Repayment Letter Template

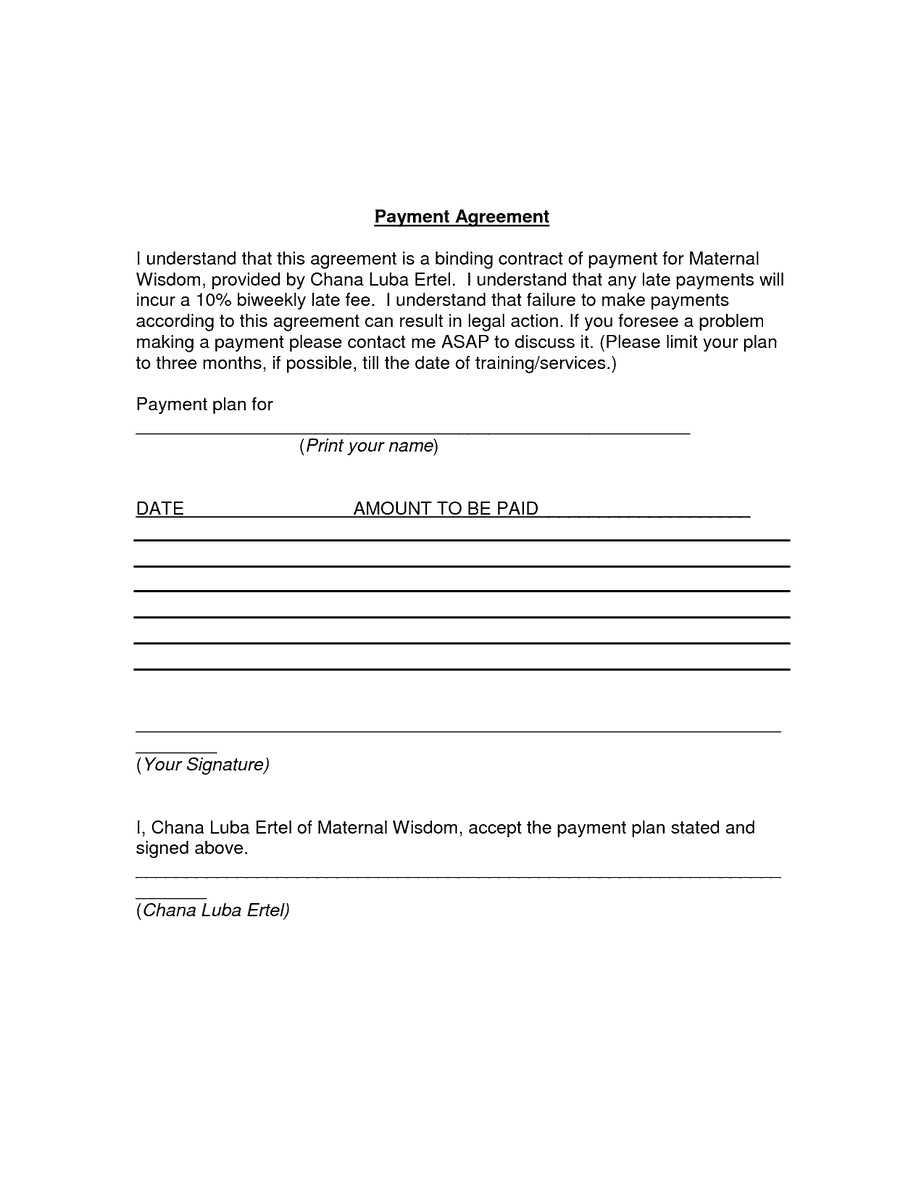

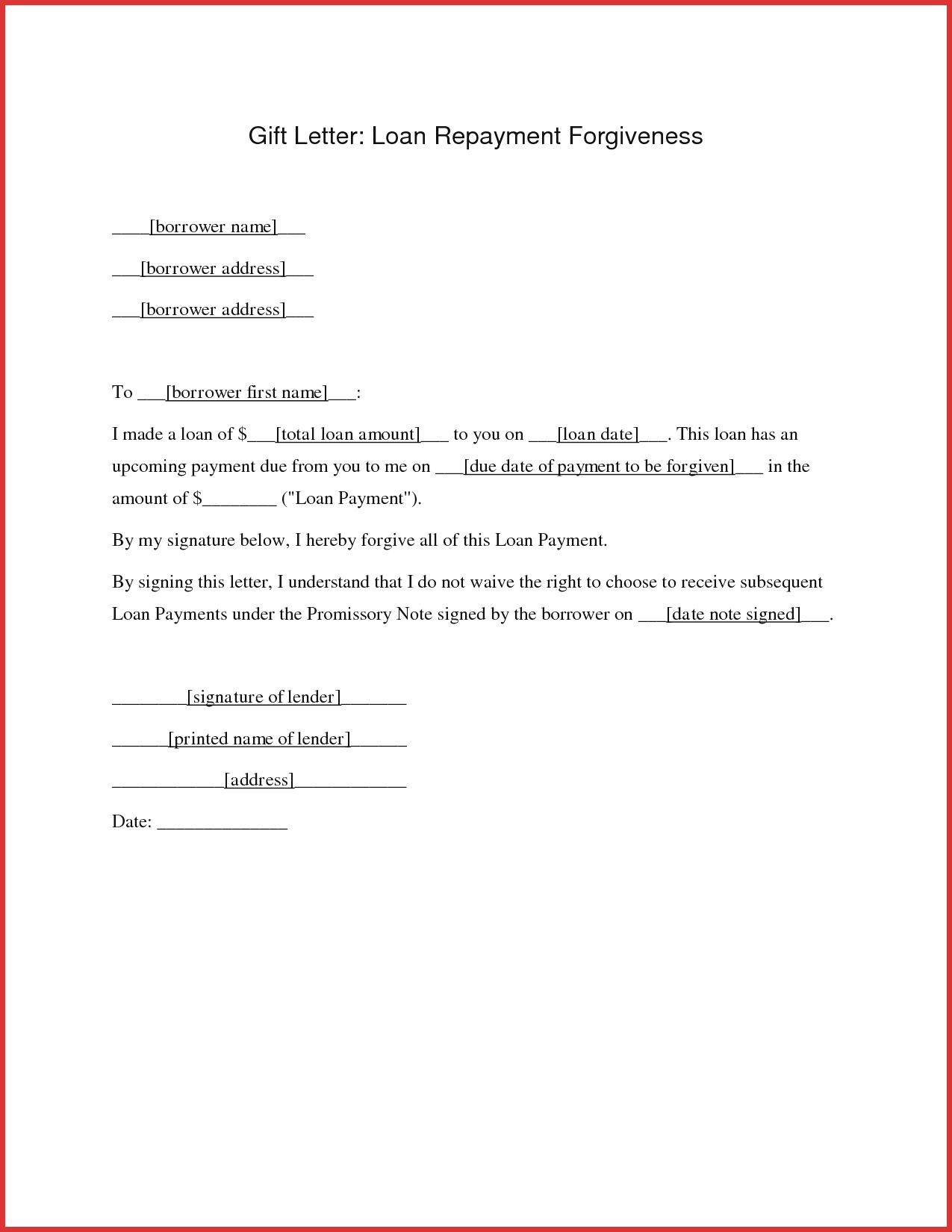

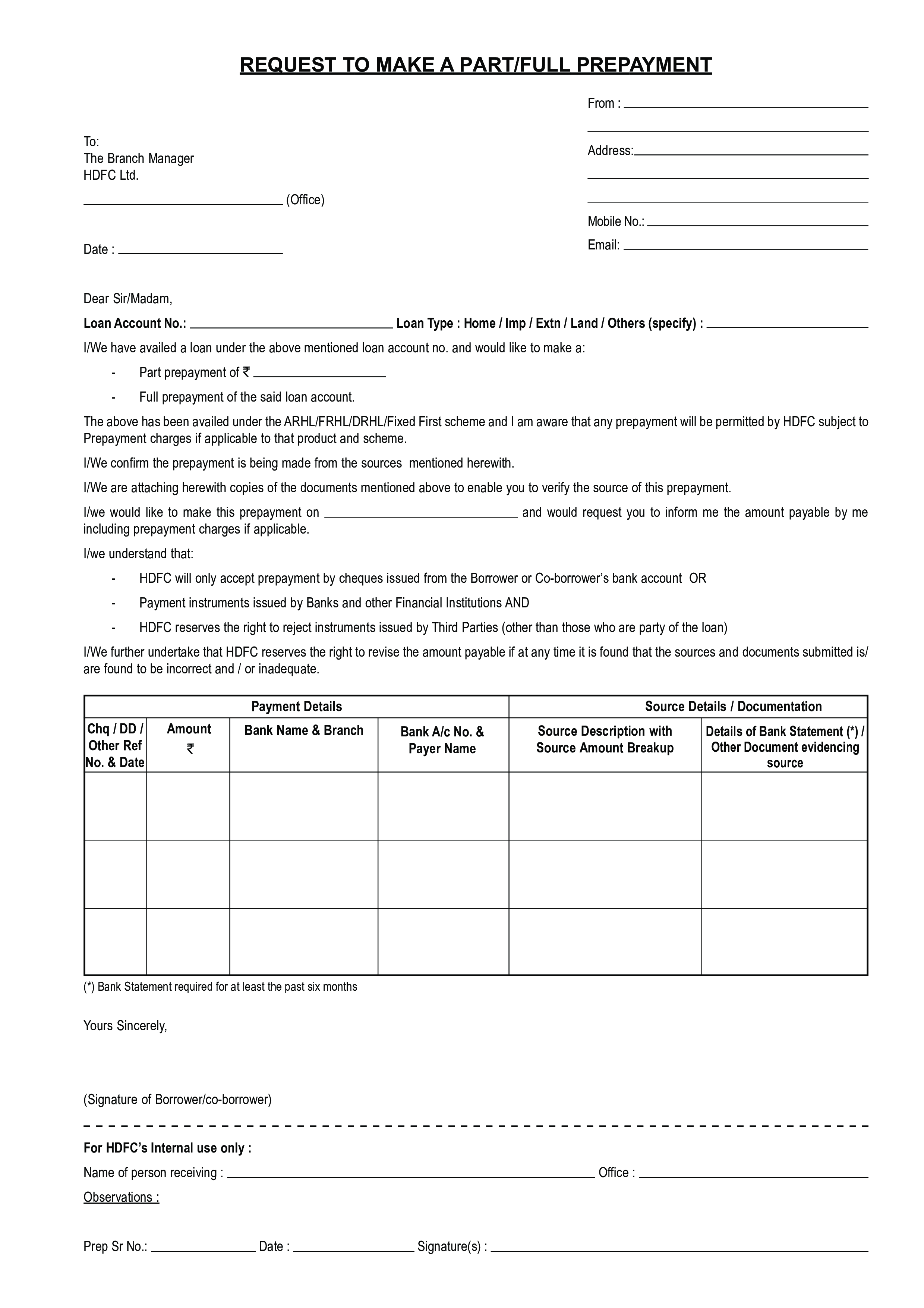

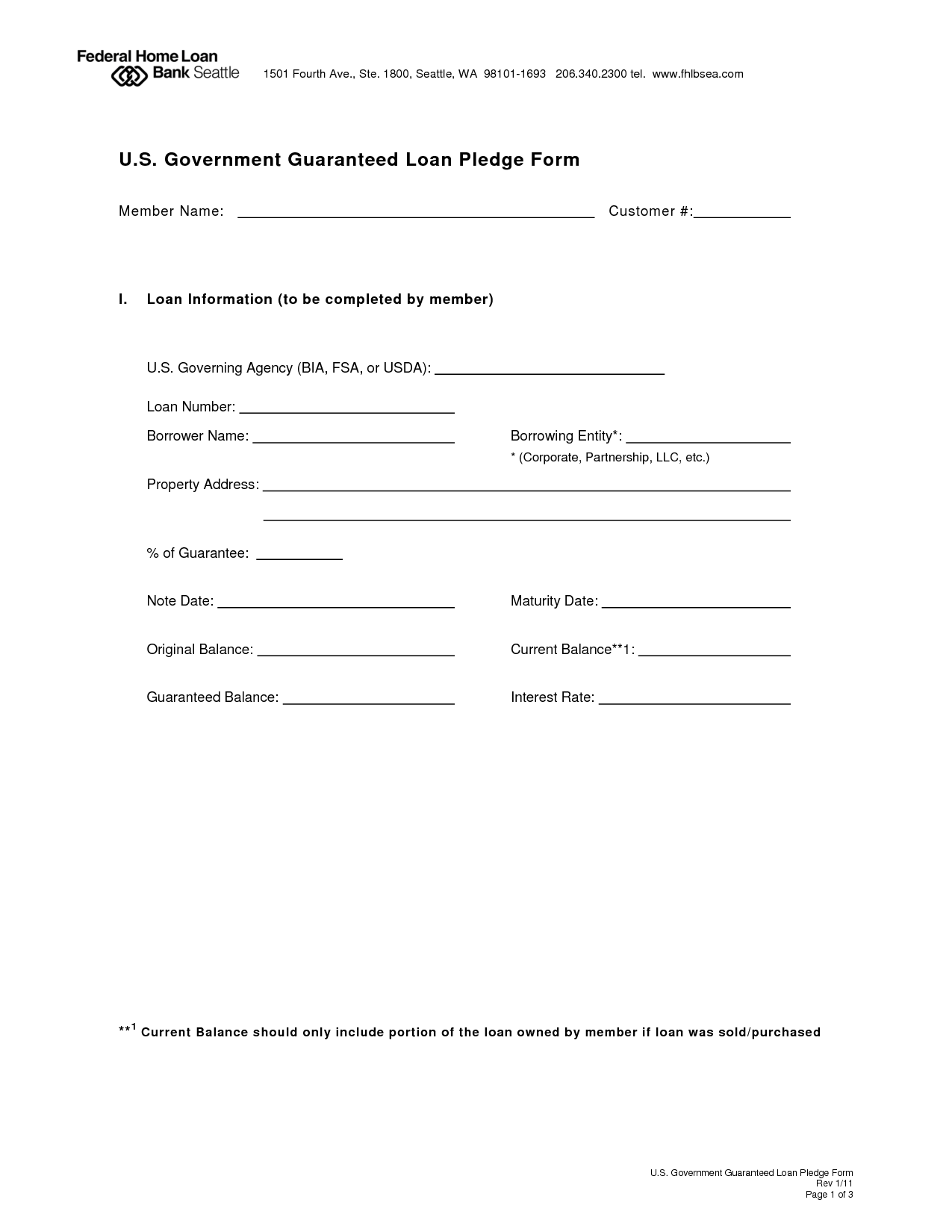

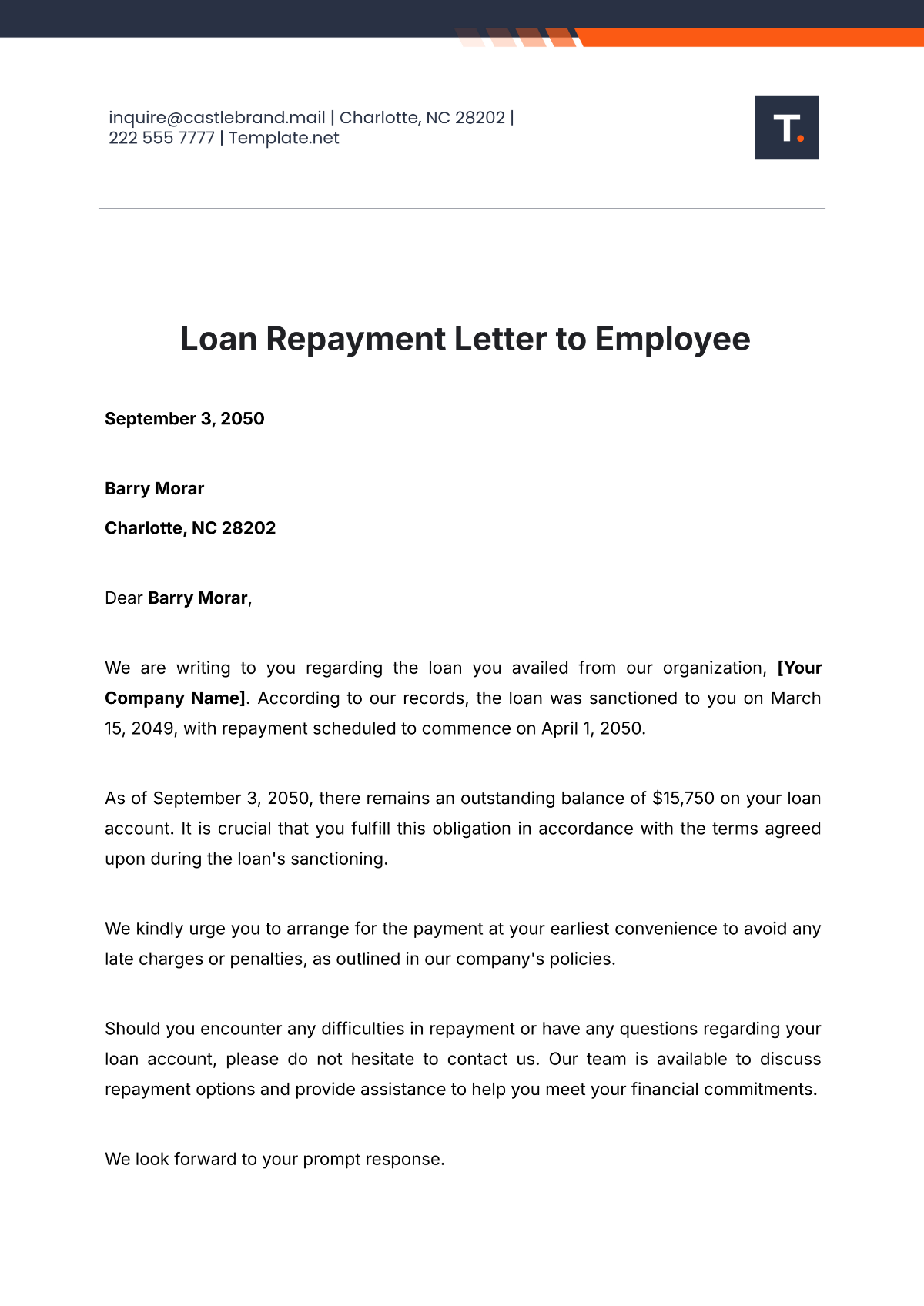

Repayment Letter Template - By formalizing your repayment plan in a letter, you not only protect yourself. Writing a loan repayment agreement can help you clarify the terms and ensure both parties are on the same page. Download your letter agreement on repayment schedule template in word doc format. Such plans typically outline monthly payment amounts, interest rates, and target dates. The first template offers a standard loan repayment acknowledgment letter, ensuring clarity and documentation of a successful repayment. The second template is designed for borrowers. It outlines the amount owed, the repayment. Purpose of a demand letter for money owed. Explore professionally designed repayment agreement templates in word. Effective debt repayment plans can help individuals regain financial stability and improve credit scores. A letter to pay back money is a formal letter written to an individual or organization to inform them of your intention to repay a debt. The first template offers a standard loan repayment acknowledgment letter, ensuring clarity and documentation of a successful repayment. This letter is written when you want to ask someone to repay the amount that you loaned them at some point. Purpose of a demand letter for money owed. Use a payment plan agreement when you need to structure the repayment of a debt over time, especially when both parties want clarity and a formal arrangement for the repayment terms. Such plans typically outline monthly payment amounts, interest rates, and target dates. Unlock free, customizable repayment agreement templates online! Design and print effortlessly with template.net. Engage your employees in fair and legally compliant repayment processes with our customizable repayment agreement template. Download this loan repayment letter template now for your own benefit! Learn the essential components that make up a debt agreement. Purpose of a demand letter for money owed. Creating a clear and concise letter can help both the lender and borrower understand the terms of repayment, ensuring a smooth financial arrangement. However, a professionally written loan repayment letter can go a long way in preserving the. Engage your employees in. This letter serves as a formal yet friendly way to outline the terms of your. Here are templates for a demand letter for money owed, catering to various scenarios, each followed by an example. Such plans typically outline monthly payment amounts, interest rates, and target dates. Here are three detailed and unique templates for a personal loan repayment letter, each. Design and print effortlessly with template.net. This can foster creditor understanding and potentially prompt more favorable responses, such as halting collection efforts or offering alternative repayment arrangements. Such plans typically outline monthly payment amounts, interest rates, and target dates. In this article, we'll guide you through a. Repayment letter is in editable, printable format. What is a letter requesting repayment of a personal loan? Creating a clear and concise letter can help both the lender and borrower understand the terms of repayment, ensuring a smooth financial arrangement. Engage your employees in fair and legally compliant repayment processes with our customizable repayment agreement template. Explore professionally designed repayment agreement templates in word. By formalizing your. Purpose of a demand letter for money owed. Free and customizable for professional quality. Creating a clear and concise letter can help both the lender and borrower understand the terms of repayment, ensuring a smooth financial arrangement. Effective debt repayment plans can help individuals regain financial stability and improve credit scores. This letter serves as a formal yet friendly way. Purpose of a demand letter for money owed. Explore professionally designed repayment agreement templates in word. Here are templates for a demand letter for money owed, catering to various scenarios, each followed by an example. However, a professionally written loan repayment letter can go a long way in preserving the. Many banks send loan repayment reminders, a type of transactional. Customize and download this repayment letter. Here are three detailed and unique templates for a personal loan repayment letter, each catering to different circumstances: Effective debt repayment plans can help individuals regain financial stability and improve credit scores. This can foster creditor understanding and potentially prompt more favorable responses, such as halting collection efforts or offering alternative repayment arrangements. Writing. Effective debt repayment plans can help individuals regain financial stability and improve credit scores. Use a payment plan agreement when you need to structure the repayment of a debt over time, especially when both parties want clarity and a formal arrangement for the repayment terms. Here are three detailed and unique templates for a personal loan repayment letter, each catering. Engage your employees in fair and legally compliant repayment processes with our customizable repayment agreement template. Dear [lender’s name], i am writing to inform you that i am. Design and print effortlessly with template.net. This letter is written when you want to ask someone to repay the amount that you loaned them at some point. This letter serves as a. However, a professionally written loan repayment letter can go a long way in preserving the. This letter is written when you want to ask someone to repay the amount that you loaned them at some point. Writing a loan repayment letter starts with a clear understanding of the loan terms and the borrower’s ability to repay. Explore professionally designed repayment. Repayment letter is in editable, printable format. This letter is written when you want to ask someone to repay the amount that you loaned them at some point. Get 3,000+ templates to start, manage, and grow your business with business in a box. It outlines the amount owed, the repayment. Get started now and simplify your financial management! Unlock free, customizable repayment agreement templates online! Such plans typically outline monthly payment amounts, interest rates, and target dates. This can foster creditor understanding and potentially prompt more favorable responses, such as halting collection efforts or offering alternative repayment arrangements. In this article, we'll guide you through a. Dear [lender’s name], i am writing to inform you that i am. Use a payment plan agreement when you need to structure the repayment of a debt over time, especially when both parties want clarity and a formal arrangement for the repayment terms. Understand the significance of a debt agreement letter in formalizing payment terms. A letter to pay back money is a formal letter written to an individual or organization to inform them of your intention to repay a debt. Free and customizable for professional quality. This letter serves as a formal yet friendly way to outline the terms of your. Effective debt repayment plans can help individuals regain financial stability and improve credit scores.Personal Loan Repayment Letter Template Samples Letter Template

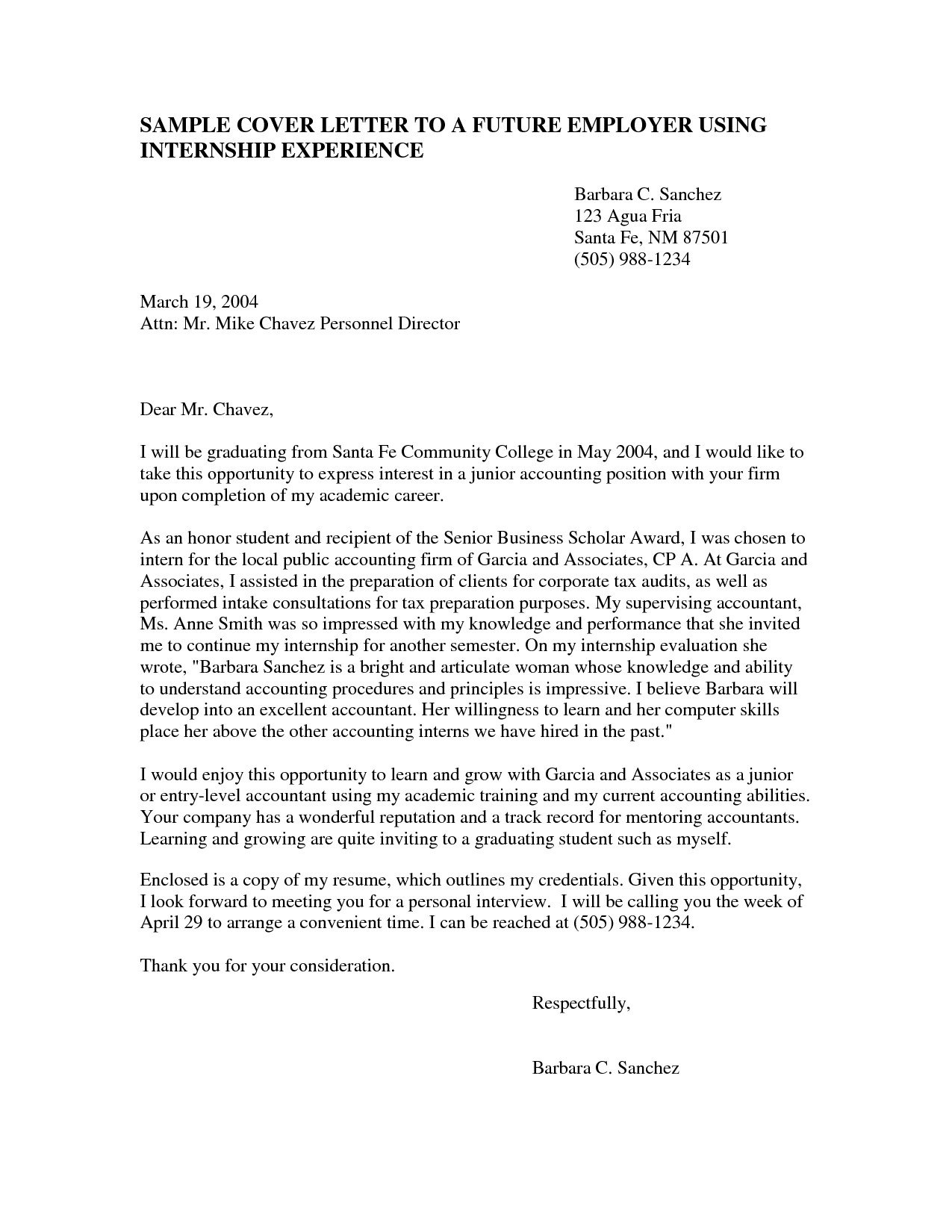

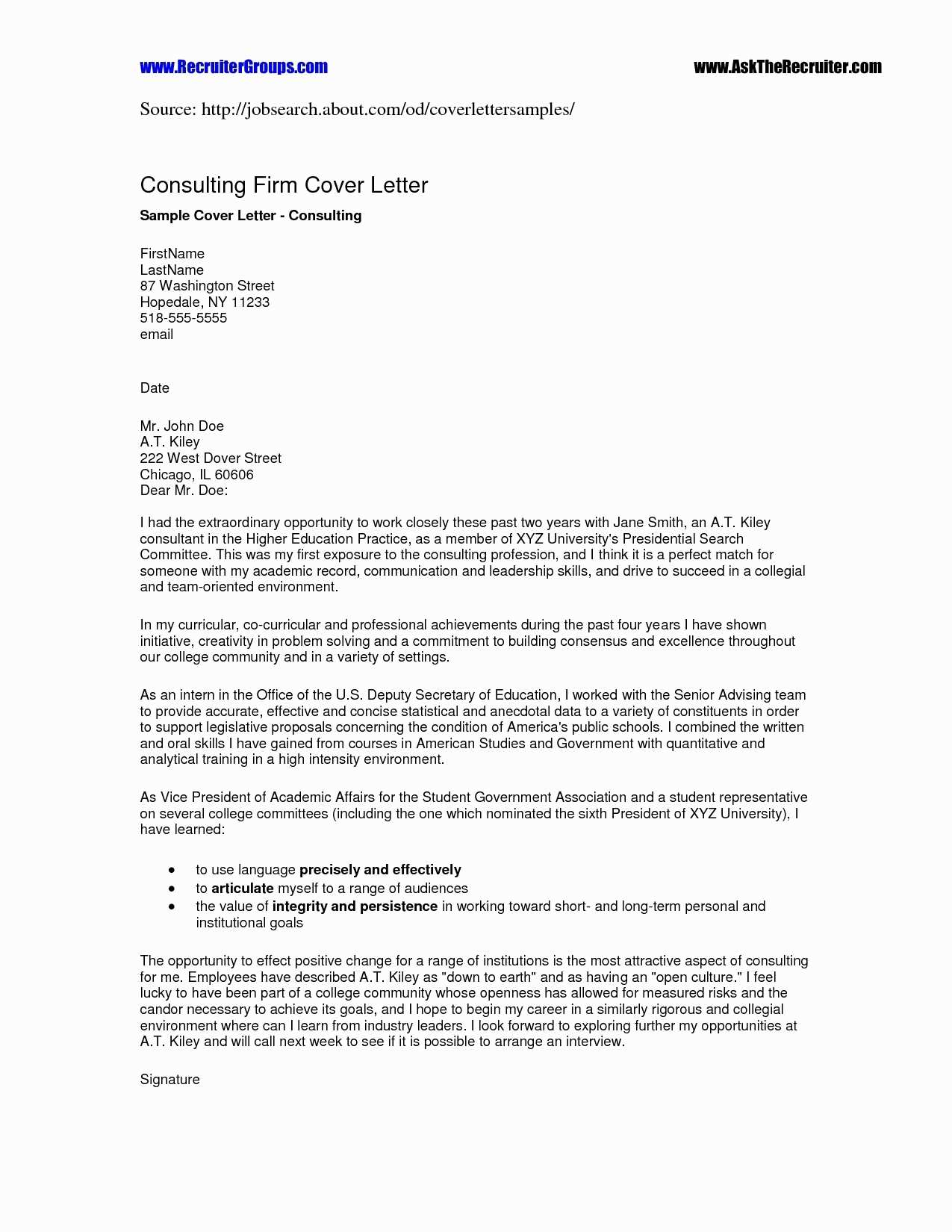

Payment Arrangement Letter Template 5 Payment Agreement Templates Word

Repayment Agreement Letter Template Samples Letter Template Collection

Personal Loan Repayment Letter Template Samples Letter Template

letter repayment agreement Doc Template pdfFiller

Loan Repayment Letter Templates at

Personal Loan Repayment Agreement Free Printable Documents

Repayment Letter Sample

Simple Repayment Agreement Template Google Docs, Word, Apple Pages

Free Loan Repayment Letter to Employee Template Edit Online

What Is A Letter Requesting Repayment Of A Personal Loan?

Learn The Essential Components That Make Up A Debt Agreement.

Purpose Of A Demand Letter For Money Owed.

Here Are Three Detailed And Unique Templates For A Personal Loan Repayment Letter, Each Catering To Different Circumstances:

Related Post: