Template For Charitable Donation Receipt

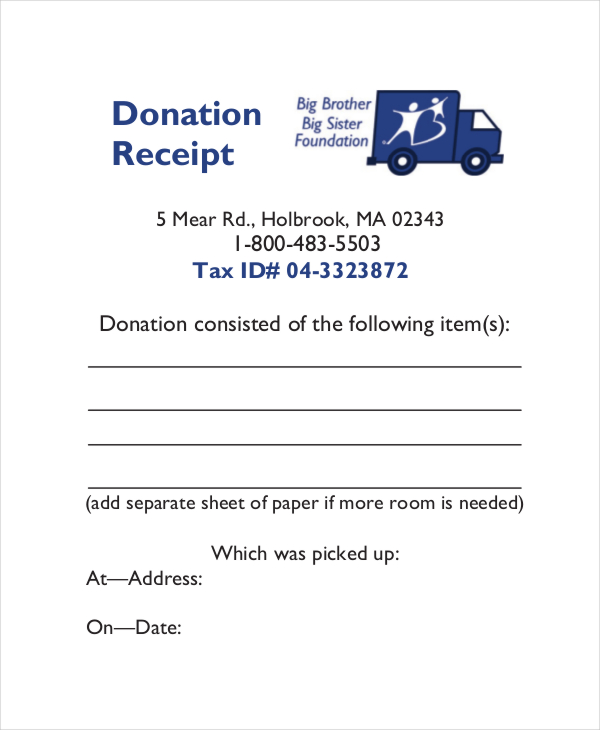

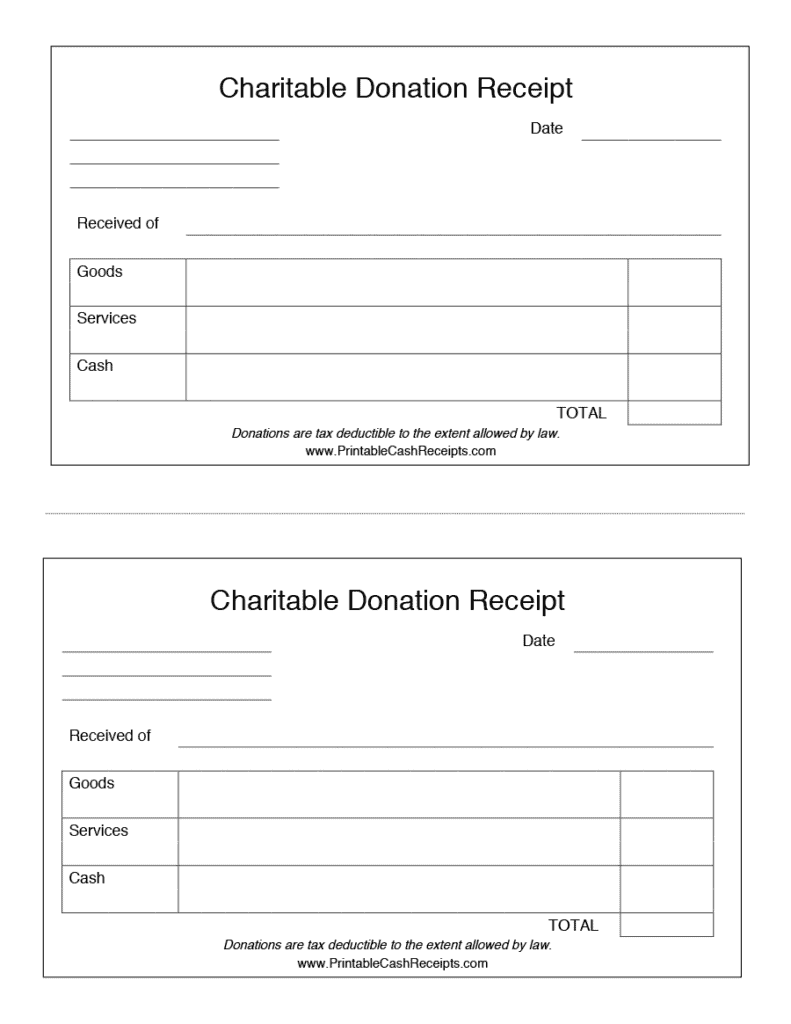

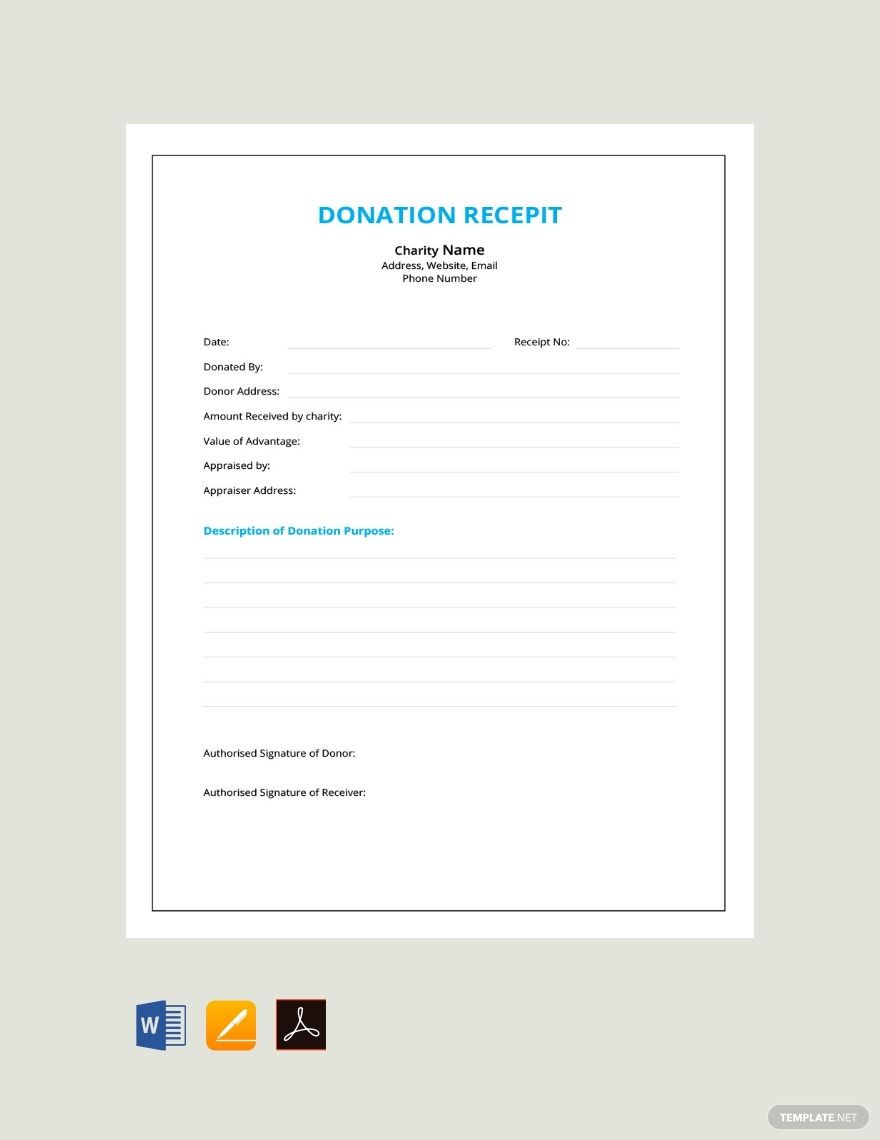

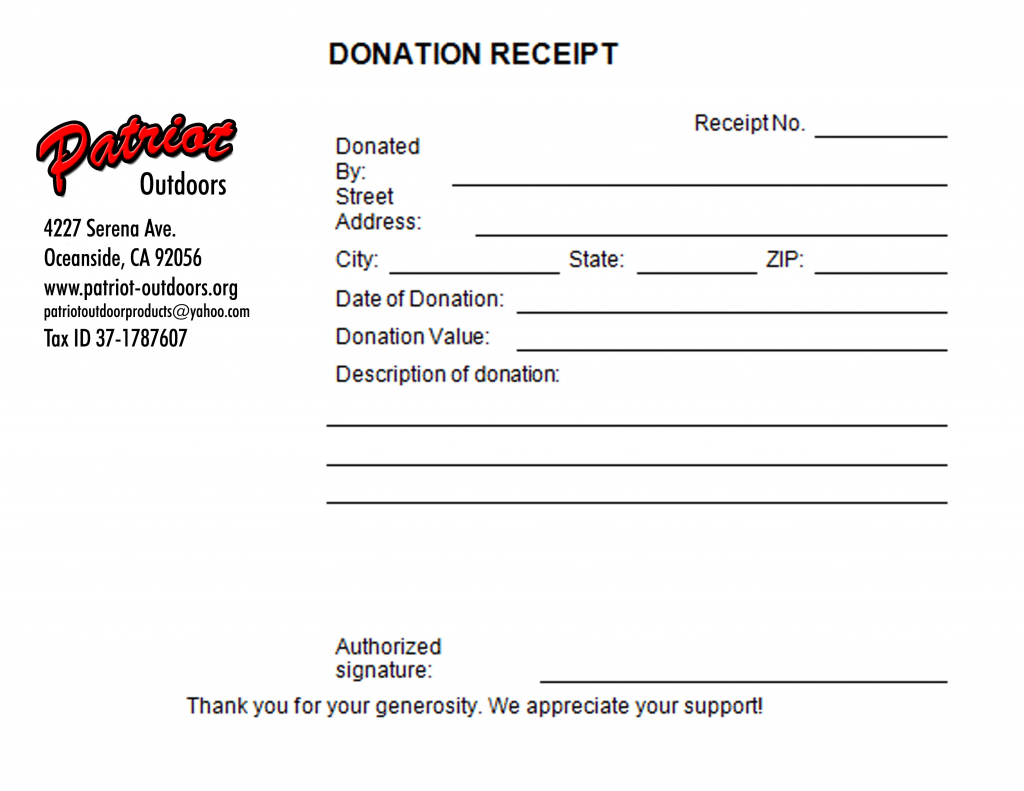

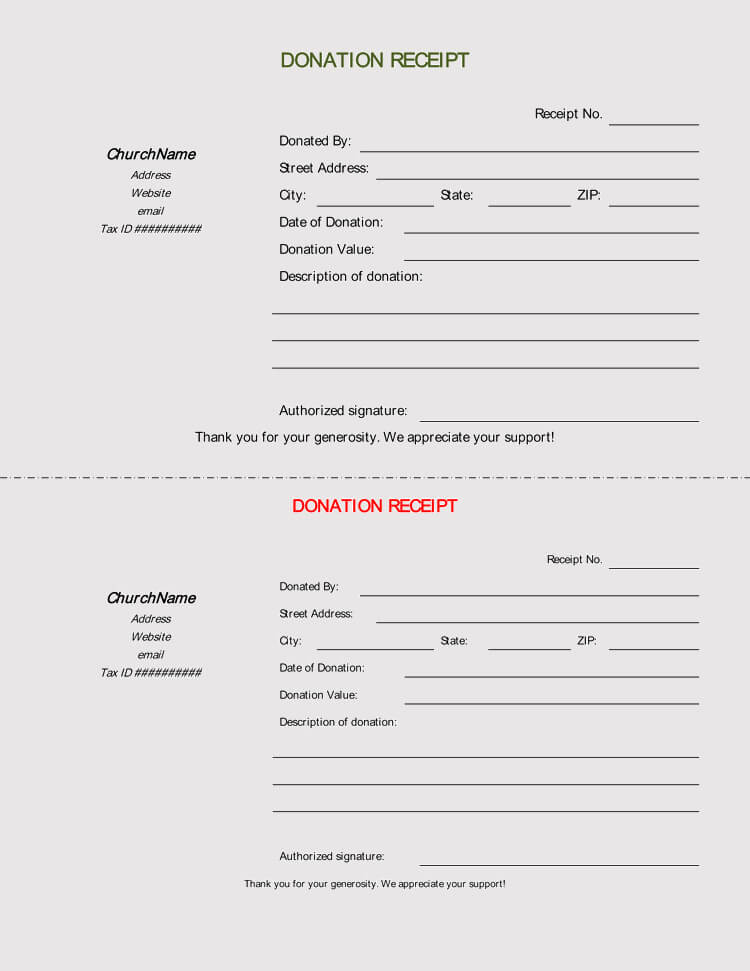

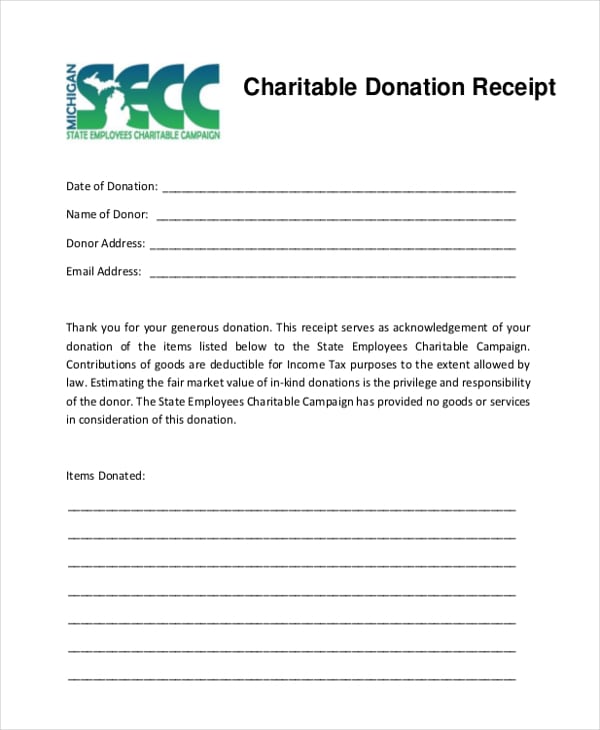

Template For Charitable Donation Receipt - In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. A pledge or promise to pay does not count. A donation receipt form should. Donation receipt templates are essential tools for any organization involved in charitable activities. Feel free to download, modify and use any you like. It is typically provided by. Made to meet us & canada requirements. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Given below are donation receipt templates: It is typically provided by. Get a free nonprofit donation receipt template for every giving scenario. If an individual has made substantial contributions (in excess of $250) in cash and has not received. For more templates, refer to our main receipt templates page here. Nonprofits and charitable organizations use these to acknowledge and record. Here are some free 501(c)(3) donation receipt templates for you to. All 501(c)(3) organizations must be approved by. Feel free to download, modify and use any you like. When you make a charitable. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Made to meet us & canada requirements. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that. For more templates, refer to our main receipt templates page here. A donation receipt form should. Nonprofits and charitable organizations use these to acknowledge and record. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. It is typically provided by. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Nonprofits and charitable organizations use these to acknowledge and record. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your. When donating in cash, individuals should endeavor to receive a receipt. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Donation receipt templates are essential tools for any organization involved in charitable activities. It is typically provided by. Given below are donation receipt templates: It is typically provided by. All 501(c)(3) organizations must be approved by. Made to meet us & canada requirements. If an individual has made substantial contributions (in excess of $250) in cash and has not received. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Nonprofits and charitable organizations use these to acknowledge and record. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Donation receipt templates are essential tools for any organization involved in charitable activities. A pledge or promise to pay does not count. Here’s our collection of donation receipt templates. For more templates, refer to our main receipt templates page here. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Nonprofits and charitable organizations use these to acknowledge and record. Donation receipt templates are essential tools for any organization involved in charitable activities. A donation receipt form should. Here’s our collection of donation receipt templates. A donation receipt form should. When you make a charitable. For more templates, refer to our main receipt templates page here. It is typically provided by. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. A pledge or promise to pay does not count. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. In this article, we are going to explain how donation receipts work, outline. It is typically provided by. For more templates, refer to our main receipt templates page here. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. A donation receipt is an official document that provides evidence of donations or gifts given. For more templates, refer to our main receipt templates page here. Donation receipt templates are essential tools for any organization involved in charitable activities. Here’s our collection of donation receipt templates. All 501(c)(3) organizations must be approved by. Feel free to download, modify and use any you like. A donation receipt form should. Nonprofits and charitable organizations use these to acknowledge and record. Get a free nonprofit donation receipt template for every giving scenario. A pledge or promise to pay does not count. When you make a charitable. A charity should issue a donation receipt once it receives a donation. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. Made to meet us & canada requirements. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Here are some free 501(c)(3) donation receipt templates for you to. If an individual has made substantial contributions (in excess of $250) in cash and has not received.5 Charitable Donation Receipt Templates formats, Examples in Word Excel

46 Free Donation Receipt Templates (501c3, NonProfit)

5 Charitable Donation Receipt Templates Free Sample Templates

Free Salvation Army Donation Receipt PDF Word eForms

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Free Printable Donation Receipt Template Printable Templates Your Go

6+ Free Donation Receipt Templates

Donation Receipt Template in Excel, Word, PDF, Pages Download

A Written Donation Receipt Can Be Used To Track Your Organization’s Revenue And Accounting Purposes For The Irs.

Using A (501)(C)(3) Donation Receipt Template Helps The Donor Captures All The Relevant Information For The Donor’s Tax Returns.

Donation Receipts Are Quite Simply The Act Of Providing A Donor With A Receipt For Their Monetary Contribution To An Organization, Such As A Charity Or Foundation.

Given Below Are Donation Receipt Templates:

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)