Venture Capital Agreement Template

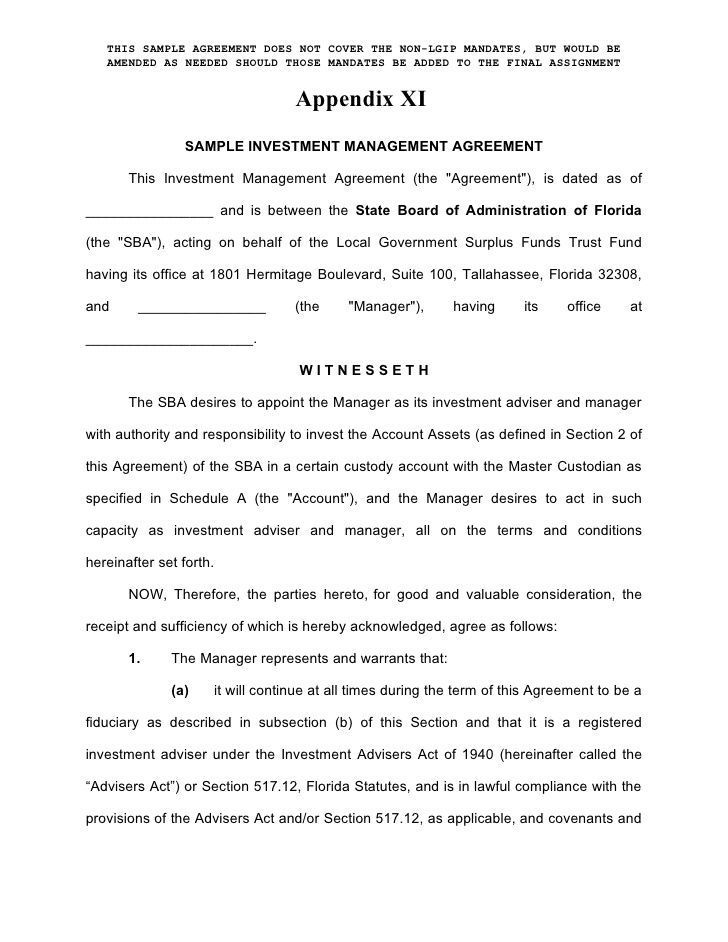

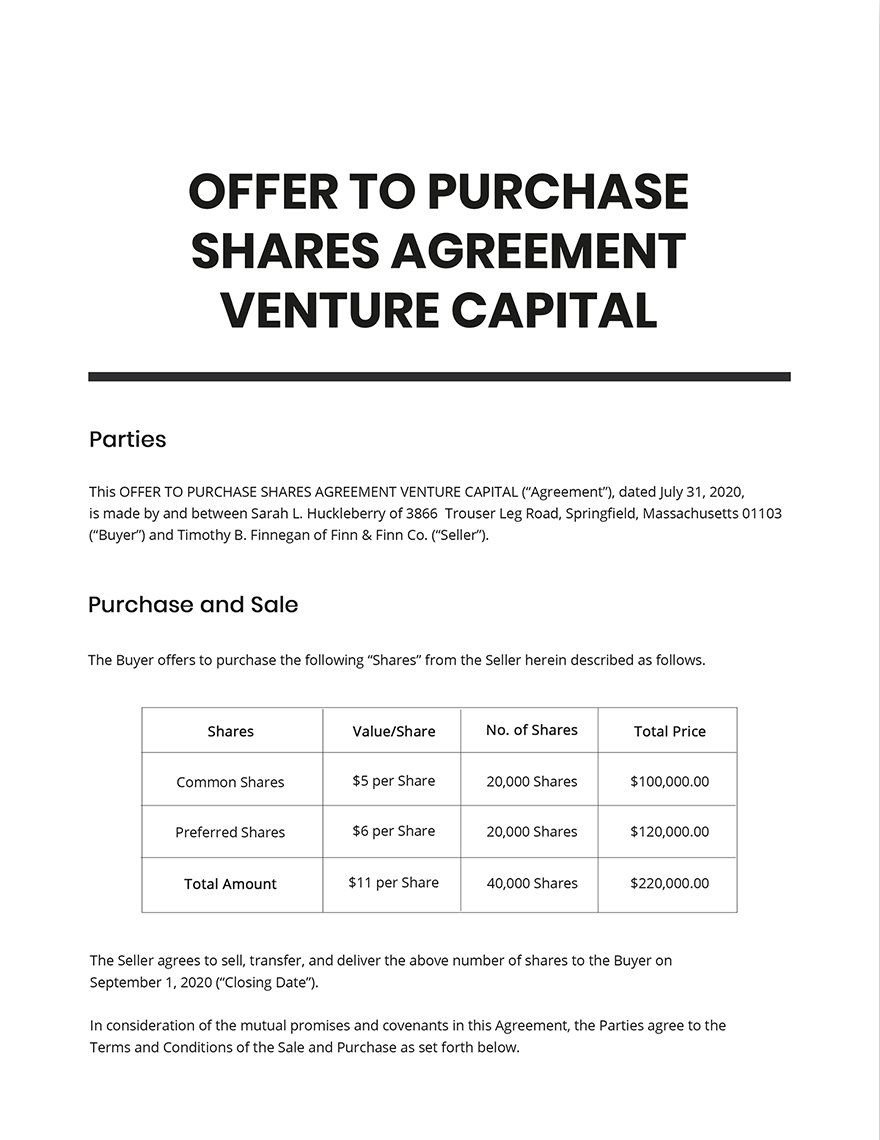

Venture Capital Agreement Template - This chapter will help you structure the term sheet or investment by the venture capitalists into the company. It is now time to begin courting venture capitalists. A venture capital investment is a professional relationship between an investor and a booming company. It was released by vc lab in october of 2021. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. Agreements, documents and resources for the venture capital industry. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. The term sheet, or letter of intent, is a key document in a venture capital transaction. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. Vc lab has developed a free venture share agreement that is designed to be used by venture capital firms and venture partners alike to quickly start working together. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business and structural issues involved in the proposed investment. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. The term sheet, or letter of intent, is a key document in a venture capital transaction. It is now time to begin courting venture capitalists. Vc lab has developed a free venture share agreement that is designed to be used by venture capital firms and venture partners alike to quickly start working together. They reflect current market norms and legal precedents, covering key documents like term sheets, stock purchase agreements, and investor rights. A venture capital investment is a professional relationship between an investor and a booming company. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. The term sheet is short, usually less than 10 pages, and is prepared by the investor. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. Agreements, documents and resources for the venture capital industry. A venture capital investment is a professional relationship between an investor and a booming company. The model agreements can. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. The term sheet, or letter of intent, is a key document in a venture capital transaction. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. The agreement usually comes from venture capital firms who specialize. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. They reflect current market norms and legal precedents, covering key documents like term sheets, stock. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. The term sheet, or letter of intent, is a key document in a venture capital transaction. Vc lab has developed a free venture share agreement that is designed to be used by venture capital firms and venture partners alike to quickly start working together.. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. The term sheet is short, usually less than 10 pages, and is prepared by the investor. It is now time to begin courting venture capitalists. The term sheet, or letter of intent, is a key document in a venture capital transaction. It was released. The term sheet, or letter of intent, is a key document in a venture capital transaction. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business and structural issues involved in the proposed investment. Vc lab has developed a free venture. The term sheet is short, usually less than 10 pages, and is prepared by the investor. It was released by vc lab in october of 2021. The template agreement is designed to specify the duties and compensation of a venture partner by checking boxes. The model agreements can be downloaded from the sal and svca’s website (click here to access. It is now time to begin courting venture capitalists. A venture capital investment is a professional relationship between an investor and a booming company. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. By focusing on the term sheet, the. A venture capital investment is a professional relationship between an investor and a booming company. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. Agreements, documents and resources for the venture capital industry. A venture capital investment is a. The model agreements can be downloaded from the sal and svca’s website (click here to access singapore law watch and svca’s website). A venture capital investment is a professional relationship between an investor and a booming company. It was released by vc lab in october of 2021. It is now time to begin courting venture capitalists. Nvca model legal documents are a set of standardized agreements designed to streamline venture capital transactions. The template agreement is designed to specify the duties and compensation of a venture partner by checking boxes. Vc lab has developed a free venture share agreement that is designed to be used by venture capital firms and venture partners alike to quickly start working together. They reflect current market norms and legal precedents, covering key documents like term sheets, stock purchase agreements, and investor rights. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law. Agreements, documents and resources for the venture capital industry. This chapter will help you structure the term sheet or investment by the venture capitalists into the company.Offer To Purchase Shares Agreement Venture Capital Template in Word

Share Subscription Agreement for Venture Capital Template in Word

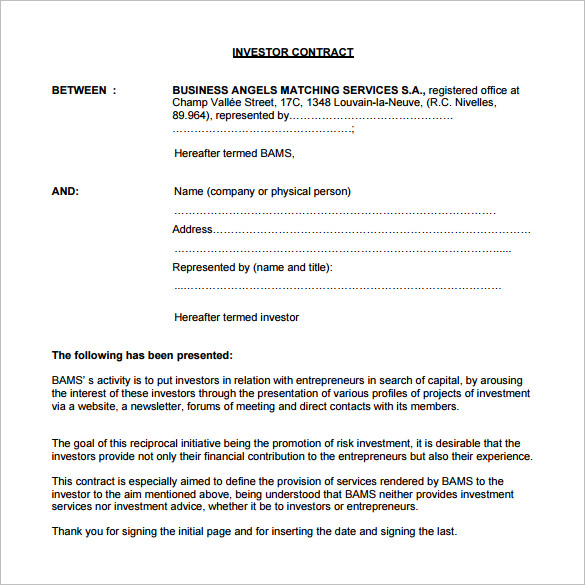

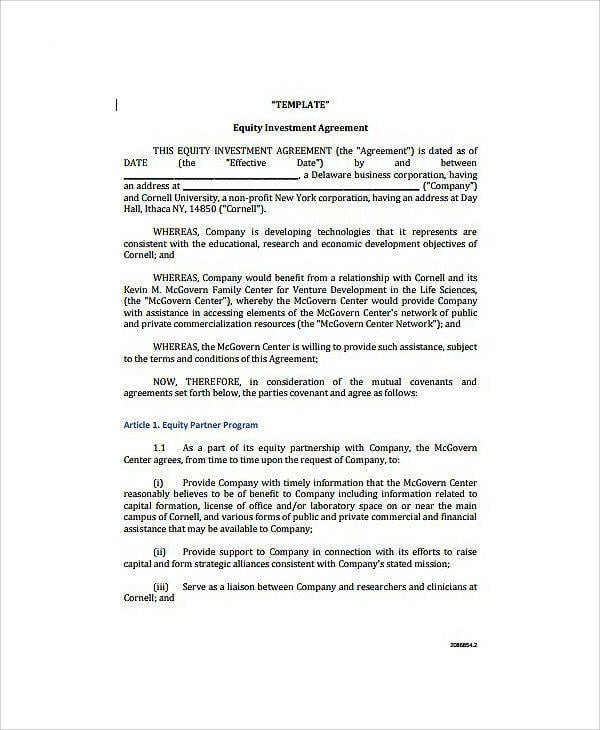

Venture Capital Investment Agreement 11+ Examples, Format, Pdf

Venture Capital Agreement Template

Venture Capital Investment Agreement 11+ Examples, Format, Pdf

Shares Agreement Templates 41+ Designs, Free Downloads

Venture Capital Investment Agreement 11+ Examples, Format, Pdf

Venture Capital Business Cooperation Agreement Template Download on Pngtree

Unincorporated Joint Venture Agreement Template Google Docs, Word

Venture Capital Templates

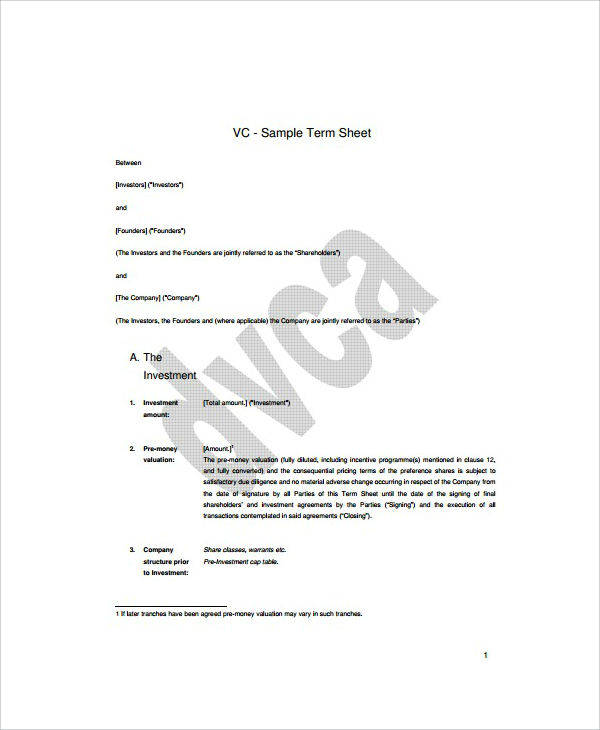

The Term Sheet Is Short, Usually Less Than 10 Pages, And Is Prepared By The Investor.

The Term Sheet, Or Letter Of Intent, Is A Key Document In A Venture Capital Transaction.

By Focusing On The Term Sheet, The Attention Of The Company Seeking The Investment (The “Company”) And The Venture Capital Investor (The “Investor”) Is Directed To The Major Business And Structural Issues Involved In The Proposed Investment.

Related Post: