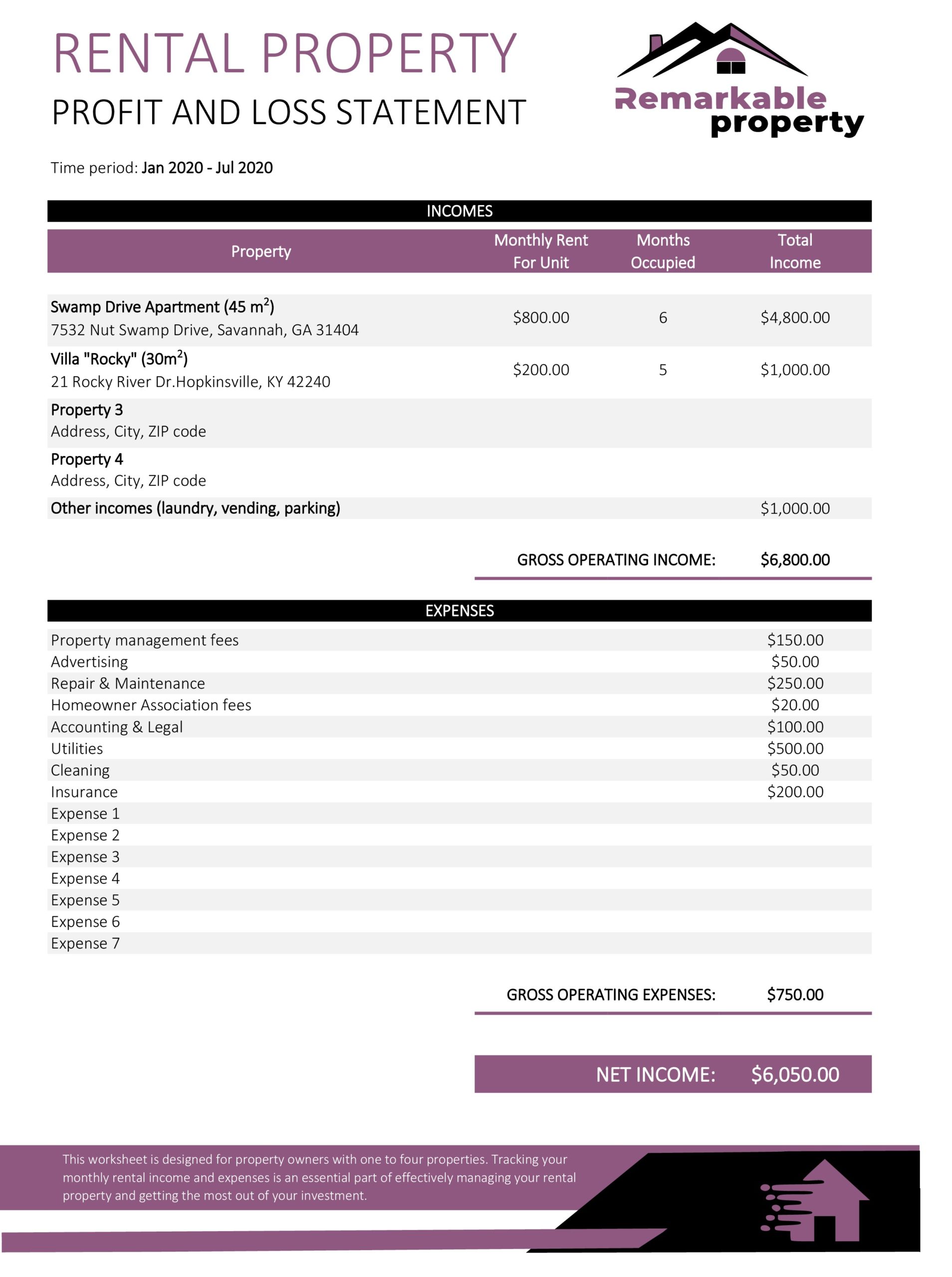

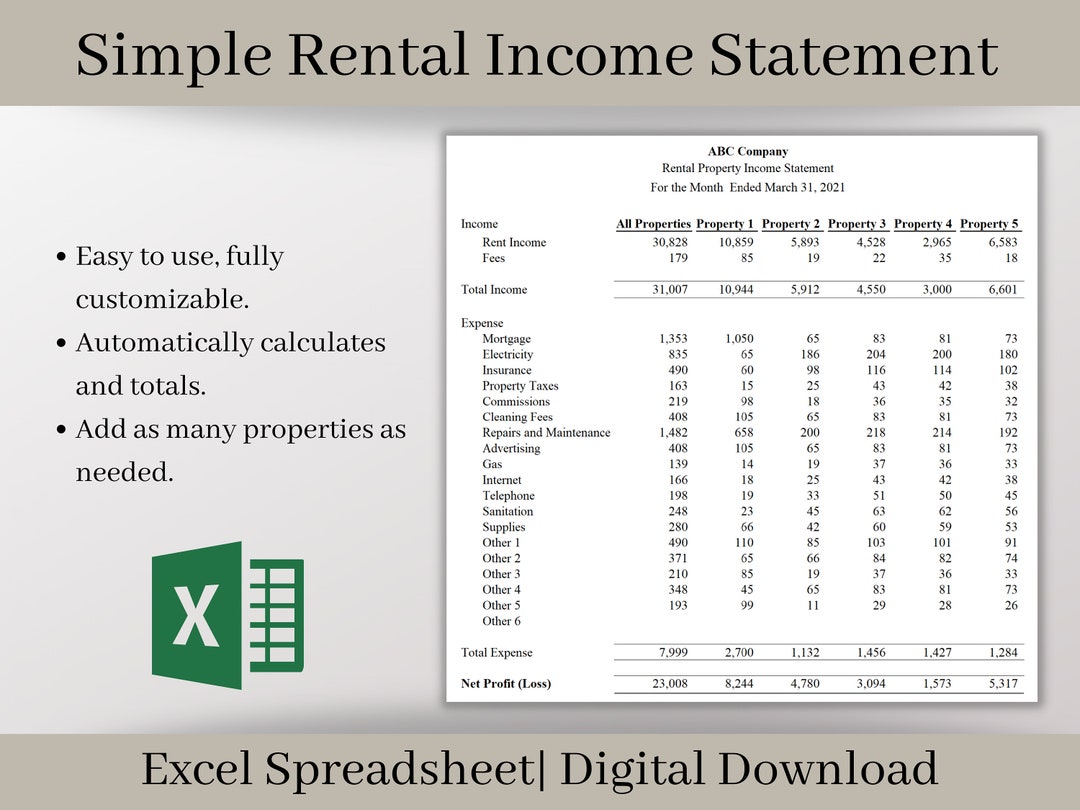

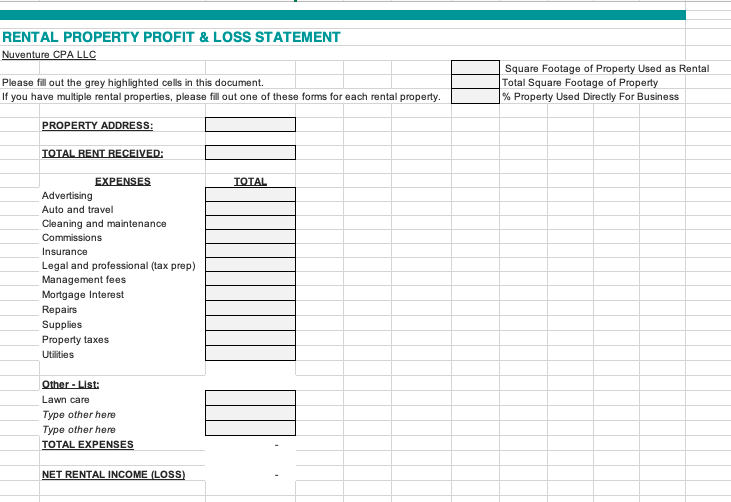

Rental Property Profit And Loss Template - The remaining $250,000 in profit is taxed at. Gross profit is calculated by subtracting cogs from total revenue. Effortlessly analyze your property investments,. Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. We’re excited to offer you a free rent ledger template to simplify your property management tasks. Maximize your rental income and minimize your headaches with our rental profit and loss template! This powerful spreadsheet is the. The first $200,000 in profit is subject to depreciation recapture and taxed at your ordinary income tax rate or 25%, whichever is less; Drag the formula across all months to. If there are any expenses that we do not have listed and you would not. Marketing and promotional costs depreciation: The first $200,000 in profit is subject to depreciation recapture and taxed at your ordinary income tax rate or 25%, whichever is less; Drag the formula across all months to. This template offers a simple layout with sections for gross profit calculation, detailed expense categories, and net income. Owning rental properties can be a rewarding venture, offering both financial gain and personal satisfaction. Access to a free, customizable template designed to make the whole process easier. Profit and loss for rental property refer to the financial analysis of the income and expenses associated with owning and managing a rental property. Plus, we’ll share some awesome features of our own template so you. Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. Let’s tackle the numbers together and to set you up for success. This template is designed for rental property owners who are having trouble compiling accurate financial information. In a new row labeled “gross profit,” enter the formula: Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. The first $200,000 in profit is subject to depreciation recapture and taxed at your. If there are any expenses that we do not have listed and you would not. The first $200,000 in profit is subject to depreciation recapture and taxed at your ordinary income tax rate or 25%, whichever is less; This powerful spreadsheet is the. Access to a free, customizable template designed to make the whole process easier. Profit and loss for. Record all operating expenses during the period, categorized as follows: If there are any expenses that we do not have listed and you would not. Plus, we’ll share some awesome features of our own template so you. I’ve found over the years that managing a. We’re excited to offer you a free rent ledger template to simplify your property management. Profit and loss for rental property refer to the financial analysis of the income and expenses associated with owning and managing a rental property. If there are any expenses that we do not have listed and you would not. I’ve found over the years that managing a. Utilizing a template for this document will help ensure you’re correctly categorizing expenses. Why use a rental property depreciation spreadsheet? This template is designed for rental property owners who are having trouble compiling accurate financial information. Gain financial clarity and strategic insights tailored for rental property owners with our rental property profit & loss statement template. If there are any expenses that we do not have listed and you would not. But let’s. Owning rental properties can be a rewarding venture, offering both financial gain and personal satisfaction. This template is designed for rental property owners who are having trouble compiling accurate financial information. Marketing and promotional costs depreciation: Let’s tackle the numbers together and to set you up for success. This template offers a simple layout with sections for gross profit calculation,. The first $200,000 in profit is subject to depreciation recapture and taxed at your ordinary income tax rate or 25%, whichever is less; This template is designed for rental property owners who are having trouble compiling accurate financial information. Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. If. Utilizing a template for this document will help ensure you’re correctly categorizing expenses in line with irs requirements, and help you capture all the necessary details. In this article, we’ll run through the finer details of what a rental property spreadsheet template is. Drag the formula across all months to. Net profit or loss is the remaining income after subtracting. Download it for free today! Access to a free, customizable template designed to make the whole process easier. In a new row labeled “gross profit,” enter the formula: Record all operating expenses during the period, categorized as follows: If there are any expenses that we do not have listed and you would not. This template offers a simple layout with sections for gross profit calculation, detailed expense categories, and net income. Gross profit is calculated by subtracting cogs from total revenue. Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. Why use a rental property depreciation spreadsheet? Access to a free, customizable. Maximize your rental income and minimize your headaches with our rental profit and loss template! Plus, we’ll share some awesome features of our own template so you. This template is designed for rental property owners who are having trouble compiling accurate financial information. Gross profit is calculated by subtracting cogs from total revenue. Our free rental property depreciation spreadsheet comes with a built in depreciation calculator. Effortlessly analyze your property investments,. But let’s be honest, it also brings its fair share of challenges,. Gain financial clarity and strategic insights tailored for rental property owners with our rental property profit & loss statement template. The first $200,000 in profit is subject to depreciation recapture and taxed at your ordinary income tax rate or 25%, whichever is less; In a new row labeled “gross profit,” enter the formula: Net profit or loss is the remaining income after subtracting all expenses (cogs, labor, and operating expenses) from total revenue. In this article, we’ll run through the finer details of what a rental property spreadsheet template is. Utilizing a template for this document will help ensure you’re correctly categorizing expenses in line with irs requirements, and help you capture all the necessary details. This powerful spreadsheet is the. The remaining $250,000 in profit is taxed at. I’ve found over the years that managing a.Rental Property Profit And Loss Statement Pdf Fill Online, Printable

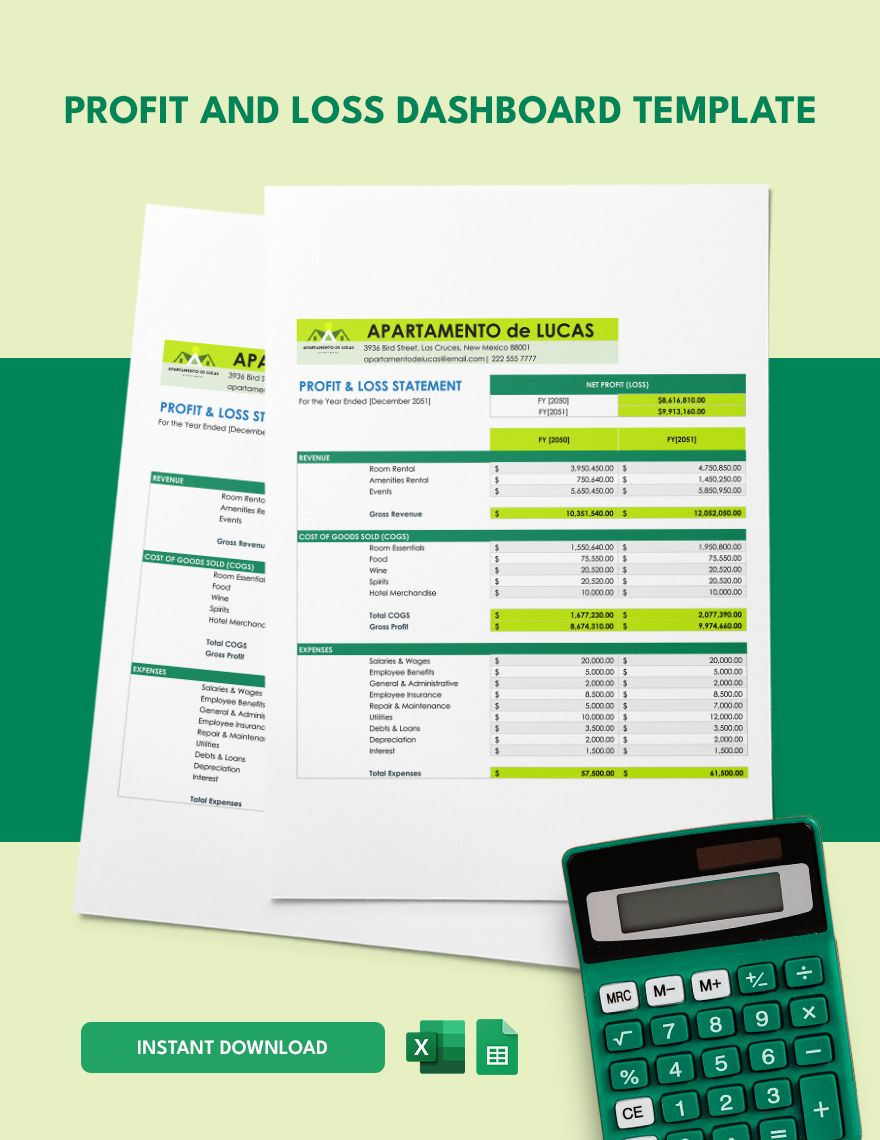

Rental Property Profit And Loss Statement Template Excel Templates

Rental Statement Spreadsheet, Landlords Template for Google

Real Estate Profit And Loss Template

Download Free Rental Property P&L Template [2024 Edition]

Download Free Rental Property P&L Template [2024 Edition]

Printable Rental Property Profit And Loss Statement Template

Rental Property Profit And Loss Template Excel

Rental Property Profit And Loss Template in Excel, Google Sheets

Download Free Rental Property P&L Template [2024 Edition]

Drag The Formula Across All Months To.

Why Use A Rental Property Depreciation Spreadsheet?

If There Are Any Expenses That We Do Not Have Listed And You Would Not.

Access To A Free, Customizable Template Designed To Make The Whole Process Easier.

Related Post:

![Download Free Rental Property P&L Template [2024 Edition]](https://coefficient.io/wp-content/uploads/2023/10/year-to-date-profit-and-loss-scaled.webp)

![Download Free Rental Property P&L Template [2024 Edition]](https://coefficient.io/wp-content/uploads/2023/11/Rental-PL-2.webp)

![Download Free Rental Property P&L Template [2024 Edition]](https://coefficient.io/wp-content/uploads/2023/11/Rental-PL-3.webp)