Tax Exemption Letter Template

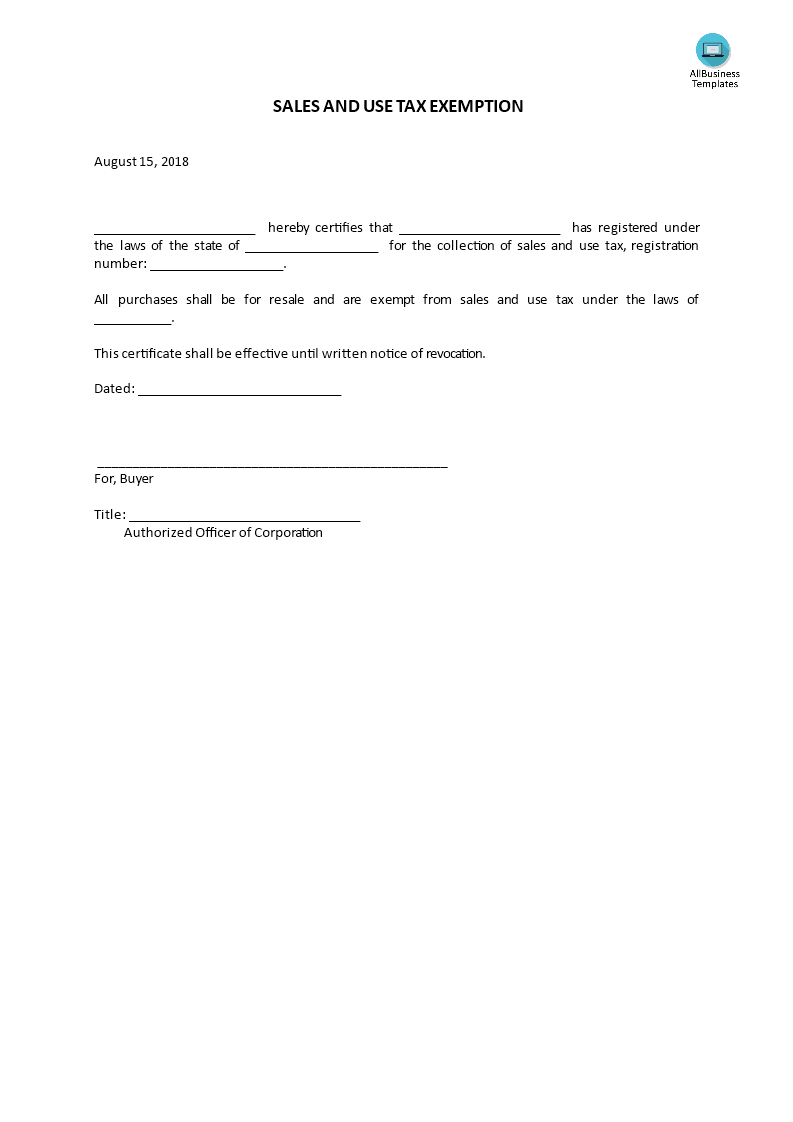

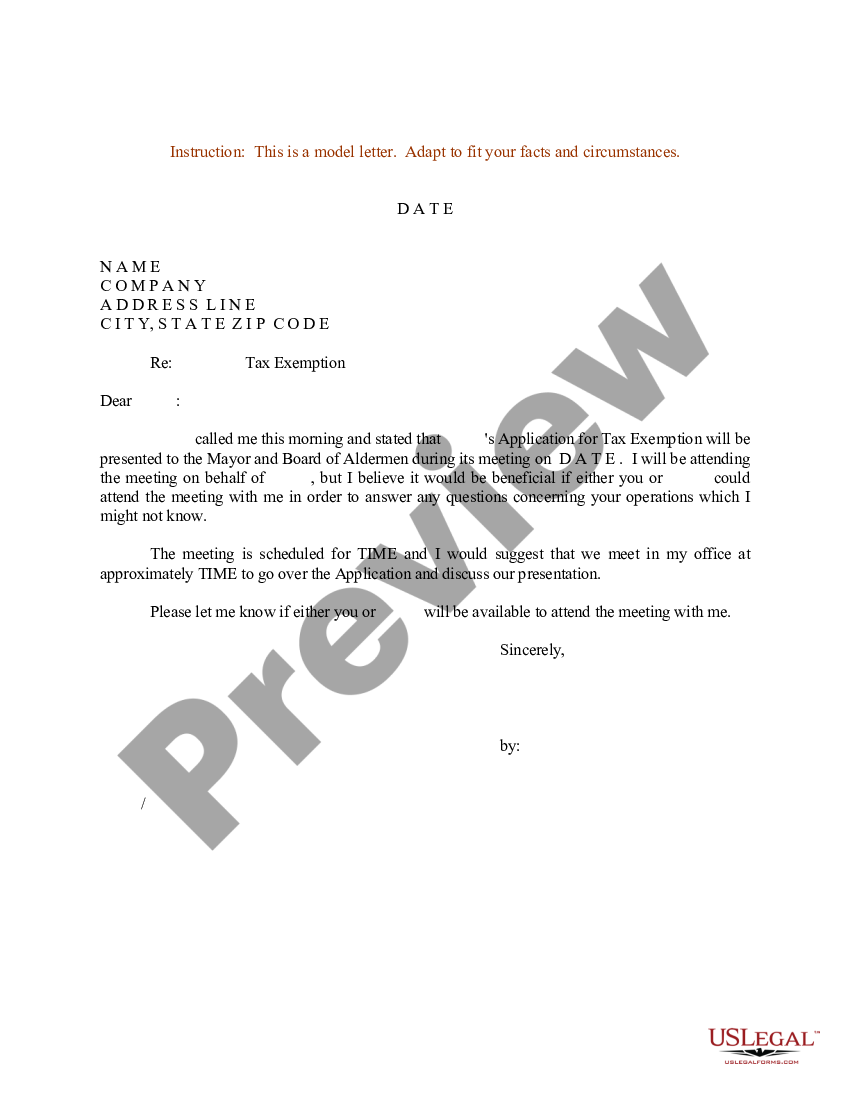

Tax Exemption Letter Template - A tax engagement letter is a written agreement that details the work a tax professional will do for a client and the client’s responsibilities in the process. Small business tax exemption serves as a vital financial relief mechanism for emerging enterprises, typically defined as those with fewer than 500 employees. In this post, we have come up with a collection of request letter format for tax exemption from sales. If so, an organization may generally contact customer. Are you looking for an exemption letter for your specific situation? — a sample letter for personal tax exemption is used by individuals to request exemption from certain taxes based. Individuals can write a request letter to claim a tax exemption for personal reasons such as medical expenses, charitable. Ready to learn how to draft the. Up to $40 cash back in some cases, taxpayers may need to formally request tax exemption. Tax exempt application letter sample (still best to create your. A tax engagement letter is a written agreement that details the work a tax professional will do for a client and the client’s responsibilities in the process. If so, an organization may generally contact customer. Tax exemption status verification requires essential information linked to the tax identification number (tin) associated with a specific entity, such as a nonprofit organization or charitable. Up to $40 cash back personal tax exemption request: Are you looking for an exemption letter for your specific situation? Ready to learn how to draft the. Common reasons for exemption include purchases. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. — a sample letter for personal tax exemption is used by individuals to request exemption from certain taxes based. Join me as we unpack the essential elements of this vital document and share tips to help you present your organization's goals clearly and effectively. Common reasons for exemption include purchases. You can use the sample letter requesting tax exemption certificate to. It serves as a legal agreement and clearly. Individuals can write a request letter to claim a tax exemption for personal reasons such as medical expenses, charitable. Join me as we unpack the essential elements of this vital document and share tips to. If so, an organization may generally contact customer. Small business tax exemption serves as a vital financial relief mechanism for emerging enterprises, typically defined as those with fewer than 500 employees. Tax exempt application letter sample (still best to create your. Individuals can write a request letter to claim a tax exemption for personal reasons such as medical expenses, charitable.. Tax exemption status verification requires essential information linked to the tax identification number (tin) associated with a specific entity, such as a nonprofit organization or charitable. Common reasons for exemption include purchases. This article will provide a detailed description of how to write an effective sample letter request. — a sample letter for personal tax exemption is used by individuals. If so, an organization may generally contact customer. A contractor tax exemption certificate serves as an official document that allows contractors and related service providers to obtain tax exemption on certain projects, specifically those related. Individuals can write a request letter to claim a tax exemption for personal reasons such as medical expenses, charitable. A tax engagement letter is a. Ready to learn how to draft the. Are you looking for an exemption letter for your specific situation? It serves as a legal agreement and clearly. In this post, we have come up with a collection of request letter format for tax exemption from sales. Tax exemption status verification requires essential information linked to the tax identification number (tin) associated. Small business tax exemption serves as a vital financial relief mechanism for emerging enterprises, typically defined as those with fewer than 500 employees. Ready to learn how to draft the. Tax exempt application letter sample (still best to create your. Up to $40 cash back in some cases, taxpayers may need to formally request tax exemption. Tax exemption status verification. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. A contractor tax exemption certificate serves as an official document that allows contractors and related service providers to obtain tax exemption on certain projects, specifically those related. A tax engagement letter is a written agreement that details the work a tax. Up to $40 cash back in some cases, taxpayers may need to formally request tax exemption. You can use the sample letter requesting tax exemption certificate to. In this post, we have come up with a collection of request letter format for tax exemption from sales. Tax exemption status verification requires essential information linked to the tax identification number (tin). If so, an organization may generally contact customer. A tax engagement letter is a written agreement that details the work a tax professional will do for a client and the client’s responsibilities in the process. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. You can use the sample letter. You can use the sample letter requesting tax exemption certificate to. Are you looking for an exemption letter for your specific situation? In this post, we have come up with a collection of request letter format for tax exemption from sales. Tax exemption status verification requires essential information linked to the tax identification number (tin) associated with a specific entity,. Ready to learn how to draft the. Individuals can write a request letter to claim a tax exemption for personal reasons such as medical expenses, charitable. Up to $40 cash back in some cases, taxpayers may need to formally request tax exemption. Small business tax exemption serves as a vital financial relief mechanism for emerging enterprises, typically defined as those with fewer than 500 employees. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. Sales tax exemption requests often pertain to specific circumstances in which goods or services purchased may not be subject to taxation. It serves as a legal agreement and clearly. In this post, we have come up with a collection of request letter format for tax exemption from sales. Tax exempt application letter sample (still best to create your. Our collection of exemption letters provides you with the necessary documentation to request an exemption. Are you looking for an exemption letter for your specific situation? A contractor tax exemption certificate serves as an official document that allows contractors and related service providers to obtain tax exemption on certain projects, specifically those related. A tax engagement letter is a written agreement that details the work a tax professional will do for a client and the client’s responsibilities in the process. Common reasons for exemption include purchases. — a sample letter for personal tax exemption is used by individuals to request exemption from certain taxes based. If so, an organization may generally contact customer.Tax Letter Template Format, Sample, and Example in PDF & Word

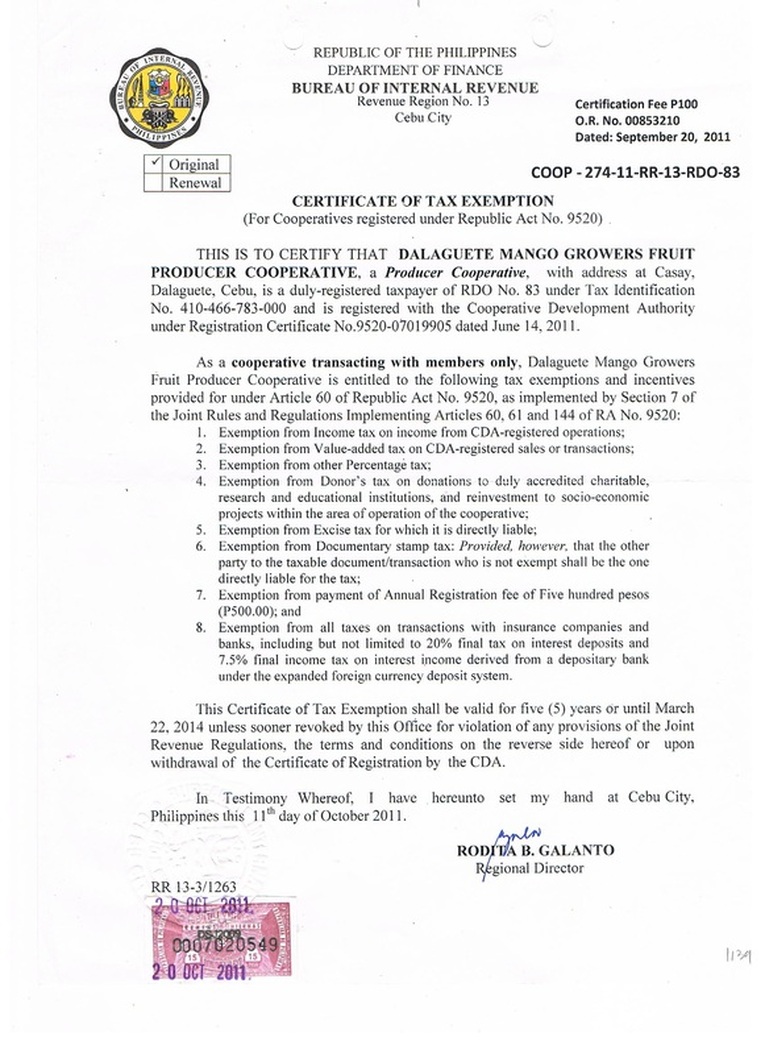

What Is A Withholding Tax Exemption Certificate at Howard Walton blog

Sales and Use Tax Exemption Letter Templates at

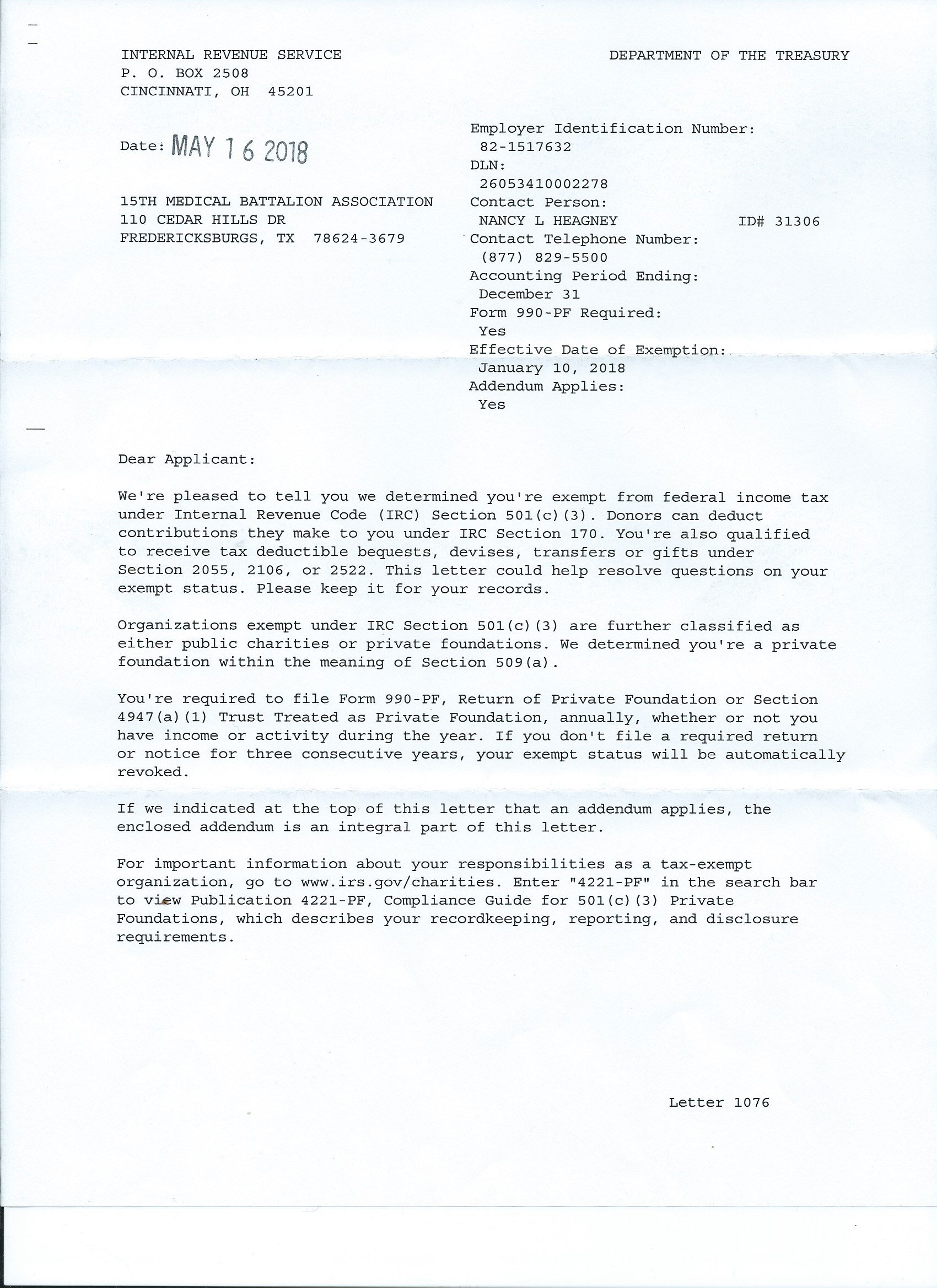

Sample Tax Exempt Letter

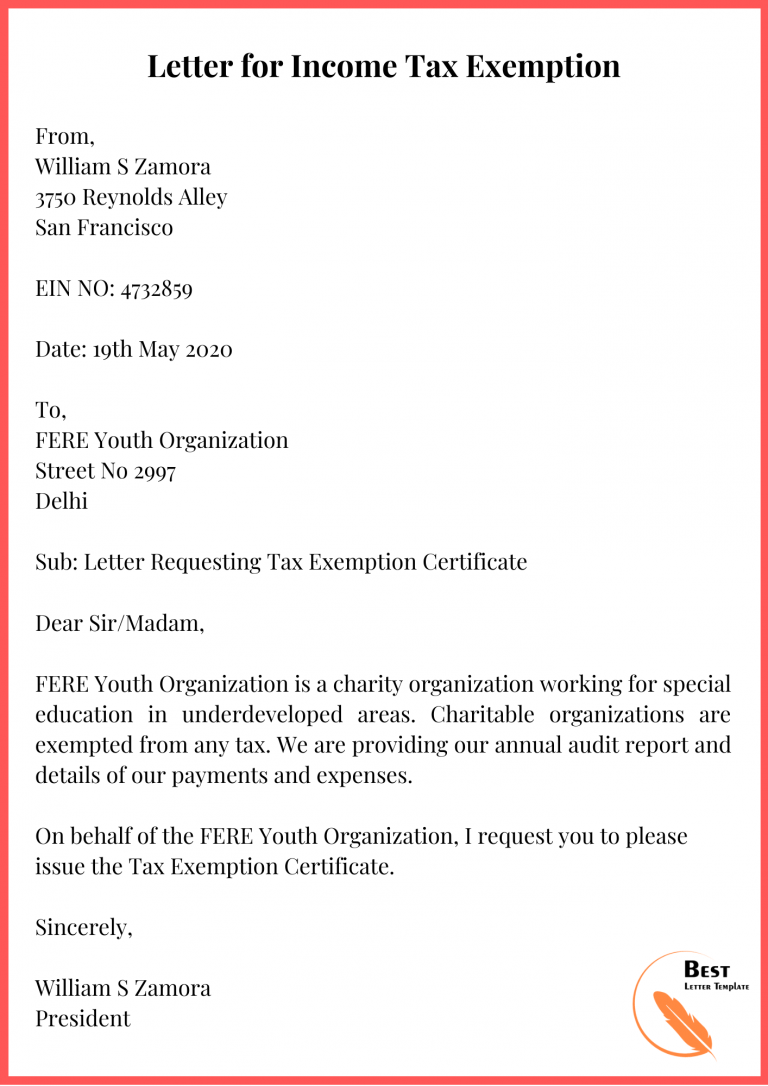

Request For Tax Exemption Letter Example

Letter Request Tax Exemption PDF Corporations Internal Revenue

Tax Exemption Letter Arancel Impuestos

Letter Of Exemption Sample

How To Apply For Irs Tax Exemption Tax Walls

Tax Exemption Application With Taxexempt Status US Legal Forms

Join Me As We Unpack The Essential Elements Of This Vital Document And Share Tips To Help You Present Your Organization's Goals Clearly And Effectively.

Tax Exemption Proof Request Typically Involves Documentation From Government Entities, Such As The Internal Revenue Service (Irs) In The United States.

Tax Exemption Status Verification Requires Essential Information Linked To The Tax Identification Number (Tin) Associated With A Specific Entity, Such As A Nonprofit Organization Or Charitable.

Up To $40 Cash Back Personal Tax Exemption Request:

Related Post: