Roi Template

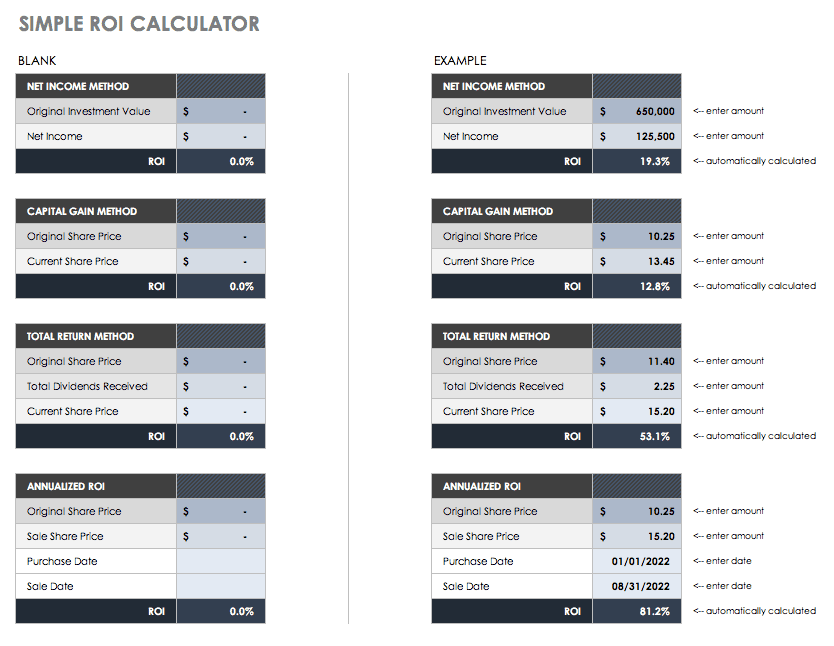

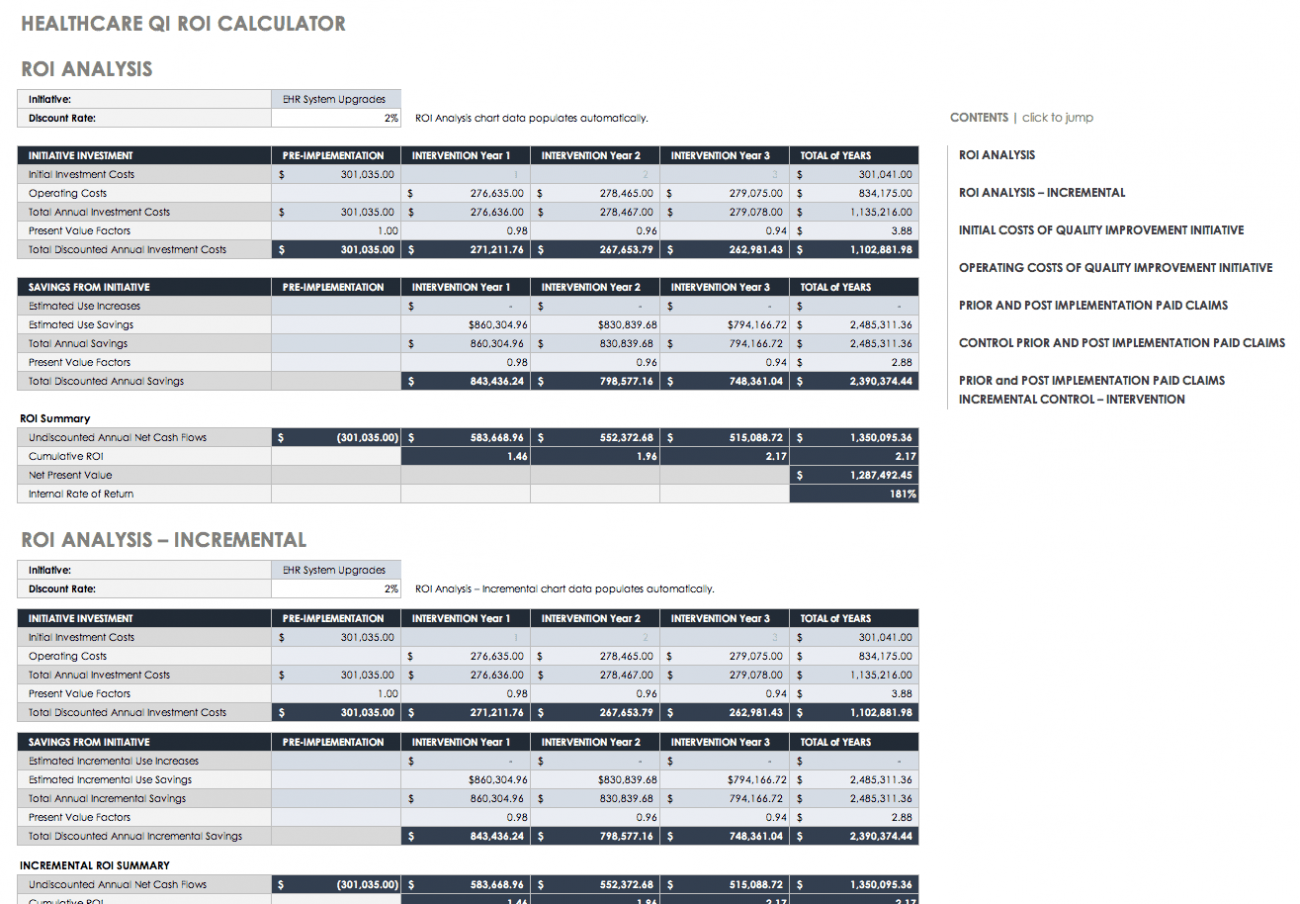

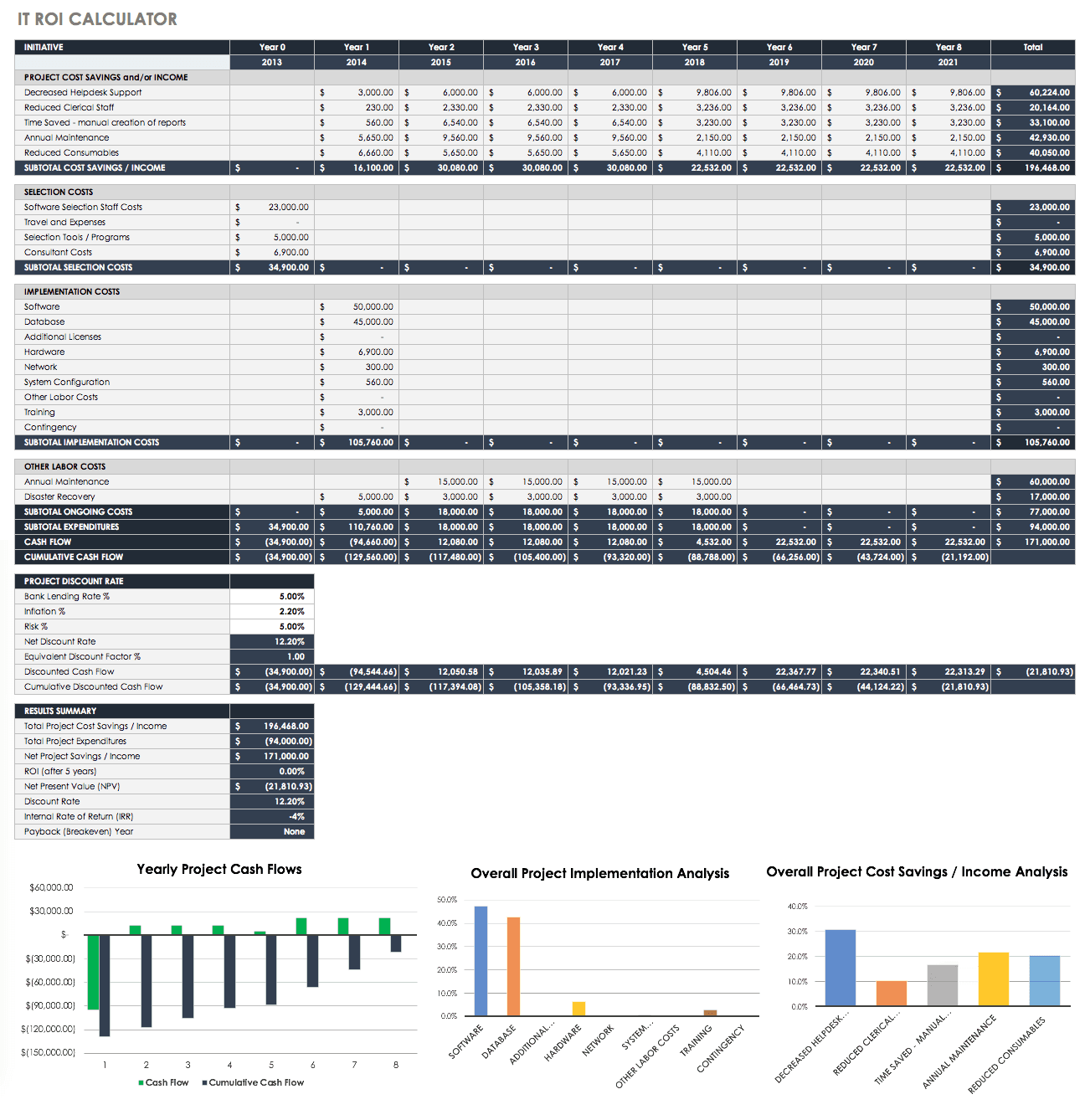

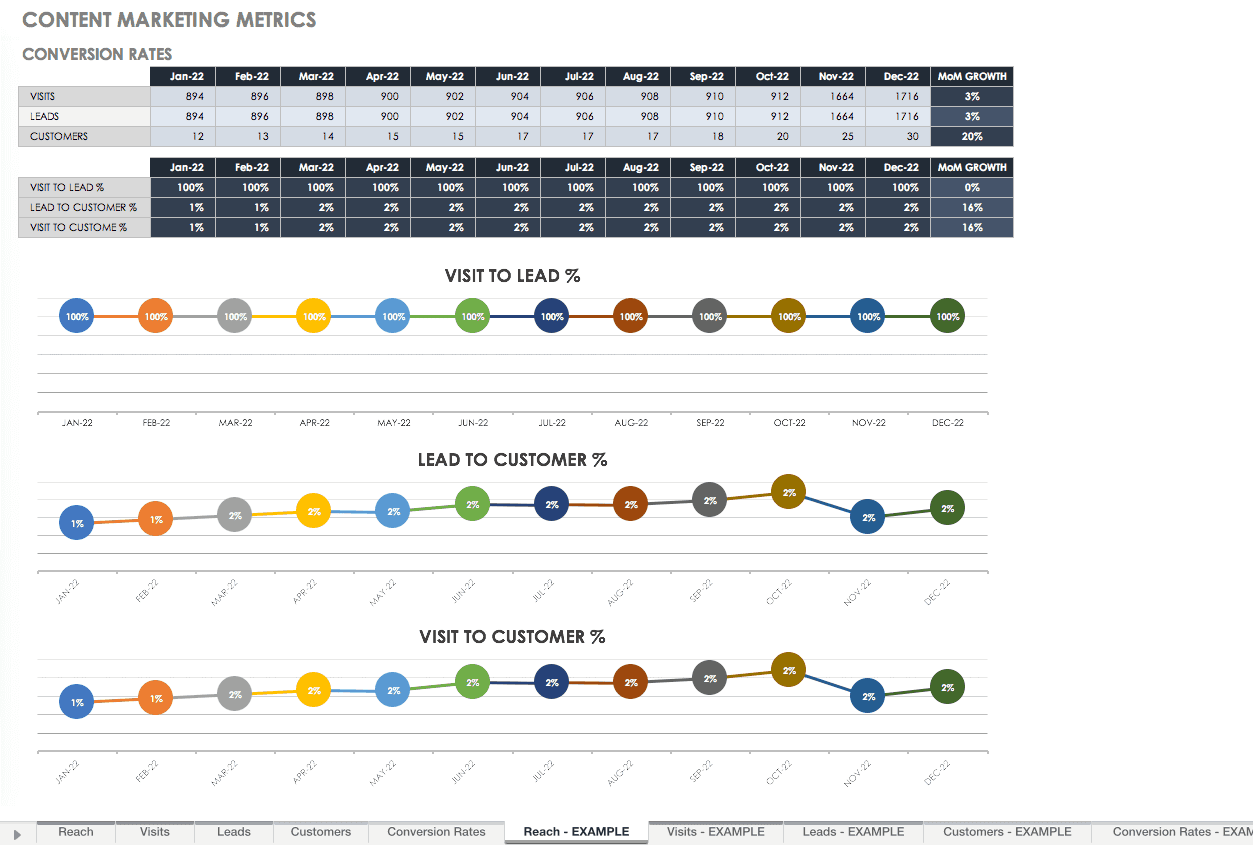

Roi Template - Due to its flexibility and simplicity, roi is one of the most frequently used profitability metrics. Return on capital (roc) is a ratio that measures how well a company turns capital (e.g. Learn definitions, examples, & calculations for this economic strategy. Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. Let’s say you want to start building your passive income investments on january 1st, 2022. Saving for retirement shouldn’t be a mystery. At the moment, you have $10,000 in initial savings to start. An income statement provides insight into a company's revenues, expenses, gains, and losses in a given period. How does a disclosure statement work? What is return on capital? Financial statement analysis example for the income statement. Let’s say you want to start building your passive income investments on january 1st, 2022. Return on capital (roc) is a ratio that measures how well a company turns capital (e.g. What is cost benefit analysis and how do experts use it to make educated decisions? How to find irr on a financial calculator. Saving for retirement shouldn’t be a mystery. If you don’t use excel, you can still calculate irr using a financial calculator (such as the texas instrument ba ii plus). Roi (or return on investment) is a key financial ratio that measures the gain/loss from an investment in relation to the initial investment. For example, an analyst issuing a report on october 15, 2019 will report trailing twelve months (ttm) earnings as those from october 1, 2018 to. How does a disclosure statement work? How to find irr on a financial calculator. Financial statement analysis example for the income statement. An income statement provides insight into a company's revenues, expenses, gains, and losses in a given period. At the moment, you have $10,000 in initial savings to start. What is return on capital? Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. Due to its flexibility and simplicity, roi is one of the most frequently used profitability metrics. How to find irr on a financial calculator. Dupont analysis examines the return on equity (roe) analyzing profit margin, total asset turnover, and financial leverage. In the case of a loan, the. Let’s say you want to start building your passive income investments on january 1st, 2022. Return on capital (roc) is a ratio that measures how well a company turns capital (e.g. Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. Financial statement analysis example for the income statement. For example, an analyst issuing a report on october. Let’s say you want to start building your passive income investments on january 1st, 2022. An income statement provides insight into a company's revenues, expenses, gains, and losses in a given period. Financial statement analysis example for the income statement. What is return on capital? Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. What is cost benefit analysis and how do experts use it to make educated decisions? For example, an analyst issuing a report on october 15, 2019 will report trailing twelve months (ttm) earnings as those from october 1, 2018 to. Dupont analysis examines the return on equity (roe) analyzing profit margin, total asset turnover, and financial leverage. If you don’t. For example, an analyst issuing a report on october 15, 2019 will report trailing twelve months (ttm) earnings as those from october 1, 2018 to. Roi (or return on investment) is a key financial ratio that measures the gain/loss from an investment in relation to the initial investment. How to find irr on a financial calculator. Let’s say you want. In the case of a loan, the disclosure statement describes the terms of the loan, such as the interest rate, the amount borrowed, the repayment schedule, fees, disbursement conditions, collateral requirements, insurance requirements, prepayment rights (or penalties), and any other expectations of the lender and. Dupont analysis examines the return on equity (roe) analyzing profit margin, total asset turnover, and. Learn definitions, examples, & calculations for this economic strategy. In the case of a loan, the disclosure statement describes the terms of the loan, such as the interest rate, the amount borrowed, the repayment schedule, fees, disbursement conditions, collateral requirements, insurance requirements, prepayment rights (or penalties), and any other expectations of the lender and. Financial statement analysis example for the. Roi (or return on investment) is a key financial ratio that measures the gain/loss from an investment in relation to the initial investment. Learn definitions, examples, & calculations for this economic strategy. Due to its flexibility and simplicity, roi is one of the most frequently used profitability metrics. Let’s say you want to start building your passive income investments on. Learn definitions, examples, & calculations for this economic strategy. Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. It's extremely useful to gauge the efficiency and profitability of investments. Financial statement analysis example for the income statement. Let’s say you want to start building your passive income investments on january 1st, 2022. At the moment, you have $10,000 in initial savings to start. It's extremely useful to gauge the efficiency and profitability of investments. Financial statement analysis example for the income statement. For example, an analyst issuing a report on october 15, 2019 will report trailing twelve months (ttm) earnings as those from october 1, 2018 to. How does a disclosure statement work? In the case of a loan, the disclosure statement describes the terms of the loan, such as the interest rate, the amount borrowed, the repayment schedule, fees, disbursement conditions, collateral requirements, insurance requirements, prepayment rights (or penalties), and any other expectations of the lender and. Saving for retirement shouldn’t be a mystery. Dupont analysis examines the return on equity (roe) analyzing profit margin, total asset turnover, and financial leverage. What is cost benefit analysis and how do experts use it to make educated decisions? Due to its flexibility and simplicity, roi is one of the most frequently used profitability metrics. Ttm is a helpful statistic for reporting, comparing, and contrasting financial figures. Learn definitions, examples, & calculations for this economic strategy. How to find irr on a financial calculator. What is return on capital? Roi (or return on investment) is a key financial ratio that measures the gain/loss from an investment in relation to the initial investment.Free ROI Templates and Calculators Smartsheet

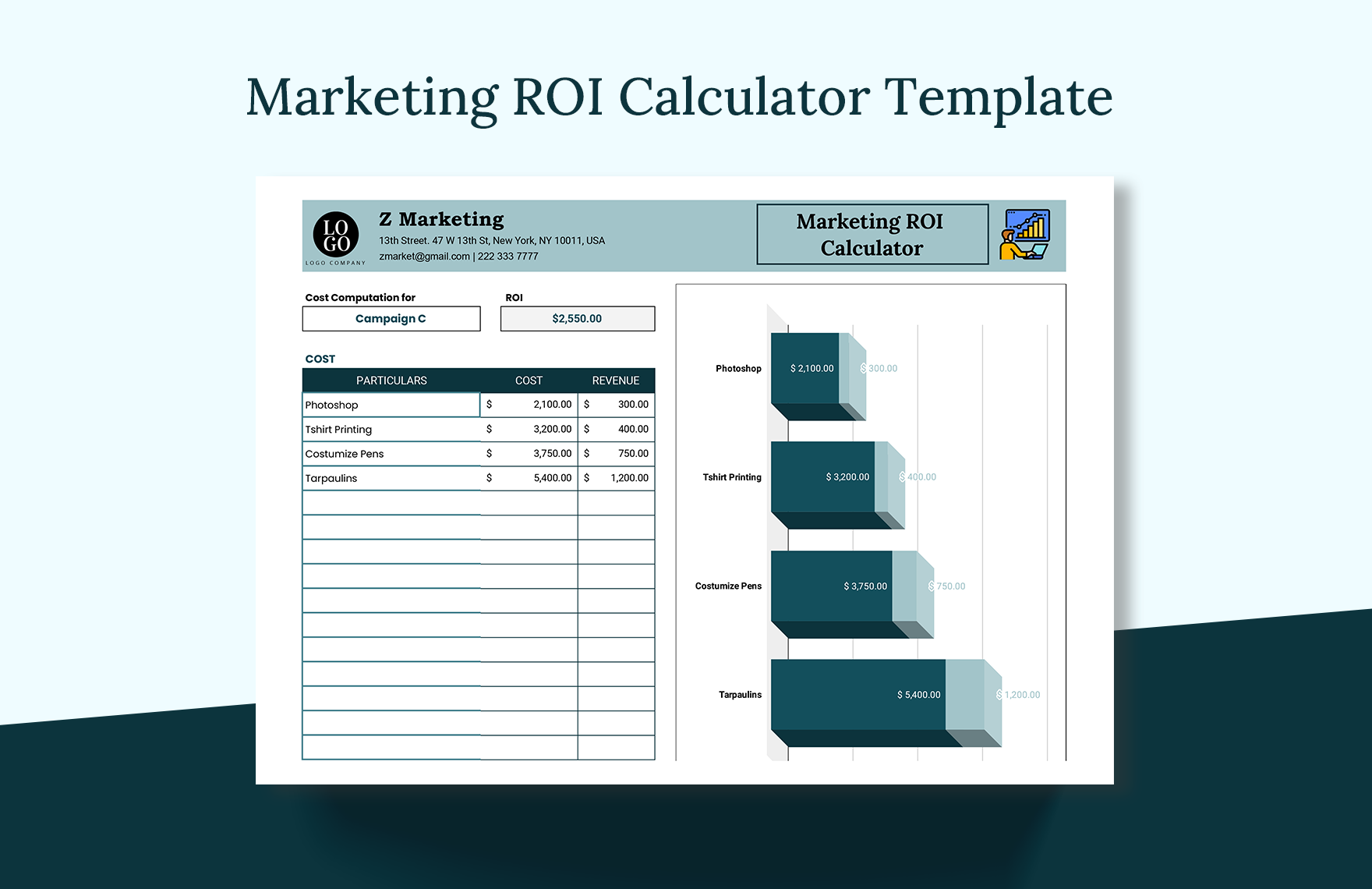

Roi Templates

Return On Investment (ROI) Analysis Template Google Sheets, Excel

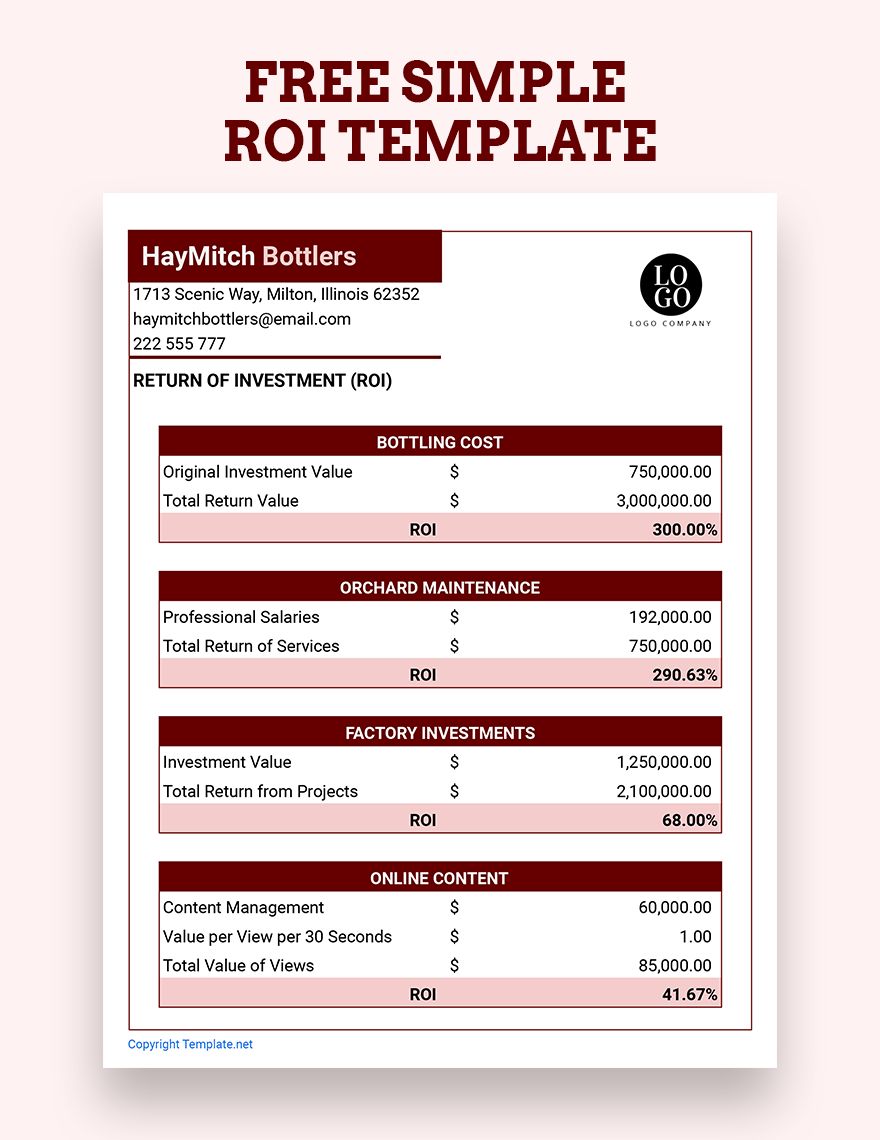

FREE ROI (Return of Investment) Template Download in Word, Google

Roi Template In Excel

ROI [Return of Investment] Templates Design, Free, Download

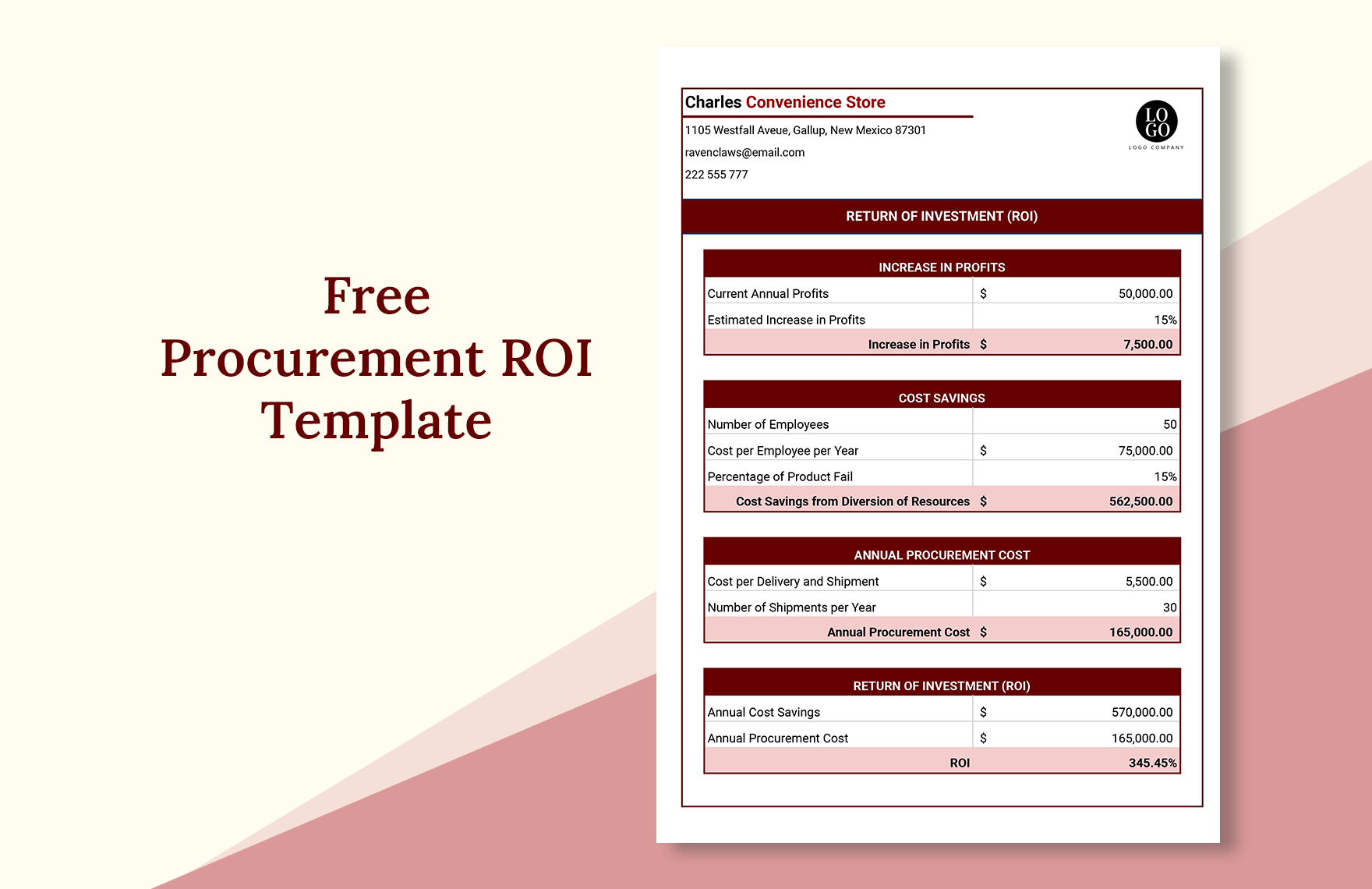

Free ROI Templates and Calculators Smartsheet

Free ROI Templates and Calculators Smartsheet

Free ROI Templates and Calculators Smartsheet

Free ROI Templates and Calculators Smartsheet

Let’s Say You Want To Start Building Your Passive Income Investments On January 1St, 2022.

If You Don’t Use Excel, You Can Still Calculate Irr Using A Financial Calculator (Such As The Texas Instrument Ba Ii Plus).

Return On Capital (Roc) Is A Ratio That Measures How Well A Company Turns Capital (E.g.

An Income Statement Provides Insight Into A Company's Revenues, Expenses, Gains, And Losses In A Given Period.

Related Post:

![ROI [Return of Investment] Templates Design, Free, Download](https://images.template.net/130365/return-on-investment--roi--analysis-template-mff0l.png)