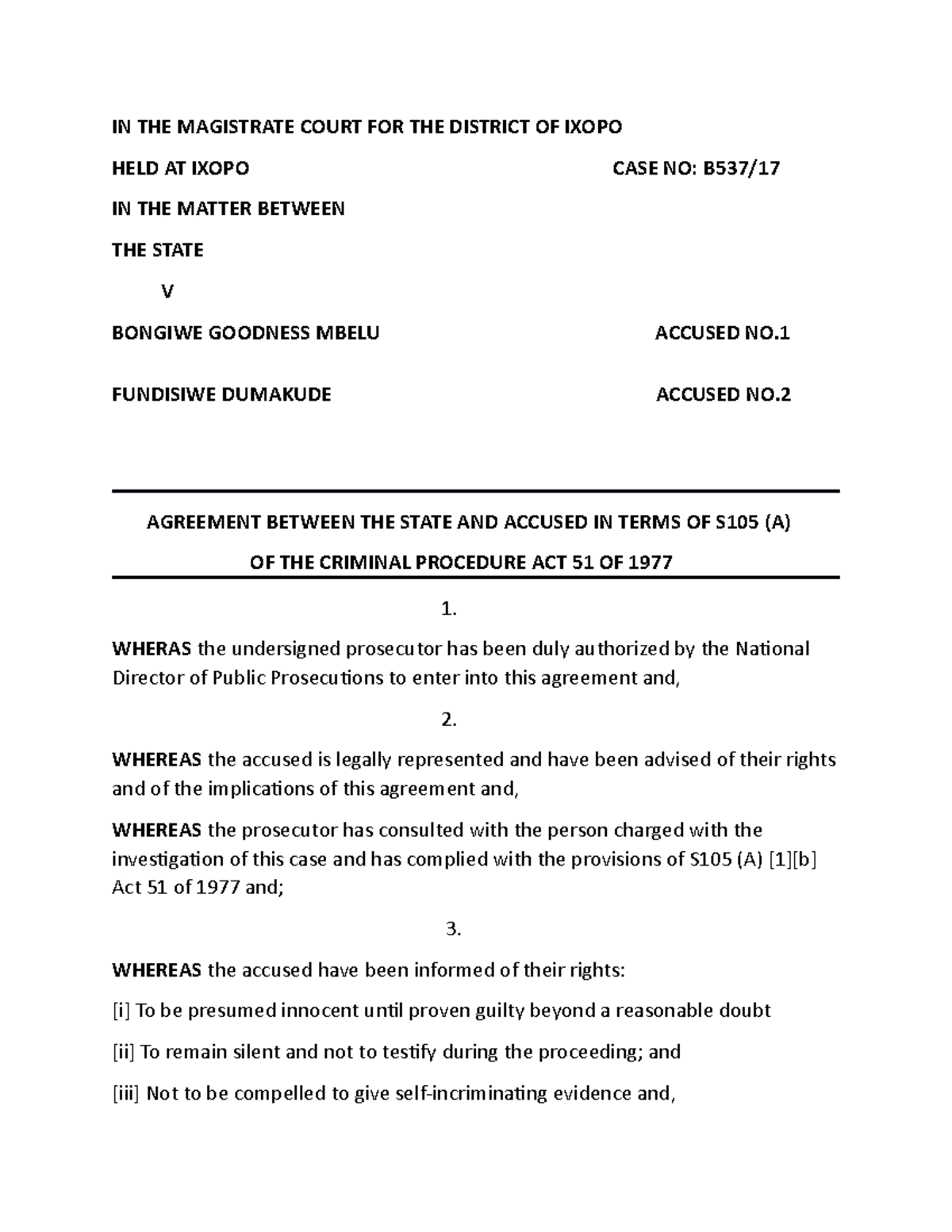

Section 105 Plan Template

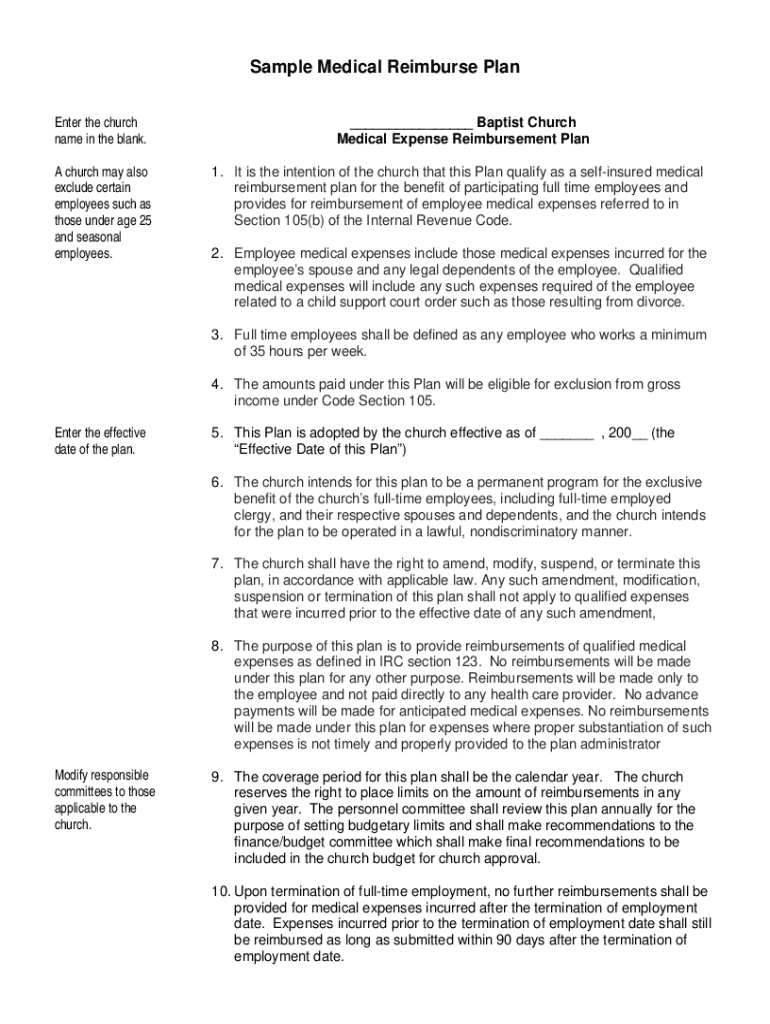

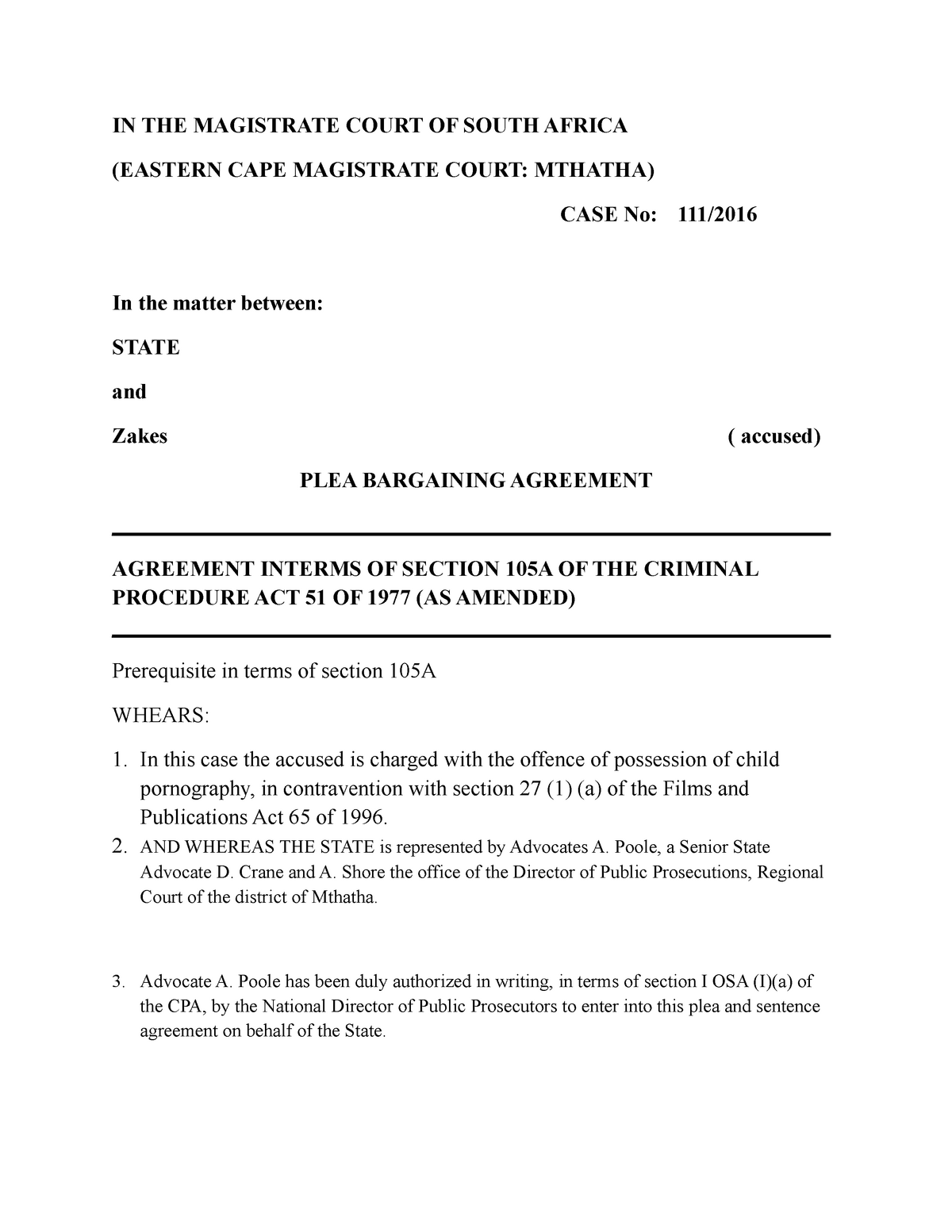

Section 105 Plan Template - Health reimbursement plan the undersigned adopting employer hereby adopts this plan. This section of the code. The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to comply with the. 105 employee welfare benefit master plan (the “plan”), is as follows: It is a very important document and you. Section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health insurance for purposes of § 105. Piedmont healthcare, inc (the “employer”) has established the piedmont healthcare, inc section 105 hra plan (the “hra”). With this type of section 105 plan, a small business does not offer a. The plan is intended to qualify as a health reimbursement arrangement under code sections. This health reimbursement arrangement (hra) plan guide was created to provide a basic, but practical, summary of the major hra plan compliance rules. Thus, the employee may submit for reimbursement any. This health reimbursement arrangement (hra) plan guide was created to provide a basic, but practical, summary of the major hra plan compliance rules. Use this worksheet to find out if your qsehra meets requirements for “affordability.” if your qsehra doesn’t meet the requirements for “affordability,” you may qualify for a premium tax. Health reimbursement plan the undersigned adopting employer hereby adopts this plan. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213, subject to an annual limit of $10,000. The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended. The section 105 plan turns personal medical expenses into business deductions. 105 employee welfare benefit master plan (the “plan”), is as follows: Piedmont healthcare, inc (the “employer”) has established the piedmont healthcare, inc section 105 hra plan (the “hra”). The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to comply with the. The purpose of this hra is to reimburse participants for certain. With this type of section 105 plan, a small business does not offer a. Health reimbursement plan the undersigned adopting employer hereby adopts this plan. The section 105 plan turns personal medical expenses into business deductions. The plan is designed and intended to qualify as an accident and health. Creating the best section 105 deduction with the section 105 medical plan done properly, you will deduct 100 percent of your family’s medical expenses, including copays, deductibles, and. The master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. The purpose of this hra is to reimburse participants for certain.. Health reimbursement plan the undersigned adopting employer hereby adopts this plan. It is a very important document and you. With this type of section 105 plan, a small business does not offer a. Use this worksheet to find out if your qsehra meets requirements for “affordability.” if your qsehra doesn’t meet the requirements for “affordability,” you may qualify for a. The purpose of this hra is to reimburse participants for certain. Thus, the employee may submit for reimbursement any. This section of the code. Use this worksheet to find out if your qsehra meets requirements for “affordability.” if your qsehra doesn’t meet the requirements for “affordability,” you may qualify for a premium tax. This health reimbursement arrangement (hra) plan guide. Health reimbursement plan the undersigned adopting employer hereby adopts this plan. Creating the best section 105 deduction with the section 105 medical plan done properly, you will deduct 100 percent of your family’s medical expenses, including copays, deductibles, and. The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of. The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended. The master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. Use this worksheet to find out if your qsehra meets. Thus, the employee may submit for reimbursement any. 105 employee welfare benefit master plan (the “plan”), is as follows: Section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health insurance for purposes of § 105. The master plan is the primary plan document that establishes the particulars. Creating the best section 105 deduction with the section 105 medical plan done properly, you will deduct 100 percent of your family’s medical expenses, including copays, deductibles, and. Use this worksheet to find out if your qsehra meets requirements for “affordability.” if your qsehra doesn’t meet the requirements for “affordability,” you may qualify for a premium tax. This health reimbursement. Piedmont healthcare, inc (the “employer”) has established the piedmont healthcare, inc section 105 hra plan (the “hra”). The purpose of this hra is to reimburse participants for certain. The master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. This health reimbursement arrangement (hra) plan guide was created to provide. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213, subject to an annual limit of $10,000. The plan is intended to qualify as a health reimbursement arrangement under code sections. 105 employee welfare benefit master plan (the “plan”), is as follows: This health reimbursement arrangement (hra). With this type of section 105 plan, a small business does not offer a. Piedmont healthcare, inc (the “employer”) has established the piedmont healthcare, inc section 105 hra plan (the “hra”). Creating the best section 105 deduction with the section 105 medical plan done properly, you will deduct 100 percent of your family’s medical expenses, including copays, deductibles, and. This health reimbursement arrangement (hra) plan guide was created to provide a basic, but practical, summary of the major hra plan compliance rules. Use this worksheet to find out if your qsehra meets requirements for “affordability.” if your qsehra doesn’t meet the requirements for “affordability,” you may qualify for a premium tax. It is a very important document and you. The section 105 plan turns personal medical expenses into business deductions. Section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health insurance for purposes of § 105. The purpose of this hra is to reimburse participants for certain. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. Thus, the employee may submit for reimbursement any. The master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. The plan is intended to qualify as a health reimbursement arrangement under code sections. 105 employee welfare benefit master plan (the “plan”), is as follows: The plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended.Section 105 Medical Reimbursement Plan Template Fill Online

Section 105 Plan Template

A Guide to Section 105 Plans Section 105 Plans for Dummies

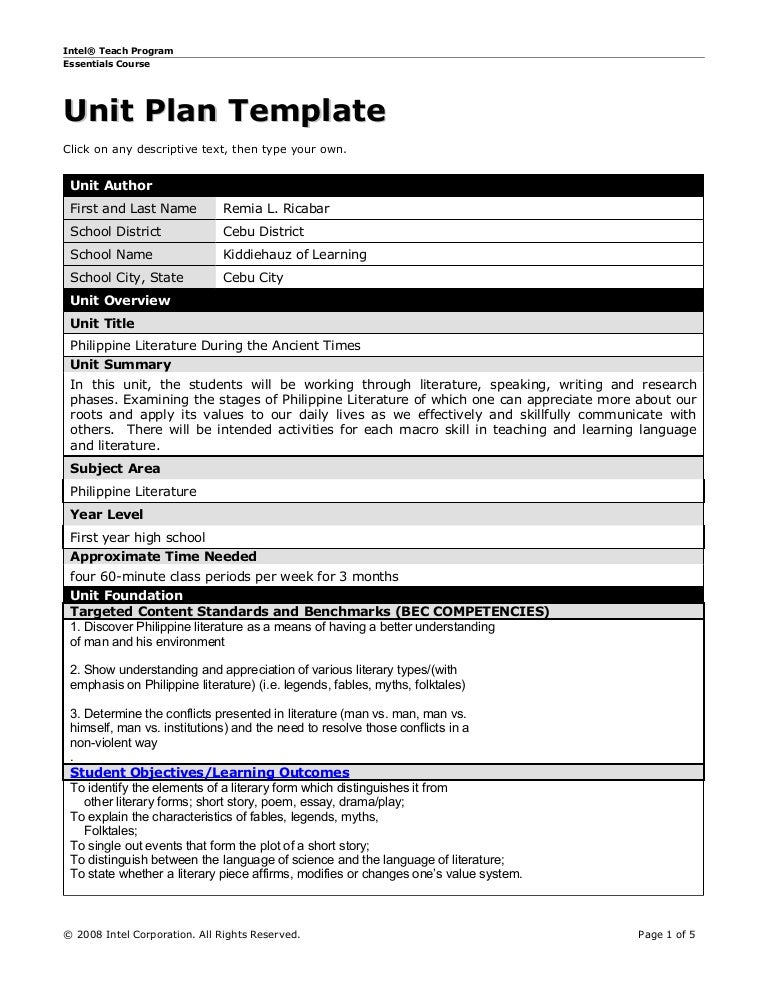

Section 105 Medical Reimbursement Plan Template Printable Word Searches

Section 105 Plan How to 'Legally' Set Up + IRS Document Doc Template

Section 105 Plan Template

Section 105 Plan Template

Section 105 Plan Template

Section 105 Plan Template

Section 105 Plan Template

Health Reimbursement Plan The Undersigned Adopting Employer Hereby Adopts This Plan.

The Plan Shall Reimburse Eligible Employees For The Cost Of Eligible Medical And Dental Expenses, As Defined Under Internal Revenue Code Section 213, Subject To An Annual Limit Of $10,000.

This Section Of The Code.

The Plan Is Designed And Intended To Qualify As An Accident And Health Plan Within The Meaning Of Section 105 Of The Internal Revenue Code Of 1986, As Amended, And To Comply With The.

Related Post: